Description

Description:

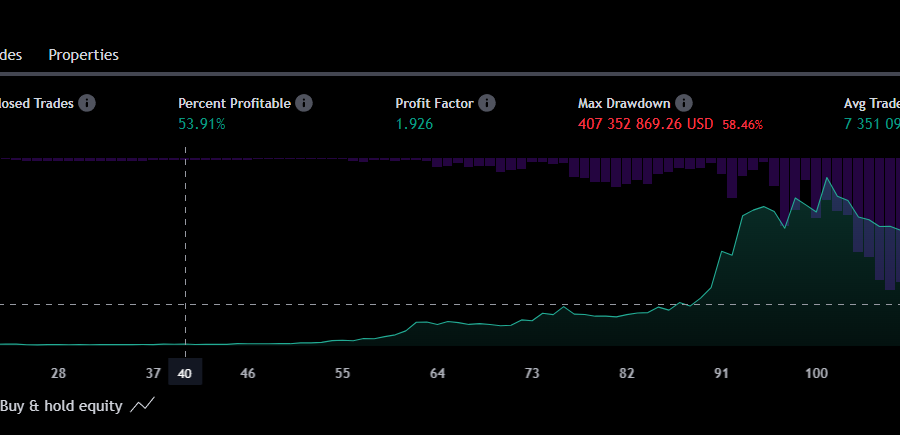

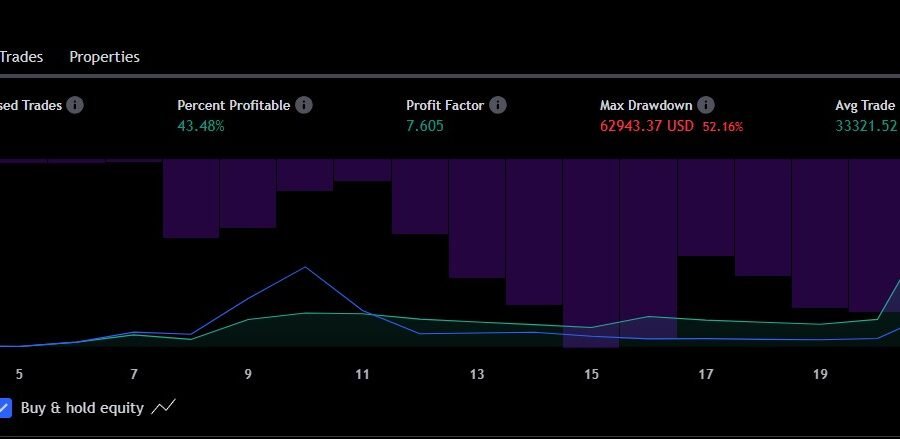

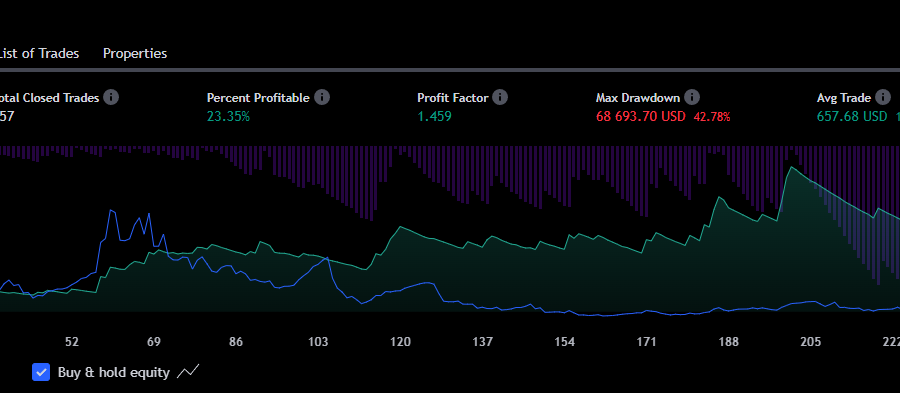

Unveil the potential of low and medium cap altcoins through the precision of our Linear Regression Bands Scalping Strategy. Tailored for traders who thrive in the fast-paced environment of the cryptocurrency market, this strategy is optimized for scalping on short timeframes, particularly 3 to 5 minutes, though adaptable across a range of trading conditions.

Leveraging the mathematical prowess of Linear Regression alongside dynamically adjusted Standard Deviation bands, our strategy aims to pinpoint outlier trading opportunities with high precision. The strategy’s core revolves around the concept of standard deviation as a measure of volatility, enabling traders to make informed decisions based on the proximity of price to these critical bands.

Features:

- Dynamic Entry and Exit Points: Choose from seven different levels for both entry and exit, ranging from the Linear Regression line (Basis) to three Standard Deviation (SD) bands above or below it. This granularity allows for customized strategy tuning to match your risk tolerance and trading style.

- Adaptive to Market Conditions: Designed for 3-5 minute timeframes, with recommendations for adjusting lengths based on market volatility and timeframe shifts. Suitable for high-frequency trading scenarios common in altcoin markets.

- Customizable Take Profit and Stop Loss Levels: Initial settings aim to capture outliers, with TP and SL percentages set outside the usual range. Adjust these parameters to fine-tune the strategy’s responsiveness to price movements and secure gains while minimizing risks.

- Color-Coded Visualization: Quickly assess market conditions with color-coded SD bands – darker colors indicate proximity to the Linear Regression line, while brighter colors signal outliers. This visual cue aids in rapid decision-making during scalping sessions.

Ideal Use Case:

This strategy shines in low to medium cap altcoin markets, where volatility can provide ripe opportunities for scalping. It’s particularly suited for traders who prefer low timeframes and demand a high level of precision in their technical analysis tools.

Configuration Tips:

- Start with the suggested length of 500-1000 for the Linear Regression calculation on 3-5 min timeframes. Adjust based on the asset and market conditions.

- The TP and SL percentages are initially set to 99% to encourage trades outside the typical range. Once you’re comfortable with the strategy’s operation, fine-tune these values to optimize for your trading goals.

Visual Aids:

Plots include the basis Linear Regression line and six Standard Deviation bands, each with distinct color for intuitive analysis. These visual aids are designed to help traders quickly identify the price’s position relative to expected volatility and regression trends, essential for making fast, informed scalping decisions.

Warning – so far I’ve had the best results within ranging markets. In a bull run it wont work with default settings, because it tries to short the outlier long candle with the idea that it will regress to the linear regression line, that most likely won’t happen in a bull run. It can work if you completely change entry requirements for bull runs. It is a tool to be fitted to your strategy.

Warning: past results are not indicative of future gains. Please read the guidelines of the website, we provide tools for you to use, not guaranteed profit.

Reviews

There are no reviews yet.