Introduction

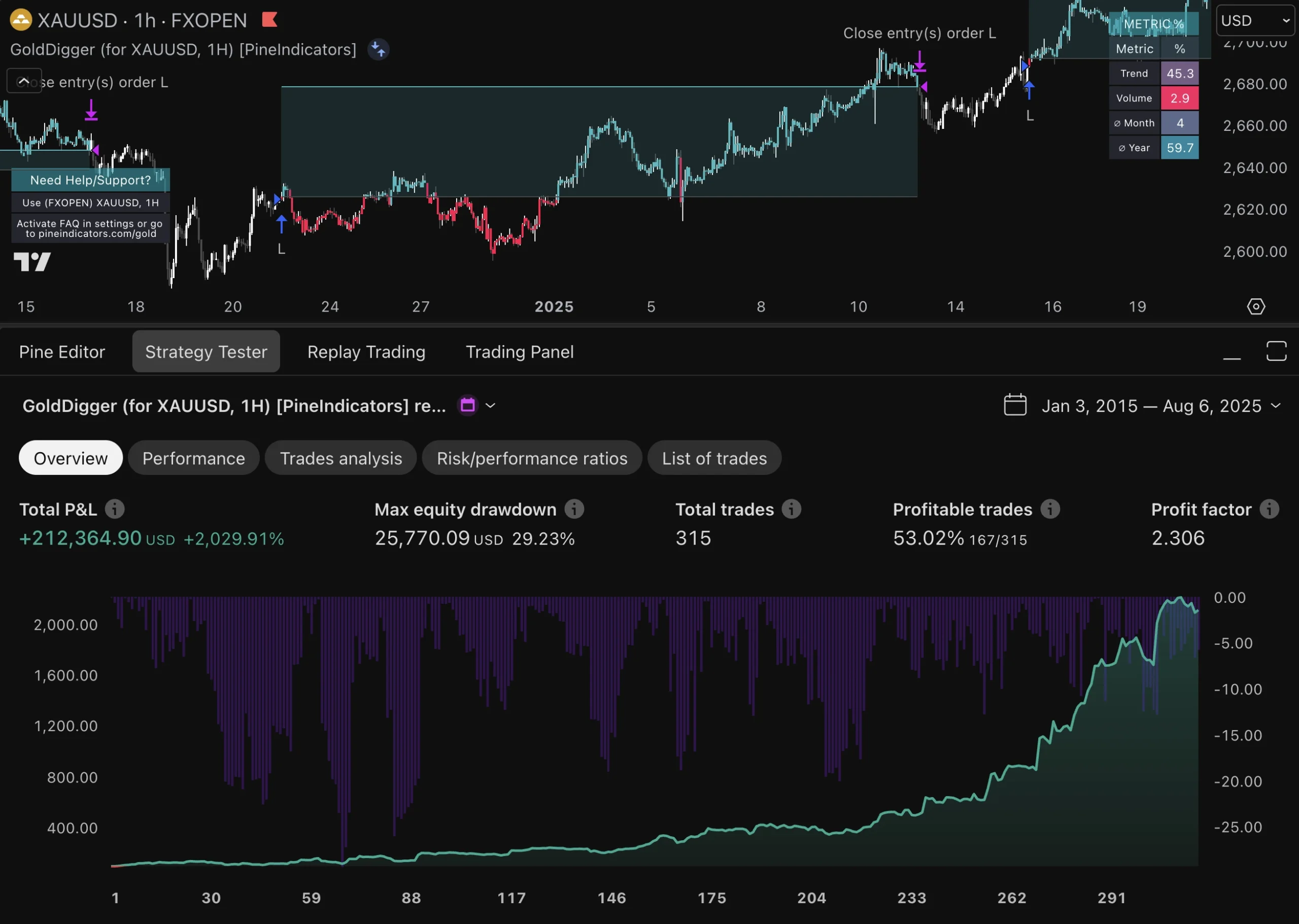

The cryptocurrency market can be intimidating because of its natural ups and downs. Prices can change drastically in a short time, offering both chances and dangers.

Having effective crypto trading strategies is crucial. Without a well-defined plan, you may find yourself making impulsive decisions that could lead to significant losses. Strategies help you make informed decisions, manage risks, and capitalize on market movements.

This article looks at some of the best strategies for crypto trading. By understanding various trading techniques, you can develop a strong approach tailored to your specific situation and goals. From breakout trading to the careful use of leverage, these strategies will give you the tools needed to navigate the ever-changing cryptocurrency world.

Understanding Market Dynamics and Key Trading Strategies

1. Breakout Trading

Breakout trading is a strategy where traders seek to identify significant price movements beyond defined support or resistance levels. This method is crucial in the cryptocurrency market due to its inherent volatility and the frequent occurrence of such breakouts.

Definition and Significance of Breakout Trading in the Crypto Market

In breakout trading, a breakout occurs when the price of a cryptocurrency moves outside a predefined range. This range is typically marked by support (the lower boundary where prices tend to stop falling) and resistance (the upper boundary where prices tend to stop rising). When the price breaches these levels, it often signals a strong move in the direction of the breakout, providing traders with potential entry points.

Breakout trading is significant because:

- It captures large price movements.

- It can be applied in various market conditions.

- It relies on clear technical indicators, making it accessible for both novice and experienced traders.

How to Identify Confirmed Price Breakouts Using Technical Analysis Tools

Identifying confirmed breakouts involves using several technical analysis tools:

Support and Resistance Levels: These are horizontal lines drawn on a chart representing historical price levels where buying or selling pressure has previously reversed. A breakout above resistance suggests bullish momentum, while a breakdown below support indicates bearish momentum. Moving Averages: These are average prices over specific periods that smooth out price data to identify trends. Commonly used moving averages include the 50-day and 200-day moving averages. A crossover above these averages can confirm an upward breakout, while a crossover below confirms a downward breakout. Volume Indicators: Volume is critical in confirming breakouts. High volume during a breakout suggests strong trader commitment, increasing the likelihood that the breakout will sustain. Low volume might indicate a false breakout or lack of conviction among traders.

Traders often use combinations of these tools to increase accuracy. For instance, if a cryptocurrency breaks above its resistance level while also crossing above its 50-day moving average on high volume, it provides a robust signal for entering a long position.

Application of Breakout Trading in Different Market Conditions

Breakout trading strategies can be tailored for both bullish and bearish market conditions:

Bullish Markets: During bullish trends, breakouts above resistance levels are more frequent. Traders look for upward momentum and higher highs as confirmation signals. For example, during Bitcoin’s bull run in late 2020, consistent breakouts above previous all-time highs provided multiple entry points for traders riding the trend upwards. Bearish Markets: In bearish conditions, breakdowns below support levels are key. Traders focus on lower lows and downward momentum as confirmation signals. For instance, during the crypto market crash in early 2018, breakdowns below critical support levels such as $10,000 for Bitcoin indicated further downside potential.

By adapting their approach based on market cycles—whether bullish trends or bearish trends—traders can effectively leverage breakout signals across different scenarios.

Understanding these dynamics not only enhances your ability to make informed trading decisions but also helps you navigate the volatile nature of the crypto market with greater confidence.

2. Moonbag Strategy

The moonbag strategy is a popular approach among crypto traders looking to capitalize on significant gains while retaining an investment for future potential. The core idea involves taking profits from an asset that has appreciated substantially, thereby recouping the initial investment. The remaining holdings, termed “moonbags,” are kept in the hopes of further appreciation.

Benefits of the Moonbag Strategy:

- Risk Management: By taking profits and securing the initial investment, you mitigate potential losses.

- Upside Potential: Retaining a portion of your holdings allows you to benefit from any additional price increases.

- Passive Income: Moonbags can be staked for passive income through yield farming or lending protocols.

Real-Life Example:

Imagine you invested in a cryptocurrency at $1 per token. If the price rises to $10, you might sell enough tokens to recoup your initial investment and some profit, then keep the remaining tokens as moonbags. This way, if the price surges further, you still benefit.

Staking Moonbags:

Yield farming and lending protocols offer opportunities for earning passive income on your moonbags. Platforms like Aave or Compound enable you to lend your crypto assets and earn interest over time. This adds another layer of profitability while holding onto your investments.

Transitioning smoothly into other strategies like Correlated Arbitrage, Wyckoff Method, Diversification Across Markets, Cautious Use of Leverage, and Scalping can further enhance your trading toolkit by offering diverse approaches suited for various market conditions, from bullish trends to bearish cycles.

3. Correlated Arbitrage

Correlated arbitrage is a strategy that takes advantage of the relationship between related assets to find and profit from price differences. In the crypto world, this usually means comparing the price movements of cryptocurrencies with traditional market assets or other digital currencies.

How to Find Correlated Assets

To successfully use this strategy, you need to:

- Find assets that move together. For instance, Bitcoin and Ethereum often show a strong connection.

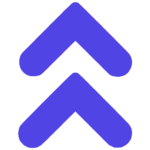

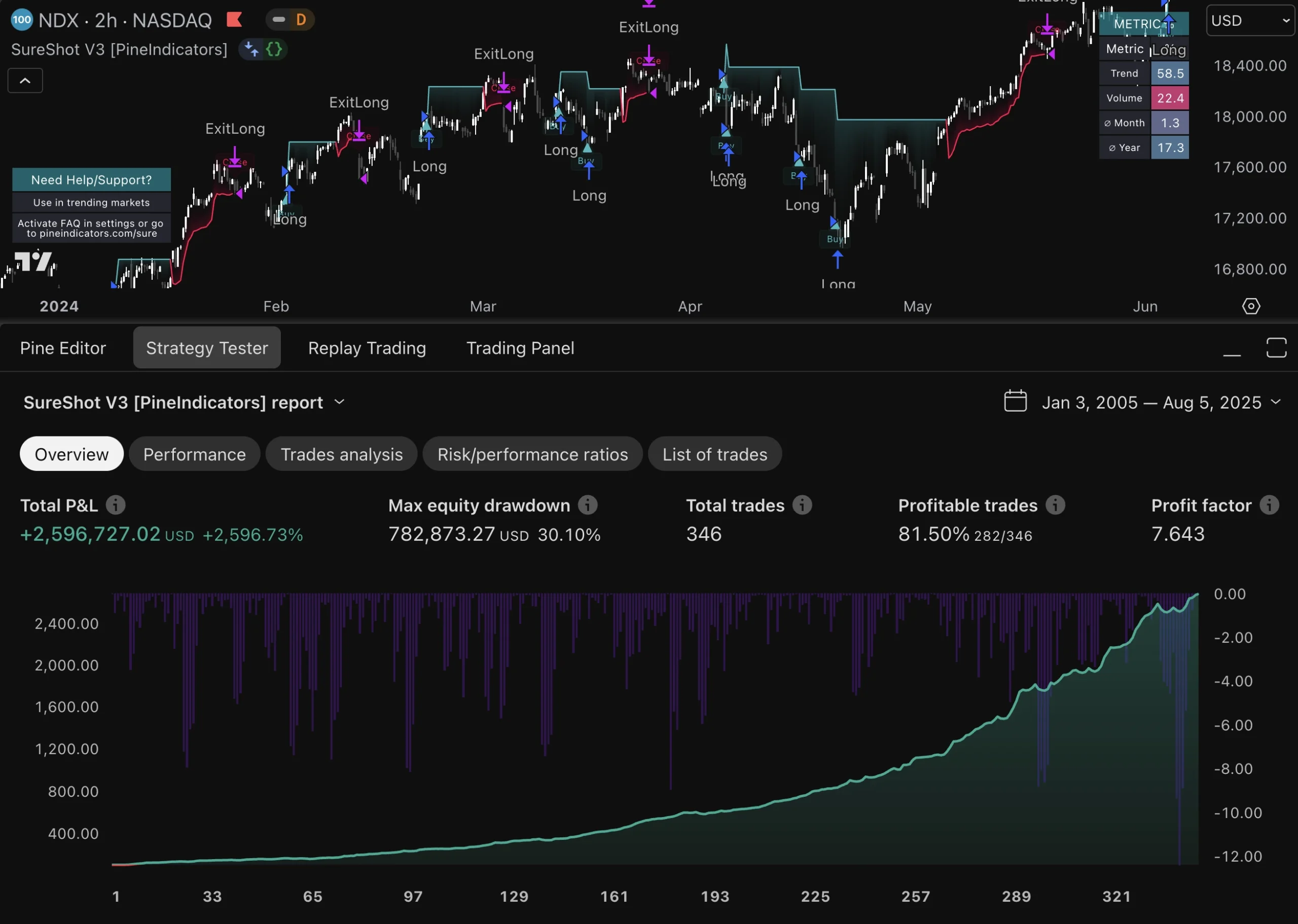

- Search for connections between crypto assets and traditional market tools like Tesla stocks or NASDAQ indices.

Tips for Making Successful Trades

- Check Multiple Exchanges: Prices can vary greatly across different platforms. Use websites like CoinMarketCap or CoinGecko to monitor these variations.

- Use Automated Trading Bots: Tools such as 3Commas or Shrimpy can help automate trades based on pre-set criteria for price discrepancies.

- Study Market Trends: Pay attention to larger market cycles—both upward and downward trends can affect correlation strength.

Arbitrage opportunities don’t last long, so timing and speed are crucial. By quickly finding correlated assets and acting fast, you can benefit from these short-lived price differences.

4. Wyckoff Method

The Wyckoff method is a popular technique used by traders to understand market cycles and make informed trading decisions. Developed by Richard D. Wyckoff, this method focuses on analyzing price action patterns and volume trends to predict future market movements.

Market Cycles and Wyckoff Theory Principles:

- Accumulation Phase: Prices are relatively stable as strong hands accumulate assets.

- Markup Phase: An upward trend begins as demand exceeds supply, leading to rising prices.

- Distribution Phase: Prices stabilize again as strong hands start distributing their holdings.

- Markdown Phase: A downward trend starts as supply exceeds demand, causing prices to fall.

Key Components of the Wyckoff Method:

- Price Action Patterns: Observing how prices move within different phases of the market cycle.

- Volume Trends: Analyzing trading volumes to identify buying or selling pressures.

Practical Tips for Applying the Wyckoff Method:

- Identify Phases: Recognize which phase the market is currently in by examining price action and volume trends.

- Use Support and Resistance Levels: Look for breakout signals at key support and resistance levels, confirming phase transitions.

- Example from Recent Crypto Movements: In early 2021, Bitcoin’s accumulation phase signaled potential bullish trends. As it moved into the markup phase, traders using the Wyckoff method capitalized on significant gains during this period.

By incorporating these principles into your trading strategy, you can better navigate the volatile cryptocurrency market and improve your decision-making process.

5. Diversification Across Markets

Diversifying beyond cryptocurrencies is crucial for risk management, especially during volatile periods. The cryptocurrency market’s inherent unpredictability makes it essential to spread your investments across different asset classes.

Engaging in other asset classes like stocks, forex, or even exploring alternative investments can enhance overall portfolio performance. Stocks and forex markets often move independently of crypto, providing a buffer against adverse price movements in any one market. Experienced traders frequently implement successful diversification strategies to mitigate risks and capture opportunities across multiple markets.

Case Study

One notable example involves a trader who balanced their crypto holdings with investments in blue-chip stocks, major forex pairs, and alternative assets. During a bearish trend in the crypto market, the stability of their stock investments helped maintain their portfolio value.

Diversification is not limited to just spreading funds across various assets. It also includes adopting multiple trading strategies such as Breakout Trading, Moonbag Strategy, Correlated Arbitrage, Wyckoff Method, and Scalping. Each strategy has its strengths and weaknesses, influenced by market cycles, bullish trends, and bearish trends.

Employing a variety of strategies ensures that you are prepared for different market conditions, maximizing your chances of success in the volatile world of crypto trading.

6. Cautious Use of Leverage

Leverage trading allows you to amplify potential profits (and losses) by borrowing funds to increase your market exposure. When executed correctly within defined risk parameters, such as maintaining a suitable margin level at all times, leverage can be a powerful tool.

Key Considerations Before Utilizing Leverage:

- Understand the Mechanics: Before diving into leverage trading, it’s crucial to understand how it works. This includes knowing how much you are borrowing, the interest rates, and the margin requirements. For beginners, it’s advisable to familiarize yourself with the basics of trading before venturing into leveraged trades.

- Risk Management: High leverage means higher risk. It’s essential to have a solid risk management strategy in place. This often involves setting stop-loss orders and not risking more than a small percentage of your trading capital on any single trade.

- Market Sentiment: Be aware that market sentiment can change drastically overnight due to unforeseen events. This can impact leveraged positions significantly.

- Margin Calls: Understand what triggers a margin call and how to avoid it. A margin call occurs when your account equity falls below the required margin level, forcing you to either add more funds or close positions.

Using leverage responsibly requires a deep understanding of market cycles, including bullish trends and bearish trends, as well as other strategies like breakout trading and moonbag strategy. This knowledge helps in making informed decisions that align with your overall trading plan.

Additionally, consider incorporating some effective strategies from forex trading tips into your approach for better results.

7. Scalping Strategy

Scalping is a trading strategy that involves making multiple trades within short timeframes to capitalize on small price movements. This approach is particularly appealing during periods of heightened volatility, where rapid fluctuations present frequent opportunities for quick profit-taking.

Key Characteristics of Scalping:

- Short Timeframes: Scalpers operate on very short timeframes, often ranging from seconds to minutes, depending on individual preferences and availability.

- High Trade Frequency: The strategy relies on executing a high number of trades throughout the day, week, or month.

- Quick Profit-Taking: Profits are usually taken quickly due to the small price changes being targeted.

During bullish trends, scalping can be highly effective as breakout signals frequently occur. Conversely, in bearish trends, scalpers may find opportunities through rapid price reversals or brief recoveries.

Advantages:

- Minimal Exposure: Reduced risk exposure as positions are held for short durations.

- Consistent Gains: Potential for steady income through numerous small gains.

Considerations:

- High Attention Requirement: Requires constant monitoring of the market.

- Transaction Costs: High frequency of trades can lead to significant transaction costs.

Scalping stands out among other strategies like correlated arbitrage, Wyckoff Method, and cautious use of leverage by focusing on immediate market cycles and price action. For a more detailed understanding of this strategy, check this comprehensive guide on scalping.

Conclusion: Adapting Strategies for Success in Crypto Trading

Embracing continuous learning is essential for the successful implementation of various strategies discussed. Enhancing your skills and knowledge base helps you stay updated with the latest developments in the industry. The constantly evolving nature of markets makes it crucial to explore new approaches, experiment with different styles, and find what works best for your unique circumstances.

- Adapting strategies according to personal risk tolerance levels.

- Considering prevailing market conditions at any given moment.

- Conducting thorough research and analysis before entering positions.

Remaining adaptable and flexible allows you to adjust your course of action if things don’t go as planned. Following all necessary steps diligently ensures everything is done correctly from start to finish without overlooking anything important along the way. This mindset will help navigate the volatile landscape and optimize your trading success.

FAQs (Frequently Asked Questions)

What are the best strategies for crypto trading?

The best strategies for crypto trading include breakout trading, moonbag strategy, correlated arbitrage, Wyckoff method, diversification across markets, cautious use of leverage, and scalping. Each of these strategies has its own unique approach to navigating the volatility of the cryptocurrency market.

How does breakout trading work in the crypto market?

Breakout trading involves identifying confirmed price breakouts using technical analysis tools like support/resistance levels or moving averages. This strategy is significant as it allows traders to capitalize on strong price movements once a cryptocurrency breaks out of a defined range, applicable in both bullish and bearish market conditions.

What is the moonbag strategy and its benefits?

The moonbag strategy involves taking profits while retaining investment potential in cryptocurrencies. It allows traders to secure gains while still having exposure to potential future price increases. Additionally, it can be combined with staking moonbags for passive income through yield farming or lending protocols.

What is correlated arbitrage in crypto trading?

Correlated arbitrage refers to exploiting price discrepancies between correlated assets in both crypto and traditional markets. Traders identify assets that move together (like Tesla and NASDAQ) and execute trades based on these discrepancies to capitalize on profit opportunities.

How can diversification across markets enhance trading performance?

Diversification across markets helps manage risk during volatile periods by spreading investments beyond cryptocurrencies into other asset classes like stocks or forex. This approach can improve overall portfolio performance and reduce exposure to market-specific risks.

What should traders consider before using leverage?

Before utilizing leverage, traders must understand its mechanics thoroughly as it amplifies both potential profits and losses. Key considerations include maintaining suitable margin levels and being aware of common pitfalls associated with high-risk trades due to sudden market sentiment changes.