Introduction

The Fibonacci strategy is a popular method in technical analysis that uses Fibonacci retracement levels to identify potential reversal points in the market. These levels are derived from the Fibonacci sequence and are key in predicting areas of support and resistance.

Pine Script is the scripting language used on TradingView, enabling traders to create custom indicators and strategies. With Pine Script, you can automate the calculation of Fibonacci levels based on recent price movements, allowing for dynamic adjustments as new data comes in.

In this article, you’ll learn:

- The significance of Fibonacci levels in identifying support and resistance zones.

- How Pine Script can be utilized to develop a Fibonacci retracement strategy.

- Steps to code a basic Fibonacci script and enhance it with advanced techniques.

- Methods for backtesting and optimizing your strategy.

- Tips for adapting your approach to different market conditions.

Understanding Fibonacci Levels

The Fibonacci Sequence and Its Mathematical Properties

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones, usually starting with 0 and 1. This sequence looks like this:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34…

The mathematical properties of the Fibonacci sequence have intriguing applications in various fields like biology, art, and finance. In trading, these numbers are used to identify potential support and resistance levels through Fibonacci retracement levels.

Key Fibonacci Retracement Levels

Fibonacci retracement levels are percentages derived from the Fibonacci sequence that indicate potential reversal points:

- 23.6%

- 38.2%

- 50%

- 61.8%

- 76.4%

Each level represents a possible area where the price might retrace before continuing in its original direction.

Importance in Identifying Potential Price Reversals:

- 23.6% Level: Minor pullback level; indicates weak support/resistance.

- 38.2% Level: Often used as a secondary support/resistance zone.

- 50% Level: Not an official Fibonacci ratio but commonly used due to psychological significance.

- 61.8% Level: Considered the “golden ratio” and a strong indicator of potential reversal.

- 76.4% Level: Indicates deep retracements; often used in volatile markets.

Determining Support and Resistance Zones

To use Fibonacci levels for identifying support and resistance zones:

- Identify Swing Highs and Lows: Determine recent significant highs and lows in the price chart.

- Apply Fibonacci Retracement Tool: Use tools on platforms like TradingView to draw lines from swing high to swing low (or vice versa).

- Analyze Price Behavior: Look for price interactions at key retracement levels—these interactions often highlight areas of support (where price stops falling) or resistance (where price stops rising).

Using these steps helps traders make informed decisions by predicting where prices might reverse or continue their trends based on historical data.

Example:

plaintext Imagine a stock moves from $100 (swing low) to $150 (swing high). Applying Fibonacci retracement:

- The 23.6% level would be around $138

- The 38.2% level would be around $131

- The 50% level would be around $125

By understanding how these levels work and applying them correctly, you can enhance your trading strategy’s effectiveness by accurately identifying crucial price points for making entry or exit decisions.

The Power of Pine Script for Traders

Pine Script is a versatile scripting language tailored specifically for the TradingView platform. It empowers traders to create custom indicators, strategies, and alerts, facilitating more informed trading decisions.

Key Features and Advantages

1. Ease of Use

Pine Script is designed with simplicity in mind, making it accessible even for those new to coding. Its syntax is straightforward, allowing traders to quickly develop and implement their ideas.

2. Custom Indicators

Create personalized indicators that match your unique trading style. Whether you’re looking to visualize trend lines or develop complex oscillators, Pine Script provides the flexibility needed.

3. Automated Trading

Automate your trading strategies directly on TradingView. With Pine Script, you can set up conditions for entering and exiting trades based on your criteria, reducing the emotional factor in trading decisions.

4. Backtesting Capabilities

Validate your strategies using historical data. Pine Script allows you to backtest your trading ideas, providing insights into their potential effectiveness before committing real capital.

5. Rich Library of Built-in Functions

Utilize an extensive range of built-in functions that simplify common tasks like calculating moving averages or identifying pivot points. This library speeds up development and ensures accuracy in calculations.

6. Integration with TradingView’s Ecosystem

Seamlessly integrate your scripts with TradingView’s expansive ecosystem. Share your scripts with the community or use those created by others to enhance your trading toolkit.

Incorporating Pine Script into your trading routine offers numerous advantages, paving the way for more strategic and disciplined approaches to market analysis. It’s worth noting that while platforms like MetaTrader 5 are popular for algo trading due to their robust features, TradingView’s capabilities combined with Pine Script offer a unique advantage in terms of user-friendly interface and customization options.

Coding a Basic Fibonacci Retracement Strategy in Pine Script

To start coding a Fibonacci strategy in Pine Script, you need to understand the basic syntax and functions. Here’s a step-by-step guide to creating a simple Fibonacci retracement script.

Step 1: Setting Up the Script

Start by opening TradingView and creating a new Pine Script strategy. Use the following template to set up the script:

pine //@version=4 strategy(“Fibonacci Retracement Strategy”, overlay=true)

Step 2: Calculating High and Low Points

Next, calculate the highest high and lowest low over a specific period. These points will serve as the basis for drawing Fibonacci retracement levels. You might also want to explore candle body range for more precise calculations.

pine var int len = input(14, title=”Length”) highLevel = highest(high, len) lowLevel = lowest(low, len)

Step 3: Defining Fibonacci Levels

Define your Fibonacci retracement levels based on the high and low points calculated previously. Commonly used levels include 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

pine fib23 = highLevel – (highLevel – lowLevel) * 0.236 fib38 = highLevel – (highLevel – lowLevel) * 0.382 fib50 = highLevel – (highLevel – lowLevel) * 0.5 fib62 = highLevel – (highLevel – lowLevel) * 0.618 fib76 = highLevel – (highLevel – lowLevel) * 0.764

Step 4: Plotting Fibonacci Levels

Plot these levels on your chart for visualization.

pine plot(fib23, color=color.red, title=”Fib 23.6%”) plot(fib38, color=color.orange, title=”Fib 38.2%”) plot(fib50, color=color.yellow, title=”Fib 50%”) plot(fib62, color=color.green, title=”Fib 61.8%”) plot(fib76, color=color.blue, title=”Fib 76.4%”)

Step 5: Creating Entry and Exit Rules

Define entry and exit conditions based on price interactions with these Fibonacci levels.

Example: Enter a long position when the price crosses above the 38.2% level and exit when it reaches the 61.8% level.

pine longCondition = crossover(close, fib38) exitCondition = crossover(close, fib62)

if (longCondition) strategy.entry(“Long”, strategy.long)

if (exitCondition) strategy.close(“Long”)

Final Script

Here is the complete script combining all steps:

pine //@version=4 strategy(“Fibonacci Retracement Strategy”, overlay=true)

var int len = input(14, title=”Length”) highLevel = highest(high, len) lowLevel = lowest(low, len)

fib23 = highLevel – (highLevel – lowLevel) * 0.236 fib38 = highLevel – (highLevel – lowLevel) * 0.382 fib50 = highLevel – (highLevel – lowLevel

Enhancing Your Fibonacci Strategy with Advanced Techniques

Improving the accuracy of your Fibonacci-based trades often involves integrating additional indicators or filters. These enhancements can help you confirm signals and avoid false breakouts.

1. Moving Averages

Simple Moving Average (SMA): Combine Fibonacci levels with SMAs to identify trends. For instance, if the price is above the SMA, it might indicate an uptrend, making Fibonacci retracement levels more reliable as support zones.

Exponential Moving Average (EMA): EMAs react faster to price changes. Using EMAs with Fibonacci levels can help in spotting quicker trend reversals.

2. Relative Strength Index (RSI)

Overbought/Oversold Conditions: When combined with Fibonacci retracement levels, RSI can signal potential reversals. If the price hits a 61.8% retracement level while RSI indicates overbought conditions, it might be a strong sell signal.

3. MACD (Moving Average Convergence Divergence)

Divergences: Look for divergences between MACD and price action at key Fibonacci levels to confirm potential reversals.

Crossovers: MACD crossovers near Fibonacci retracement levels can serve as confirmation for entry or exit points.

4. Volume Analysis

Volume Spikes: High volume at key Fibonacci levels can validate the strength of these levels as support or resistance.

Volume Oscillators: Use tools like On-Balance Volume (OBV) to gauge the strength of a trend when prices approach Fibonacci retracement zones.

5. Candlestick Patterns

Reversal Patterns: Patterns such as Doji, Hammer, or Engulfing near Fibonacci levels provide visual confirmation of potential reversals.

Continuation Patterns: Patterns like Flags or Pennants at Fibonacci levels can indicate the continuation of prevailing trends.

Combining these techniques with your existing Fibonacci strategy creates a more robust trading system. Incorporate these indicators into your Pine Script code to enhance decision-making and improve trade accuracy.

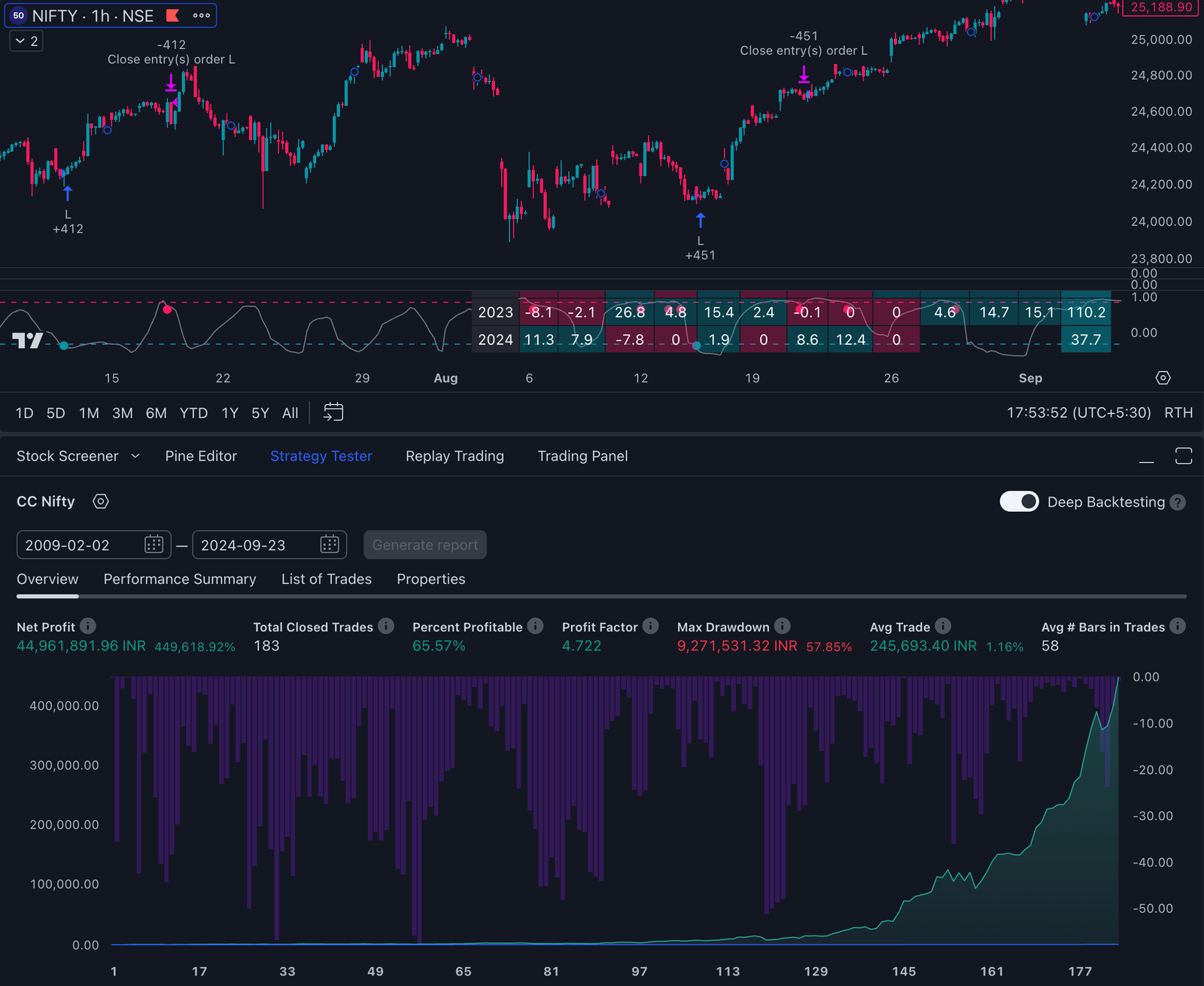

Backtesting and Optimizing Your Fibonacci Strategy

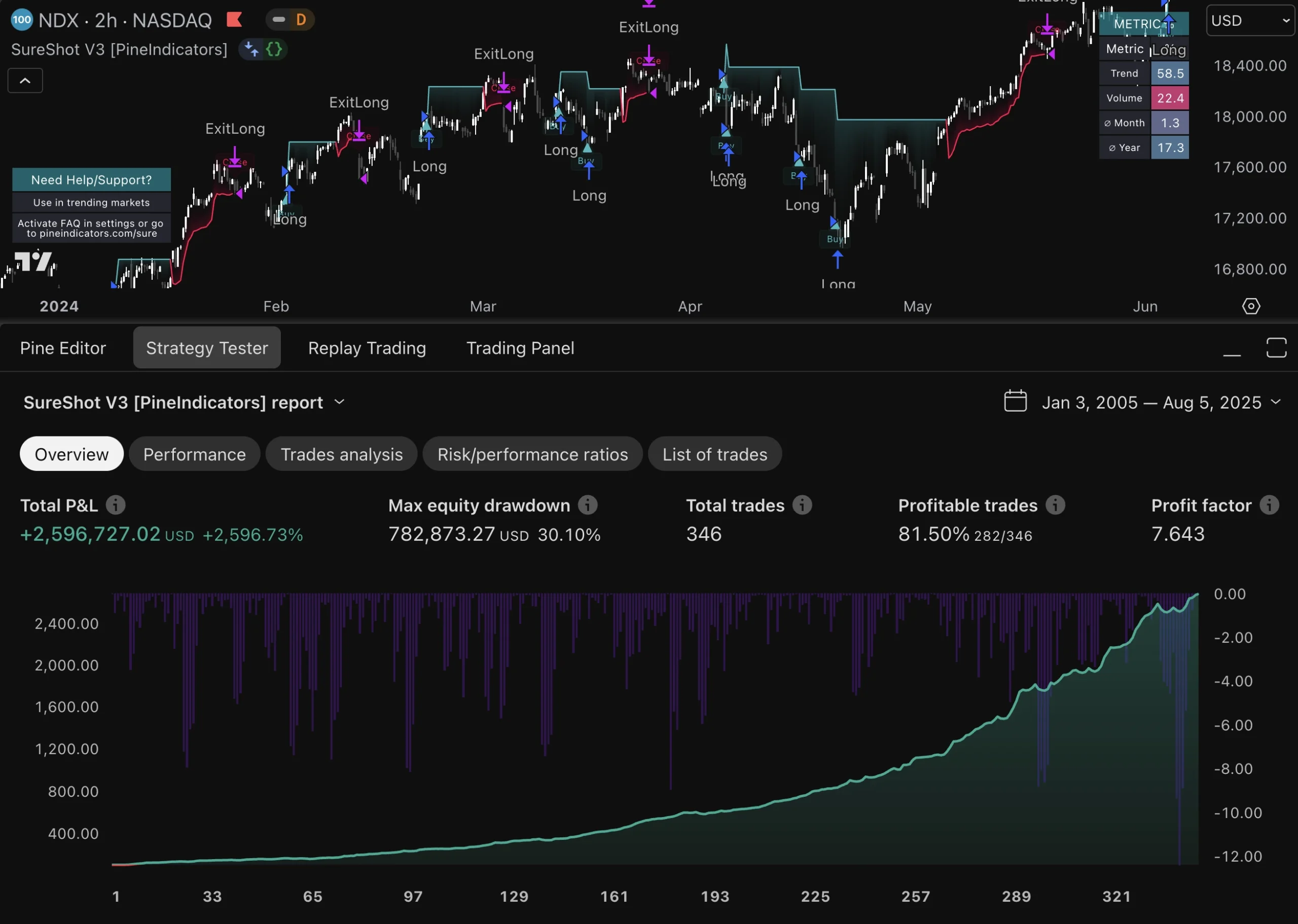

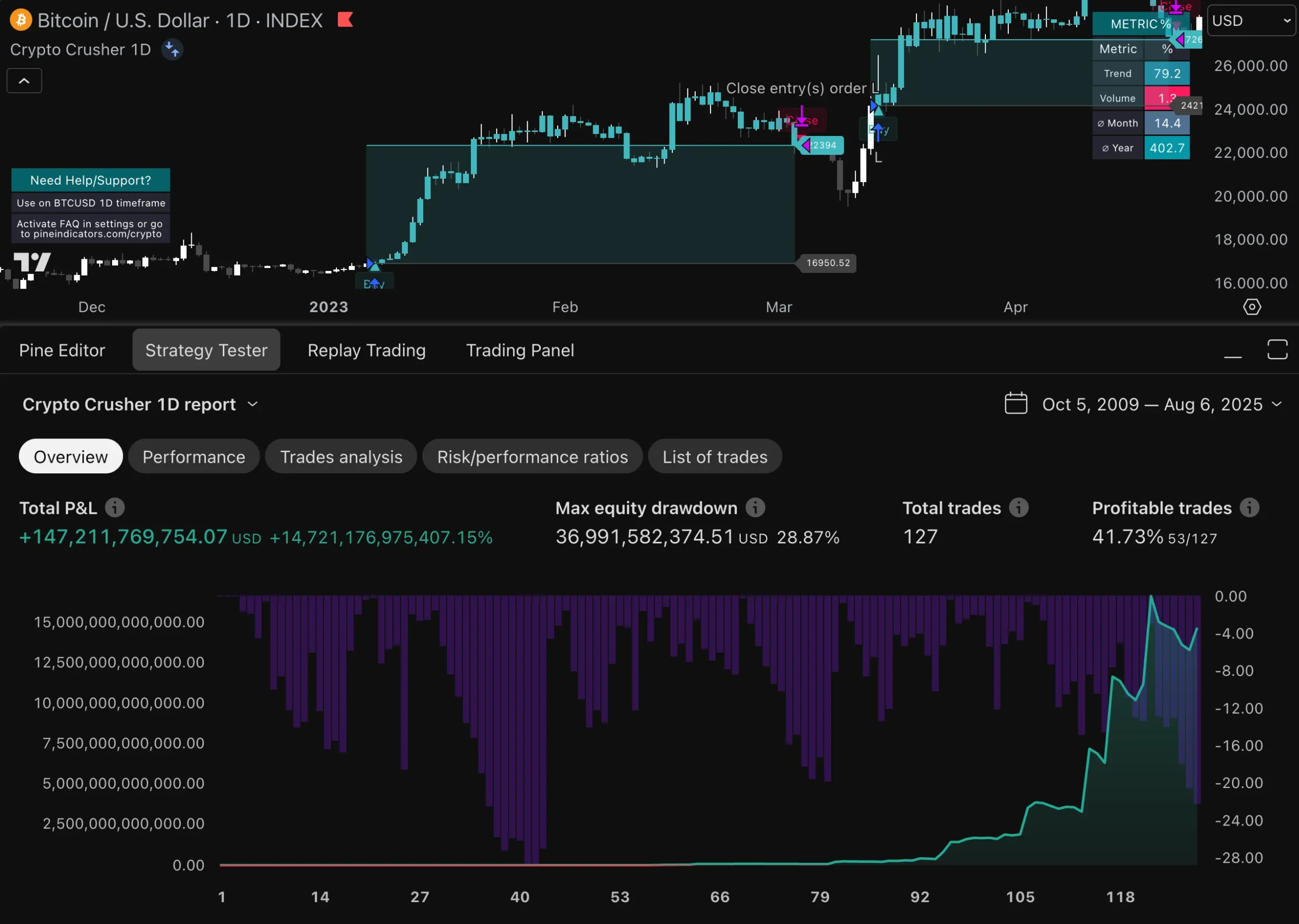

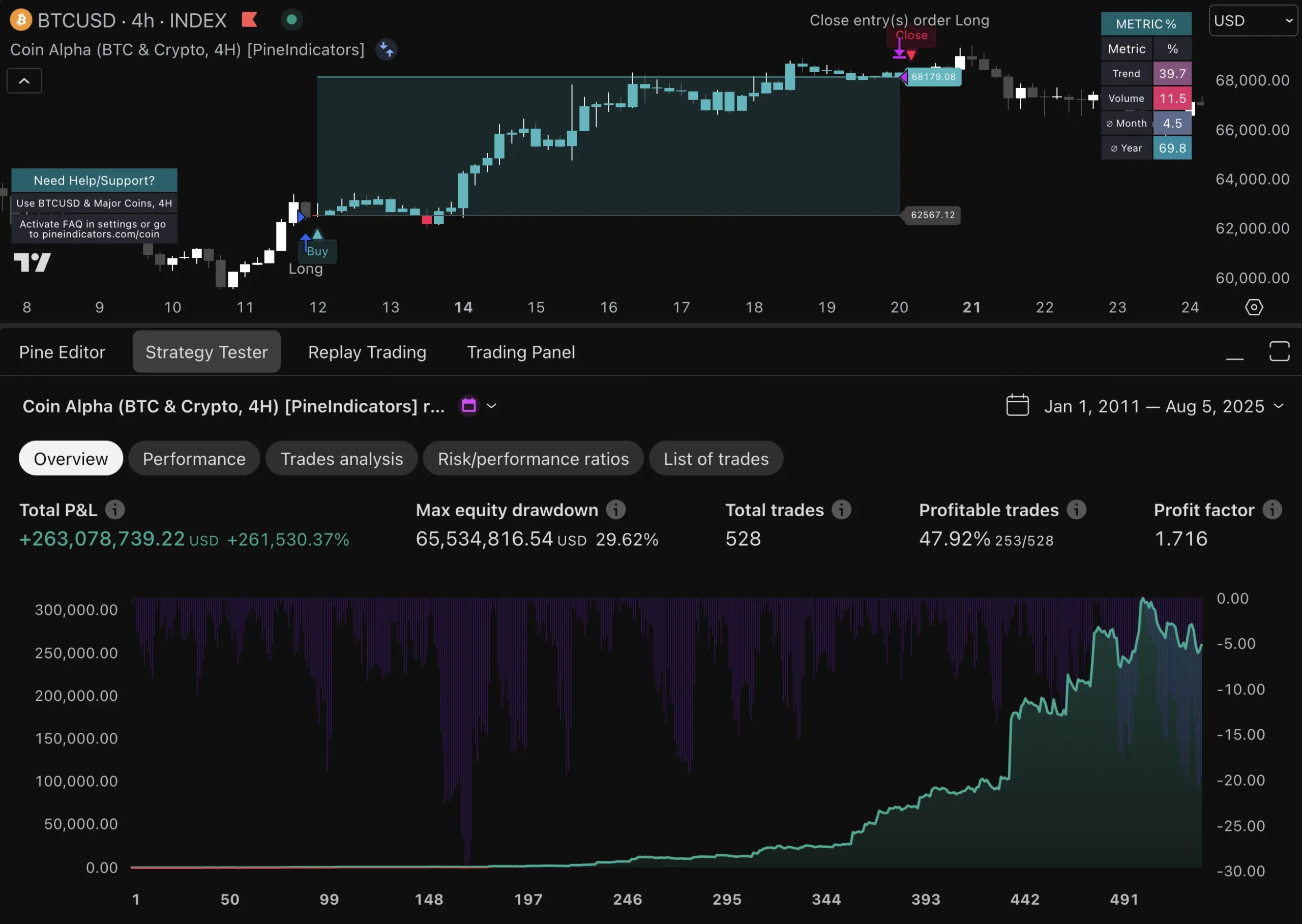

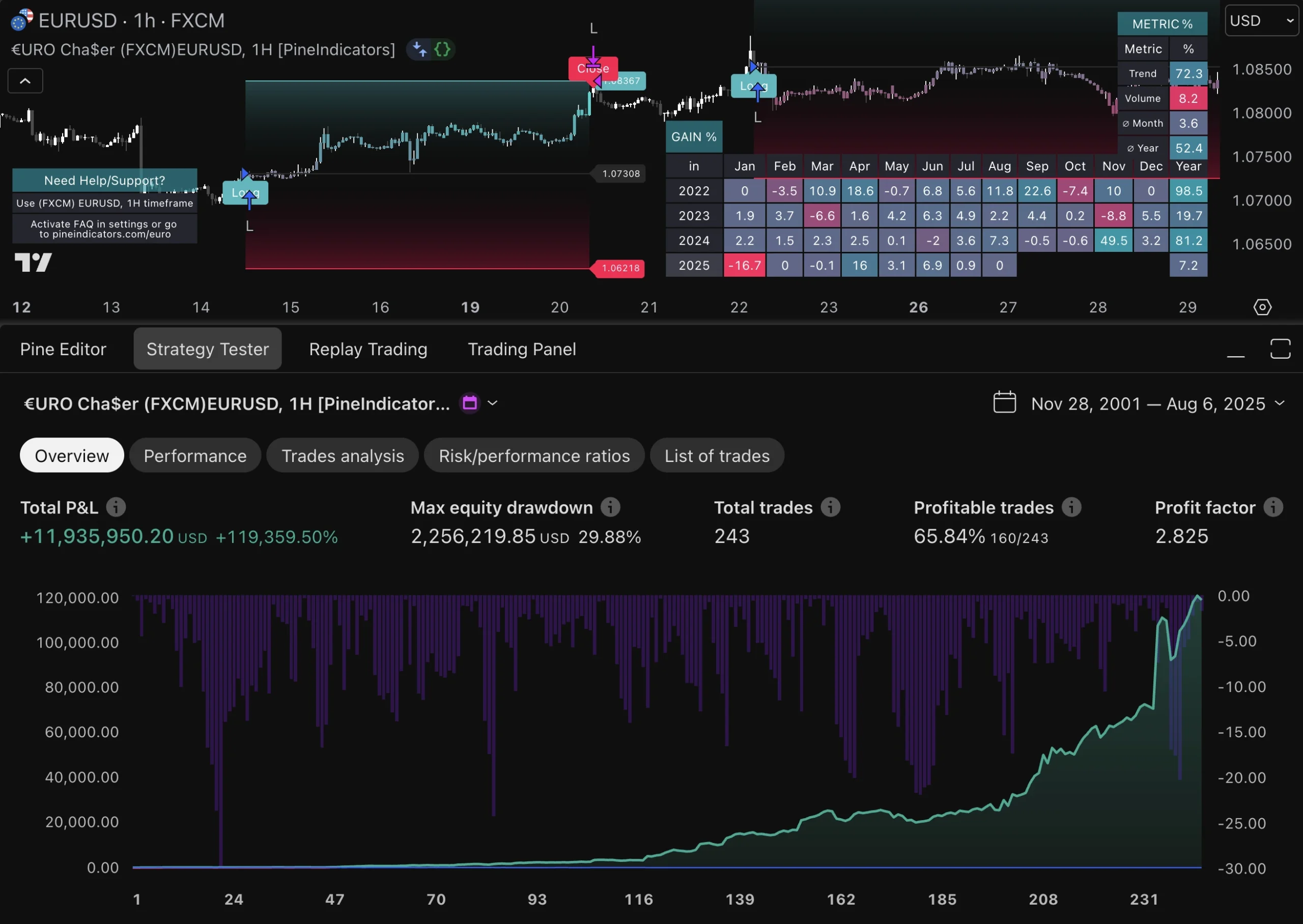

Backtesting is crucial for testing how effective your Fibonacci strategy is using historical data. By simulating trades based on past price movements, you can assess how well your strategy performs under various market conditions. This not only helps in identifying potential weaknesses but also builds confidence in your strategy before deploying it in live trading.

Key Steps for Effective Backtesting:

- Collect Historical Data: Obtain comprehensive historical price data for the assets you intend to trade.

- Define Entry and Exit Conditions: Clearly outline the criteria for entering and exiting trades based on Fibonacci levels.

- Simulate Trades: Use Pine Script to run simulations over the historical data, recording profits and losses.

- Analyze Results: Evaluate performance metrics such as win/loss ratio, drawdown, and overall profitability.

By following these steps, you can gain valuable insights into how your Fibonacci strategy behaves across different periods and market environments.

Methods for Optimizing Your Strategy Parameters:

- Parameter Tuning: Adjust key variables like retracement levels or stop-loss limits to find the optimal settings that enhance performance. For instance, experimenting with different Fibonacci levels (e.g., 23.6%, 38.2%, 50%, 61.8%, 76.4%) can help you identify which thresholds yield better results.

- Walk-Forward Analysis: Divide your historical data into multiple segments and test your strategy on each segment sequentially. This helps ensure that optimizations are robust and not simply overfitted to a specific time period.

- Genetic Algorithms: Implement advanced optimization techniques such as genetic algorithms to explore a wider range of parameter combinations efficiently. These algorithms mimic natural selection processes to evolve better-performing strategies over successive iterations.

Optimizing your strategy involves continuous refinement and validation through backtesting, enabling you to achieve better performance results while adapting to changing market conditions.

Adapting Your Fibonacci Strategy to Different Market Conditions

Understanding how market trends can impact the reliability of Fibonacci levels as support or resistance zones is crucial. In trending markets, Fibonacci retracement levels tend to be more reliable due to the clear direction of price movement. During uptrends, you often observe prices bouncing off key Fibonacci levels such as 38.2% or 61.8% before continuing higher. Conversely, in downtrends, these levels act as resistance where price may halt its correction and resume its decline.

However, in ranging markets, the price oscillates between established support and resistance zones without a clear direction. This makes Fibonacci levels less predictable. You might see prices fluctuating around these levels without significant reversals, leading to false signals.

Tips for Adjusting Your Strategy

To enhance the adaptability of your Fibonacci strategy in Pine Script:

- Identify Market Conditions: Use indicators like the Average Directional Index (ADX) to determine if the market is trending or ranging. An ADX reading above 25 typically indicates a trending market, while below 25 suggests a range-bound scenario.

- Dynamic Adjustments: Modify your entry and exit rules based on current market conditions. For instance, in trending markets, consider using tighter stop-losses and trailing stops to capture momentum more effectively.

- Combine Indicators: Integrate additional technical indicators such as Moving Averages or Relative Strength Index (RSI) with your Fibonacci strategy. These can provide confirmation signals and filter out unreliable trades during ranging periods.

By tweaking your approach according to prevailing market conditions, you can make your Fibonacci strategy more robust and adaptable. This flexibility enhances your ability to navigate different trading environments effectively with Pine Script.

Conclusion: Mastering Fibonacci Trading with Pine Script

Using the Fibonacci strategy with Pine Script offers traders a potent combination of mathematical precision and automated strategy execution. This blend allows for dynamic adjustments to market conditions, enhancing your ability to identify key support and resistance zones.

Benefits:

- Precision: Automatically calculates and adjusts Fibonacci levels.

- Efficiency: Streamlines the process of identifying trading opportunities.

Challenges:

- Complexity: Requires a solid understanding of both Fibonacci retracement and Pine Script.

- Market Variability: Success can depend on prevailing market conditions.

Encouraging you to delve deeper into risk management, trade psychology, and portfolio diversification will only strengthen your trading arsenal. Combining these advanced topics with the technical prowess of Fibonacci retracements equips you with a robust toolkit for navigating the markets effectively.

FAQs (Frequently Asked Questions)

What is the Fibonacci strategy and its significance in technical analysis?

The Fibonacci strategy is a popular technical analysis tool that utilizes the Fibonacci sequence to identify potential price reversals in the market. It highlights key retracement levels (such as 23.6%, 38.2%, 50%, 61.8%, and 76.4%) which traders use to determine support and resistance zones, making it significant for predicting future price movements.

How does Pine Script facilitate the implementation of trading strategies?

Pine Script is a powerful scripting language used on the TradingView platform, enabling traders to create custom indicators and strategies. It allows users to code their trading ideas into automated scripts, facilitating backtesting and real-time execution of trading strategies based on technical analysis principles like the Fibonacci strategy.

What are Fibonacci retracement levels and how are they used in trading?

Fibonacci retracement levels are horizontal lines that indicate potential support or resistance areas based on the Fibonacci sequence. Key levels include 23.6%, 38.2%, 50%, 61.8%, and 76.4%. Traders use these levels to identify where price reversals might occur, helping them make informed decisions about entry and exit points.

Can you provide an overview of coding a basic Fibonacci retracement strategy in Pine Script?

To code a basic Fibonacci retracement strategy in Pine Script, you start by defining the Fibonacci levels using specific functions to calculate these values based on historical price data. A step-by-step guide typically includes setting up your script environment, inputting relevant price data, calculating Fibonacci levels, and plotting them on the chart for visual reference.

How can I enhance my Fibonacci strategy with advanced techniques?

Enhancing your Fibonacci strategy can involve incorporating additional technical indicators or filters such as moving averages or RSI to confirm signals generated by Fibonacci levels. This multi-faceted approach can improve trade accuracy by providing additional context and reducing false signals.

Why is backtesting important for validating a Fibonacci strategy?

Backtesting is crucial for validating the effectiveness of a Fibonacci strategy because it allows traders to assess how well their strategy would have performed using historical data. This process helps identify strengths and weaknesses in the approach, enabling optimization of parameters for better performance results before deploying it in live markets.