Trading strategies are systematic methodologies used by traders to determine when to buy and sell financial instruments. These approaches differ based on individual objectives, risk tolerance levels, and prevailing market conditions. A trading strategy’s primary function is to establish a structured decision-making framework that minimizes emotional influences, which frequently result in suboptimal trading performance. In […]

Performance-focused trading systems are designed to enhance the efficiency and effectiveness of trading strategies by emphasizing measurable outcomes. At their core, these systems integrate various methodologies and tools that allow traders to analyze market conditions, execute trades, and assess their performance against predefined benchmarks. A performance-focused approach is not merely about making profits; it encompasses […]

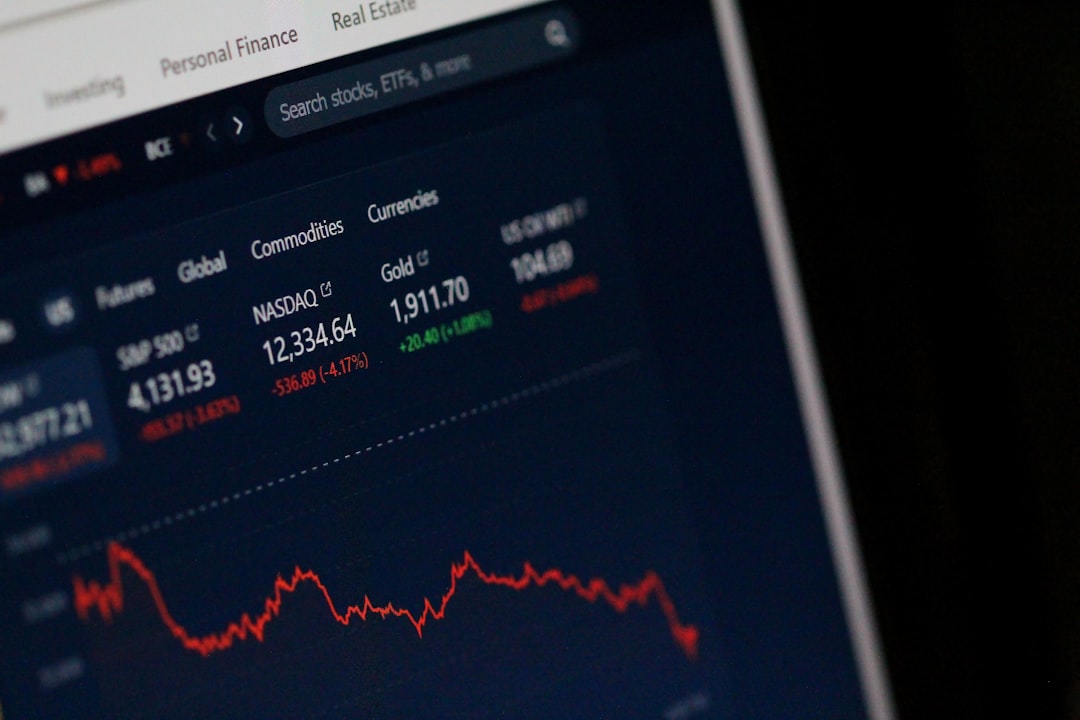

To navigate the complexities of financial markets, one must first grasp the fundamental principles that govern them. The market is a dynamic ecosystem where various factors, including economic indicators, geopolitical events, and investor sentiment, interact to influence asset prices. Understanding these elements is crucial for making informed trading decisions. For instance, economic indicators such as […]

Institutional grade trading encompasses the trading activities of large financial institutions including hedge funds, pension funds, mutual funds, and investment banks. These organizations manage significant capital volumes and implement trading strategies that typically exceed the complexity of retail investor approaches. Their operational scale provides access to exclusive market data, sophisticated trading technologies, and diverse financial […]

Trading systems are structured methodologies that traders employ to make decisions about buying and selling financial instruments. These systems can be based on a variety of factors, including technical analysis, fundamental analysis, or a combination of both. The primary goal of a trading system is to provide a systematic approach to trading that minimizes emotional […]

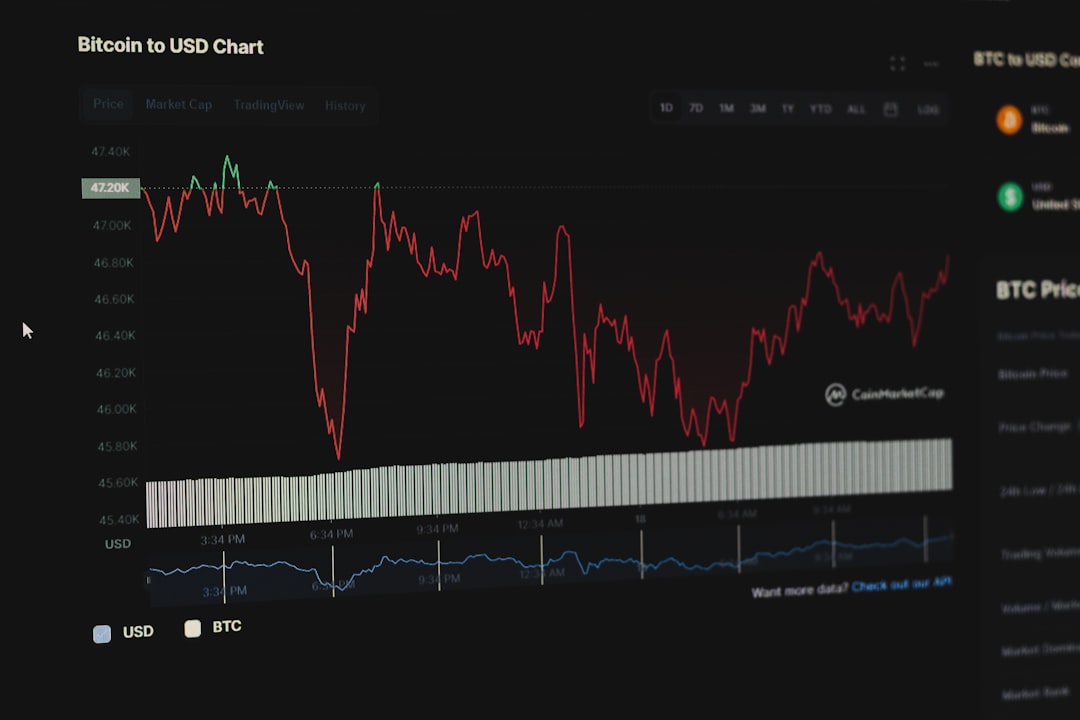

Data-driven trading strategies utilize systematic analysis of financial data to inform investment decisions, replacing subjective judgment with empirical evidence. These strategies process multiple data sources including historical price data, trading volumes, market volatility metrics, and macroeconomic indicators. Quantitative analysis methods identify statistical patterns, correlations, and market inefficiencies that traditional fundamental or technical analysis may overlook. […]

Financial markets present numerous trading strategies, with some targeting monthly returns of 10%. Such strategies typically combine technical analysis, fundamental analysis, risk management protocols, and disciplined execution. While 10% monthly returns represent substantial gains that could lead to significant capital growth over time, achieving these results consistently requires extensive market knowledge and ongoing education. These […]

Financial markets operate according to fundamental principles that traders and investors must understand to make informed decisions. Market movements are driven by multiple factors, including economic indicators, investor sentiment, and geopolitical developments. Economic indicators serve as key market drivers. Gross Domestic Product (GDP) growth rates, unemployment statistics, and inflation data directly influence market direction. Positive […]

High performance trading strategies are systematic approaches designed to optimize returns while managing risk exposure in financial markets. These strategies are categorized into three primary types based on time horizons and execution methods. Day trading involves opening and closing positions within the same trading session, typically lasting minutes to hours, to capture intraday price fluctuations. […]

Trading strategies form the foundation of successful market participation, representing systematic methodologies that guide traders in making buy and sell decisions for financial assets. Proven trading strategies are those that have undergone rigorous testing and validation across multiple time periods and market environments, consistently demonstrating their effectiveness. These strategies encompass a broad spectrum, from straightforward […]