In the ever-evolving landscape of financial trading, the advent of technology has revolutionized how traders approach the markets. Among the myriad of tools available, the Order Block Bot stands out as a sophisticated solution designed to enhance trading strategies. This automated trading system leverages the concept of order blocks—specific price levels where significant buying or selling activity occurs—to identify potential market reversals and continuations.

By utilizing this bot, traders can capitalize on these critical price zones, making informed decisions based on historical data and market behavior. The Order Block Bot is not merely a tool for executing trades; it embodies a strategic approach to understanding market dynamics. It analyzes vast amounts of data to pinpoint areas where institutional traders have placed large orders, which often leads to significant price movements.

This capability allows both novice and experienced traders to navigate the complexities of the market with greater confidence. As we delve deeper into the mechanics of order blocks and the functionality of the Order Block Bot, it becomes evident that this technology is not just a trend but a fundamental shift in how trading can be approached.

Key Takeaways

- Order Block Bot is a powerful tool for traders to identify and capitalize on order blocks in the market.

- Order blocks are significant price levels where large orders have been placed, indicating potential support or resistance.

- The bot works by scanning the market for order blocks and providing real-time alerts to traders for potential trading opportunities.

- Using Order Block Bot can help traders save time, reduce emotional trading, and improve their overall trading performance.

- To maximize trading with Order Block Bot, it’s important to combine its signals with other technical analysis and risk management strategies.

Understanding Order Blocks in Trading

Order blocks are pivotal concepts in trading that refer to specific price ranges where large volumes of buy or sell orders are concentrated.

When these traders enter or exit positions, they create zones of liquidity that can lead to sharp price reactions.

Understanding order blocks is crucial for any trader looking to gain an edge in the market, as they often serve as indicators of potential support and resistance levels. To illustrate, consider a scenario where a large financial institution decides to accumulate a significant position in a stock. As they begin to buy shares, the price may rise due to increased demand.

However, once their buying spree concludes, the price may stabilize within a certain range—this range becomes an order block. Future price movements around this block can provide insights into market sentiment; if the price approaches this level again, it may either bounce back (indicating support) or break through (indicating resistance). Recognizing these patterns allows traders to make more informed decisions about when to enter or exit trades.

How Order Block Bot Works

The Order Block Bot operates by employing advanced algorithms that analyze historical price data and identify order blocks in real-time. It scans various financial instruments, including stocks, forex, and cryptocurrencies, to detect these critical zones where significant trading activity has occurred. Once an order block is identified, the bot generates signals that indicate potential trading opportunities based on predefined criteria set by the user. The bot’s functionality extends beyond mere identification; it also incorporates risk management features that help traders protect their capital. For instance, it can set stop-loss orders at strategic levels based on the identified order blocks, ensuring that losses are minimized if the market moves against the trader’s position. Additionally, the bot can execute trades automatically when certain conditions are met, allowing traders to capitalize on opportunities without needing to monitor the markets constantly.

This automation not only saves time but also reduces emotional decision-making, which can often lead to costly mistakes.

Benefits of Using Order Block Bot

| Benefits | Description |

|---|---|

| Efficiency | Automates the process of identifying and executing order blocks, saving time and effort. |

| Accuracy | Reduces human error in identifying order blocks and placing trades. |

| Consistency | Ensures a consistent approach to trading order blocks based on predefined criteria. |

| Emotion-free trading | Eliminates emotional decision-making in trading, leading to more disciplined and rational trading. |

| Backtesting | Allows for backtesting of order block strategies to evaluate their historical performance. |

One of the primary benefits of using an Order Block Bot is its ability to enhance trading efficiency. By automating the process of identifying order blocks and executing trades, traders can focus on developing their strategies rather than getting bogged down in analysis.

The bot’s ability to react quickly to market changes can mean the difference between a profitable trade and a missed opportunity. Moreover, the Order Block Bot provides traders with a systematic approach to trading that is grounded in data rather than speculation. This reliance on empirical evidence helps mitigate risks associated with emotional trading decisions.

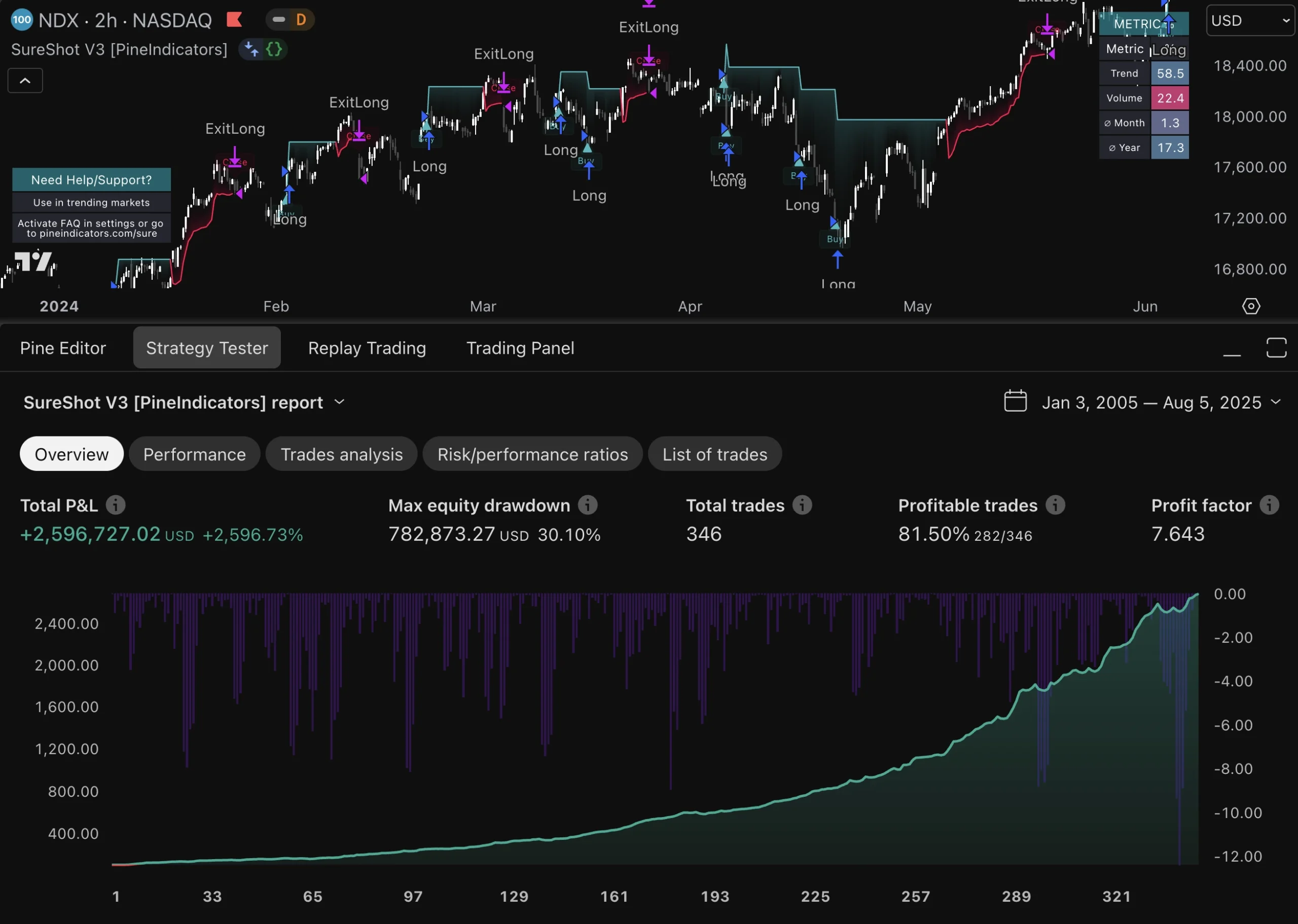

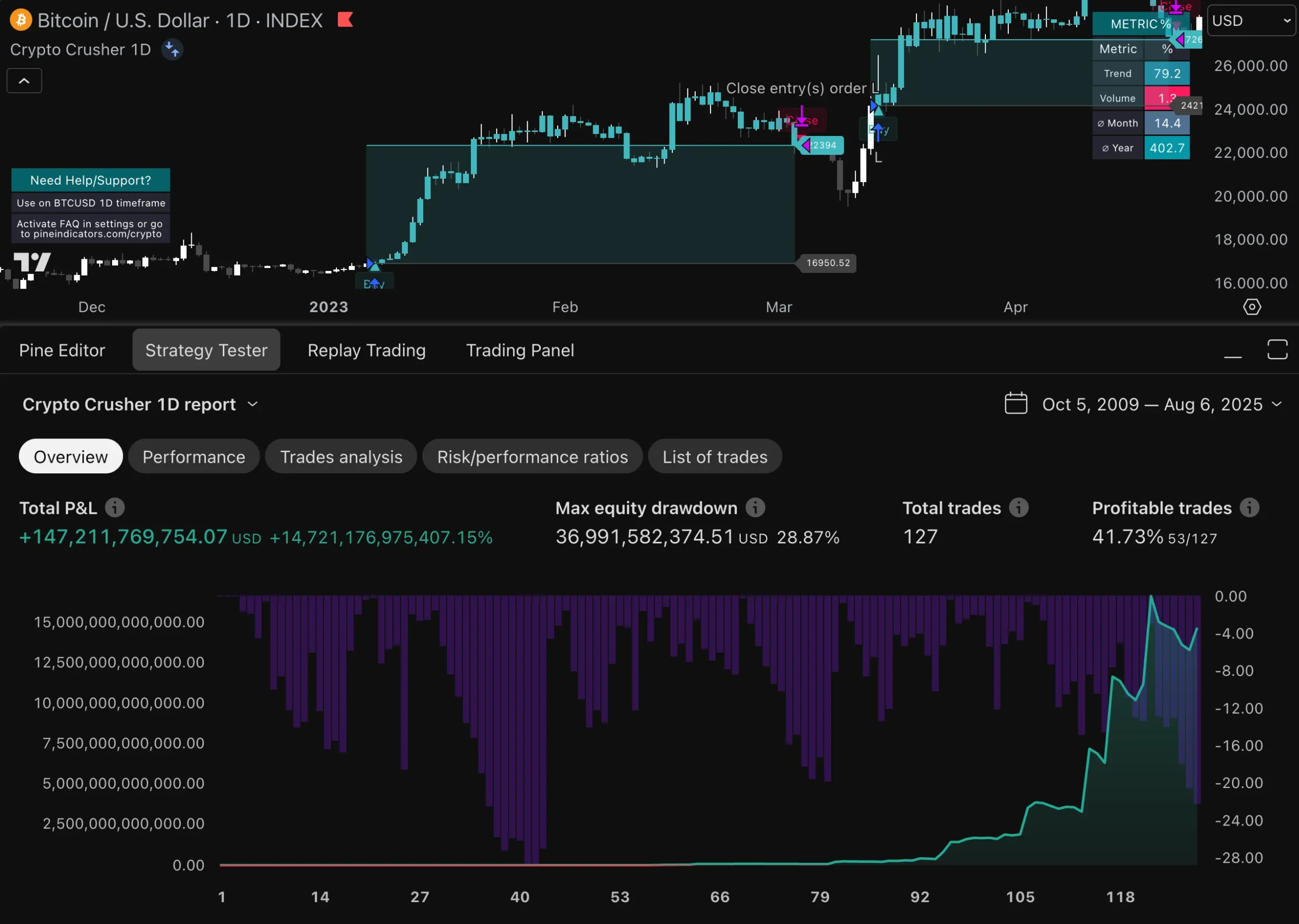

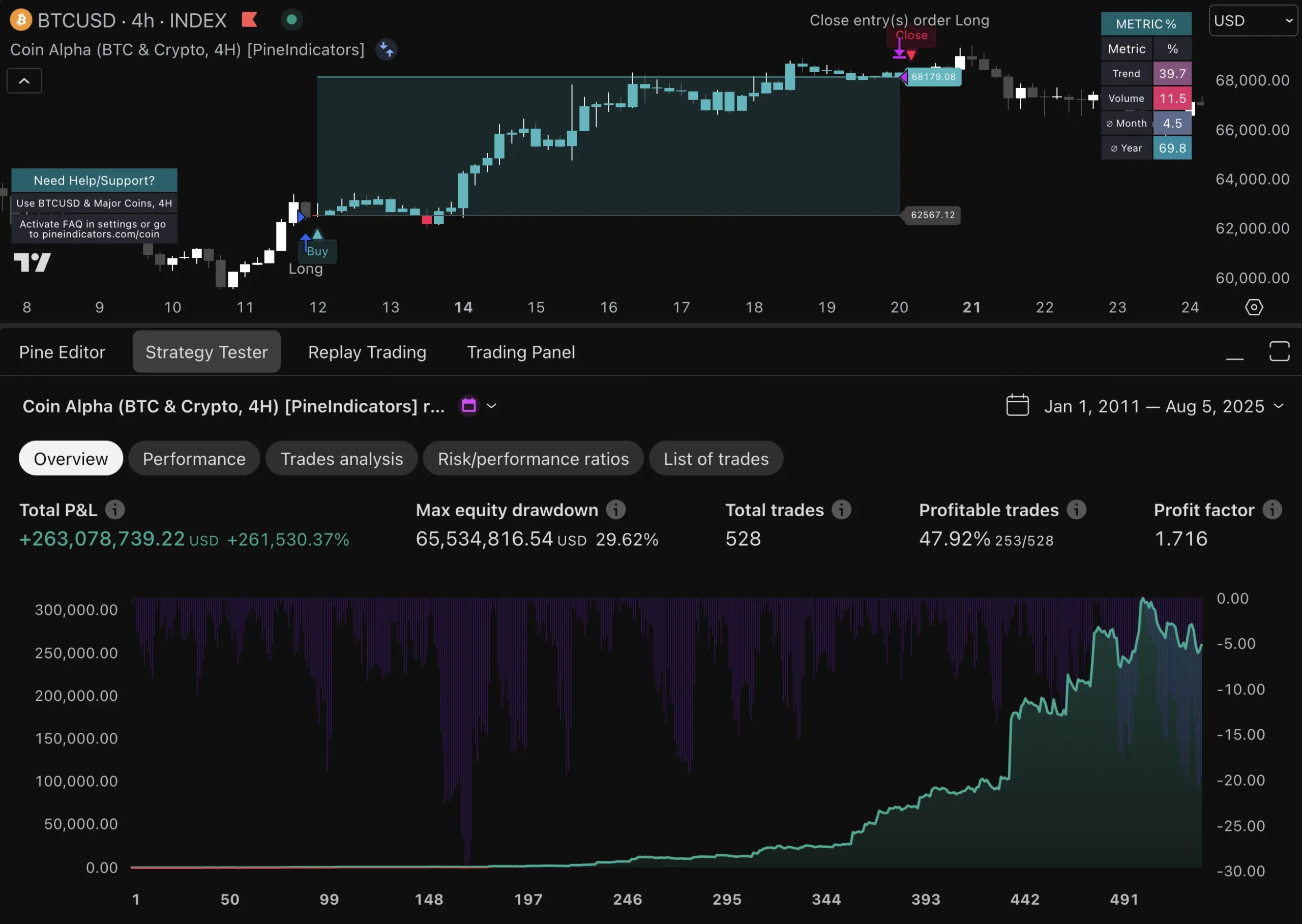

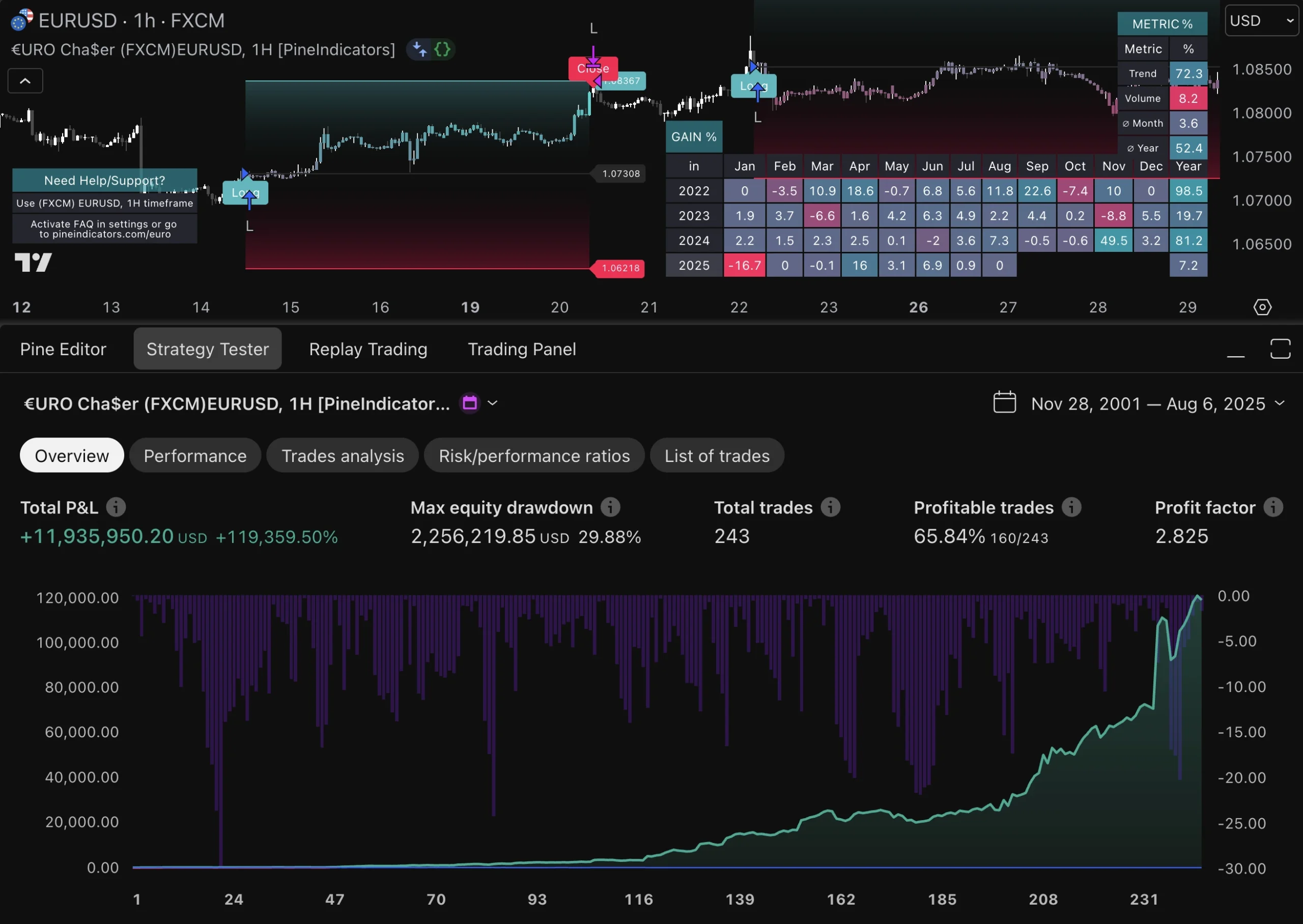

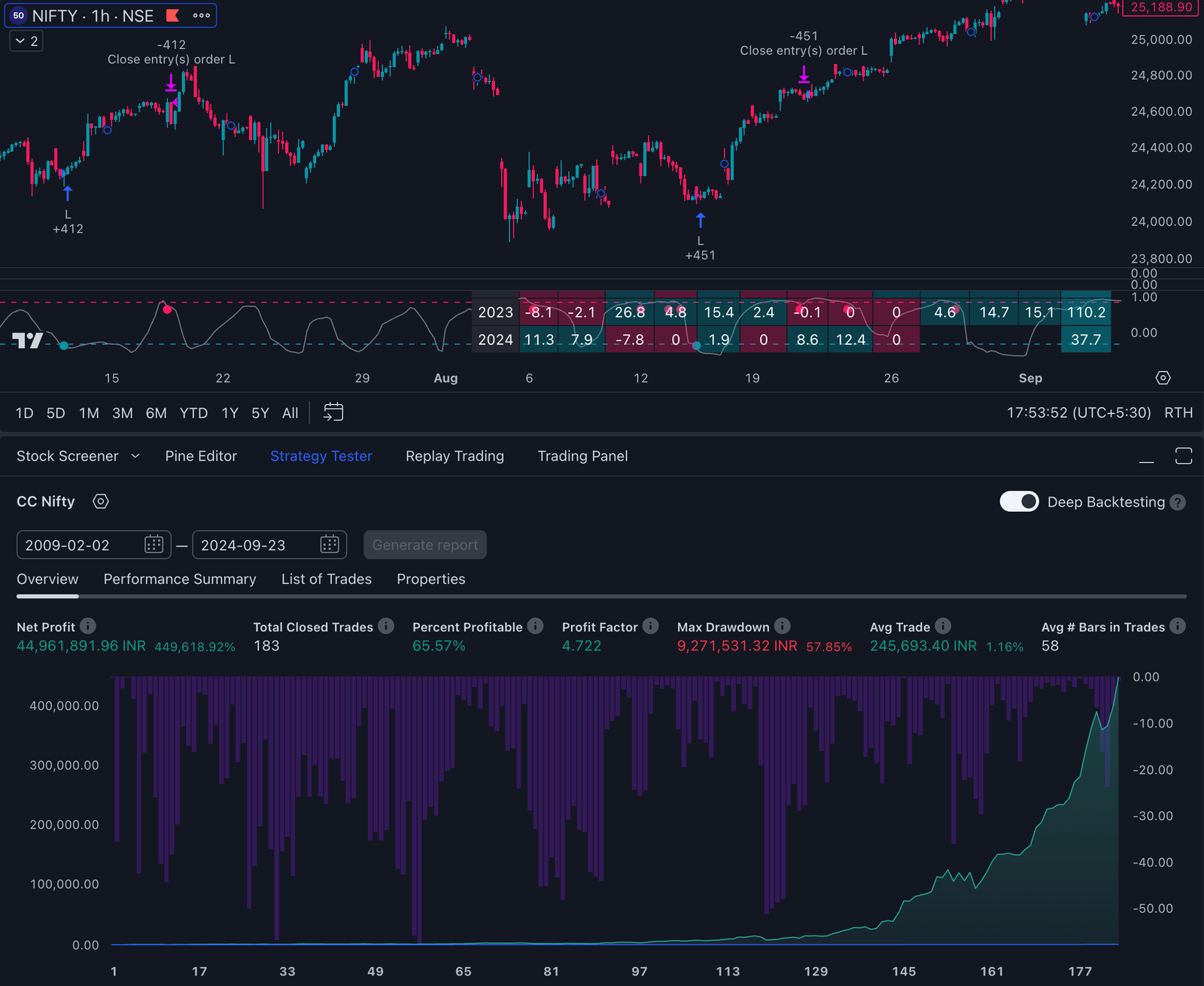

Traders can trust that their strategies are based on solid market principles rather than gut feelings or hunches. Additionally, the bot’s capacity for backtesting allows users to evaluate their strategies against historical data, providing insights into potential performance before committing real capital.

Tips for Maximizing Your Trading with Order Block Bot

To fully leverage the capabilities of the Order Block Bot, traders should consider several best practices. First and foremost, it is essential to customize the bot’s settings according to individual trading styles and risk tolerance. Each trader has unique preferences regarding trade frequency, risk management parameters, and target profit levels.

By tailoring these settings, traders can ensure that the bot aligns with their overall trading strategy. Another critical tip is to stay informed about market conditions and news events that may impact price movements. While the Order Block Bot excels at identifying technical patterns, external factors such as economic reports or geopolitical developments can significantly influence market behavior.

By combining insights from the bot with an understanding of broader market trends, traders can make more informed decisions and adjust their strategies accordingly.

Common Mistakes to Avoid When Using Order Block Bot

Despite its advantages, there are common pitfalls that traders should be wary of when using an Order Block Bot. One prevalent mistake is over-reliance on automation without understanding the underlying principles of trading. While the bot can provide valuable insights and execute trades efficiently, it is crucial for traders to maintain a foundational knowledge of market dynamics and technical analysis.

Neglecting this understanding can lead to poor decision-making when unexpected market conditions arise. Another mistake is failing to regularly review and adjust the bot’s settings based on changing market conditions or personal trading goals. Markets are dynamic environments that require adaptability; what works well in one market phase may not be effective in another.

Traders should periodically assess their strategies and make necessary adjustments to ensure continued alignment with their objectives.

Success Stories of Traders Using Order Block Bot

Numerous traders have reported significant success after incorporating the Order Block Bot into their trading routines. For instance, a forex trader who had struggled with consistent profitability found that using the bot allowed them to identify key support and resistance levels more effectively. By following the signals generated by the bot and adhering to a disciplined trading plan, they were able to achieve a 30% increase in their account balance over six months.

Similarly, a cryptocurrency trader shared their experience of using the Order Block Bot during a volatile market period. By relying on the bot’s analysis of order blocks, they were able to navigate rapid price fluctuations and capitalize on short-term trading opportunities that would have otherwise been missed. This trader reported not only improved profitability but also reduced stress levels associated with manual trading.

Conclusion and Next Steps for Implementing Order Block Bot

As technology continues to reshape the trading landscape, tools like the Order Block Bot offer innovative solutions for traders seeking an edge in their strategies. By understanding order blocks and leveraging automated systems, traders can enhance their decision-making processes and improve overall performance in various markets. For those interested in implementing this tool, it is advisable to start with a demo account to familiarize themselves with its functionalities without risking real capital.

In addition, continuous education about market trends and ongoing evaluation of trading strategies will further enhance the effectiveness of using an Order Block Bot. Engaging with trading communities and forums can provide valuable insights and shared experiences that contribute to personal growth as a trader. Ultimately, embracing technology while maintaining a solid understanding of market fundamentals will empower traders to navigate the complexities of financial markets with confidence and success.

If you are interested in custom trading strategy programming, you may want to check out this article on custom trading strategy programming from Pine Indicators. This tailored approach to success can help you optimize your trading strategies and improve your overall performance. Additionally, if you want to enhance your TradingView experience with indicator upgrades, Pine Indicators also offers an article on indicator upgrades that can help you take your trading to the next level. As always, it’s important to remember to review the disclaimer provided by Pine Indicators to ensure you understand the risks involved in trading.

FAQs

What is an Order Block Bot?

An Order Block Bot is a computer program or software designed to automatically identify and execute trades based on order block patterns in the financial markets.

How does an Order Block Bot work?

An Order Block Bot works by analyzing price action and volume data to identify order block patterns, which are areas of consolidation or accumulation in the market. Once a pattern is identified, the bot can automatically execute trades based on predefined criteria.

What are the benefits of using an Order Block Bot?

Some of the benefits of using an Order Block Bot include the ability to automate trading based on specific patterns, reduce emotional decision-making, and potentially capitalize on market inefficiencies.

Are there any risks associated with using an Order Block Bot?

Yes, there are risks associated with using an Order Block Bot, including the potential for programming errors, technical glitches, and market volatility that could lead to unexpected losses.

Is it legal to use an Order Block Bot for trading?

The legality of using an Order Block Bot for trading depends on the jurisdiction and regulations governing automated trading systems. Traders should ensure they comply with relevant laws and regulations before using such bots.

Can anyone use an Order Block Bot?

In general, anyone with access to a trading platform and the necessary technical knowledge can use an Order Block Bot. However, it’s important to have a good understanding of trading strategies and risk management before using automated trading systems.