CYBER WEEK -70%

Automated trading, often referred to as algorithmic trading, is a method of executing trades using pre-programmed instructions that take into account various market conditions. This approach leverages technology to execute trades at speeds and frequencies that are impossible for human traders to match. The core of automated trading lies in algorithms—sets of rules that dictate when to buy or sell an asset based on specific criteria.

These criteria can include price movements, volume, time, and other market indicators. By utilizing these algorithms, traders can capitalize on market opportunities without the emotional biases that often accompany manual trading. The concept of automated trading has evolved significantly over the years, particularly with advancements in technology and data analysis.

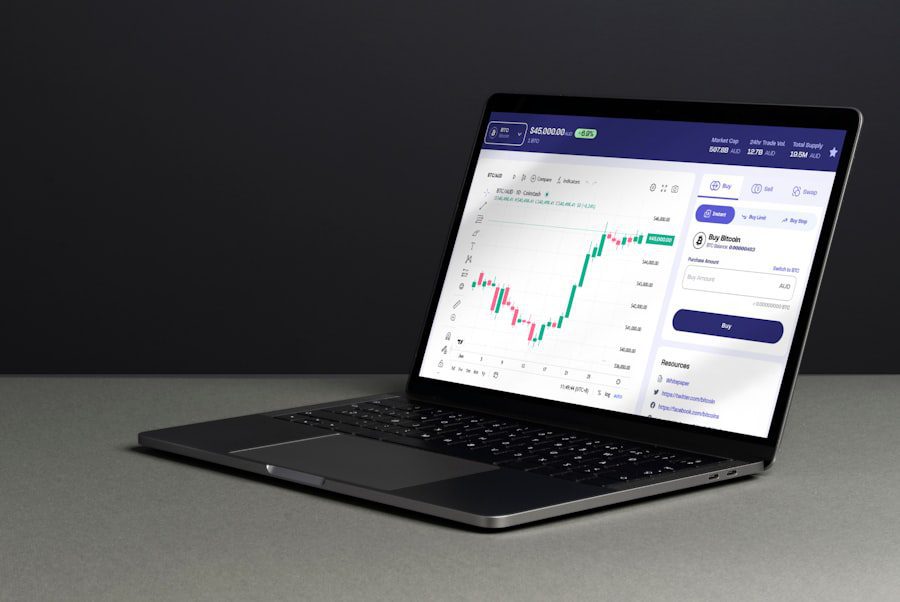

Initially, it was primarily used by institutional investors and hedge funds due to the high costs associated with developing and maintaining sophisticated trading systems. However, the democratization of technology has made automated trading accessible to retail traders as well. Today, many platforms offer user-friendly interfaces that allow individuals to create and implement their own trading strategies without needing extensive programming knowledge.

This shift has transformed the landscape of trading, enabling a broader range of participants to engage in the markets.

One of the most significant advantages of automated trading is its ability to eliminate emotional decision-making. Human traders often struggle with psychological factors such as fear and greed, which can lead to impulsive decisions that negatively impact trading performance. Automated systems operate based on predefined rules, ensuring that trades are executed consistently and without emotional interference.

This objectivity can lead to more disciplined trading practices and improved overall performance. Additionally, automated trading allows for the execution of trades at a speed and frequency that is unattainable for manual traders. Algorithms can analyze vast amounts of market data in real-time, identifying opportunities and executing trades within milliseconds.

This rapid execution can be particularly beneficial in volatile markets where prices can change dramatically in a short period. Furthermore, automated trading systems can monitor multiple markets and assets simultaneously, providing traders with a broader scope of opportunities and the ability to diversify their portfolios effectively.

Getting started with automated trading involves several key steps that require careful consideration and planning. First, aspiring traders should educate themselves about the fundamentals of trading and the specific strategies they wish to implement. Understanding market dynamics, technical analysis, and risk management principles is crucial for developing effective automated trading strategies.

Numerous online courses, webinars, and books are available that cover these topics in depth. Once a solid foundation has been established, the next step is to choose a suitable trading platform that supports automated trading. Many brokers offer platforms with built-in algorithmic trading capabilities or allow for third-party integrations.

It is essential to evaluate the features of each platform, including ease of use, available tools for strategy development, and the quality of customer support. After selecting a platform, traders can begin developing their algorithms or utilizing pre-existing strategies provided by the platform or community.

| Factors to Consider | Automated Trading Platform |

|---|---|

| Cost | Free, Subscription-based, or One-time Purchase |

| Strategy Customization | Ability to Create and Customize Trading Strategies |

| Backtesting | Feature for Testing Strategies on Historical Data |

| Technical Indicators | Availability of a Wide Range of Technical Indicators |

| Execution Speed | Fast and Reliable Order Execution |

| Broker Integration | Compatibility with Different Brokers |

Selecting the right automated trading platform is a critical decision that can significantly impact a trader’s success. Various factors should be considered when evaluating different platforms. One of the primary considerations is the range of assets available for trading.

Some platforms may specialize in specific markets, such as forex or cryptocurrencies, while others offer a more comprehensive selection across multiple asset classes. Traders should choose a platform that aligns with their investment goals and preferred markets. Another important aspect is the platform’s user interface and ease of navigation.

A well-designed interface can enhance the user experience and make it easier to develop and implement trading strategies. Additionally, traders should assess the availability of backtesting tools that allow them to test their strategies against historical data before deploying them in live markets. This feature is crucial for refining algorithms and ensuring they perform as expected under various market conditions.

Finally, considering the fees associated with each platform—such as commissions, spreads, and withdrawal fees—is essential for understanding the overall cost of trading.

Setting up automated trading strategies involves defining specific rules and parameters that will guide the algorithm’s decision-making process. Traders must first identify their trading goals, such as whether they aim for short-term gains through day trading or long-term growth through swing trading or position trading. Once these goals are established, traders can begin formulating their strategies based on technical indicators, chart patterns, or fundamental analysis.

For instance, a common strategy might involve using moving averages to identify trends. A trader could program their algorithm to buy an asset when its short-term moving average crosses above its long-term moving average—a signal known as a “golden cross.” Conversely, the algorithm could be set to sell when the short-term moving average crosses below the long-term moving average—a signal known as a “death cross.” By clearly defining these parameters within the algorithm, traders can automate their decision-making process while adhering to their established strategy.

Risk management is a crucial component of any trading strategy, and automated trading is no exception. While algorithms can execute trades based on predefined rules, they cannot inherently assess risk without proper parameters set by the trader. One effective method for managing risk in automated trading is through position sizing—determining how much capital to allocate to each trade based on the trader’s overall portfolio size and risk tolerance.

Another essential aspect of risk management is setting stop-loss orders within the algorithm. A stop-loss order automatically closes a position when it reaches a predetermined price level, helping to limit potential losses. For example, if a trader sets a stop-loss order at 5% below their entry price, the algorithm will execute a sell order if the asset’s price falls to that level.

This feature is particularly valuable in volatile markets where prices can fluctuate rapidly.

Even though automated trading systems operate independently once set up, ongoing monitoring is essential to ensure they function as intended and adapt to changing market conditions. Traders should regularly review their algorithms’ performance metrics, such as win rates, average returns per trade, and drawdown periods. By analyzing these metrics, traders can identify areas for improvement and make necessary adjustments to enhance performance.

Moreover, market conditions are not static; they evolve over time due to various factors such as economic indicators, geopolitical events, and changes in market sentiment. As such, it may be necessary to recalibrate algorithms periodically to align with current market dynamics. For instance, if a particular strategy performs well during trending markets but struggles during sideways markets, traders may need to incorporate additional filters or modify their approach to account for these shifts.

While automated trading offers numerous advantages, there are common pitfalls that traders should be aware of to avoid detrimental outcomes. One frequent mistake is over-optimization—tweaking an algorithm excessively based on historical data to achieve seemingly perfect results. While this may yield impressive backtesting results, it often leads to poor performance in live markets due to overfitting; the algorithm becomes too tailored to past data and fails to adapt to new conditions.

Another common error is neglecting proper risk management practices. Some traders may become overly reliant on automation and fail to implement adequate safeguards against significant losses. This oversight can lead to catastrophic results if an unexpected market event occurs or if the algorithm encounters unforeseen circumstances that it was not programmed to handle.

Establishing robust risk management protocols from the outset is essential for mitigating potential losses.

Technology plays a pivotal role in the realm of automated trading by enabling faster execution speeds, sophisticated data analysis capabilities, and enhanced connectivity across global markets. High-frequency trading (HFT) firms exemplify this technological advantage by utilizing advanced algorithms that execute thousands of trades per second based on minute price fluctuations. These firms often invest heavily in infrastructure—such as co-location services that place their servers physically closer to exchange servers—to minimize latency and gain a competitive edge.

Moreover, advancements in artificial intelligence (AI) and machine learning are revolutionizing automated trading strategies by allowing algorithms to learn from vast datasets and adapt over time. These technologies enable traders to develop more complex models that can identify patterns and correlations that may not be immediately apparent through traditional analysis methods. As AI continues to evolve, its integration into automated trading systems will likely lead to even more sophisticated strategies capable of navigating increasingly complex market environments.

The future of automated trading appears promising as technology continues to advance at an unprecedented pace. With the rise of artificial intelligence and machine learning algorithms, traders can expect more sophisticated systems capable of analyzing vast amounts of data in real-time and making informed decisions based on predictive analytics. This evolution will likely lead to increased efficiency in trade execution and improved profitability for those who leverage these technologies effectively.

Furthermore, as regulatory frameworks surrounding automated trading evolve, there may be greater transparency and accountability within the industry. Regulators are increasingly focused on ensuring fair practices in algorithmic trading to prevent market manipulation and protect investors’ interests. This shift could lead to enhanced trust among retail traders who may have previously been hesitant to engage with automated systems due to concerns about fairness and transparency.

For those interested in delving deeper into automated trading, numerous resources are available that cater to various learning preferences. Online courses offered by platforms like Coursera or Udemy provide structured learning paths covering topics such as algorithm development, backtesting techniques, and risk management strategies tailored specifically for automated trading. Books authored by industry experts also serve as valuable resources for gaining insights into successful automated trading practices.

Titles such as “Algorithmic Trading: Winning Strategies and Their Rationale” by Ernie Chan or “Trading Systems: A New Approach to System Development and Portfolio Optimization” by Tomasini and Jaekle offer comprehensive guidance on developing effective algorithms. Additionally, online forums and communities dedicated to algorithmic trading provide opportunities for networking with like-minded individuals who share similar interests in automation within financial markets.

Engaging with these communities can facilitate knowledge sharing and foster collaboration among traders seeking innovative solutions in their automated trading endeavors.

For those interested in automating their trading strategies, a valuable resource is the article on TradingView Automation for Consistent Trades. This article provides insights into how traders can leverage automation tools within TradingView to enhance their trading efficiency and consistency. By integrating automated systems, traders can minimize human error and execute trades based on predefined criteria, ensuring a disciplined approach to the market. Whether you’re a novice or an experienced trader, understanding the fundamentals of trading automation can significantly impact your trading success.

Automated trading, also known as algorithmic trading, is the use of computer programs to automatically execute trading strategies. These programs can be designed to trade stocks, options, futures, and other financial instruments.

Automated trading works by using pre-defined rules and criteria to execute trades without the need for human intervention. Traders can use programming languages like Python or specialized trading platforms to create and backtest their trading strategies.

Automated trading can offer several benefits, including the ability to execute trades at high speeds, the elimination of emotional decision-making, the ability to backtest strategies, and the potential for 24/7 trading.

Risks of automated trading include the potential for technical failures, system errors, and the need for continuous monitoring to ensure that the trading algorithms are performing as intended.

Popular tools for automated trading include trading platforms like MetaTrader, NinjaTrader, and TradeStation, as well as programming languages like Python and R for creating custom trading algorithms. Additionally, there are specialized firms that offer automated trading services for retail traders.

pineindicators.com

pineindicators.com

Wait! Before your leave, don’t forget to…

OR copy the website URL and share it manually:

https://pineindicators.com/free