Introduction

TradingView is a popular platform that provides traders with powerful tools for market analysis and strategy development. It allows users to create, backtest, and optimize trading strategies using its proprietary programming language, Pine Script.

Coding strategies is crucial for effective trading as it enables you to automate decision-making processes, ensuring consistent application of your trading rules. This automation helps in reducing emotional biases and improving the overall performance of your trading activities.

In this article, we will explore how to code trading strategies using Pine Script on TradingView. From understanding the basics to implementing complex strategies, you’ll learn how to fully utilize Pine Script for your trading needs.

Getting Started with Pine Script

Pine Script is a lightweight programming language designed by TradingView to facilitate the creation of custom indicators and trading strategies. Its user-friendly syntax makes it accessible for traders without extensive coding experience. The language’s design focuses on simplicity, providing built-in error checking which aids beginners in identifying and correcting mistakes swiftly.

Why Choose Pine Script?

1. User-Friendly Syntax

Pine Script’s syntax is straightforward, making it easier to write and understand compared to more complex programming languages like Python or C++.

2. Built-In Error Checking

This feature helps beginners by highlighting errors in the code, offering suggestions for corrections, and reducing debugging time.

3. Simplicity Compared to Other Languages

Unlike Java or C#, which have steeper learning curves, Pine Script is tailored for users who may not have a technical background. It offers a level of simplicity that makes it an attractive option for non-programmers.

4. Lightweight Design

It is designed specifically for trading strategies, avoiding unnecessary complexity found in general-purpose languages like Rust or Go, which are often used for broader applications but lack the specialized focus of Pine Script.

How to Start Using Pine Script

Step 1: Create an Account on TradingView

- Visit TradingView.

- Click on “Sign Up” and follow the instructions to create your account.

Step 2: Access the Charting Platform

Once logged in, navigate to the charting section by clicking on “Chart” in the main menu.

Step 3: Open Pine Editor

On the chart page, click on the “Pine Editor” tab at the bottom of the screen.

Step 4: Start Writing Scripts

Begin by typing your first script in the editor. For example, you can start with a simple moving average calculation:

pinescript //@version=4 study(“Simple Moving Average”, overlay=true) sma = sma(close, 14) plot(sma)

This foundational knowledge will enable you to explore more advanced features and develop sophisticated trading strategies using Pine Script on TradingView.

Developing Trading Strategies in Pine Script

Understanding the definition and importance of trading strategies is crucial for anyone involved in financial markets. A trading strategy is a systematic approach to buying and selling securities based on predefined criteria. These strategies help traders make informed decisions, minimize emotional biases, and enhance consistency in their trading activities.

Backtesting plays a significant role in developing effective trading strategies. By simulating trades using historical data, you can evaluate the performance of your strategy without risking real capital. This process allows you to identify potential weaknesses and refine your approach before applying it to live markets.

We will delve into common trading strategies that can be implemented using Pine Script:

- Moving Average Crossover Strategy: This trend-following strategy involves using two moving averages (a shorter period and a longer period) to generate buy or sell signals based on their crossover points.

- RSI-Based Trading System: The Relative Strength Index (RSI) helps identify potential market reversals or continuations. By setting specific RSI thresholds, you can create conditions for entering or exiting trades.

These examples provide a foundation for understanding how Pine Script can be used to develop sophisticated trading strategies tailored to your individual needs.

Key Commands for Strategy Coding

Strategy coding for TradingView relies on specific commands to define trading actions within a script. Two fundamental commands in Pine Script are strategy.entry and strategy.exit.

strategy.entry Command

The strategy.entry command is used to specify the conditions under which a trade should be initiated. This command requires several parameters:

- id: A unique identifier for the entry order.

- long or short: Defines whether the trade is a long position (

strategy.long) or a short position (strategy.short). - conditions: Logic that determines when the entry should be executed.

Example: pinescript strategy.entry(“Long Entry”, strategy.long, when=close > open)

In this example, a long trade is initiated when the closing price is higher than the opening price.

strategy.exit Command

The strategy.exit command specifies how and when to close an open position. Key parameters include:

- id: The identifier of the exit order.

- from_entry: The identifier of the entry order that this exit relates to.

- conditions: Rules dictating when the exit should occur.

Example: pinescript strategy.exit(“Exit Long”, from_entry=”Long Entry”, when=close < open)

This command closes the long position initiated by “Long Entry” if the closing price falls below the opening price.

Using these commands, you can effectively define entry and exit points in your script, forming the foundation of any trading strategy on TradingView.

Order Management Techniques in Pine Script

Effectively managing trades within your strategy involves understanding the different order types available in Pine Script. The primary order types include:

- Market Orders: Executed immediately at the current market price.

- Limit Orders: Executed at a specified price or better, providing more control over entry and exit points.

How to Place Orders in Pine Script

Implementing these orders in Pine Script is straightforward. Here’s how you can do it:

Placing a Market Order

To place a market order, use strategy.entry with either the strategy.long or strategy.short parameters:

pinescript strategy.entry(“Long”, strategy.long)

Placing a Limit Order

For limit orders, specify a price level:

pinescript limitPrice = close – 10 strategy.entry(“Buy Limit”, strategy.long, limit = limitPrice)

Advanced Order Management Techniques

In addition to basic order types, Pine Script offers advanced techniques for managing trades more effectively:

Pyramiding

Pyramiding allows multiple entries in the same direction, enhancing flexibility in position sizing. Control pyramiding with the pyramiding parameter in strategy(). For instance:

pinescript strategy(“My Strategy”, pyramiding=3)

One Cancels All (OCA) Groups

OCA groups manage multiple orders where triggering one cancels the others. Use the oca_name and oca_type parameters within strategy.entry:

pinescript strategy.entry(“Long OCA”, strategy.long, oca_name=”OCA Group”, oca_type=strategy.oca.cancel)

These techniques enable sophisticated order management within your trading strategy, enhancing control and execution efficiency.

Implementing Risk Management Rules

Incorporating risk management rules into your trading strategies is crucial for long-term success. Proper risk management helps mitigate potential losses and ensures that your trading strategy remains viable even in volatile market conditions.

Setting Predefined Risk Criteria

To set predefined risk criteria in Pine Script:

- Define the maximum percentage of equity you are willing to risk on a single trade.

- Use the

strategy.risk.max_drawdownfunction to set a maximum drawdown limit. - Implement stop-loss orders using the

strategy.exitcommand to automatically close positions when certain conditions are met.

pinescript //@version=4 strategy(“Risk Management Example”, overlay=true) riskPercentage = 1 // 1% risk per trade maxDrawdown = 10 // 10% max drawdown

// Define stop loss and take profit levels stopLoss = close * (1 – (riskPercentage / 100)) takeProfit = close * (1 + (riskPercentage / 100))

// Place a trade with predefined risk criteria if (crossover(close, sma(close, 14))) strategy.entry(“Buy”, strategy.long) strategy.exit(“Take Profit/Stop Loss”, “Buy”, stop=stopLoss, limit=takeProfit)

// Set max drawdown limit strategy.risk.max_drawdown(maxDrawdown, strategy.percent)

Handling Order Cancellations

Order cancellations can be managed within your script by implementing conditions to cancel pending orders if certain criteria are met. This ensures that your strategy adapts to changing market conditions.

pinescript //@version=4 strategy(“Order Cancellation Example”, overlay=true)

// Place a buy order if moving average crossover occurs if (crossover(sma(close, 14), sma(close, 28))) strategy.entry(“Long”, strategy.long)

// Cancel order if price moves against your position by more than 2% cancelCondition = close < (strategy.position_avg_price * 0.98) if (cancelCondition) strategy.close(“Long”)

Common Strategy Examples Using Pine Script

1. Moving Average Crossover Strategy

The moving average crossover strategy is a popular trend-following approach used by traders to identify potential entry and exit points in the market. This strategy involves using two moving averages: a short-term moving average (e.g., 50-day) and a long-term moving average (e.g., 200-day). When the short-term moving average crosses above the long-term moving average, it signals a potential buy opportunity. Conversely, when it crosses below, it indicates a potential sell signal.

Key Steps to Implementing the Moving Average Crossover Strategy in Pine Script:

1. Define the Moving Averages:

To start, define the short-term and long-term moving averages using Pine Script’s built-in functions.

pinescript //@version=4 study(“Moving Average Crossover Strategy”, overlay=true) shortMaLength = input(50, title=”Short MA Length”) longMaLength = input(200, title=”Long MA Length”)

shortMa = sma(close, shortMaLength) longMa = sma(close, longMaLength)

plot(shortMa, color=color.blue, title=”Short MA”) plot(longMa, color=color.red, title=”Long MA”)

2. Create Entry and Exit Conditions:

Next, create conditions for entering and exiting trades based on the crossover of these moving averages.

pinescript longCondition = crossover(shortMa, longMa) if (longCondition) strategy.entry(“Long”, strategy.long)

shortCondition = crossunder(shortMa, longMa) if (shortCondition) strategy.close(“Long”) strategy.entry(“Short”, strategy.short)

3. Incorporate Plotting for Visualization:

For better visualization on the chart, plot buy and sell signals where crossovers occur.

pinescript // Buy Signal plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text=”BUY”)

// Sell Signal plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text=”SELL”)

4. Run Backtesting:

Enable backtesting to evaluate how this strategy performs over historical data.

pinescript // Define initial capital and commission fee strategy(“Moving Average Crossover Strategy”, overlay=true, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

// Apply Entry Conditions if (longCondition) strategy.entry(“Buy Signal”, strategy.long)

if (shortCondition) strategy.close(“Buy Signal”) strategy.entry(“Sell Signal”, strategy.short)

By following these steps and utilizing provided code snippets you can effectively implement a moving average crossover strategy within TradingView’s Pine Script environment.

2. RSI-Based Trading System

The Relative Strength Index (RSI) is a popular momentum oscillator that measures the speed and change of price movements. It plays a crucial role in identifying potential market reversals or continuations by indicating overbought or oversold conditions.

Significance of the RSI Indicator:

- Overbought Conditions: When the RSI value is above 70, it suggests that an asset might be overbought, signaling a potential price drop.

- Oversold Conditions: Conversely, an RSI value below 30 indicates that an asset might be oversold, suggesting a potential price increase.

Example Conditions for Entry and Exit:

To implement an RSI-based trading system in Pine Script:

1. Define the RSI Indicator:

pinescript //@version=4 study(“RSI-Based Trading System”, shorttitle=”RSI Strategy”, overlay=true) rsi = rsi(close, 14)

2. Set Entry and Exit Conditions:

pinescript // Buy when RSI crosses below 30 (oversold) if (crossover(rsi, 30)) strategy.entry(“Buy”, strategy.long)

// Sell when RSI crosses above 70 (overbought) if (crossunder(rsi, 70)) strategy.exit(“Sell”, from_entry=”Buy”)

3. Complete Code Example:

pinescript //@version=4 study(“RSI-Based Trading System”, shorttitle=”RSI Strategy”, overlay=true)

rsi = rsi(close, 14)

// Plotting the RSI plot(rsi, title=”RSI”, color=color.blue)

// Buy condition: RSI crosses below 30 if (crossover(rsi, 30)) strategy.entry(“Buy”, strategy.long)

// Sell condition: RSI crosses above 70 if (crossunder(rsi, 70)) strategy.exit(“Sell”, from_entry=”Buy”)

// Adding horizontal lines for clarity hline(70, “Overbought Level”, color=color.red) hline(30, “Oversold Level”, color=color.green)

This simple example demonstrates how to use the RSI indicator to create entry and exit points based on overbought and oversold conditions. The script initiates a buy order when the RSI crosses below 30 and exits the trade when it crosses above 70.

3. Multi-Indicator Strategies Using Pine Script

Using multiple indicators in a trading strategy can significantly enhance the accuracy of your trading signals. Combining indicators helps confirm signals and filter out false ones, leading to more reliable trades.

Benefits of Multi-Indicator Approach

- Enhanced Signal Confirmation: Using several indicators together can validate trading signals, reducing the likelihood of false positives.

- Reduced Noise: Multiple indicators can help filter out market noise, providing clearer entry and exit points.

- Diverse Perspectives: Different indicators analyze various aspects of market data, offering a well-rounded view of market conditions.

Combining Indicators with Pine Script

Combining indicators in Pine Script involves the integration of multiple conditions to form a cohesive strategy. Here’s an example that combines a Moving Average Crossover Strategy with an RSI filter:

pinescript //@version=5 strategy(“Multi-Indicator Strategy”, overlay=true)

// Define Moving Averages shortMA = ta.sma(close, 9) longMA = ta.sma(close, 21)

// Define RSI rsi = ta.rsi(close, 14)

// Plotting Moving Averages plot(shortMA, color=color.blue) plot(longMA, color=color.red)

// Entry Condition: MA Crossover + RSI Filter if (ta.crossover(shortMA, longMA) and rsi < 70) strategy.entry(“Buy”, strategy.long)

// Exit Condition: MA Crossunder or RSI Overbought if (ta.crossunder(shortMA, longMA) or rsi > 70) strategy.close(“Buy”)

In this script:

- Moving Averages: Two simple moving averages (SMA) with periods of 9 and 21 are used.

- RSI Filter: The Relative Strength Index (RSI) is calculated over a period of 14.

- Entry Condition: The strategy enters a long position when the short MA crosses above the long MA and RSI is below 70.

- Exit Condition: The position is closed when the short MA crosses below the long MA or RSI exceeds 70.

This multi-indicator approach leverages both trend-following and momentum strategies to improve trade reliability.

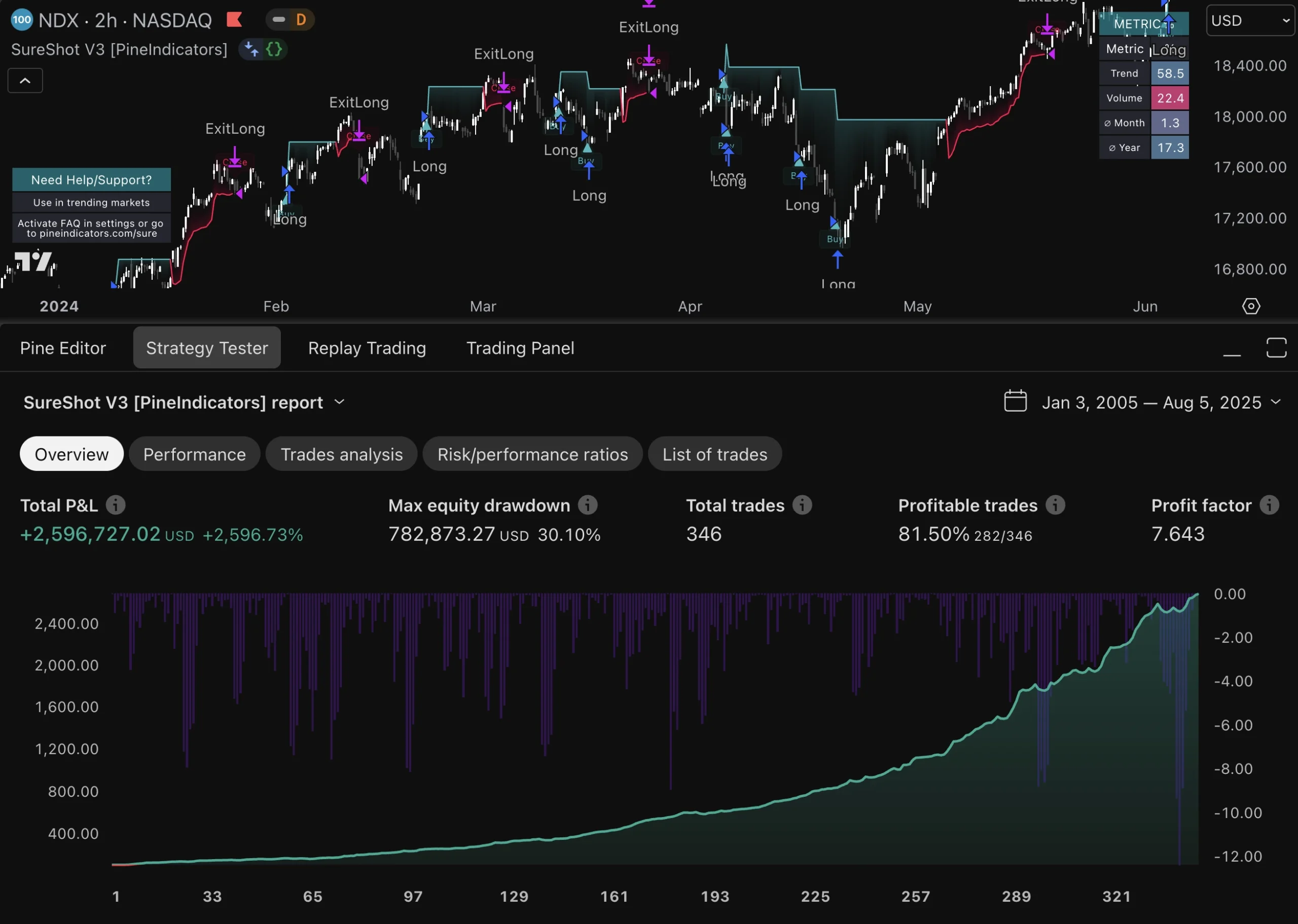

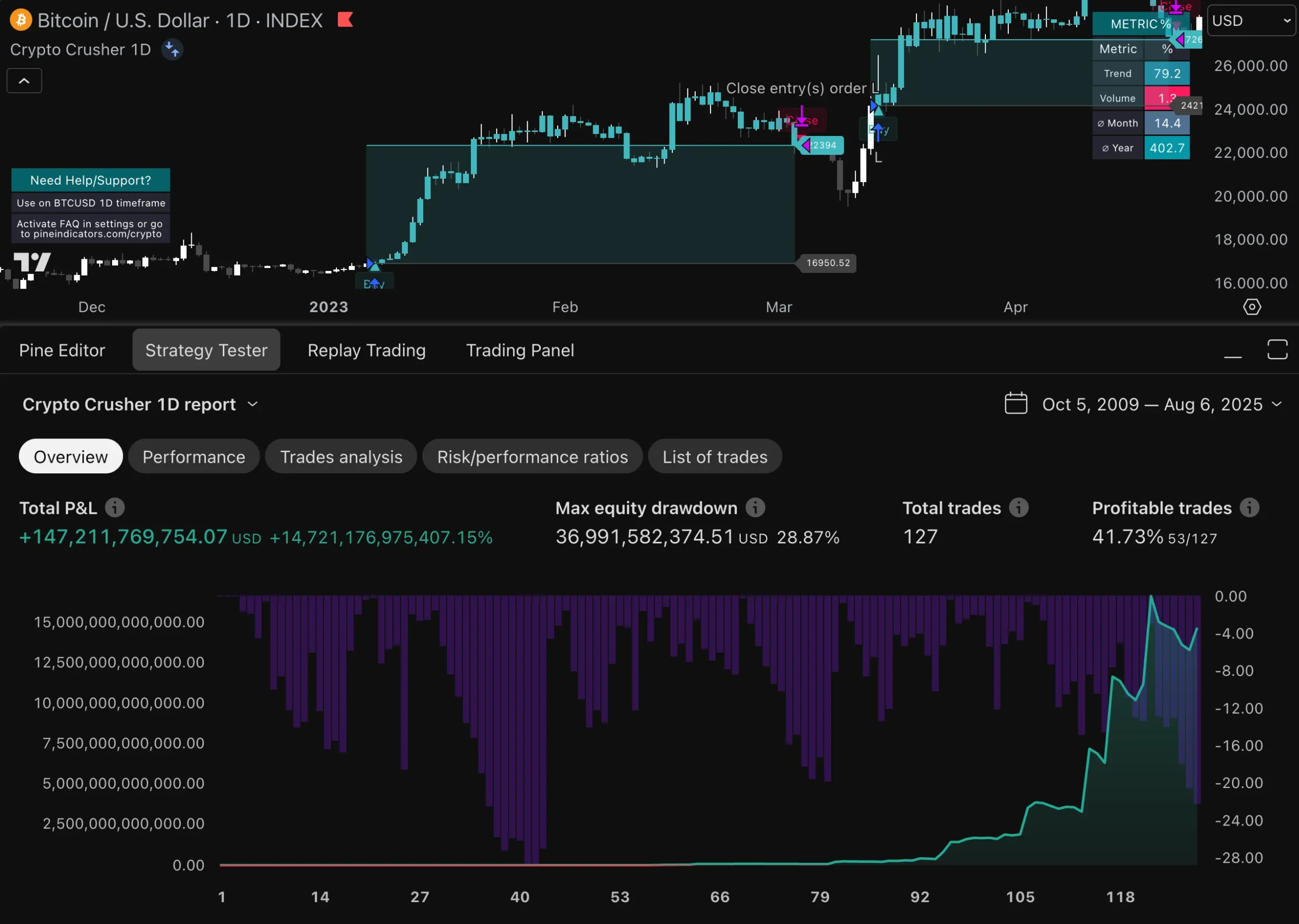

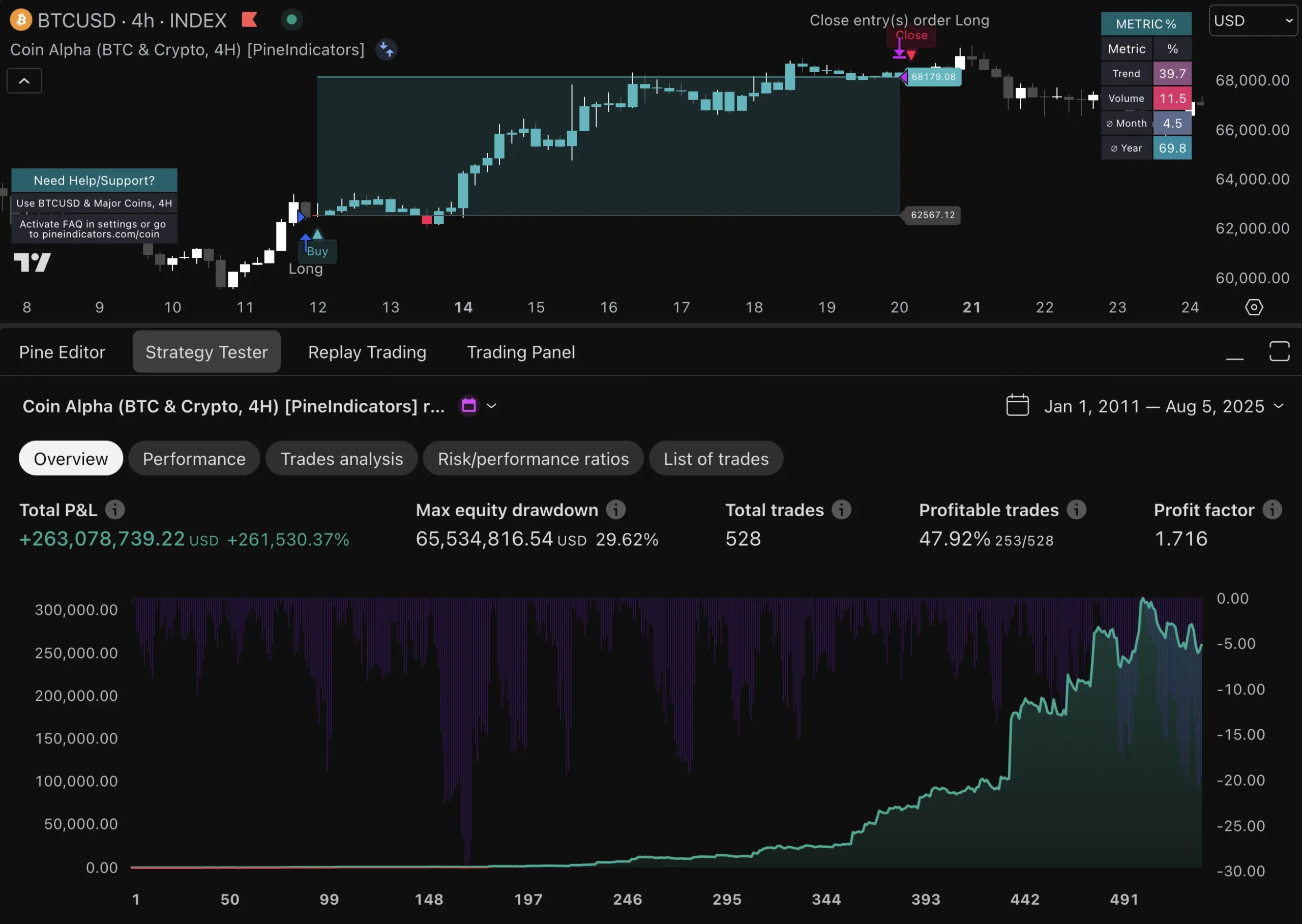

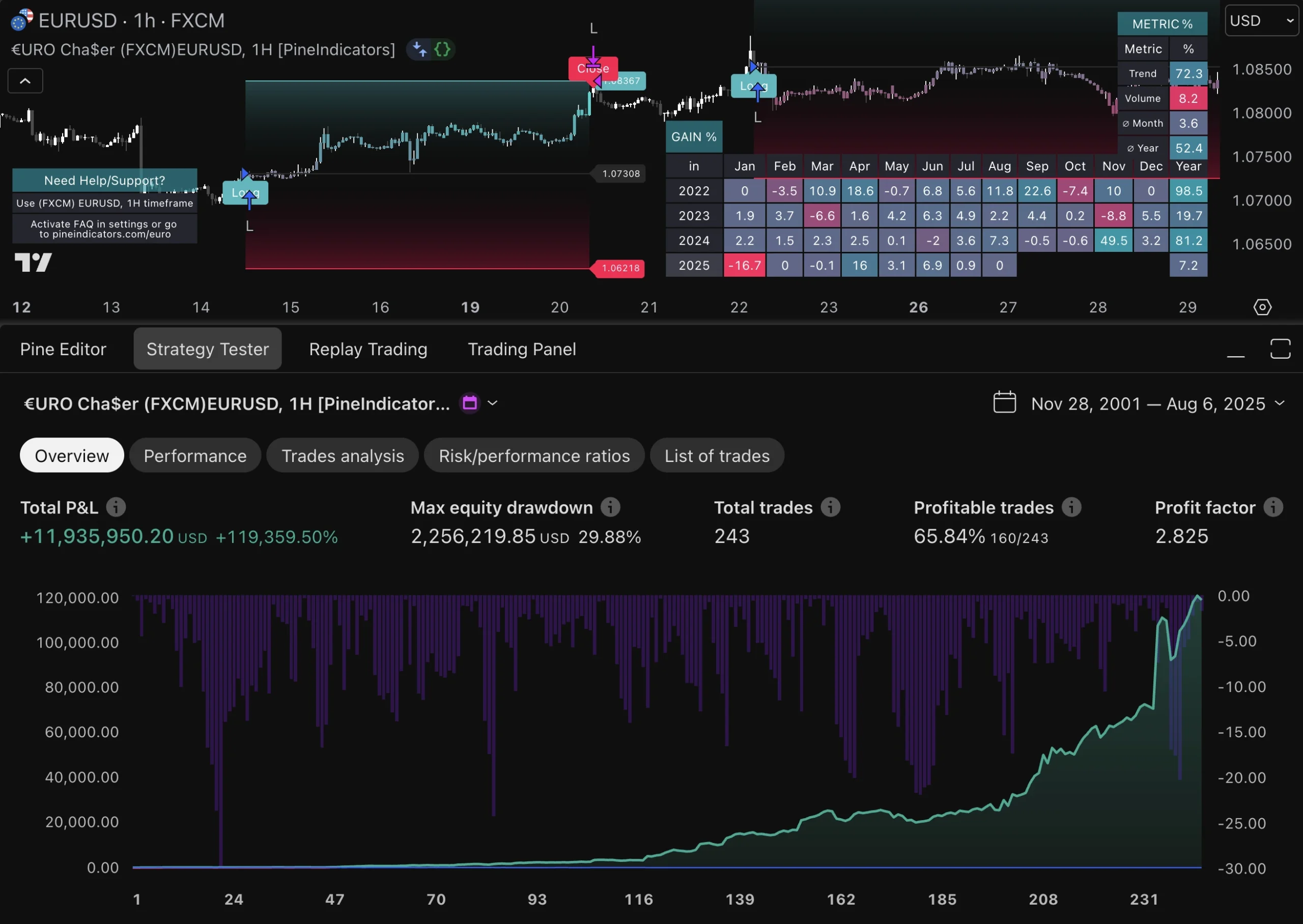

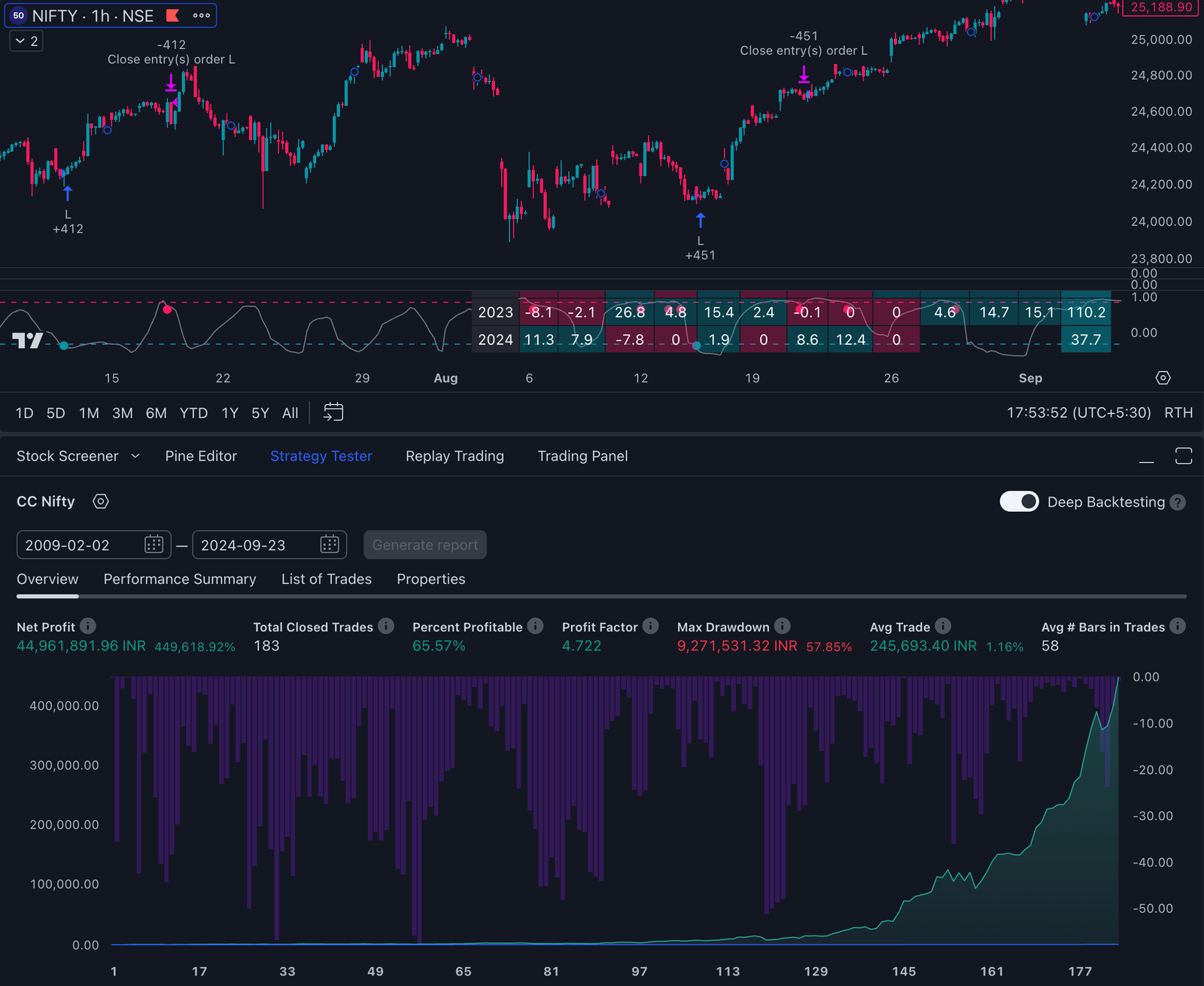

Performance Reporting and Analysis Techniques

Analyzing performance reports is essential after backtesting a trading strategy coded in Pine Script. Evaluating these reports provides insights into the effectiveness of your strategy, helping you make informed adjustments.

Key Metrics to Evaluate:

- Win Rate: Indicates the percentage of profitable trades out of the total number of trades. A high win rate suggests that the strategy is effective in predicting market movements.

- Drawdown: Measures the peak-to-trough decline during a specific period, expressed as a percentage. Lower drawdowns indicate better risk management and less potential for significant losses.

- Profit Factor: The ratio of gross profits to gross losses. A profit factor greater than 1 signifies that the strategy generates more profit than loss, with higher values indicating a more profitable strategy.

Interpreting these metrics helps refine your trading strategies, ensuring they meet your risk tolerance and profitability goals.

Publishing Your Scripts on TradingView’s Public Library

Sharing your Pine Script code on TradingView’s public library opens up a wealth of opportunities. The process to publish is straightforward:

- Navigate to the Pine Editor: Within the TradingView charting platform, open the Pine Editor where your script is written.

- Prepare Your Script: Ensure your script is well-documented and includes comments explaining key sections.

- Publish: Click on the “Publish Script” button, fill in details such as script name, description, and choose whether it’s an indicator or strategy.

- Submit for Review: Once completed, submit your script for review by the TradingView team.

Benefits of Sharing Code

- Feedback: By sharing your code, you can receive valuable feedback from other traders and developers.

- Learning Opportunities: Reviewing others’ scripts and receiving comments on your own can greatly enhance your coding skills.

- Collaborations: Engaging with the community can lead to potential collaborations, where you can work together to refine strategies or develop new ones.

Publishing scripts not only aids personal development but also contributes to the collective knowledge within the TradingView community.

Limitations and Workarounds When Using Pine Script

While Pine Script offers a robust platform for strategy coding on TradingView, it does come with certain limitations:

1. Limited Access to External Data Sources

Unlike languages such as Python or R, Pine Script is confined to the data available within the TradingView ecosystem. This constraint can limit the incorporation of alternative data sources, such as economic indicators or custom datasets.

2. Restricted Advanced Features

Pine Script lacks some advanced features found in other programming languages like C++ or Java. For instance, it doesn’t support complex data structures or multi-threading, which can be crucial for high-frequency trading strategies.

Impact on Strategy Development

These limitations can impact the flexibility and complexity of your trading strategies. However, there are several workarounds:

- Data Import via CSV: While you can’t directly access external APIs, importing data via CSV files for backtesting purposes is a viable option. You need to manually update these files to keep your strategies current.

- Simplified Logic Implementation: Focus on implementing simplified versions of complex algorithms. Breaking down sophisticated strategies into manageable components within Pine Script’s capabilities can still yield effective results.

- Combination with Other Tools: Use Pine Script in conjunction with other analytical tools. Perform preliminary analysis in languages like Python and then translate key insights into simpler Pine Script code for execution within TradingView.

By understanding these constraints and leveraging workarounds, you can still develop powerful and effective trading strategies on TradingView using Pine Script.

Using the Pine Editor Effectively

The Pine Editor within TradingView’s platform is designed to make writing and testing scripts straightforward. Key features of the Pine Editor include:

- Syntax Highlighting: Helps in easily identifying different elements of the script.

- Auto-Completion: Assists in writing code faster by suggesting functions and variables.

- Error Checking: Built-in error checking highlights mistakes in real-time, making debugging simpler.

- Code Templates: Predefined templates for common indicators and strategies can be used as starting points.

- Script Outputs: Visualize your strategy directly on the chart with real-time updates.

To access the Pine Editor, simply:

- Open TradingView and navigate to any chart.

- Click on the Pine Editor tab at the bottom of the screen.

- Begin writing or pasting your script into the editor window.

These features ensure that you can efficiently develop, test, and refine your trading strategies right within TradingView.

FAQs (Frequently Asked Questions)

What is Pine Script and why is it important for traders?

Pine Script is a lightweight programming language designed specifically for coding strategies on TradingView. It features a user-friendly syntax that makes it accessible for beginners. Coding strategies in Pine Script is crucial for effective trading as it allows traders to automate their strategies, backtest them using historical data, and refine their approaches based on performance.

How do I get started with coding in Pine Script on TradingView?

To get started with Pine Script on TradingView, you first need to create an account on the platform. Once you have access to the charting interface, you can begin writing your scripts using the Pine Editor. The platform also offers built-in error checking, which is beneficial for beginners as it helps identify issues in your code quickly.

What are some common trading strategies that can be implemented using Pine Script?

Some common trading strategies that can be implemented using Pine Script include the Moving Average Crossover Strategy and the RSI-Based Trading System. These strategies utilize technical indicators to identify entry and exit points in the market, allowing traders to automate their trades based on predefined conditions.

How does risk management play a role in trading strategies coded in Pine Script?

Incorporating risk management measures into trading strategies is essential to protect capital and minimize losses. In Pine Script, traders can set predefined risk criteria and manage order cancellations effectively within their scripts, ensuring that they adhere to their risk tolerance while executing trades.

What are some key commands used in strategy coding on TradingView?

Key commands used in strategy coding on TradingView include ‘strategy.entry’ for defining entry points and ‘strategy.exit’ for setting exit points. These commands allow traders to specify when to enter or exit a trade based on their strategy’s conditions.

What should I consider when publishing my scripts on TradingView’s public library?

When publishing scripts on TradingView’s public library, it’s important to ensure that your code is well-documented and tested. Sharing your scripts can provide valuable feedback from the community, foster learning opportunities, and potentially lead to collaborations with other traders interested in similar strategies.