Introduction

Long-term trading success isn’t about quick wins – it’s about building sustainable wealth through disciplined investment strategies. The path to profitable trading requires patience, knowledge, and a well-structured approach.

Key differences between short-term and long-term trading:

- Short-term trading focuses on daily market fluctuations

- Long-term trading capitalizes on extended market trends

- Short-term requires constant monitoring

- Long-term allows for strategic planning and reduced stress

Your success in the markets depends on mastering essential principles:

- Developing a solid investment strategy

- Understanding market fundamentals

- Maintaining emotional discipline

- Conducting thorough research

- Building a diversified portfolio

To aid in developing a solid investment strategy, utilizing resources such as advanced Pine Script tutorials can be invaluable. These tutorials provide in-depth knowledge about creating custom indicators and strategies that can enhance your trading approach.

Moreover, understanding market fundamentals is crucial. This includes knowing when to enter or exit a trade, which is where trading signals can play a significant role. By leveraging these signals, you can make informed decisions based on real-time market data.

Maintaining emotional discipline is another key aspect of successful trading. It’s easy to let emotions dictate your trading decisions, especially in the short term. However, with a well-structured long-term strategy, this risk is significantly reduced.

Conducting thorough research is essential for building a diversified portfolio. Utilizing Pine Script templates can streamline this process by providing pre-built scripts that can be customized to fit your specific needs.

Long-term trading offers distinct advantages for investors seeking steady growth. You’ll experience reduced transaction costs, lower tax implications, and the power of compound interest. This approach helps you weather market volatility while building substantial wealth over time.

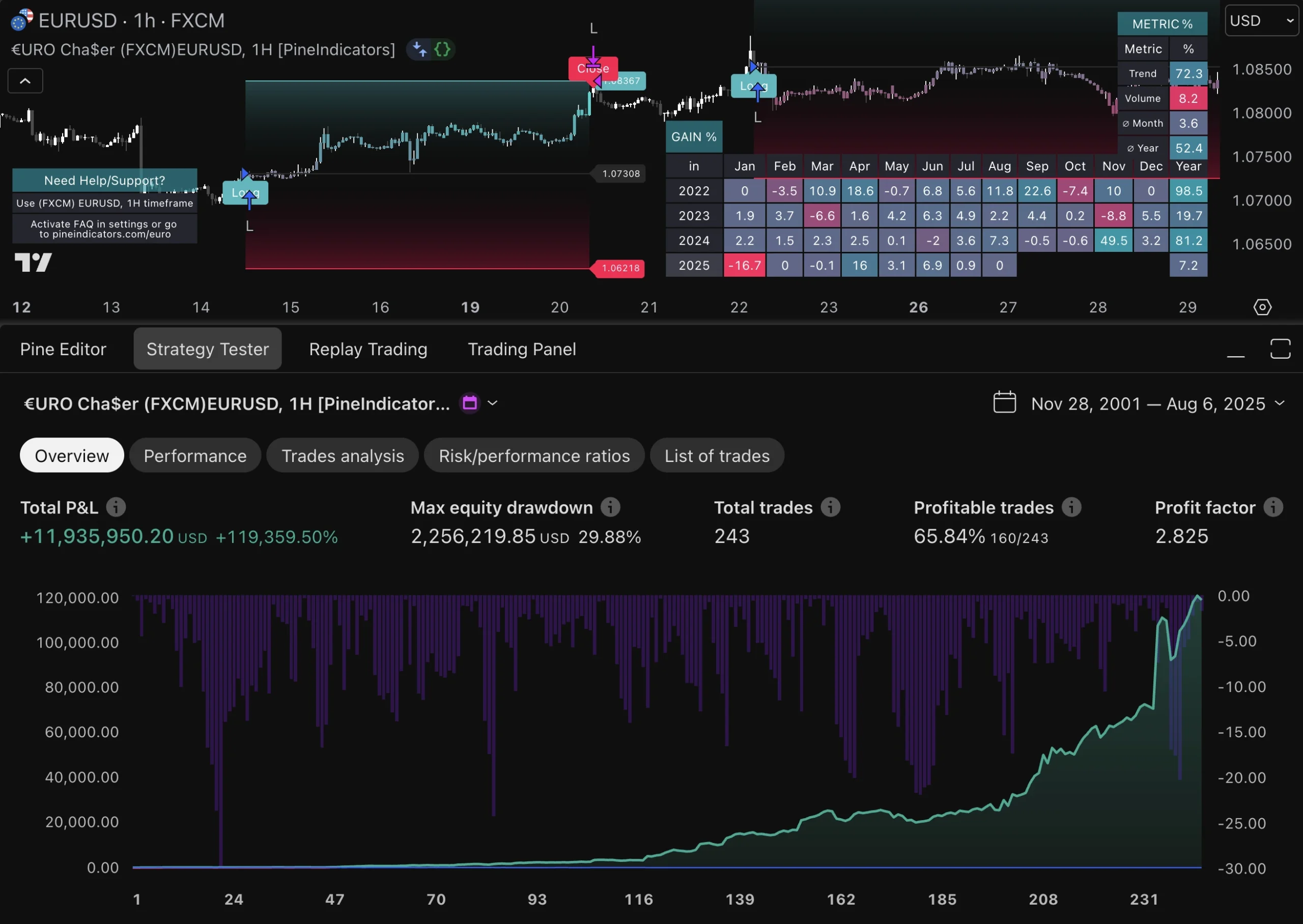

These proven strategies have helped countless investors achieve their financial goals. Let’s explore the secrets that can transform your trading journey with the right tools and resources at your disposal. For instance, if you’re interested in Forex trading, exploring Forex indicator scripts for TradingView could provide you with valuable insights and tools tailored specifically for that market.

Adopting a Long-Term Perspective

A buy-and-hold strategy means you commit to keeping your investments even when the market goes up and down. You buy good stocks and keep them for a long time – usually years or even decades – no matter what happens in the short term.

The benefits of this approach are significant:

- Reduced Transaction Costs: Less frequent trading means lower brokerage fees

- Tax Advantages: Long-term capital gains receive preferential tax treatment

- Compound Growth: Your investments benefit from exponential growth over time

- Stress Reduction: Less time spent monitoring daily market movements

Identifying Solid Stocks for Long-Term Holding

To find strong stocks that you can hold onto for a long time, look for these qualities:

- Strong competitive advantages

- Consistent revenue growth

- Healthy balance sheets

- Sustainable business models

- Reliable dividend payments

Examples of Companies with Strong Fundamentals

Companies like Microsoft, Johnson & Johnson, and Berkshire Hathaway are great examples of businesses that have these qualities. Their stock prices go up because they have strong fundamentals, not because people are guessing what will happen in the market. When you’re investing, it’s important to think about how long you plan to hold onto your investments – if you’re saving for retirement, it can be helpful to think about it as a 20-30 year timeframe.

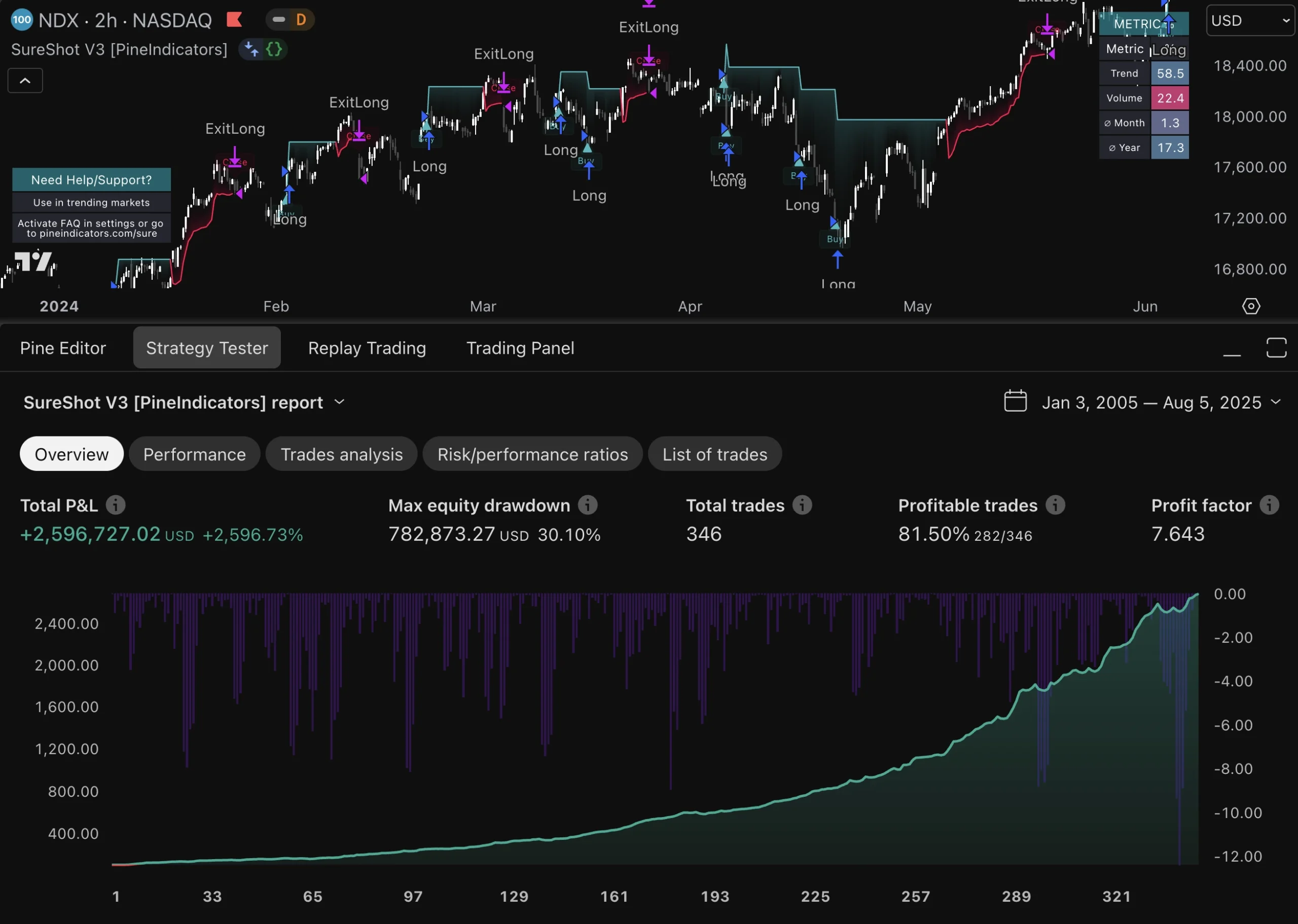

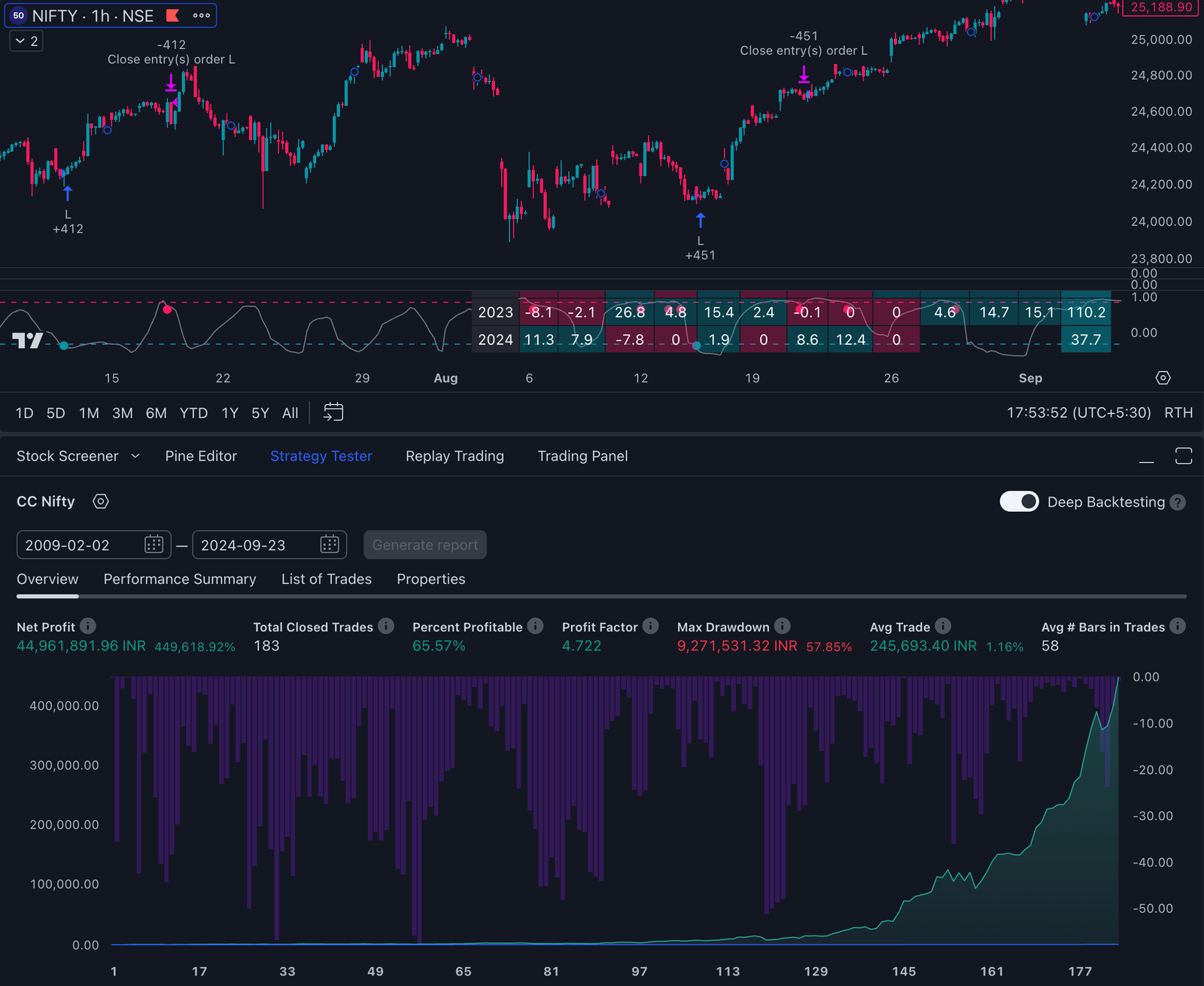

Leveraging Tools to Enhance Your Trading Experience

While adopting such a strategy, it can be beneficial to leverage tools that enhance your trading experience. For instance, you might consider exploring options like buying TradingView indicators which can provide valuable insights. Moreover, utilizing the TradingView strategy tester can help in refining your investment strategies.

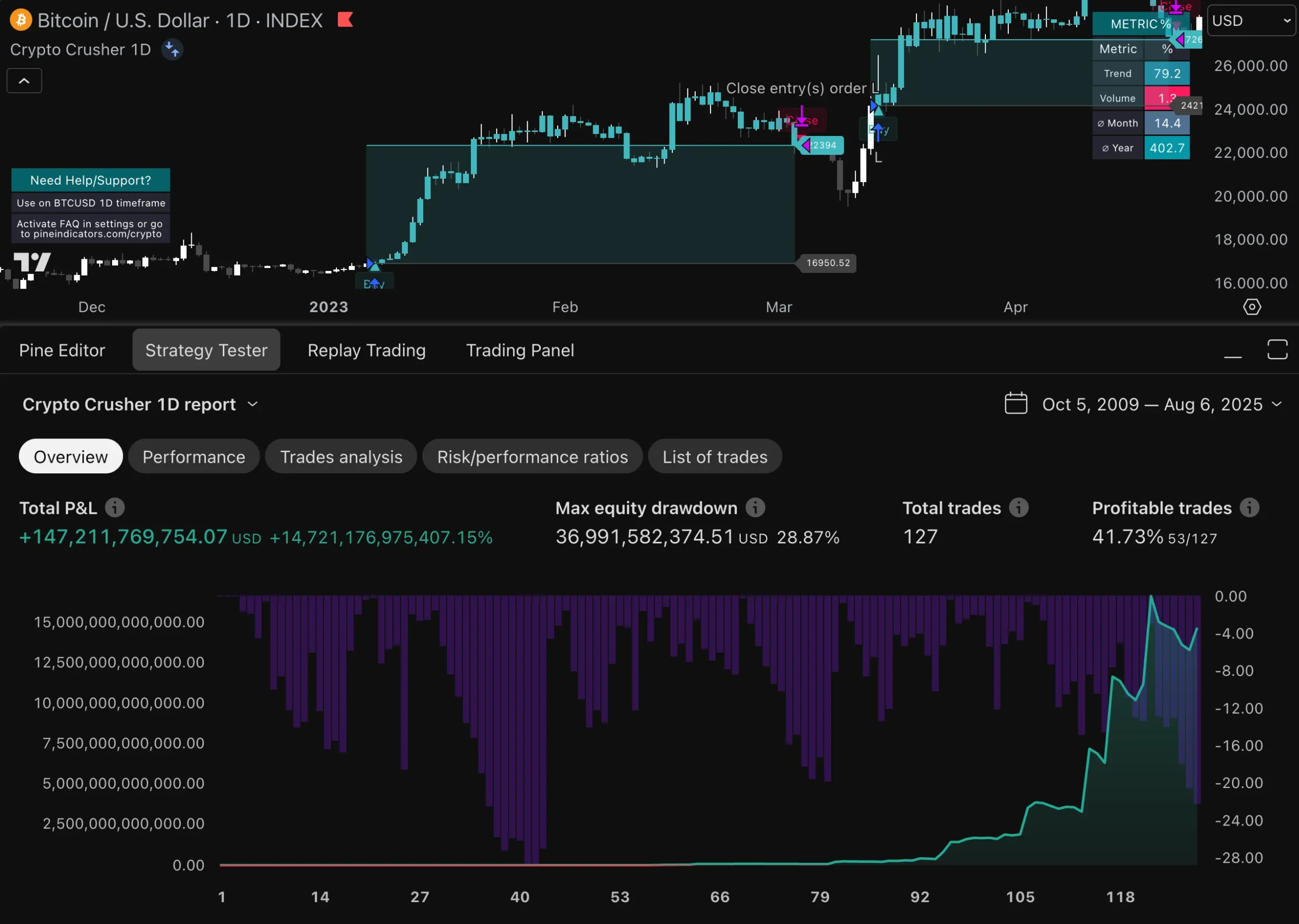

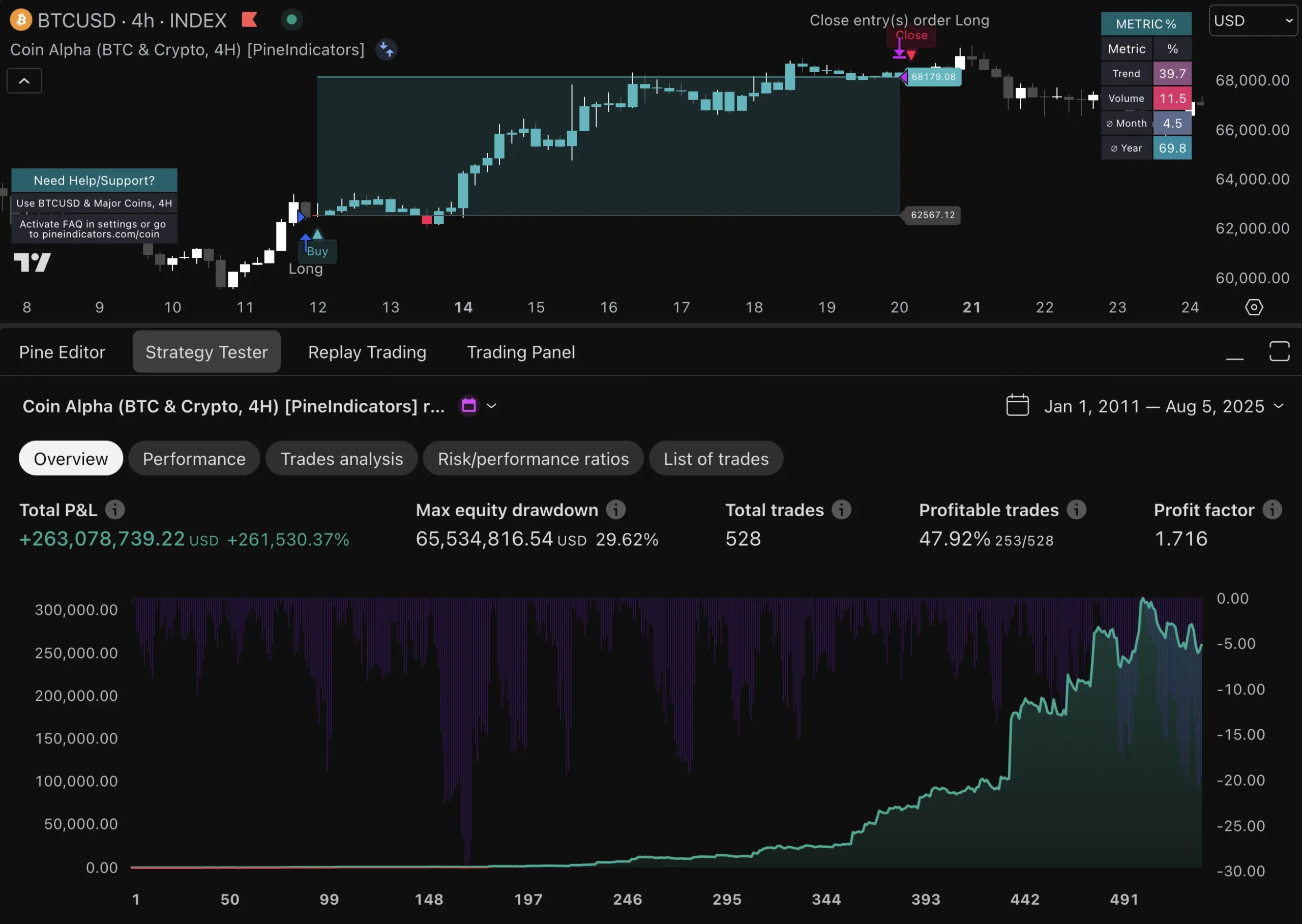

Diversifying Your Portfolio with Cryptocurrencies

If you’re also interested in diversifying your portfolio with cryptocurrencies, there are crypto strategies available for TradingView that could prove useful. Additionally, if you’re keen on customising your trading experience further, seeking assistance from Pine Script experts could be a great step forward.

Understanding Pine Script as a Beginner

For beginners looking to understand the intricacies of Pine Script, there are comprehensive resources available such as the Pine Script for beginners guide which can provide a solid foundation.

Avoiding Chasing Hot Tips

Hot stock tips can lead to impulsive decisions and significant losses. These seemingly attractive opportunities often come from unreliable sources, market manipulation, or outdated information.

Common risks of following market tips:

- Delayed information reaching retail investors

- Pump-and-dump schemes

- Emotional trading decisions

- Limited understanding of underlying assets

Your investment success depends on thorough personal research. Create a systematic approach to analyze potential investments:

- Study company financial statements

- Track industry trends

- Monitor competitive landscape

- Assess management team credibility

- Review historical performance patterns

Building a reliable analysis framework helps you:

- Filter market noise

- Identify genuine opportunities

- Make data-driven decisions

- Maintain investment discipline

Consider using technical analysis tools from platforms like PineIndicators.com to supplement your research. These tools provide objective data points for better-informed trading decisions.

Remember: A well-researched investment based on solid analysis outperforms quick decisions based on market rumors or social media buzz.

Focusing on the Bigger Picture

Market cycles shape your investment trajectory. These cycles – from bull markets to bear markets – create natural ebbs and flows in asset values. Understanding these patterns helps you maintain perspective during market fluctuations.

Key Market Cycle Characteristics:

- Bull markets typically last 3-5 years

- Bear markets average 9-18 months

- Recovery periods present prime buying opportunities

Volatility tests your resolve as a long-term investor. Price swings can trigger emotional responses, pushing you to make hasty decisions. The secret lies in viewing volatility as a natural market characteristic rather than a threat to your strategy.

Building long-term confidence requires:

- Regular review of your investment thesis

- Focus on company fundamentals

- Analysis of industry growth potential

- Recognition of temporary vs. permanent market shifts

Your success in long-term trading depends on your ability to separate market noise from meaningful changes. Track key performance indicators that align with your investment goals, and maintain your strategic direction through market ups and downs.

Evaluating Beyond Price-to-Earnings Ratios

P/E ratios serve as a quick snapshot of a company’s valuation, but they don’t tell the complete story. A low P/E might signal an undervalued stock – or a company in decline. A high P/E could indicate overvaluation – or a company poised for exceptional growth.

Here are critical metrics to examine alongside P/E ratios:

- Revenue Growth Rate: Look for consistent year-over-year increases

- Profit Margins: Higher margins often indicate competitive advantages

- Market Share: Companies with growing market share tend to outperform

- Return on Equity (ROE): Measures management’s efficiency

- Debt-to-Equity Ratio: Lower ratios suggest financial stability

Industry context shapes these metrics significantly. A tech company might justify a higher P/E ratio through rapid growth, while utilities typically maintain lower P/E ratios despite stable earnings.

Consider Amazon’s historical P/E ratios – often appearing overvalued by traditional standards. Investors who looked beyond this metric to examine Amazon’s market dominance and growth trajectory captured significant returns.

The key lies in building a comprehensive evaluation framework that considers multiple factors within their proper industry context. This approach helps you identify truly promising investments rather than merely cheap stocks.

Caution with Penny Stocks

Penny stocks attract new traders with their low prices and promises of massive returns. The reality? These stocks often represent companies with weak business fundamentals and uncertain futures.

Many traders fall into common traps:

- Believing a $0.50 stock is “cheaper” than a $50 stock

- Assuming low prices mean more room for growth

- Trusting promotional materials without verification

The volatility in penny stocks can be extreme. A 50% price swing in a single day isn’t uncommon, making risk management challenging. These stocks also face:

- Limited financial reporting requirements

- Low trading volume leading to price manipulation

- High risk of delisting from exchanges

Stable Alternatives to Consider:

- Mid-cap growth stocks with proven track records

- ETFs tracking emerging market sectors

- Blue-chip stocks during market corrections

You’ll find better opportunities in established companies with solid revenue streams, transparent financials, and strong market positions. These investments might not promise overnight riches, but they offer sustainable growth potential with manageable risk levels.

Sticking to a Strategy

A clear investment strategy acts as your compass in the market’s turbulent waters. You need a well-defined approach that aligns with your financial goals and risk tolerance.

Three primary investment strategies dominate the market:

- Value Investing: Identifying undervalued stocks trading below their intrinsic worth

- Growth Investing: Targeting companies with above-average growth potential

- Dividend Investing: Focusing on established companies that distribute regular dividends

Each strategy offers distinct advantages:

- Value investing suits patient investors who enjoy detailed company analysis.

- Growth investing appeals to those seeking capital appreciation through emerging market leaders.

- Dividend investing provides steady income streams while maintaining portfolio stability.

Your chosen strategy becomes your decision-making framework. When market volatility strikes, this framework helps you stay focused on your long-term objectives rather than reacting to short-term market noise.

Consistent application of your strategy builds resilience against market swings. You’ll make better decisions by filtering opportunities through your strategic lens rather than jumping between different approaches.

For those interested in high-profit trading strategies or backtesting Pine Script strategies, there are numerous resources available. You might also explore tradingview breakout strategies to further enhance your investment approach.

If you’re looking for more technical strategies, consider mastering the [EMA crossover strategy](https://pineindicators.com/ema-crossover-pine-script) with Pine Script, which can offer valuable insights into market trends. Additionally, staying updated with the best TradingView indicators for 2024 could significantly improve your market analysis and trading strategies.

Focusing on Future Potential

Past performance doesn’t guarantee future success in trading. Historical data serves as a reference point, but market conditions evolve rapidly, making future potential the true indicator of investment value.

You can assess future performance through these key methods:

- Market Trend Analysis: Study emerging industry patterns and technological shifts

- Company Innovation Pipeline: Evaluate upcoming products, services, and expansion plans

- Competitive Position: Analyze market share trajectory and adaptation capabilities

- Management Vision: Research leadership’s strategic planning and execution track record

Notable Success Stories:

Amazon’s early investors saw beyond its initial identity as an online bookstore. They recognized Jeff Bezos’s vision for e-commerce dominance and cloud computing innovation. A $1,000 investment in Amazon’s 1997 IPO would be worth over $2 million today.

Tesla demonstrates similar potential-based success. Early investors who looked past initial production struggles saw the broader electric vehicle revolution. They understood Tesla’s potential to transform both automotive and energy storage industries.

These examples highlight the power of proactive investing based on future growth indicators rather than historical metrics.

Selling Losers and Letting Winners Ride

Successful trading requires decisive action with underperforming assets. You need a clear cutting losses strategy to protect your portfolio from significant drawdowns. Set specific exit points – whether it’s a 15% loss threshold or a breach of key technical support levels.

The art of maximizing gains lies in letting profitable trades run their course. Many traders cut their winners too early, missing out on substantial returns. Amazon’s early investors who held through multiple market cycles saw returns exceeding 100,000%.

Your emotions can sabotage sound portfolio management. Fear might push you to sell winners too soon, while hope keeps you holding losing positions. Combat these biases by:

- Setting clear stop-loss levels before entering trades

- Reviewing positions based on current market conditions, not your purchase price

- Scaling out of winning positions instead of complete exits

- Implementing trailing stops to protect profits while allowing upside potential

To assist in implementing these strategies, consider exploring some automated solutions such as automated Pine Script strategies which can help streamline your trading process. Alternatively, if you’re interested in Forex trading, there are specific Pine Script strategies tailored for that market.

Remember: The market doesn’t care about your entry price. Base your decisions on future potential, not past performance or emotional attachments. For instance, utilizing scalping strategies could provide you with quick profits while RSI strategies might help in identifying overbought or oversold conditions.

Ultimately, the key to trading success lies in mastering the art of selling losers and letting winners ride, combined with the use of effective tools and strategies such as the top Pine Script strategies available on TradingView.

Remaining Open-Minded

The most significant investment opportunities often lie beyond well-known market giants. Lesser-known companies can offer exceptional growth potential and unique market advantages that established players might lack.

Consider these success stories:

- Netflix in 1997 – A small DVD-by-mail service challenging Blockbuster

- Amazon in 1997 – Just an online bookstore

- Tesla in 2010 – An electric car startup competing with auto industry titans

Investment diversity thrives when you look beyond household names. Smaller companies often:

- Adapt faster to market changes

- Identify and fill niche market gaps

- Show higher growth rates than industry leaders

Research strategies for discovering hidden gems:

- Track emerging industry trends

- Study market disruption patterns

- Analyze companies solving real-world problems

- Monitor innovative business models

Your investment research should span across different market segments, company sizes, and growth stages. This approach helps you spot unconventional opportunities before they become mainstream success stories.

Remember: Today’s market leaders were once unknown companies that savvy investors recognized early.

Considering Tax Implications

Tax efficiency is crucial for long-term trading success. The U.S. tax system rewards patient investors with lower capital gains rates on assets held for over a year.

Here’s what you need to know about tax-smart investing:

1. Short-term vs. Long-term Holdings

- Short-term gains (assets held < 1 year): Taxed at your regular income rate

- Long-term gains (assets held > 1 year): Maximum 20% tax rate for most investors

2. Strategic Tax Planning

- Consider tax-loss harvesting to offset gains

- Time your trades to qualify for long-term rates

- Use tax-advantaged accounts for high-turnover strategies

The tax implications of your trading decisions can significantly impact your returns. A stock delivering a 15% return might net only 9% after short-term capital gains taxes, while long-term holdings could preserve 12% or more of those gains.

Smart investors factor these tax considerations into their trading strategies without letting them override sound investment decisions. You’ll often find greater success by focusing on quality investments and holding periods that align with your financial goals while optimizing for tax efficiency.

Incorporating effective entry and exit strategies into your trading plan can also help manage these tax implications. By strategically timing your trades, you can maximize your returns while minimizing the tax burden associated with short-term capital gains.

Conclusion

Building wealth through disciplined trading isn’t a sprint—it’s a marathon. The secrets of long-term trading success lie in your commitment to proven principles: thorough research, strategic patience, and calculated decision-making.

Your trading journey can transform with these key insights:

- Maintain a steadfast focus on long-term value

- Trust your research over market noise

- Let your winning trades flourish

- Keep tax efficiency in mind

Ready to elevate your trading strategy? At PineIndicators.com, we offer advanced trading tools designed to support your long-term success. Our high-performing strategies align with the disciplined approach needed for sustainable wealth building.

For instance, you can master trading with custom scripts using TradingView’s Pine Script. This allows you to create custom indicator scripts that enhance your trading strategies and leverage community-developed tools.

Alternatively, our Versatile Bollinger Band Cascade strategy is an advanced and adaptive trading system designed to elevate your trading experience. Unlike traditional Bollinger Bands strategies, this approach integrates unique features and customization options that make it stand out in the crowded world of trading algorithms.

Moreover, you can explore our advanced Pine Script strategies which enhance your trading on TradingView with backtesting and risk management techniques.

We also provide insights into the best strategies for crypto trading and share the best TradingView strategies for successful trading.

Take action today—implement these principles and explore how our proven strategies can enhance your trading journey.

FAQs (Frequently Asked Questions)

What are the key principles for achieving long-term trading success?

Key principles for long-term trading success include adopting a disciplined trading approach, focusing on solid investment strategies, maintaining a long-term perspective, and avoiding the temptation to chase hot tips or market speculation.

How can I identify solid stocks for long-term holding?

To identify solid stocks for long-term holding, consider companies with strong fundamentals, consistent earnings growth, and a competitive market position. A buy-and-hold mentality also emphasizes the importance of evaluating a company’s growth potential beyond just its current price-to-earnings ratio.

Why should I avoid chasing hot tips in the market?

Chasing hot tips can lead to significant risks as these tips are often based on speculation rather than thorough analysis. Conducting personal research and developing a reliable analysis framework helps mitigate these risks and supports more informed investment decisions.

What should I consider when evaluating investments beyond P/E ratios?

While P/E ratios provide insight into a company’s value, it’s essential to consider additional metrics such as growth rates, market position, and industry context. A comprehensive evaluation gives a clearer picture of a company’s potential for long-term success.

What are the risks associated with investing in penny stocks?

Penny stocks often come with high volatility and increased risk due to their lower liquidity and lack of regulatory oversight. Common misconceptions may lead investors to view them as easy opportunities; however, understanding their potential pitfalls is crucial for making informed investment choices.

How can I effectively manage my portfolio by selling losers and letting winners ride?

Recognizing when to cut losses on underperforming assets is vital for effective portfolio management. Allowing successful investments to grow unchecked maximizes gains. Psychological factors play a role in this decision-making process, so having a clear strategy can help maintain discipline.