Introduction

Forex trading involves the exchange of currencies on a global market, requiring sharp strategies to capitalize on price movements. Indicators play a crucial role in enhancing these strategies by providing insights into market trends and potential reversals.

TradingView stands out as a powerful platform for traders, offering extensive tools and resources for technical analysis. Its community-driven approach to indicator development allows users to share and explore a vast array of custom scripts, fostering a collaborative environment.

Understanding Forex Indicator Scripts

Forex indicator scripts are essential tools for traders aiming to analyze market trends and make well-informed trading decisions. These scripts, often written in Pine Script, play a pivotal role in interpreting vast amounts of data to identify potential trading opportunities. TradingView provides access to a wide range of market data for use in Pine Script, though there are limitations in accessing certain data types such as order book and tick data.

Definition and Significance:

These are specialized algorithms or formulas that use price, volume, and/or open interest data to forecast market direction. They help traders predict future price movements based on historical data.

Significance:

By leveraging these indicators, traders can enhance their strategies, minimize risks, and potentially increase profitability. Whether it’s identifying trends, spotting reversals, or gauging market momentum, indicators serve as a backbone for technical analysis.

Key Features of Pine Script™:

Pine Script is the programming language behind custom indicators on TradingView. It’s crafted specifically for creating bespoke trading tools.

- User-Friendly Syntax: Pine Script is designed to be accessible even to those with limited programming experience. Its straightforward syntax allows traders to develop complex indicators with relative ease. However, having some coding experience can be beneficial, especially when using AI tools to assist in developing strategies.

- Built-in Functions: The language includes a variety of built-in functions tailored for financial analysis. These functions simplify the process of coding by providing pre-defined operations for common tasks like calculating moving averages or plotting price levels.

- Customization Capabilities: Traders can tailor indicators to their specific needs by adjusting parameters and incorporating unique variables. This flexibility ensures that the tools align closely with individual trading strategies.

Understanding these aspects of Forex indicator scripts and Pine Script provides a foundational knowledge base for any trader looking to leverage TradingView’s powerful platform for enhanced market analysis. The platform offers numerous custom scripts that can further assist traders in their analysis and decision-making processes.

The Power of Pine Script™

Pine Script™ is a programming language tailored for creating custom indicators on TradingView. With its user-friendly syntax, even traders with limited programming experience can develop powerful tools. Custom indicators and strategies are created directly within the TradingView platform using the Pine Script editor. Here are some of the key features that make Pine Script a valuable asset:

- Simple Syntax: Pine Script’s syntax is straightforward, making it easy to learn. Basic operations like defining variables and creating functions require just a few lines of code.

- Built-in Functions: Pine Script comes with numerous built-in functions such as sma() for simple moving averages or rsi() for relative strength index calculations. These functions simplify complex coding tasks.

- User Inputs: Traders can add customizable inputs to their scripts, allowing for dynamic adjustments based on market conditions.

Backtesting Strategies with Pine Script

Backtesting enables you to evaluate the effectiveness of your trading strategies before applying them in live markets. Here’s a step-by-step guide to performing backtests using Pine Script:

- Define Your Strategy: Start by coding your trading logic using Pine Script syntax. For instance: pinescript //@version=4 strategy(“Simple Moving Average Strategy”, overlay=true) shortSMA = sma(close, 10) longSMA = sma(close, 30)

- if (crossover(shortSMA, longSMA)) strategy.entry(“Buy”, strategy.long) if (crossunder(shortSMA, longSMA)) strategy.close(“Buy”)

- Set Initial Conditions: Use strategy() function to set up initial trading conditions and parameters.

- Execute Backtest: Apply the script to historical data on TradingView to simulate trades based on your criteria.

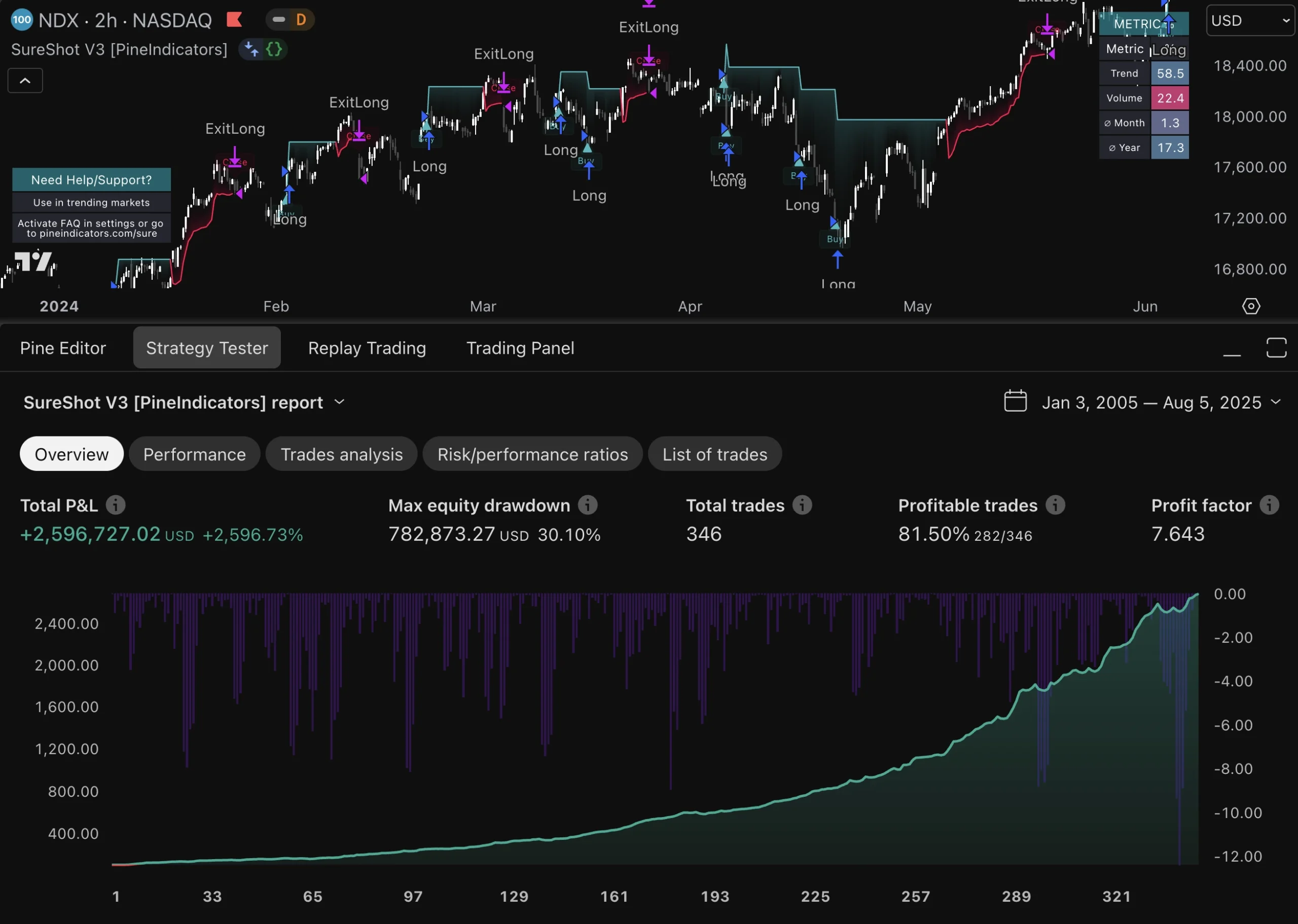

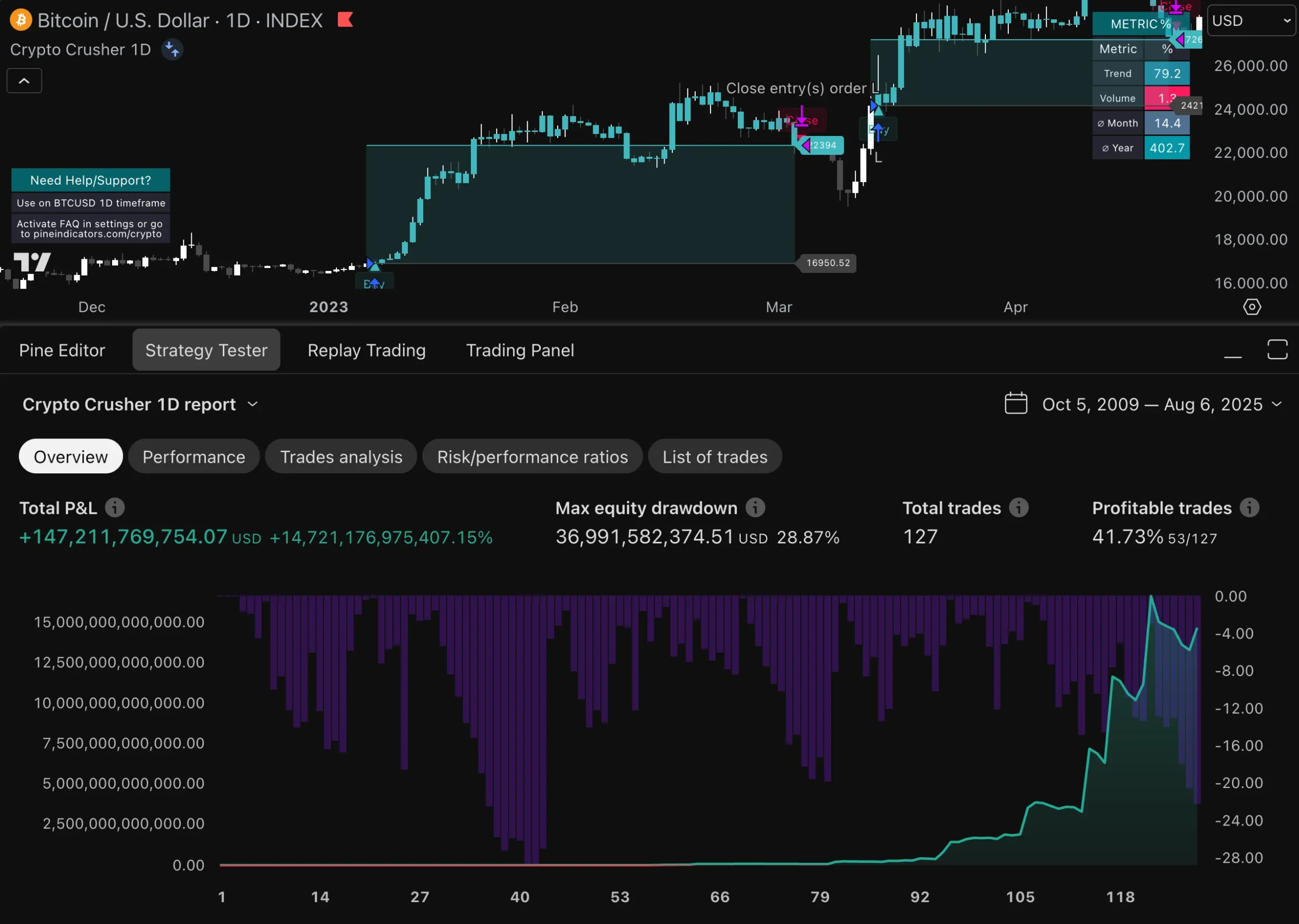

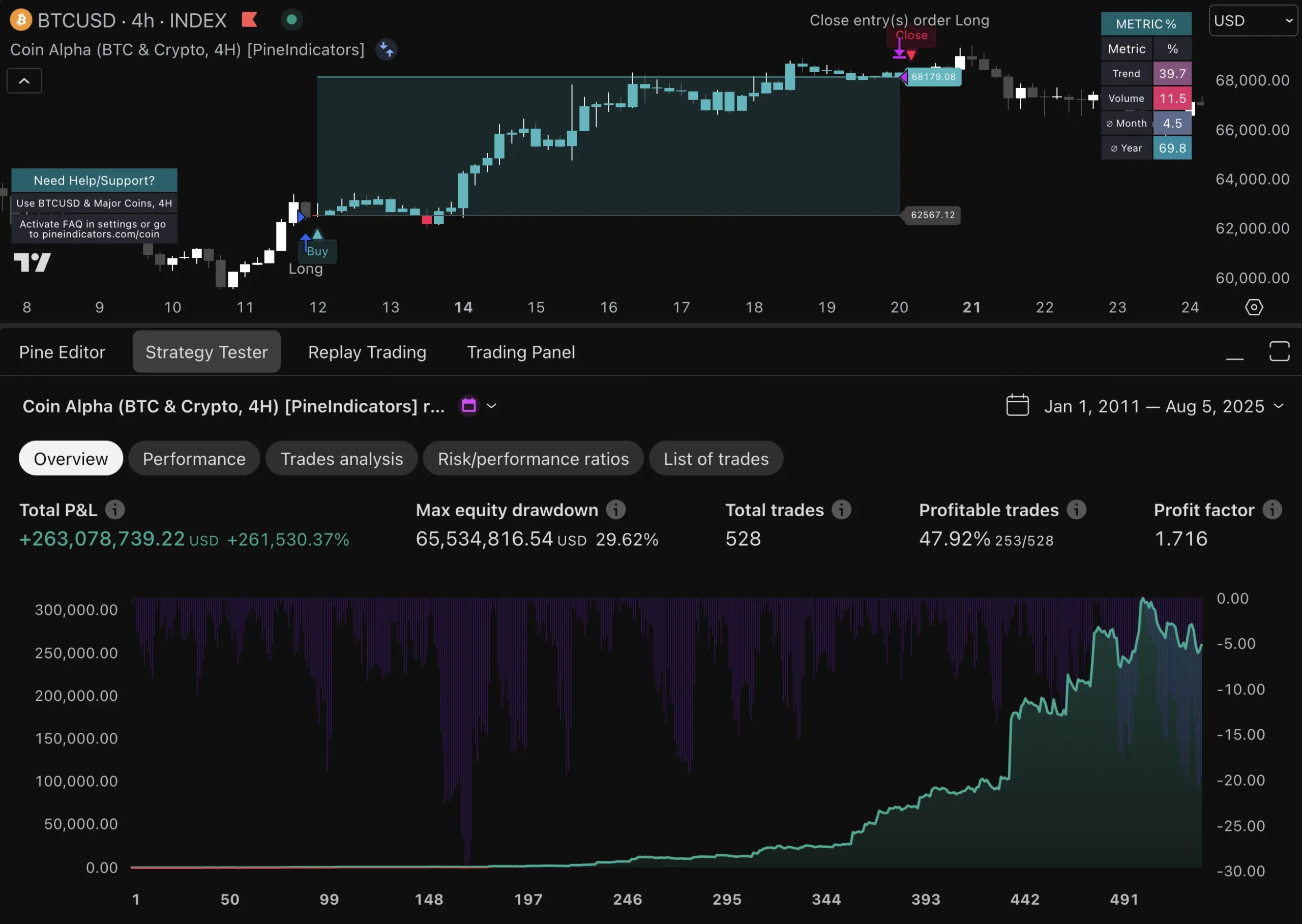

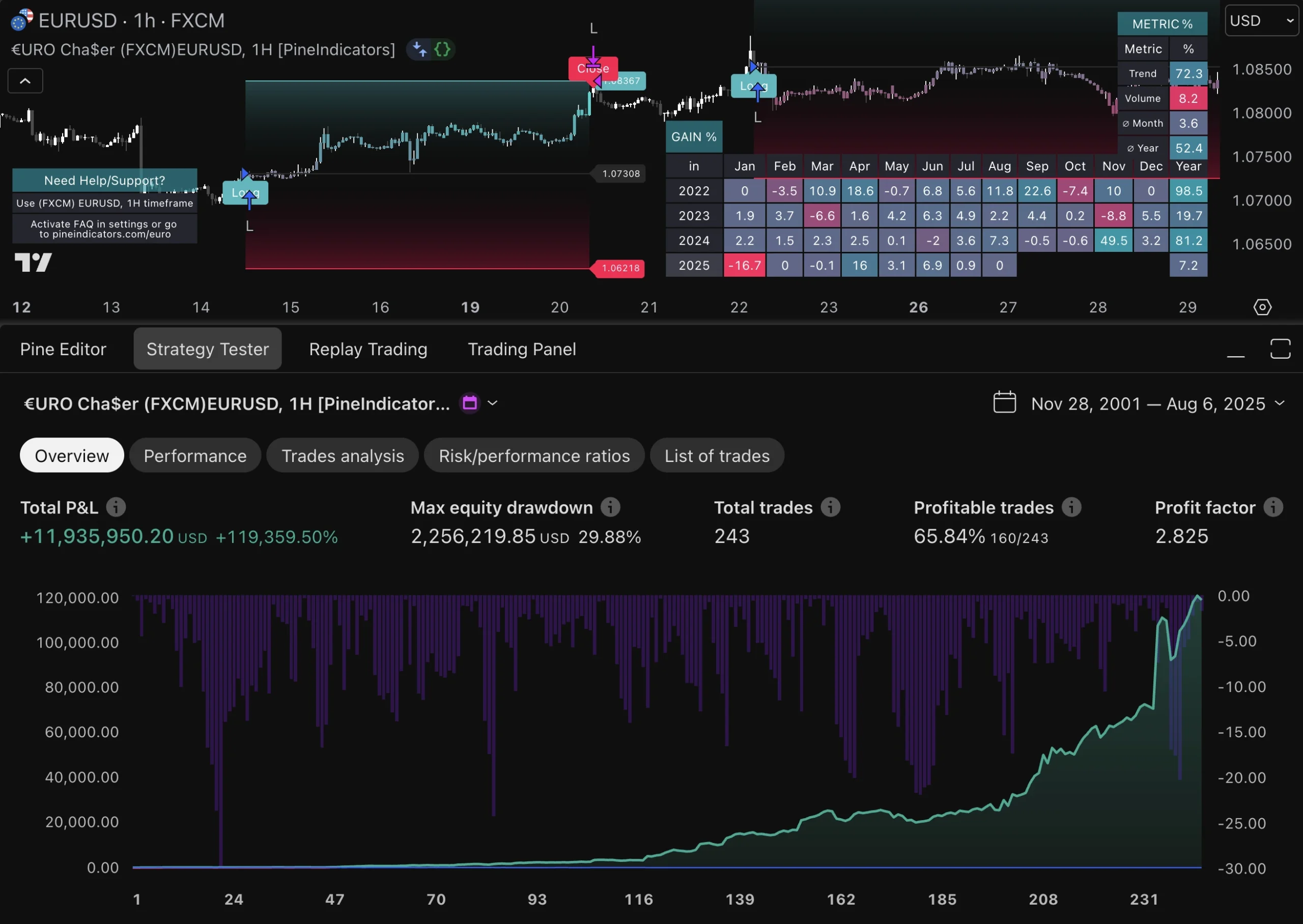

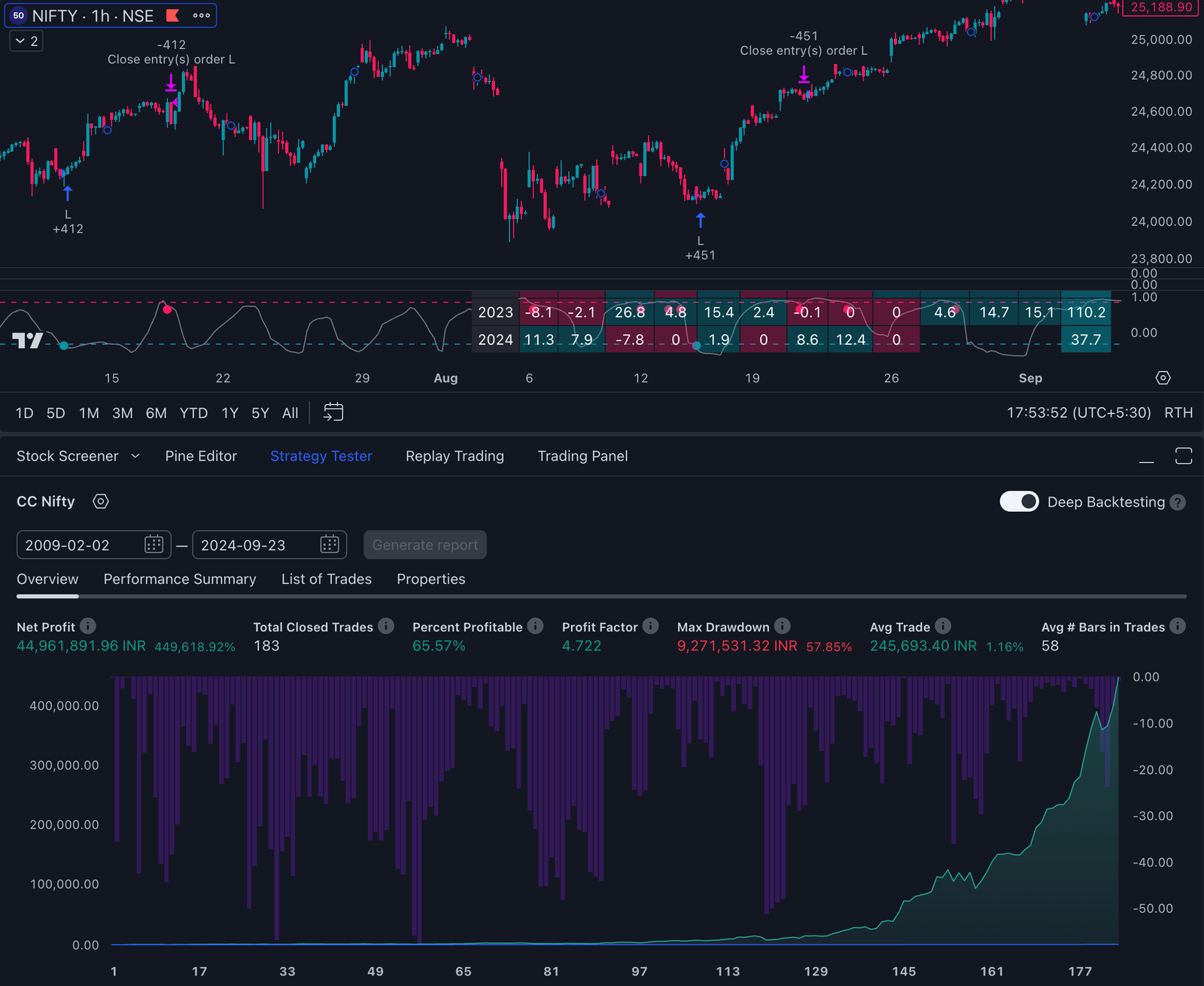

- Analyze Results: Review performance metrics like profit/loss, win rate, and drawdown directly in TradingView’s strategy tester tab. Backtesting helps ensure your strategy can perform as expected under various market conditions. For more examples of popular Pine Script strategies for TradingView backtesting, check out this resource.

By leveraging these capabilities, you can refine your indicators and strategies for better decision-making in Forex trading. If you’re interested in learning more about how to create a simple trading strategy with TradingView, this guide could be useful. Additionally, for those who are new to Pine Script, the quickstart guide provides a comprehensive introduction to the language and its features.

Creating Custom Indicators on TradingView

Building a custom indicator from scratch on TradingView using Pine Script is straightforward and highly rewarding. Creating indicators allows you to customize and enhance your trading tools, tailoring them to your specific strategies and analysis needs. Begin by opening the Pine Script editor, accessible from the TradingView platform. Here’s a practical demonstration to create a simple moving average indicator:

Step 1: Open Pine Script Editor

Navigate to the Pine Script editor by selecting “Pine Editor” at the bottom of your TradingView chart.

Step 2: Write Basic Code

pine //@version=5 indicator(title=”Simple Moving Average”, shorttitle=”SMA”, overlay=true) length = input.int(14, minval=1, title=”Length”) src = input(close, title=”Source”) sma = ta.sma(src, length) plot(sma, title=”SMA”, color=color.blue)

The input parameters, such as length and source, have default values that can be customized by the user.

Step 3: Save and Add to Chart

Click “Add to Chart” to visualize your custom indicator. The indicator will be plotted directly onto the chart, making it easy to analyze market trends.

Key Coding Concepts

- Indicator Declaration: //@version=5 denotes the script version.

- User Inputs: input.int and input allow users to customize parameters like length and source.

- Plot Function: plot(sma) displays the moving average on your chart.

Advanced Features

User Inputs for Customization

pine length2 = input.int(20, minval=1, title=”Length 2″) sma2 = ta.sma(src, length2) plot(sma2, title=”SMA 2″, color=color.red)

This code allows users to add a second moving average with customizable length.

Multiple Time Frame Analysis

pine higherTimeframe = input.timeframe(“D”, “Higher Timeframe”) smaHigher = request.security(syminfo.tickerid, higherTimeframe, ta.sma(src, length)) plot(smaHigher, title=”Higher TF SMA”, color=color.green)

Incorporate multiple time frame analysis by requesting data from different time frames using request.security

Creating custom indicators not only enhances your trading strategy but also personalizes your TradingView experience. Experiment with these basics and explore more advanced features in the TradingView library.

Working with Moving Averages

Moving averages are a cornerstone of technical analysis, providing traders with a clear way to identify trends and potential reversals in any financial instrument. On TradingView, users can harness the power of Pine Script to create custom indicators that plot moving averages directly onto their price charts, making it easier to visualize market sentiment and inform their trading decisions.

A moving average is essentially a line that represents the average closing price of a financial instrument over a specific period. This smooths out price fluctuations, helping traders spot the underlying trend. The two most common types are the simple moving average (SMA) and the exponential moving average (EMA). While the SMA gives equal weight to all data points in the period, the EMA places more emphasis on recent prices, making it more responsive to current market conditions. Each type has its own advantages, and the choice often depends on your trading style and strategy.

Creating a moving average indicator in TradingView is straightforward with the Pine Editor. For example, you can write a simple script using the “` sma()

//@version=5 indicator(“Custom SMA”, overlay=true) length = input.int(20, minval=1, title=”SMA Length”) sma_line = ta.sma(close, length) plot(sma_line, title=”SMA”, color=color.blue)

Popular Forex Indicators on TradingView

TradingView offers a diverse range of Forex indicators that cater to various trading styles and preferences. In this section, we will cover some of the most popular indicators available on the platform. Here are some widely used options:

Trend Visualization Tools

- Moving Average Convergence Divergence (MACD): This indicator consists of two lines and a histogram. The MACD identifies changes in the strength, direction, momentum, and duration of a trend. The histogram is typically green when the MACD line is above the signal line, indicating bullish sentiment.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements to identify overbought or oversold conditions. It’s a versatile tool for spotting potential reversal points.

Volatility Adaptive Indicators

- Bollinger Bands: These bands adjust dynamically with market volatility, providing a visual representation of high and low price levels relative to previous trades. Useful for identifying potential breakout points.

- Average True Range (ATR): ATR measures market volatility by decomposing the entire range of an asset price for that period. Traders use it to set stop-loss orders and gauge potential market moves.

Machine Learning-Based Signals

- Neural Network Indicator: This advanced tool leverages machine learning algorithms to predict price trends based on historical data. It provides adaptive signals that can be more accurate than traditional methods.

- Support Vector Machine (SVM) Indicator: SVMs classify data points to make predictions about future price movements. This indicator is particularly useful for complex market conditions where traditional indicators may fall short.

Real-World Applications

For instance, MACD is often used in conjunction with other indicators like RSI to confirm trend reversals, while Bollinger Bands can highlight breakout opportunities in volatile markets. These indicators can generate buy and sell signals based on specific market conditions, helping traders decide when to enter or exit positions. Neural Network Indicators offer predictive insights that can adapt as new data comes in, making them invaluable for algorithmic trading strategies.

These tools provide robust frameworks for analyzing market conditions, making informed decisions, and enhancing your trading strategy on TradingView.

Community and Collaboration in TradingView

The TradingView community is a lively platform where traders worldwide come together to share their scripts, work on projects, and learn from each other’s skills. This supportive environment encourages ongoing growth and creativity in trading strategies through open-source code sharing.

Here are some standout contributions by talented members of the community that have become quite popular among users:

- LazyBear: Known for creating various popular indicators like the “CMO + EMA” and “Squeeze Momentum Indicator.” His scripts are widely used for their simplicity and effectiveness.

- ChrisMoody: Another prominent contributor who has developed indicators such as the “WaveTrend Oscillator” and “Ichimoku Cloud with Alerts.” These tools are appreciated for their advanced features and customization options.

- HPotter: Recognized for his work on volume-based indicators like the “Volume Flow Indicator” and “Volume Profile.” His contributions help traders gain deeper insights into market volume dynamics.

The collaborative nature of TradingView allows you to leverage these contributions, adapt them to your personal trading style, and even contribute your own innovations to the community.

Enhancing Your Trading Experience with Scripts

Using Forex indicator scripts on TradingView can greatly improve your trading experience. Various platforms, including TradingView, support Pine Script and facilitate the use of custom indicators and automation.

With pre-built or customized scripts, you can automate trade execution based on predefined criteria such as:

These scripts can generate trading signals to alert you of potential market opportunities, ensuring you never miss a crucial trade. Automation through scripts reduces the emotional bias involved in trading, promoting consistency and discipline. Customization options allow for tailoring these scripts to align with your unique trading strategies, maximizing their effectiveness in various market conditions.

Setting Up Alerts for Timely Market Notifications Using Scripts

Configuring alerts within your script code ensures you never miss out on potential trading opportunities. Alerts can be set up and managed directly within the script window or chart window in TradingView alerts, allowing you to monitor and respond to market conditions efficiently. Using Pine Script™, you can set up alerts based on specific market conditions, such as price action patterns or indicator crossovers.

Steps to Set Up Alerts:

1. Define Alert Conditions

pine if (crossover(sma(close, 50), sma(close, 200))) alert(“Bullish crossover detected!”, alert.freq_once_per_bar)

2. Customize Alert Frequency

Adjust the alert.freq_once_per_bar to suit your needs, ensuring timely notifications.

3. Test and Validate

Backtest your script to confirm the accuracy of alert triggers under various market scenarios.

By integrating these alerts, you enhance your responsiveness to market movements, optimizing your trading strategy. Always conduct your own research and validation to ensure the reliability of your alert logic before using it in live trading.

Conclusion

Using Forex indicator scripts on TradingView can give you a significant advantage in today’s competitive markets. With these scripts, you can create strategies that are specifically designed for your trading style. By consistently experimenting with different approaches, you’ll keep your skills sharp and adaptable.

It’s also important to stay informed about future trends in indicator development. Machine learning integration and multi-dimensional analysis techniques have the potential to greatly improve decision-making accuracy as time goes on. Embracing these advancements will help you maintain an edge and continuously refine your trading strategies. Before implementing any new strategies or indicators, always conduct thorough research to ensure they are well-suited to your goals and to help mitigate potential risks.

FAQs (Frequently Asked Questions)

What are Forex indicator scripts and why are they important?

Forex indicator scripts are tools used to analyze market trends and assist traders in making informed trading decisions. They enhance trading strategies by providing visual representations of market data, helping traders identify potential entry and exit points.

What is Pine Script and how does it relate to TradingView?

Pine Script is a programming language specifically designed for creating custom indicators on TradingView. It offers a user-friendly syntax that allows traders, even those with limited programming experience, to develop their own indicators and backtest trading strategies effectively.

How can I create custom indicators using Pine Script on TradingView?

Creating custom indicators involves coding in Pine Script to define the logic behind your indicator. These custom indicators can be displayed directly on the price chart for easy analysis. You can start with simple examples and gradually incorporate advanced features like user inputs for customization and multiple time frame analysis to enhance your indicators.

What are some popular Forex indicators available on TradingView?

TradingView offers a variety of popular Forex indicators, including trend visualization tools, volatility adaptive indicators, and machine learning-based signals. For example, the Aroon indicator helps traders identify whether a market is trending or ranging by analyzing the positions of its lines. It also detects new highs and lows over a specific period to determine trend strength and potential shifts. Each of these indicators has unique strengths and weaknesses, which can be explored through real-world applications in different market conditions.

How does the TradingView community contribute to indicator development?

The TradingView community fosters collaboration by allowing traders to share their scripts, collaborate on projects, and learn from each other’s expertise. This vibrant environment has led to notable contributions that have gained popularity among users.

How can I set up alerts for market notifications using scripts?

You can configure alerts within your script code by defining specific market conditions that trigger notifications. This ensures you stay informed about potential trading opportunities even when you’re not actively monitoring your charts.