TradingView has emerged as a leading platform for traders and investors, offering a comprehensive suite of tools for market analysis and strategy development. One of its most compelling features is auto trading, which allows users to automate their trading strategies based on predefined criteria. This capability not only enhances efficiency but also enables traders to capitalize on market opportunities without the need for constant monitoring.

By leveraging TradingView’s robust charting tools and extensive library of indicators, traders can create sophisticated automated trading systems that execute trades on their behalf. The allure of auto trading lies in its potential to remove emotional decision-making from the trading process. Many traders struggle with the psychological aspects of trading, often leading to impulsive decisions that can result in significant losses.

Auto trading mitigates this risk by adhering strictly to the rules set forth in a trader’s strategy. As a result, traders can focus on refining their strategies and improving their overall performance while the automated system handles the execution of trades. This article will delve into the intricacies of auto trading on TradingView, providing insights into setting up strategies, selecting indicators, managing risk, and optimizing performance.

Key Takeaways

- TradingView Auto Trading allows users to automate their trading strategies using the platform’s built-in tools.

- Auto trading on TradingView involves using scripts and alerts to execute buy and sell orders based on predefined conditions.

- Setting up an auto trading strategy on TradingView requires selecting the appropriate time frame, market, and trading pair, as well as defining entry and exit points.

- Choosing the right indicators and signals is crucial for successful auto trading on TradingView, as they help identify potential trading opportunities.

- Managing risk and protecting profits is essential when auto trading on TradingView, and users can set stop-loss and take-profit levels to achieve this.

Understanding the Basics of Auto Trading on TradingView

Auto trading on TradingView involves the use of scripts written in Pine Script, TradingView’s proprietary programming language. These scripts allow traders to define specific conditions under which trades will be executed automatically. For instance, a trader might create a script that buys a stock when its 50-day moving average crosses above its 200-day moving average, signaling a potential bullish trend.

Conversely, the script could also include conditions for selling or shorting the asset when certain bearish signals are detected. To get started with auto trading, users must first familiarize themselves with the TradingView interface and its various features. The platform provides an extensive library of public scripts that can serve as a foundation for developing custom strategies.

Additionally, users can access educational resources and community forums to learn from experienced traders who share their insights and strategies. Understanding how to navigate these resources is crucial for anyone looking to harness the power of auto trading effectively.

Setting Up Your Auto Trading Strategy on TradingView

Creating an auto trading strategy on TradingView begins with defining clear objectives and parameters. Traders should consider their risk tolerance, investment goals, and preferred trading style—whether day trading, swing trading, or long-term investing. Once these factors are established, traders can begin drafting their strategy using Pine Script.

The script should outline entry and exit conditions, stop-loss levels, and take-profit targets. For example, a swing trader might develop a strategy that incorporates both trend-following and mean-reversion techniques. The script could specify that a buy order is triggered when the price breaks above a resistance level while also considering overbought or oversold conditions indicated by the Relative Strength Index (RSI).

By combining multiple indicators and conditions, traders can create more nuanced strategies that adapt to changing market dynamics.

Choosing the Right Indicators and Signals for Auto Trading

| Indicator/Signal | Description | Advantages | Disadvantages |

|---|---|---|---|

| Simple Moving Average (SMA) | Average price over a specific time period | Smooths out price fluctuations | May lag behind current price movements |

| Relative Strength Index (RSI) | Measures the speed and change of price movements | Helps identify overbought or oversold conditions | May generate false signals in ranging markets |

| MACD (Moving Average Convergence Divergence) | Compares two moving averages to identify trend direction | Provides early signals of trend reversals | May produce false signals during choppy markets |

The selection of indicators is a critical component of any auto trading strategy. Traders must choose indicators that align with their trading philosophy and provide reliable signals for entry and exit points. Commonly used indicators include moving averages, Bollinger Bands, MACD (Moving Average Convergence Divergence), and RSI.

Each indicator has its strengths and weaknesses, making it essential for traders to understand how they function and how they can be effectively combined. For instance, moving averages are often used to identify trends, while oscillators like RSI can help determine overbought or oversold conditions. A trader might decide to use a combination of a short-term moving average crossover with RSI to confirm entry signals.

This dual approach can enhance the reliability of trade signals by ensuring that both trend direction and momentum are considered before executing a trade.

Managing Risk and Protecting Your Profits with Auto Trading

Risk management is paramount in trading, and auto trading is no exception. Traders must implement strategies to protect their capital while maximizing potential returns. One effective method is to set stop-loss orders within the auto trading script.

A stop-loss order automatically closes a position when the price reaches a predetermined level, limiting potential losses. Additionally, traders should consider using trailing stops, which adjust dynamically as the price moves in favor of the trade, allowing for profit protection while still giving the trade room to grow. Another aspect of risk management involves position sizing.

Traders should determine how much capital to allocate to each trade based on their overall portfolio size and risk tolerance.

By incorporating these risk management techniques into their auto trading strategies, traders can safeguard their investments against unforeseen market fluctuations.

Backtesting Your Auto Trading Strategy on TradingView

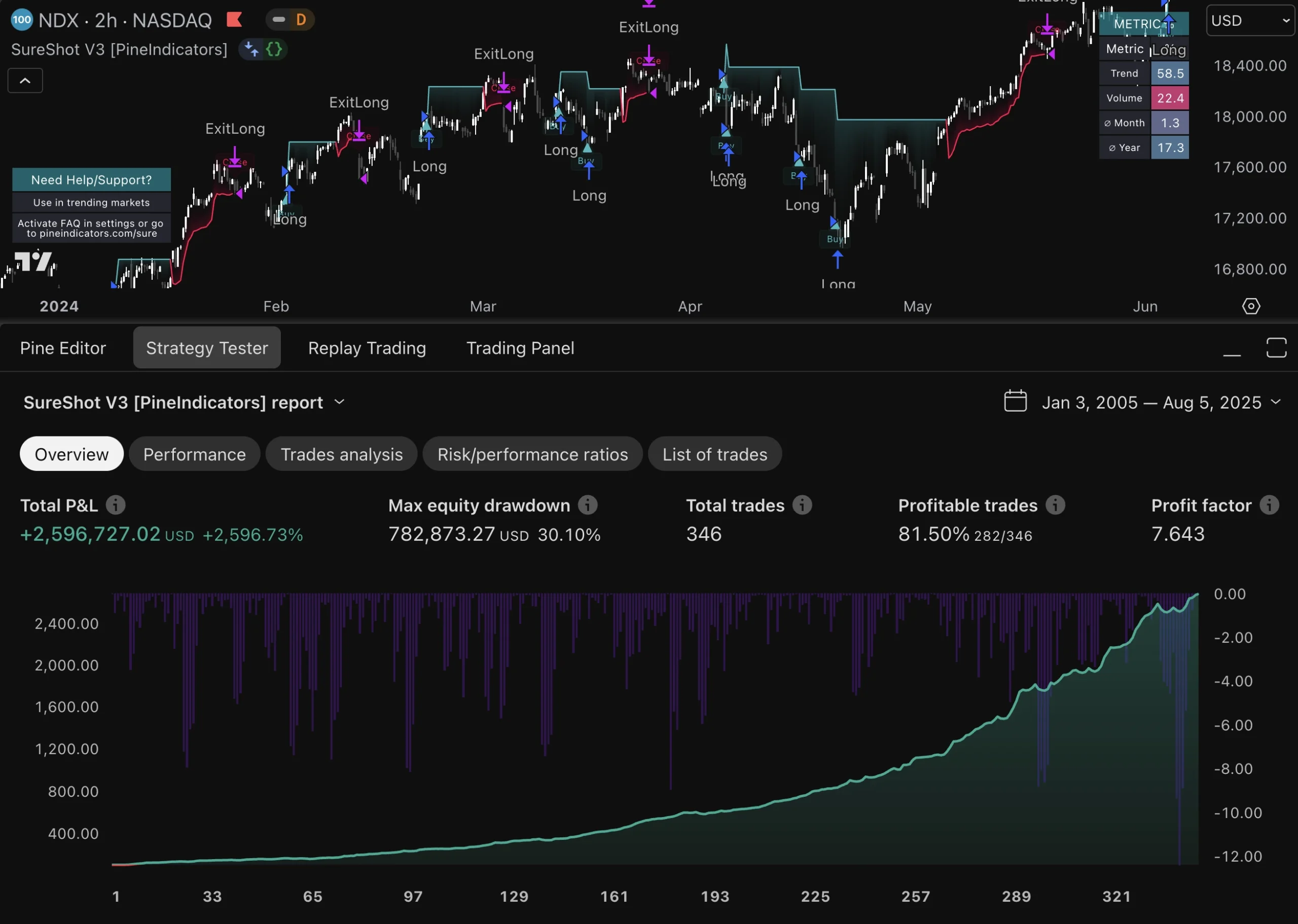

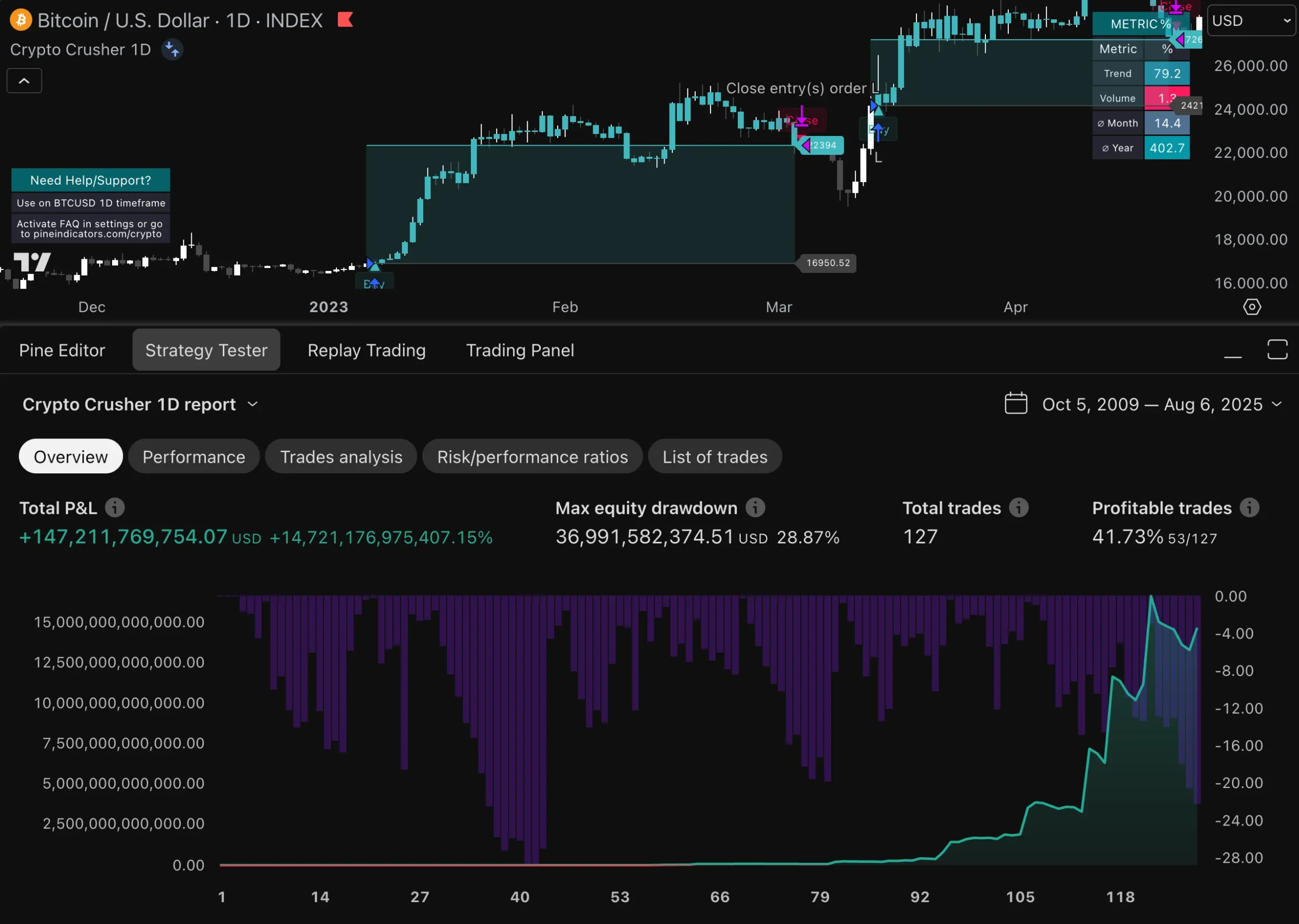

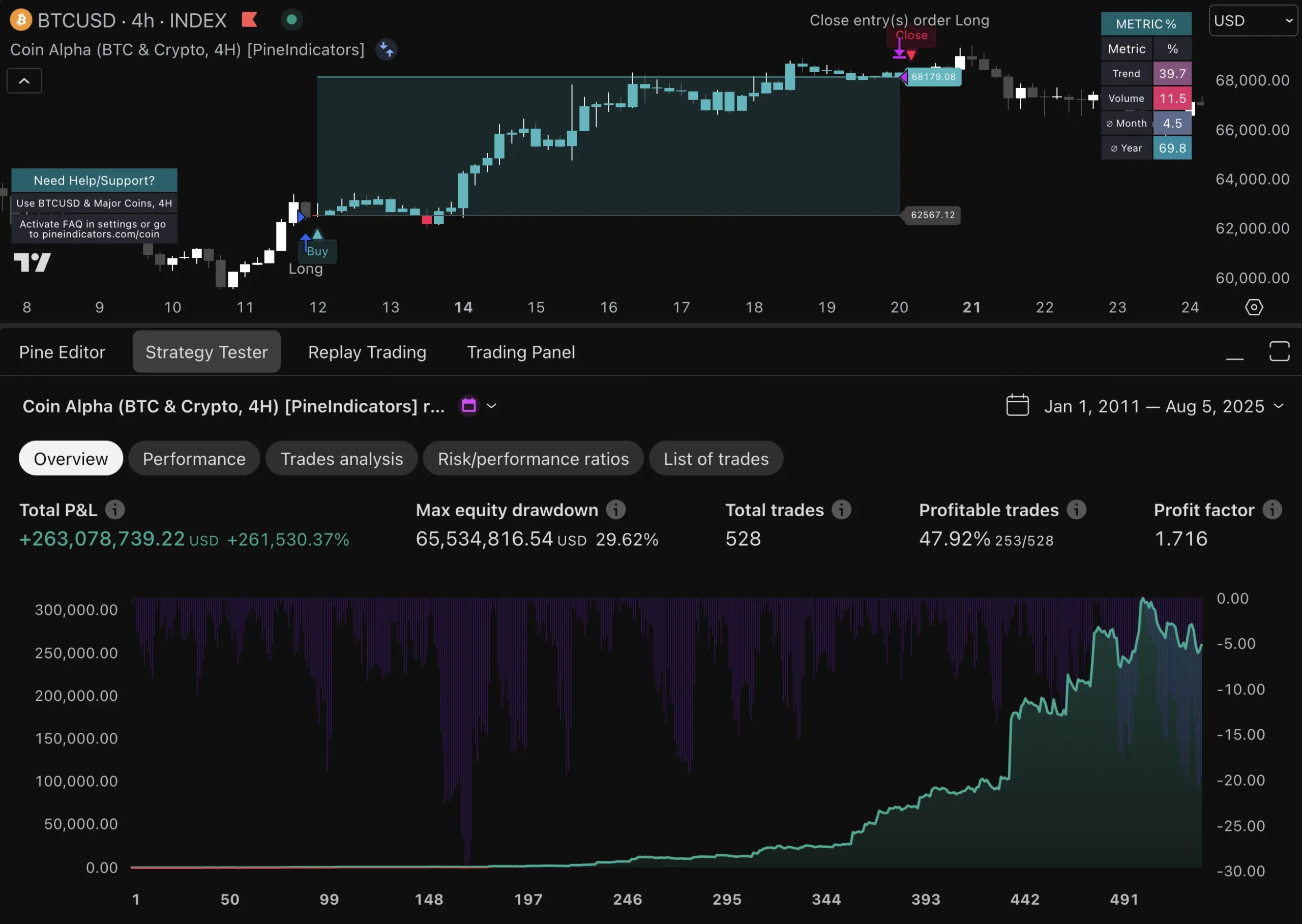

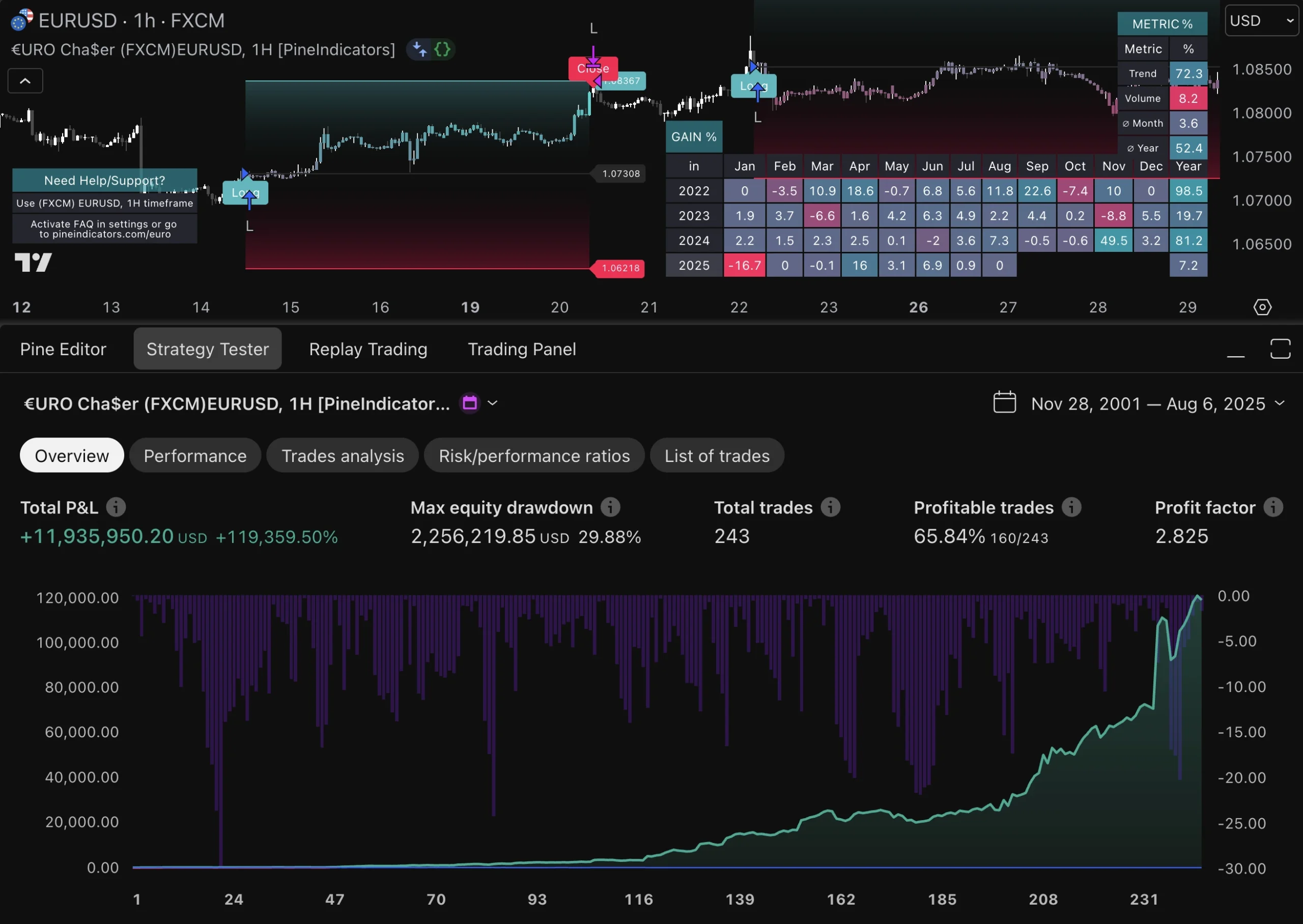

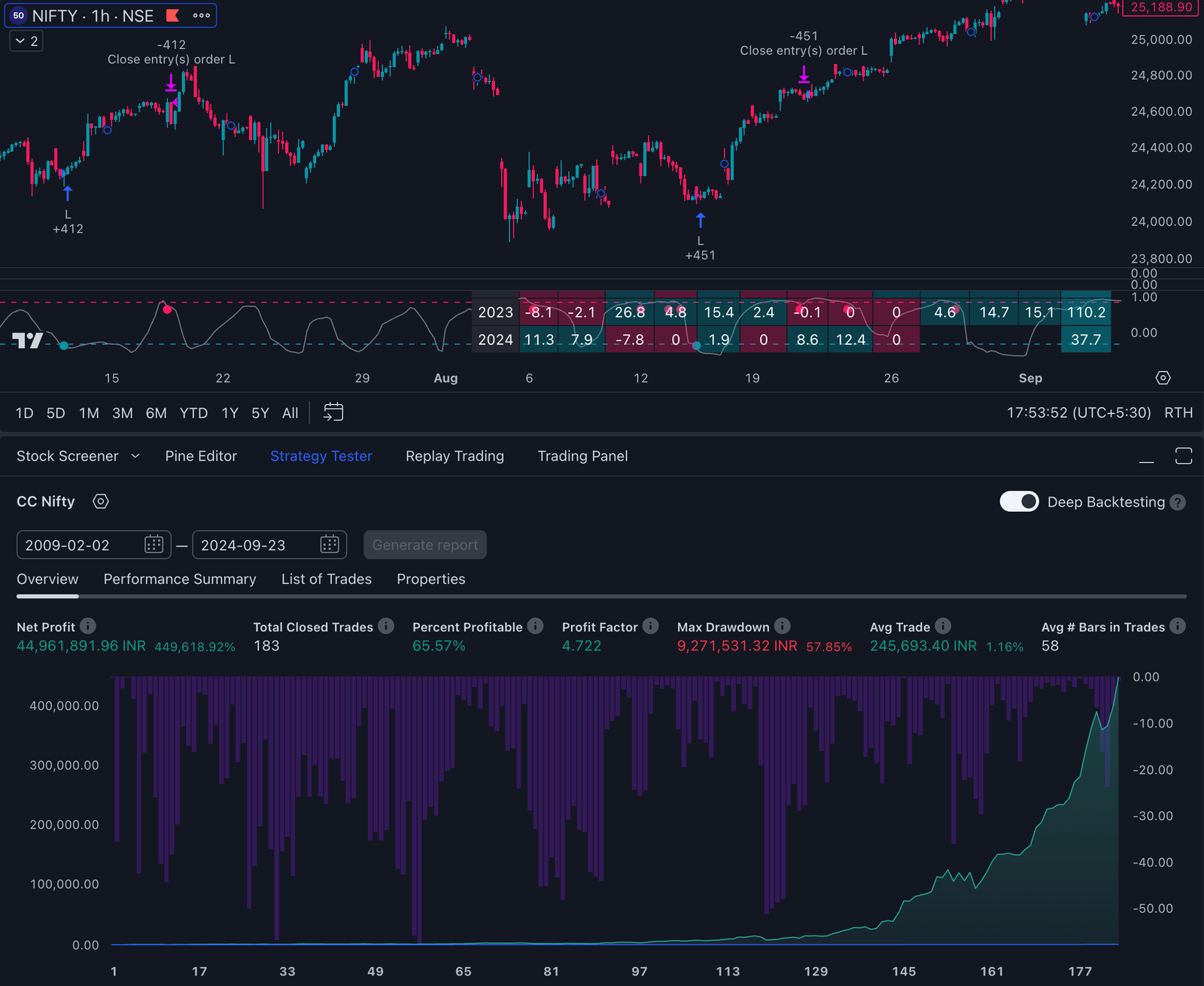

Backtesting is an essential step in developing an effective auto trading strategy. It involves testing the strategy against historical market data to evaluate its performance over time. TradingView provides users with powerful backtesting tools that allow them to simulate trades based on past price movements.

By analyzing how the strategy would have performed in various market conditions, traders can gain valuable insights into its potential effectiveness. During backtesting, traders should pay attention to key performance metrics such as win rate, average profit per trade, maximum drawdown, and overall return on investment (ROI). These metrics help assess whether the strategy is viable and highlight areas for improvement.

For example, if a strategy shows a high win rate but suffers from significant drawdowns, it may indicate that while the strategy is effective in generating winning trades, it lacks adequate risk management measures.

Optimizing Your Auto Trading Strategy for Maximum Profits

Once a strategy has been backtested and refined based on historical data, traders can focus on optimization to enhance profitability further. Optimization involves adjusting various parameters within the strategy to find the most favorable settings for achieving desired outcomes. This process can include tweaking indicator settings, adjusting stop-loss levels, or modifying entry and exit criteria.

Traders should approach optimization with caution; over-optimization can lead to curve fitting, where a strategy performs exceptionally well on historical data but fails in live markets due to its specificity to past conditions. To avoid this pitfall, it is advisable to use out-of-sample testing—evaluating the strategy on data not used during the optimization phase—to ensure its robustness across different market scenarios.

Monitoring and Adjusting Your Auto Trading Strategy in Real Time

Even after setting up an auto trading strategy, continuous monitoring is crucial for success in dynamic markets. Traders should regularly review their strategies’ performance and make adjustments as necessary based on changing market conditions or personal circumstances. TradingView offers real-time alerts that notify users when specific conditions are met or when trades are executed, allowing for timely intervention if needed.

Moreover, traders should remain vigilant about external factors that could impact their strategies, such as economic news releases or geopolitical events. These factors can lead to increased volatility or sudden price movements that may not align with the original strategy’s assumptions. By staying informed and being willing to adapt their strategies accordingly, traders can maintain an edge in the ever-evolving landscape of financial markets.

Leveraging Advanced Features for Auto Trading on TradingView

TradingView offers several advanced features that can enhance auto trading capabilities beyond basic scripting. One such feature is the ability to create alerts based on custom conditions defined within Pine Script. These alerts can trigger notifications via email or mobile app when specific criteria are met, allowing traders to stay informed even when they are not actively monitoring the platform.

Additionally, TradingView supports integration with various brokerage accounts through its API (Application Programming Interface). This integration enables seamless execution of trades directly from TradingView based on signals generated by auto trading scripts. By utilizing these advanced features, traders can streamline their workflows and enhance their overall trading experience.

Integrating Automation and Artificial Intelligence into Your Trading Strategy

The integration of automation and artificial intelligence (AI) into trading strategies represents a significant advancement in the field of finance. AI algorithms can analyze vast amounts of data at speeds unattainable by human traders, identifying patterns and trends that may not be immediately apparent. By incorporating machine learning techniques into auto trading strategies on TradingView, traders can enhance their decision-making processes.

For instance, AI-driven models can continuously learn from new data inputs and adjust trading parameters accordingly. This adaptability allows for more responsive strategies that can evolve with changing market conditions. Furthermore, AI can assist in sentiment analysis by processing news articles or social media posts related to specific assets, providing additional context for trade decisions.

Taking Your Trading to the Next Level with TradingView Auto Trading

TradingView’s auto trading capabilities offer an innovative approach for traders looking to enhance their performance in financial markets. By understanding the fundamentals of auto trading, setting up effective strategies, managing risk diligently, and leveraging advanced features such as AI integration, traders can significantly improve their chances of success. The platform’s user-friendly interface combined with powerful analytical tools makes it accessible for both novice and experienced traders alike.

As technology continues to evolve within the financial sector, embracing automation will likely become increasingly essential for those seeking to remain competitive in the marketplace. By harnessing the full potential of TradingView’s auto trading features, traders can take their trading endeavors to new heights while minimizing emotional stress and maximizing efficiency in their operations.

For those interested in enhancing their TradingView auto trading experience, exploring custom trading strategies can be incredibly beneficial. A related article that delves into this topic is available on Pine Indicators, which discusses the advantages of tailored trading strategies. This article, titled “Custom Trading Strategy Programming: A Tailored Approach to Success,” provides insights into how personalized strategies can optimize trading outcomes. You can read more about it by visiting the following link: Custom Trading Strategy Programming: A Tailored Approach to Success.

FAQs

What is TradingView auto trading?

TradingView auto trading refers to the ability to automatically execute trades based on trading signals generated by TradingView’s charting and analysis platform. This feature allows traders to set specific criteria for trade entry and exit, and have these criteria automatically executed by a connected brokerage account.

How does TradingView auto trading work?

TradingView auto trading works by connecting a trader’s TradingView account to a compatible brokerage platform. Traders can then create and customize trading strategies using TradingView’s Pine Script programming language or built-in strategy tools. Once a strategy is set up, it can be automated to execute trades based on specific conditions without the need for manual intervention.

What are the benefits of using TradingView auto trading?

The benefits of using TradingView auto trading include the ability to execute trades based on predefined criteria without the need for constant monitoring, the potential for faster trade execution, and the ability to backtest and optimize trading strategies using historical data.

Are there any risks associated with TradingView auto trading?

While TradingView auto trading can offer benefits, there are also risks to consider. These include the potential for technical glitches or system failures that could result in unintended trades, as well as the risk of losses from poorly designed or malfunctioning trading strategies. It’s important for traders to thoroughly test and monitor their automated trading strategies to mitigate these risks.

Which brokerage platforms are compatible with TradingView auto trading?

TradingView auto trading is compatible with a range of brokerage platforms, including popular options such as Interactive Brokers, OANDA, FXCM, and others. Traders can check TradingView’s website or contact their brokerage to confirm compatibility and set up auto trading capabilities.