Description

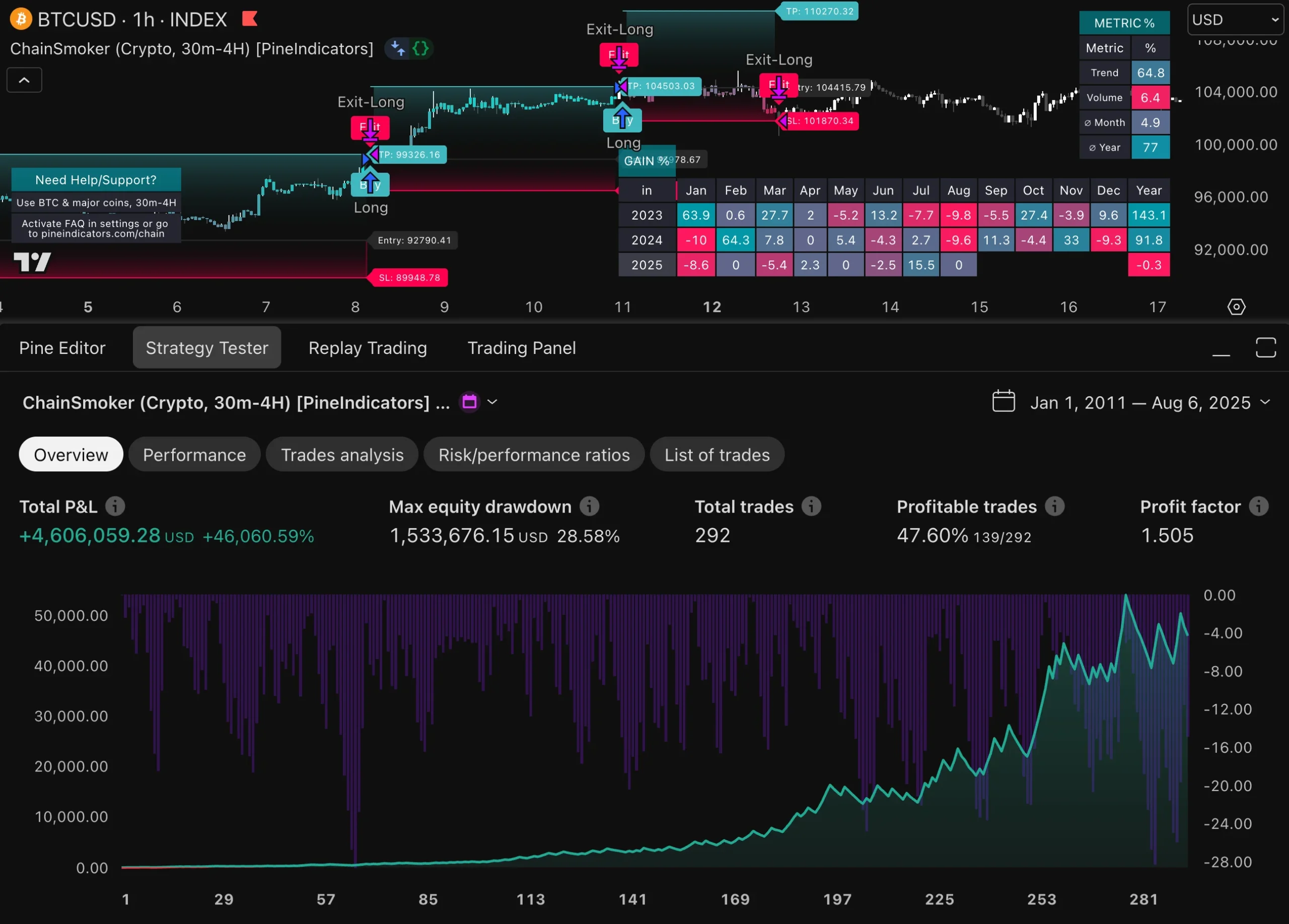

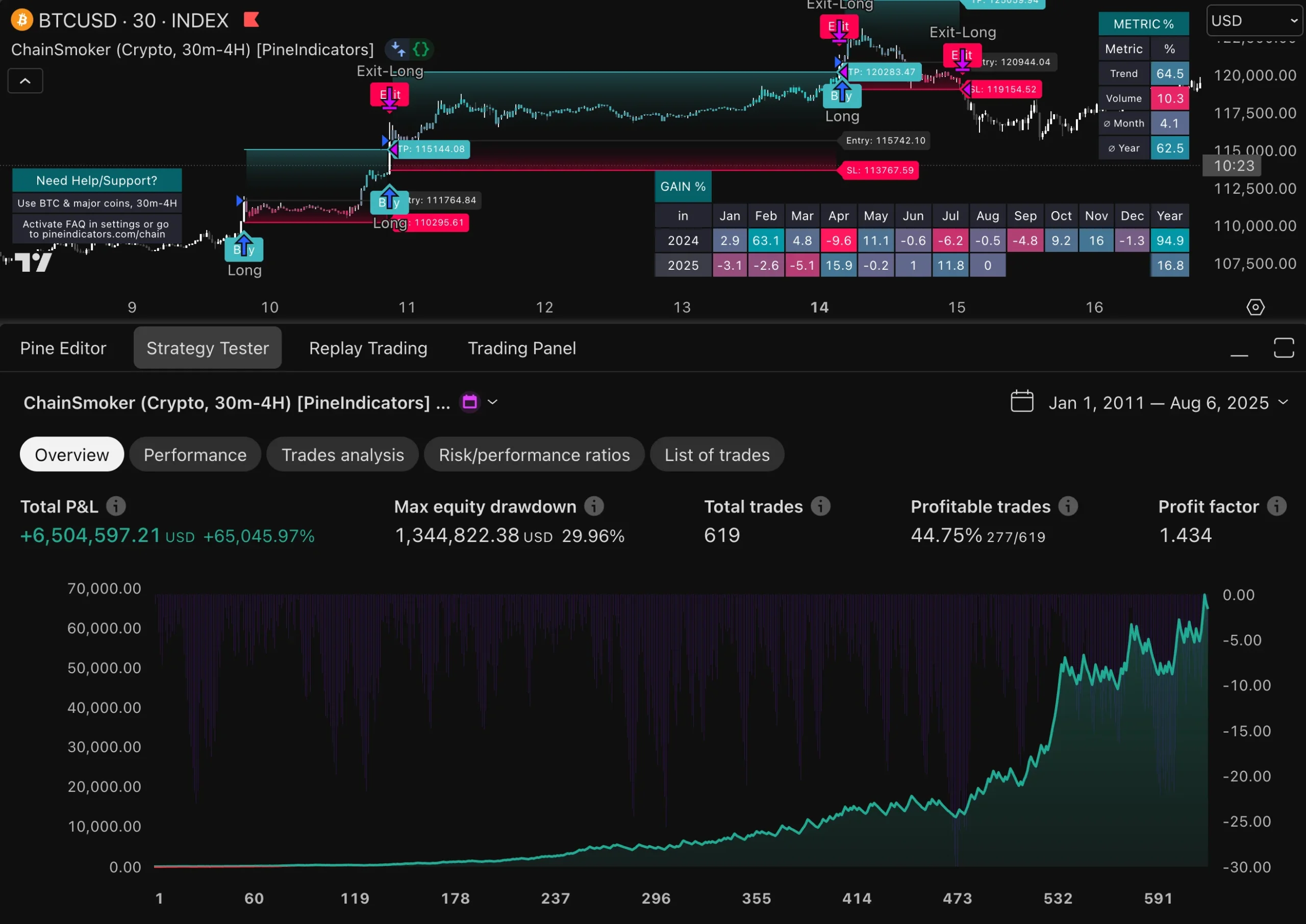

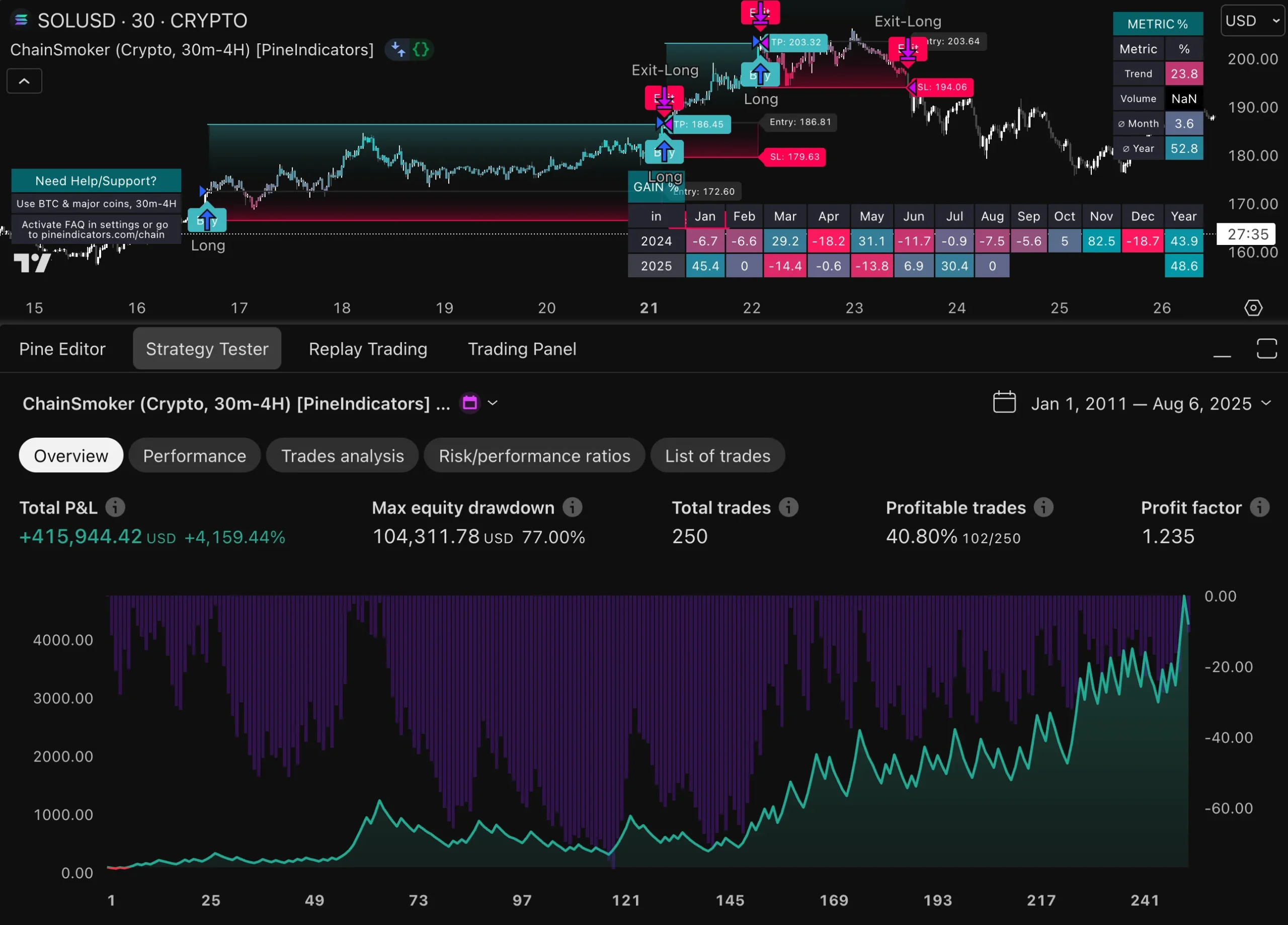

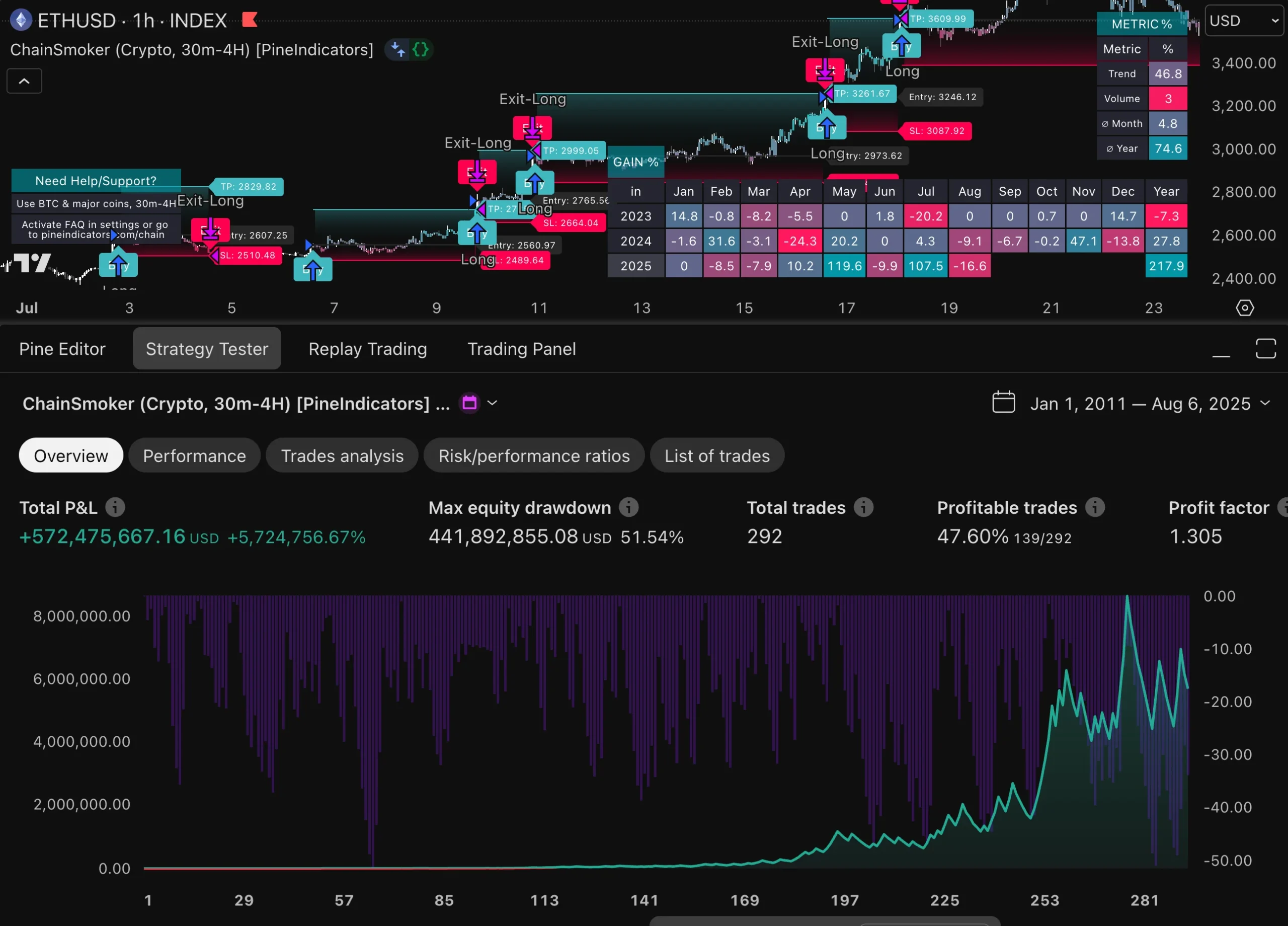

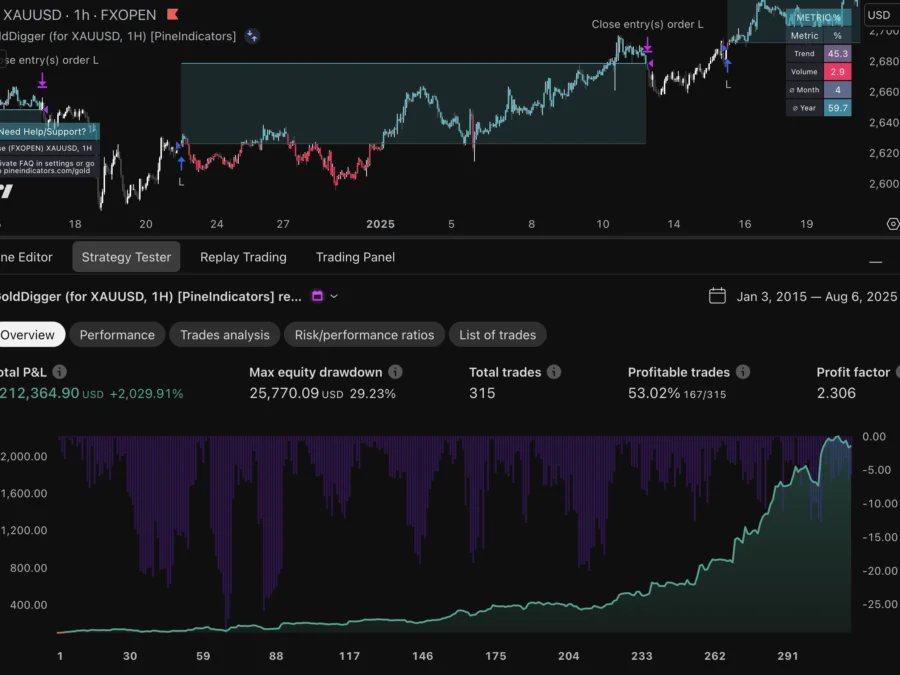

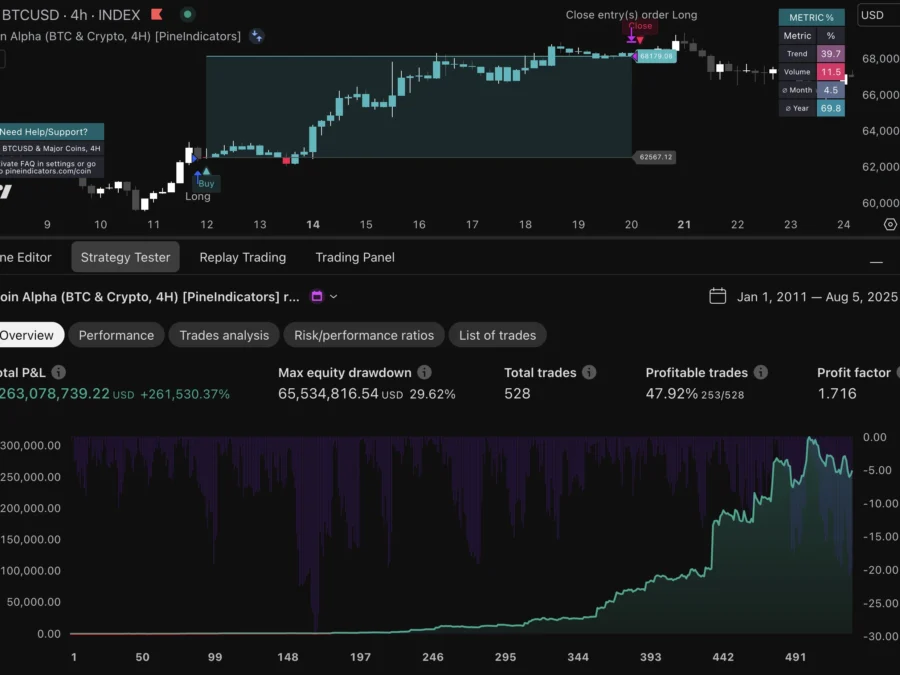

ChainSmoker is a flexible crypto trading strategy with extraordinary results on BTC and ETH from as low as 30m up to 4H timeframe with fixed TP/SL levels.

| Metric | Value |

|---|---|

| Net return | +506 % |

| Profit factor | 1.50 |

| Hit-rate | 49.8 % (128 / 257) |

| Max drawdown | -34 % |

| Average trades | ≈ 12 per month |

*Strategy-tester assumptions; past performance ≠ future results.

Key Features

- Cointegration pulse scanner – hunts for cross-asset dislocations of BTC, ETH, etc. to catch mean-reversion bursts.

- ATR-adaptive sizing – exposure expands in calm tapes and contracts in storms, keeping risk percentage steady without manual tweaking.

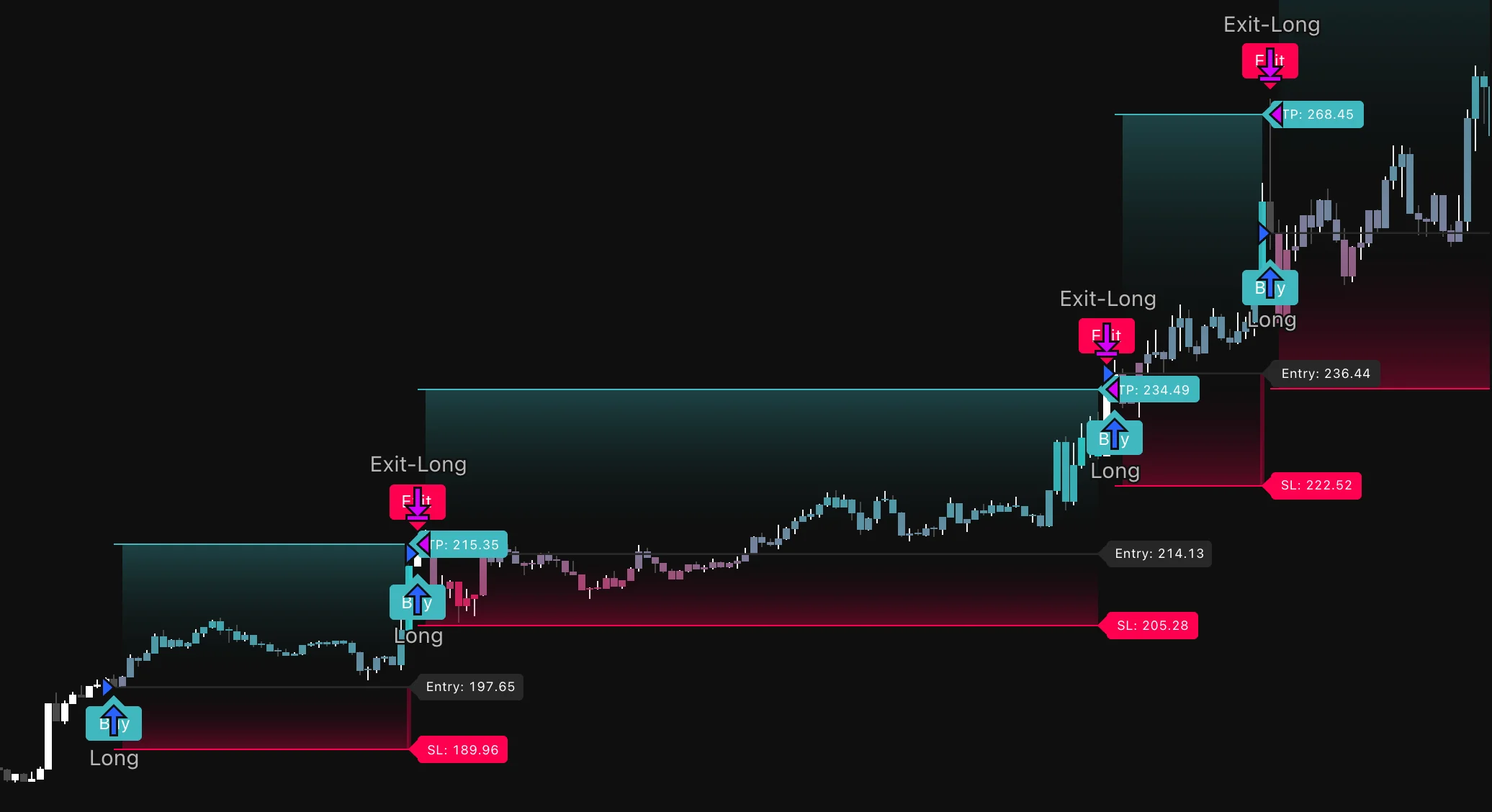

- Visual trade boxes – auto-drawn entry, TP and SL lines plus a live P & L bar so you always know where you stand at a glance.

- Smart on-chart warnings – instant alerts if lot size is too small, drawdown too high, or volatility spikes beyond plan.

- Webhook-ready JSON alerts – copy-paste messages fire directly into Binance, Bybit, Kraken / CCXT, or any broker supporting webhooks.

Quick Start

- Open

BTCUSDT(or your preferred BTC-perp) on a 30-minute chart. - Add ChainSmoker from your scripts list.

- In Inputs ▶ Position Sizing pick:

- Optimised (default): risk-% / ATR

- % of Equity for proportional sizing

- Fixed quantity for contract trading

- Create an alert → message: {{strategy.order.alert_message}} → paste your exchange’s webhook URL.

Best-Practice Tips

- Run signals on BTC 30 m and route orders to the most liquid perp at your venue.

- Keep Order Size % between 50–150 % when trading spot; halve if you’re on 2× leverage.

- Heed the on-chart red overlays: they’re early warnings, not after-the-fact scolding.

Let ChainSmoker sniff out cross-asset mis-pricings, size intelligently, and exit calmly—so you can trade crypto momentum without chain-watching charts all day.

Reviews

There are no reviews yet.