Description

Check out the Metatrader 5 Expert Advisor version on MQL5 market.

Checkout the setup guide on YouTube

Key Features

Advanced RSI Strategy

- Proprietary RSI-based algorithm that identifies high-probability reversal points

- Dynamic entry and exit points based on market conditions

- Intelligent trend recognition system

Risk Management

- Customizable risk parameters

- Advanced position sizing based on account equity

- Optional trailing stop loss functionality

- Maximum drawdown protection

Trading Flexibility

- Works on any timeframe

- Customizable trading direction (long-only, short-only, or both)

- Multiple currency pair support

- No hedging restrictions

Technical Specifications

Minimum Requirements

- Initial Capital: $1,000 recommended

- Broker: Pepperstone or ICMarkets

- Symbol: Works on any symbol, but you need to adjust the parameters accordingly

Key Parameters

- Customizable RSI levels for entry and exit

- Adjustable fibonacci take profit levels

- Flexible lot sizing and risk management

- Advanced trailing stop loss options

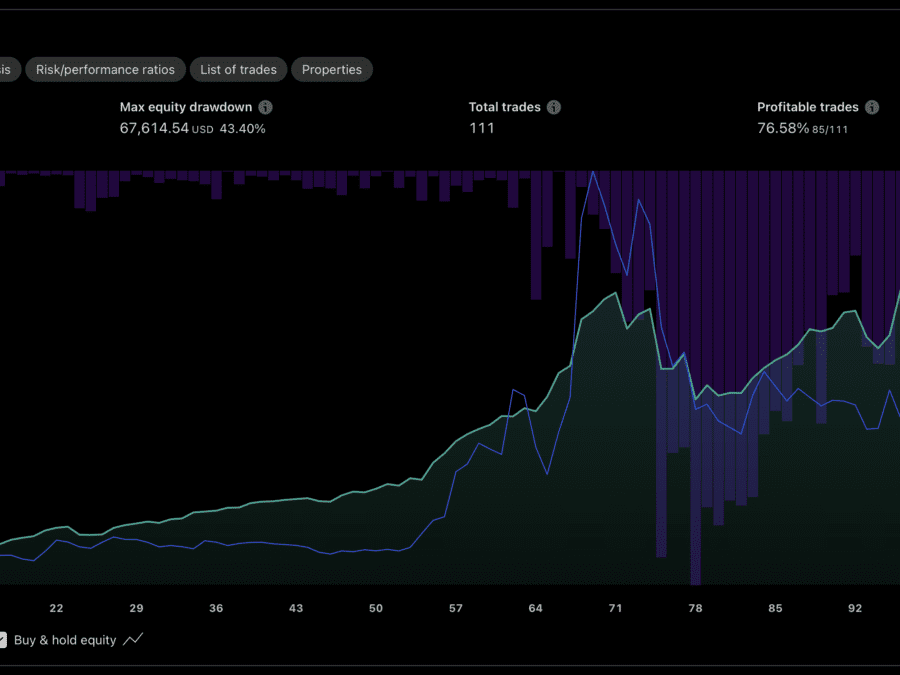

Performance Benefits

- Fully automated trading system

- Consistent performance across different market conditions

- Clear entry and exit rules

- Professional risk management

- Regular updates and optimization

Ideal For

- Traders seeking automated reversal trading strategies

- Portfolio managers looking for systematic trading solutions

- Investors wanting to diversify their trading approach

- Both beginners and experienced traders

Note: Past performance does not guarantee future results. Trading involves risk of loss. Please test thoroughly on a demo account before live trading. You can also you other symbols and timeframes, but you need to adjust the parameters accordingly.

Parameter Description

Core Parameters

- Risk: Risk percentage per trade for position sizing

- Lots: Fixed lot size (if set to 0, lot size is calculated based on RISK)

- Maximum drawdown: Maximum allowed drawdown percentage before closing all positions

RSI Settings

- Top RSI: Upper RSI threshold indicating overbought conditions

- Top reversal RSI: RSI level for confirming short entry signals

- Bottom RSI: Lower RSI threshold indicating oversold conditions

- Bottom reversal RSI: RSI level for confirming long entry signals

- RSI bars check: Number of past bars to check for overbought/oversold conditions

Trade Management

- Swing bars length: Number of bars used to identify swing points

- Take profit fibonacci ratio: Fibonacci ratio used for take profit calculation

- Minimum take profit size pips: Minimum take profit size in pips

- Liquidated candles for reversal: Number of candles to check for market liquidation

- Exit on reversal: Whether to exit positions on opposite reversal signals

This strategy combines RSI-based entry signals with advanced position management features including trailing stops and dynamic take profit levels based on market structure. The system is designed to capture reversals while maintaining strict risk management principles.

Note: For optimal performance, thoroughly test these parameters on a demo account before live trading.

Backtested parameters

USDCAD (H1)

- Top RSI: 90

- Top reversal RSI: 50

- Bottom RSI: 40

- Bottom reversal RSI: 20

- RSI bars check: 20

- Swing bars length: 5

- Take profit fibonacci ratio: 0.75

- Liquidated candles for reversal: 4

- Exit on reversal: false

GBPUSD (H1)

- Top RSI: 85

- Top reversal RSI: 65

- Bottom RSI: 30

- Bottom reversal RSI: 35

- RSI bars check: 5

- Swing bars length: 10

- Take profit fibonacci ratio: 0.25

- Liquidated candles for reversal: 3

- Exit on reversal: true

EURUSD (H1)

- Top RSI: 60

- Top reversal RSI: 60

- Bottom RSI: 30

- Bottom reversal RSI: 20

- RSI bars check: 20

- Swing bars length: 10

- Take profit fibonacci ratio: 1

- Liquidated candles for reversal: 3

- Exit on reversal: false

AUDUSD (H1)

- Top RSI: 60

- Top reversal RSI: 55

- Bottom RSI: 25

- Bottom reversal RSI: 40

- RSI bars check: 15

- Swing bars length: 10

- Take profit fibonacci ratio: 1

- Liquidated candles for reversal: 1

- Exit on reversal: true

XAUUSD (H1)

- Top RSI: 90

- Top reversal RSI: 90

- Bottom RSI: 30

- Bottom reversal RSI: 50

- RSI bars check: 20

- Swing bars length: 10

- Take profit fibonacci ratio: 1

- Liquidated candles for reversal: 3

- Exit on reversal: false

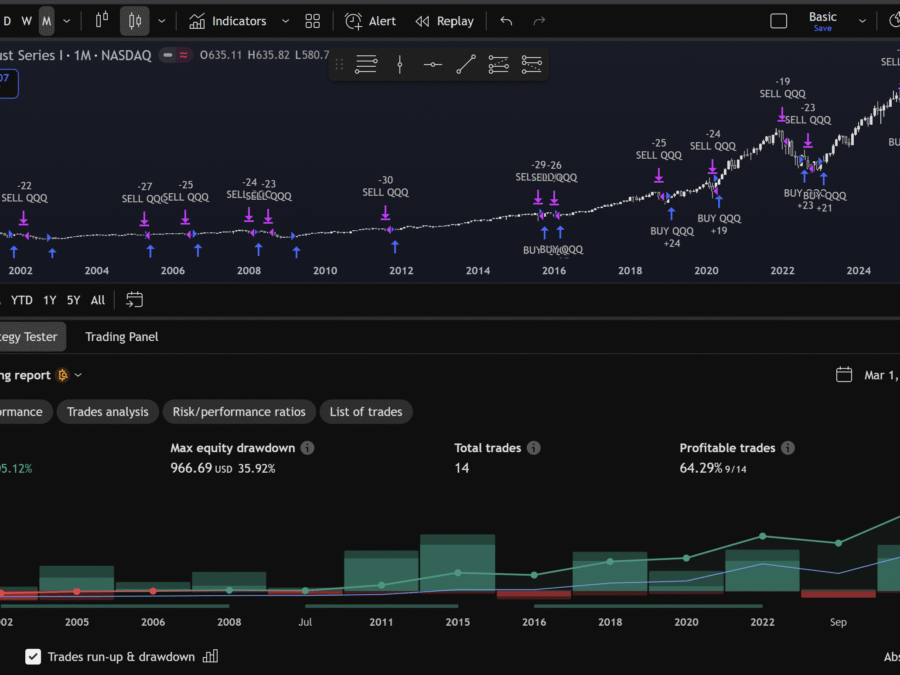

US30 (H1)

- Top RSI: 90

- Top reversal RSI: 90

- Bottom RSI: 35

- Bottom reversal RSI: 45

- RSI bars check: 15

- Swing bars length: 15

- Take profit fibonacci ratio: 0.5

- Liquidated candles for reversal: 3

- Exit on reversal: false

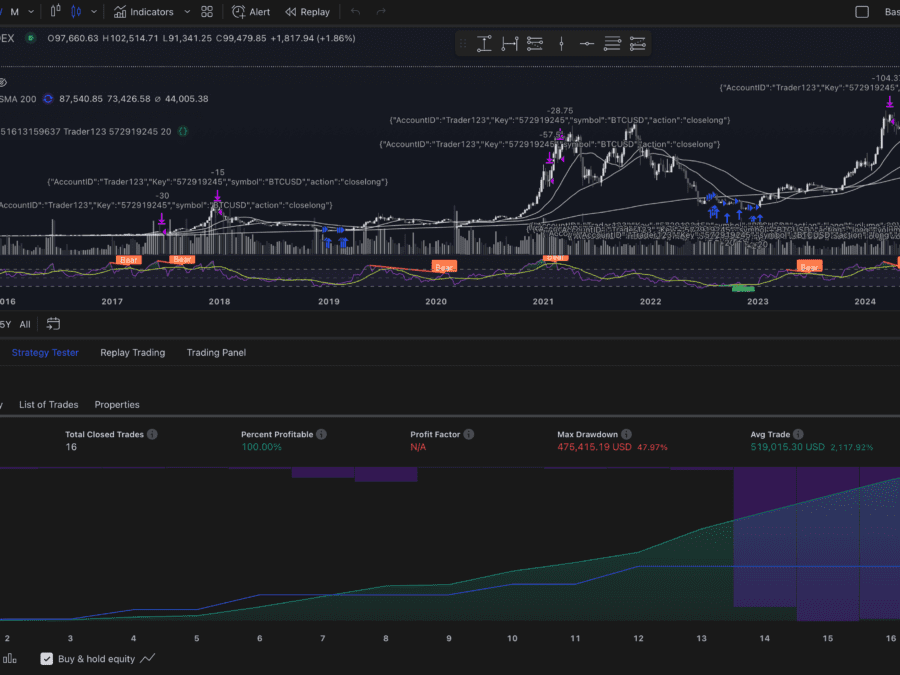

BTCUSD (H1)

- Top RSI: 90

- Top reversal RSI: 90

- Bottom RSI: 35

- Bottom reversal RSI: 47

- RSI bars check: 10

- Swing bars length: 10

- Take profit fibonacci ratio: 0.5

- Liquidated candles for reversal: 4

- Exit on reversal: true

FAQ

How to setup Pineconnector?

- Create a Pineconnector subscription and get the license number

- Input the license number into the Pineconnector account number

- Add the Pepperstone (or any broker) account size in the Initial capital in Properties

- Add the Risk for dynamic lots calculation or use a Custom lots

- Create an alert and add {{strategy.order.comment}} in the Message and add the Pineconnector Webhook URL as specified in the docs

- Proceed with the EA and VPS setup specified in the Pineconnector docs.

Strategy did not generate any orders/trades

Try to increase the Initial Capital or change the chart provider/broker. Some symbols required a minimum size per trade.

Error on bar: Invalid qty value

Decrease the risk or custom lot size,

Reviews

There are no reviews yet.