CYBER WEEK -70%

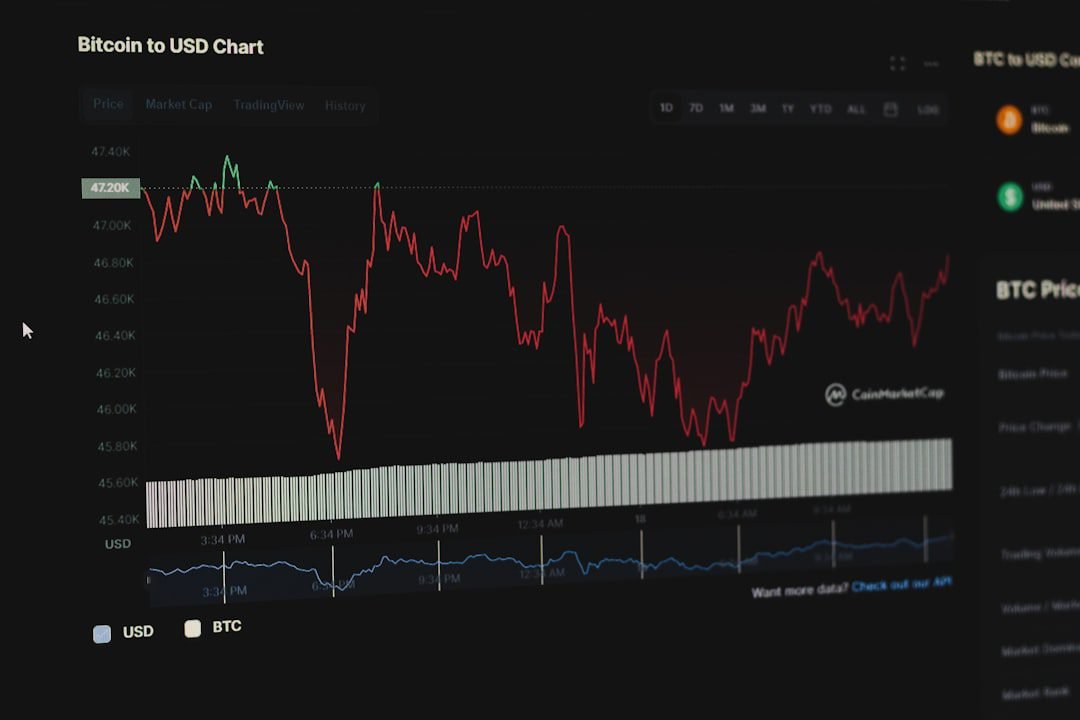

Backtested Forex bots are automated trading systems that utilize historical data to simulate trading strategies and assess their potential effectiveness. The primary purpose of backtesting is to evaluate how a trading strategy would have performed in the past, allowing traders to make informed decisions about its viability in current market conditions. By analyzing historical price movements, traders can identify patterns and trends that may inform future trades.

This process is crucial for developing a robust trading strategy, as it provides insights into the potential risks and rewards associated with a particular approach. The mechanics of backtesting involve feeding historical price data into the trading algorithm, which then executes trades as if it were operating in real-time. This simulation allows traders to observe how the bot would have reacted to various market conditions, including volatility, trends, and reversals.

A well-designed backtesting framework will also account for transaction costs, slippage, and other factors that can impact the performance of a trading strategy. By understanding the strengths and weaknesses of a backtested Forex bot, traders can refine their strategies and enhance their chances of success in live trading environments.

For instance, if you are a day trader who thrives on short-term price movements, you may want to consider a bot that specializes in scalping or high-frequency trading. Conversely, if you prefer a more conservative approach, a bot designed for swing trading or long-term investing may be more suitable.

Understanding your own trading philosophy is essential in making an informed choice.

Another important factor to consider is the underlying algorithm of the Forex bot. Different bots employ various strategies, such as trend following, mean reversion, or arbitrage. Each of these strategies has its own set of advantages and disadvantages, depending on market conditions.

For example, trend-following bots may perform exceptionally well during strong market trends but can struggle during sideways markets. Therefore, it is crucial to analyze the historical performance of the bot under different market scenarios to ensure it aligns with your expectations and objectives.

Once you have selected a backtested Forex bot that aligns with your trading strategy, the next step is to conduct thorough backtesting to optimize its performance. This process involves running the bot against historical data over various time frames to assess its effectiveness. A comprehensive backtesting procedure should include multiple currency pairs and different market conditions to ensure that the bot can adapt to changing environments.

During backtesting, it is essential to analyze key performance metrics such as profit factor, drawdown, win rate, and average trade duration. These metrics provide valuable insights into the bot’s performance and help identify areas for improvement. For instance, if the drawdown is excessively high compared to the profit factor, it may indicate that the bot is taking on too much risk. In such cases, adjustments to the strategy or risk parameters may be necessary to enhance overall performance.

| Bot Name | Win Rate | Average Return | Maximum Drawdown |

|---|---|---|---|

| Bot 1 | 75% | 3.5% | 5% |

| Bot 2 | 82% | 4.2% | 3.5% |

| Bot 3 | 68% | 2.8% | 6.2% |

Risk management is a fundamental aspect of trading that cannot be overlooked when using backtested Forex bots. Even the most sophisticated algorithms can experience periods of underperformance due to unforeseen market events or changes in volatility. Therefore, implementing robust risk management strategies is essential to protect your capital and ensure long-term success.

One effective risk management technique is position sizing, which involves determining the appropriate amount of capital to allocate to each trade based on your overall account size and risk tolerance. Many traders use a fixed percentage of their account balance for each trade, while others may employ more complex methods such as the Kelly Criterion or volatility-based position sizing. Additionally, setting stop-loss orders can help limit potential losses by automatically closing trades when they reach a predetermined loss threshold.

After deploying your backtested Forex bot in a live trading environment, continuous monitoring is crucial to ensure its ongoing effectiveness. Market conditions can change rapidly, and what worked well in the past may not necessarily yield the same results in the future. Regularly reviewing the bot’s performance allows traders to identify any discrepancies between expected and actual results.

Adjustments may be necessary based on performance metrics and changing market dynamics.

For instance, if a bot consistently underperforms during specific market conditions, it may be beneficial to tweak its parameters or even switch to a different strategy altogether. Additionally, keeping abreast of economic news and geopolitical events can provide valuable context for understanding market movements and adjusting your bot’s behavior accordingly.

Analyzing the results of your backtested Forex bot is an integral part of refining your trading strategy. This analysis should go beyond simply looking at profit and loss figures; it should encompass a comprehensive evaluation of various performance metrics. Key indicators such as maximum drawdown, recovery factor, and Sharpe ratio can provide deeper insights into how well the bot manages risk relative to its returns.

Furthermore, conducting a detailed analysis of individual trades can reveal patterns that may not be immediately apparent from aggregate statistics. For example, examining winning versus losing trades can help identify specific market conditions or setups that lead to success or failure. This granular approach allows traders to fine-tune their strategies and make data-driven decisions about future adjustments.

To achieve long-term profitability with backtested Forex bots, traders must adopt a strategic mindset that emphasizes continuous improvement and adaptation. The financial markets are inherently dynamic; therefore, what works today may not work tomorrow. By leveraging insights gained from backtesting and ongoing performance analysis, traders can refine their strategies over time.

Additionally, diversifying your portfolio by employing multiple backtested Forex bots can help mitigate risk and enhance overall returns. Different bots may perform well under varying market conditions; thus, having a mix of strategies can provide a buffer against periods of underperformance in any single approach. This diversification strategy not only spreads risk but also increases the likelihood of capturing profitable opportunities across different market environments.

While backtested Forex bots offer significant advantages in automating trading strategies, there are common pitfalls that traders should be aware of to avoid costly mistakes. One prevalent issue is overfitting, where a bot is excessively tailored to historical data at the expense of its ability to perform in real-time markets. Overfitting can lead to impressive backtest results but often results in poor live performance due to its lack of adaptability.

Another common pitfall is neglecting ongoing monitoring and adjustment after deployment. Many traders assume that once they have set up their bots based on backtesting results, they can leave them running indefinitely without further intervention. However, this approach can lead to missed opportunities or increased losses as market conditions evolve.

Regularly reviewing performance metrics and making necessary adjustments is vital for maintaining optimal performance over time. In conclusion, understanding backtested Forex bots involves recognizing their potential benefits while being mindful of their limitations. By carefully selecting a bot that aligns with your trading strategy, conducting thorough backtesting, implementing robust risk management practices, and continuously monitoring performance, traders can leverage these automated systems for long-term success in the dynamic world of Forex trading.

If you are interested in learning more about backtesting strategies in trading, you may want to check out this article on how to optimize strategy backtests. This article provides valuable insights into the process of refining and improving your trading strategies through backtesting. By understanding how to optimize your backtests, you can increase the effectiveness and profitability of your trading bot.

A backtested forex bot is a computer program or software designed to automatically execute trades in the forex market based on a set of predefined trading rules. The backtesting process involves testing the bot’s performance using historical market data to evaluate its potential profitability.

A backtested forex bot works by analyzing market data, identifying trading opportunities, and executing trades based on a set of predetermined rules and parameters. The bot uses algorithms and technical indicators to make trading decisions without the need for human intervention.

Backtesting in forex trading is the process of testing a trading strategy or forex bot using historical market data to evaluate its performance and potential profitability. This allows traders to assess the effectiveness of their strategies before risking real capital in the live market.

Some benefits of using a backtested forex bot include the ability to automate trading, eliminate emotional decision-making, backtest trading strategies for potential profitability, and execute trades based on predefined rules without the need for constant monitoring.

Limitations of backtested forex bots include the potential for over-optimization, reliance on historical data that may not accurately reflect current market conditions, and the risk of technical failures or errors in the bot’s execution of trades. Traders should also be aware that past performance is not indicative of future results.

pineindicators.com

pineindicators.com

Wait! Before your leave, don’t forget to…

OR copy the website URL and share it manually:

https://pineindicators.com/free