Description

**Key Features:**

1. **SuperTrend Indicator:** Utilizes the SuperTrend indicator to determine the overall market direction. A positive SuperTrend direction indicates an uptrend, while a negative direction indicates a downtrend.

2. **Parabolic SAR (PSAR):** Uses the PSAR indicator to identify potential reversal points in the market. The PSAR values are plotted on the chart to assist with entry and exit decisions.

3. **Long and Short Positions:** Allows for both long and short positions based on the combined signals of the SuperTrend and PSAR. The strategy can be configured to trade long, short, or both directions.

4. **Stop Loss and Take Profit:** Includes optional stop loss and take profit settings to manage risk and lock in profits. These levels are defined as percentages of the entry price.

5. **Customizable Inputs:** Provides a range of input parameters for fine-tuning the strategy, including the SuperTrend factor and ATR length, PSAR start, increment, and maximum values, and the choice of strategy direction (long, short, or both).

**Strategy Logic:**

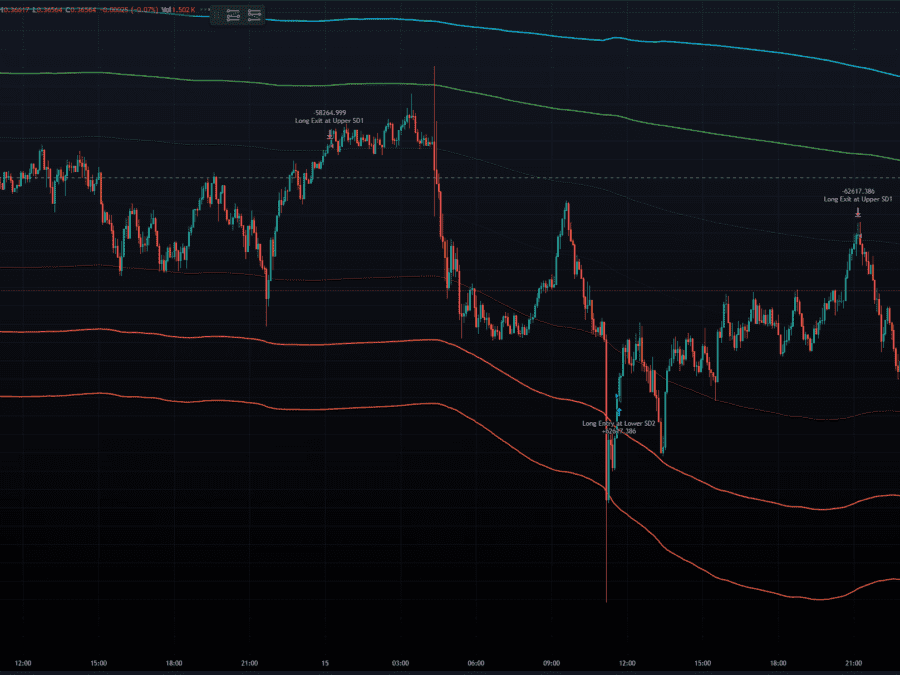

– **Long Entry:** A long position is initiated when the SuperTrend direction turns positive (indicating an uptrend) and the PSAR is below the closing price.

– **Long Exit:** The long position is closed when the SuperTrend direction turns negative (indicating a downtrend) or the PSAR moves above the closing price.

– **Short Entry:** A short position is initiated when the SuperTrend direction turns negative (indicating a downtrend) and the PSAR is above the closing price.

– **Short Exit:** The short position is closed when the SuperTrend direction turns positive (indicating an uptrend) or the PSAR moves below the closing price.

– **Stop Loss and Take Profit:** If enabled, the strategy will automatically place stop loss and take profit orders based on the specified percentages of the entry price.

**Inputs:**

– **SuperTrend Factor:** Determines the sensitivity of the SuperTrend indicator.

– **SuperTrend ATR Length:** Sets the ATR length for the SuperTrend calculation.

– **PSAR Start:** Initial value for the PSAR calculation.

– **PSAR Increment:** Incremental step for the PSAR calculation.

– **PSAR Maximum:** Maximum value for the PSAR calculation.

– **Strategy Type:** Choose between “Long”, “Short”, or “Both” strategies.

– **Use Stop Loss/Take Profit:** Enable or disable stop loss and take profit orders.

– **Stop Loss Percentage:** Percentage of the entry price to set the stop loss level.

– **Take Profit Percentage:** Percentage of the entry price to set the take profit level.

**Plotting:**

– **SuperTrend Line:** Plots the SuperTrend line on the chart, color-coded based on the trend direction (green for uptrend, red for downtrend).

– **PSAR Points:** Plots the PSAR values on the chart as blue circles.

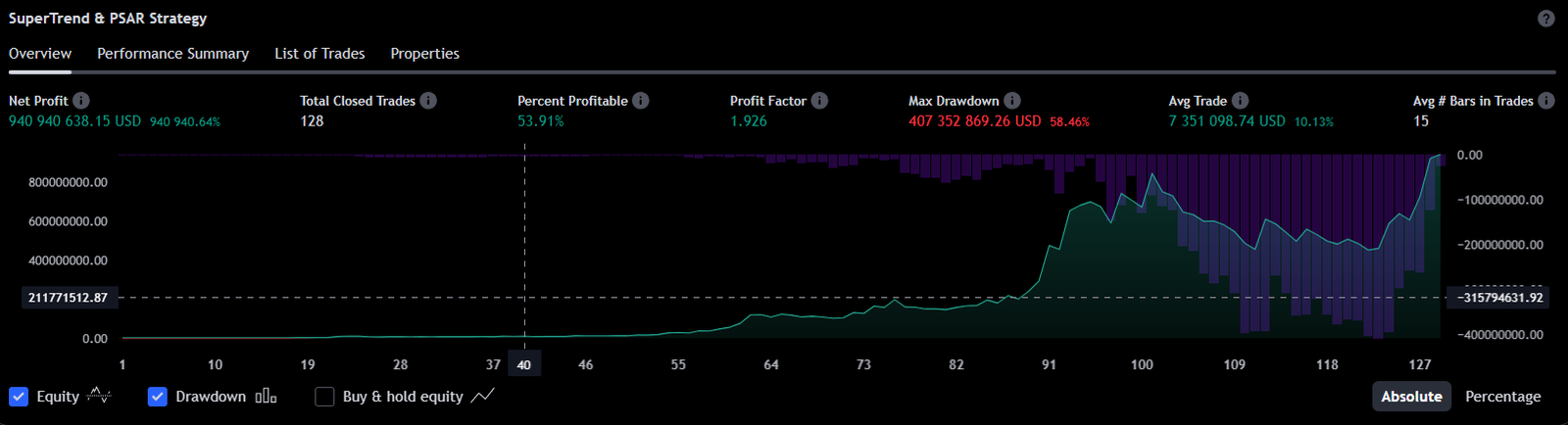

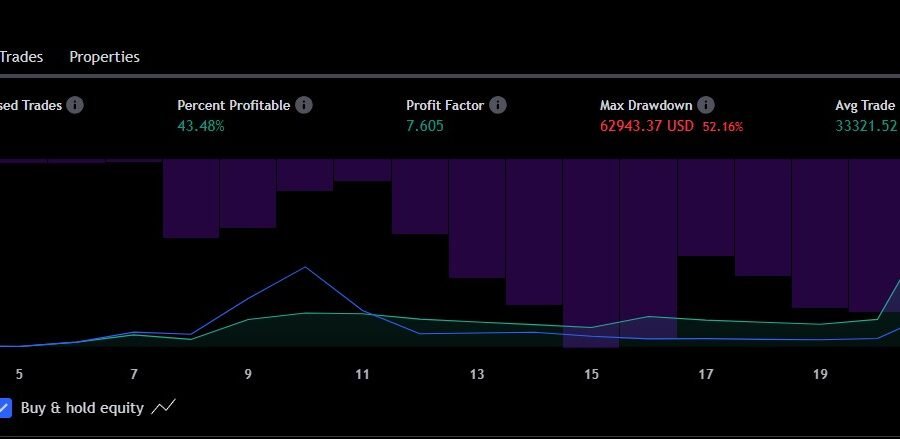

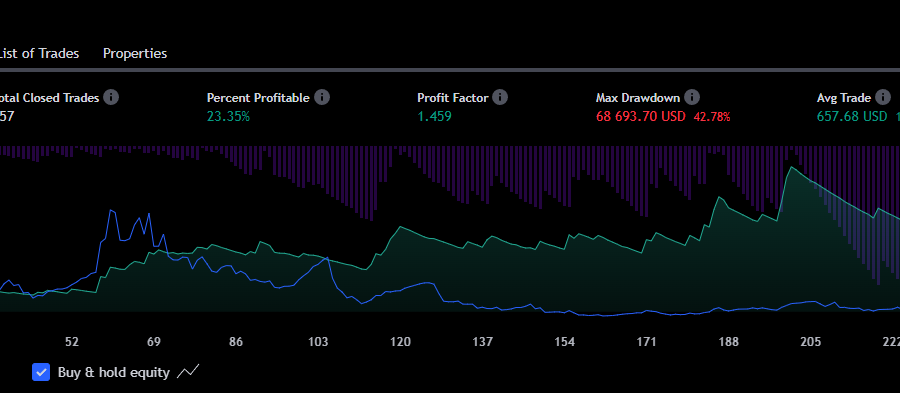

This strategy is designed for traders who want a robust and adaptable system that can trade in various market conditions while managing risk effectively. By combining the SuperTrend and PSAR indicators, traders can capture trend-following opportunities with precise entry and exit points.

Reviews

There are no reviews yet.