CYBER WEEK -70%

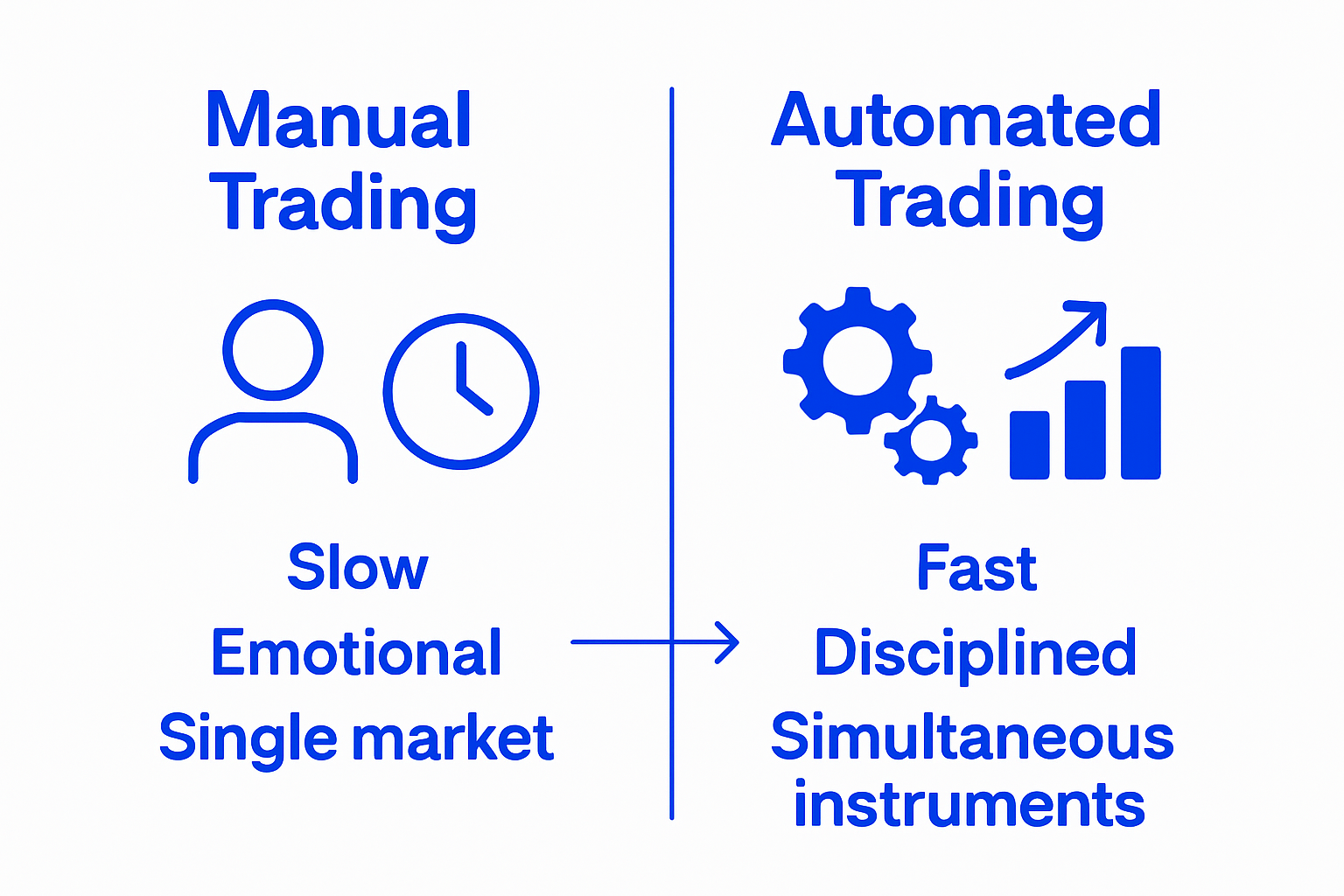

TradingView automation is taking over the way people trade by letting algorithms handle decision making instead of emotions. These sophisticated systems analyze complex market data in milliseconds, processing far more than any human possibly could. Most assume automated trading is only about cutting down manual work or speeding up trades. Strangely, the real advantage is discipline. Automation transforms guesswork into data-driven choices and can make trading more consistent—even for those who never considered programming their own strategy.

| Takeaway | Explanation |

|---|---|

| TradingView automation enhances trading efficiency. | It allows traders to automate manual processes, reducing execution times and psychological biases. |

| Implement algorithmic strategies for precision. | Automating rules with algorithms ensures disciplined trading, minimizing emotional decision making. |

| Utilize Pine Script for customization. | Traders can create tailored scripts that define specific strategies, enhancing adaptability to market conditions. |

| Backtest strategies using historical data. | This process helps refine and optimize trading strategies before real market application, increasing potential returns. |

| Automated systems adapt to multiple markets. | They can monitor and trade across various financial domains, capitalizing on opportunities instantaneously. |

TradingView automation represents a sophisticated technological approach that empowers traders to transform manual trading processes into systematic, rule-based strategies executed automatically across financial markets. By leveraging advanced scripting capabilities, traders can design custom algorithms that make trading decisions without constant human intervention.

Automated trading on TradingView involves creating predefined rules and conditions that trigger specific actions in financial markets. These mechanisms allow traders to implement complex strategies using Pine Script, TradingView’s proprietary programming language. The automation process typically includes defining entry and exit points, risk management parameters, and trade execution criteria based on technical indicators, price movements, and mathematical models.

According to research exploring algorithmic trading strategies, automated systems can significantly reduce human emotional interference and improve trade consistency. Key benefits of TradingView automation include:

Traders utilizing TradingView automation gain substantial strategic advantages by converting their trading insights into programmable logic. These automated systems can monitor multiple financial instruments simultaneously, execute trades with precision, and maintain discipline that human traders often struggle to sustain. Sophisticated algorithms can analyze complex market data in milliseconds, identifying potential trading opportunities across stocks, cryptocurrencies, forex, and other financial markets.

The core purpose of TradingView automation extends beyond mere trade execution. It represents a sophisticated approach to transforming subjective trading decisions into objective, data-driven strategies that can be rigorously backtested, refined, and optimized for improved performance.

Trading automation has emerged as a transformative force in financial markets, revolutionizing how traders approach investment strategies and decision making. In an era of complex market dynamics and information overload, automated trading systems provide traders with unprecedented capabilities to navigate financial landscapes more efficiently and strategically.

The rise of trading automation represents a significant technological leap in financial markets. Traditional manual trading methods are increasingly being replaced by sophisticated algorithms capable of processing vast amounts of market data instantaneously. Research from the New York Stock Exchange demonstrates that increased market automation has fundamentally changed trading efficiency by reducing execution times and improving price discovery mechanisms.

Key technological drivers accelerating trading automation include:

Automated trading systems offer traders multiple strategic advantages that human traders cannot consistently replicate. These systems operate with mathematical precision, eliminating emotional decision making and implementing complex trading strategies with remarkable consistency. By leveraging predefined rules and algorithms, traders can execute trades across multiple markets simultaneously, capitalize on fleeting market opportunities, and maintain strict risk management protocols.

Moreover, automation enables traders to backtest strategies using historical data, refine algorithms based on performance metrics, and adapt quickly to changing market conditions. This data-driven approach transforms trading from a subjective practice into a quantifiable, systematic process that can be continuously optimized for maximum potential returns.

TradingView automation operates through a sophisticated ecosystem of scripting, rule definition, and algorithmic execution that transforms complex trading strategies into programmable instructions. By utilizing Pine Script, traders can create intricate trading systems that analyze market conditions, generate signals, and execute trades with remarkable precision.

The table below breaks down the core components of TradingView automation, summarizing their function and importance for building effective automated trading systems.

| Component | Description | Role in Automation |

|---|---|---|

| Data Processing | Gathers and interprets market data using technical indicators and mathematical models | Enables analysis of price movement, trends, and patterns |

| Strategy Development | Construction and configuration of algorithmic trading logic in Pine Script | Defines entry/exit rules, conditional triggers, and overall approach |

| Execution Mechanisms | Executes trades automatically based on signals and strategic criteria | Ensures precise, timely order placement and management |

| Risk Management Rules | Set parameters to control exposure and manage potential losses | Protects capital and enforces discipline |

| Performance Tracking & Reporting | Measures results and tracks strategy metrics | Assesses effectiveness and supports strategy refinement |

The fundamental architecture of TradingView automation revolves around three primary elements: data processing, strategy development, and execution mechanisms. Traders construct custom scripts that define specific trading logic, enabling the platform to interpret market data through predefined mathematical models and technical indicators. According to technical documentation, these scripts can incorporate complex conditional statements, mathematical calculations, and signal generation algorithms.

Key technical components include:

Developing an automated trading strategy requires a systematic approach that combines technical analysis, statistical modeling, and risk management principles. Traders design algorithms that evaluate multiple market variables simultaneously, such as price movements, volume trends, volatility indicators, and historical performance metrics. These algorithms transform subjective trading decisions into objective, quantifiable rules.

The automation process allows traders to backtest strategies using historical market data, simulate potential performance, and refine algorithms before deploying them in live trading environments. This approach provides a scientific method for developing and validating trading strategies, reducing reliance on intuition and emotional decision-making.

Automated trading systems represent complex technological ecosystems comprised of interconnected components that work synchronously to transform trading strategies into executable actions. These sophisticated systems transcend simple programmatic instructions, integrating advanced computational techniques to analyze financial markets with unprecedented precision and efficiency.

Signal generation forms the intellectual core of automated trading systems, representing the analytical engine that identifies potential trading opportunities. These mechanisms leverage multiple technical indicators, statistical models, and mathematical algorithms to evaluate market conditions and generate actionable trading signals. According to quantitative trading research, advanced signal generation processes can dramatically improve trade decision accuracy by incorporating machine learning and predictive analytics.

Key signal generation components include:

Risk management represents a critical component that distinguishes professional automated trading systems from simplistic algorithmic approaches. Intelligent risk management frameworks dynamically adjust trading parameters, implementing predefined protective mechanisms that limit potential losses and preserve capital. These systems continuously monitor market volatility, portfolio exposure, and individual trade performance to ensure consistent and disciplined trading execution.

The execution architecture encompasses complex decision-making protocols that translate generated signals into precise trading actions. By integrating real-time market data, historical performance metrics, and predefined risk tolerance levels, automated systems can execute trades with mathematical precision, eliminating emotional interference and maintaining strategic consistency across diverse market conditions.

Trading automation has transitioned from a niche technological concept to a mainstream strategy employed across diverse financial markets. By transforming complex trading strategies into executable algorithms, traders can now leverage sophisticated computational techniques to generate consistent, data-driven investment outcomes across multiple asset classes.

Automated trading strategies demonstrate remarkable versatility across different financial markets, enabling traders to implement specialized approaches tailored to specific asset characteristics.

This table provides a comparison of how different financial markets leverage automated trading strategies, highlighting their key features and automation advantages.

| Market Type | Key Features | Automation Advantages |

|---|---|---|

| Cryptocurrency | High volatility, 24/7 trading | Monitors multiple exchanges, rapid trade execution |

| Stock Market | High-frequency trading, large volumes | Quick execution, precise price targeting |

| Forex | Currency pairs, global liquidity | Simultaneous multi-pair trading, fast response |

| Commodity Futures | Contract-based, margin trading | Automated rollovers, efficient stop-loss handling |

| Index Funds | Diversified portfolios | Maintains balance, periodic rebalancing automation |

| Cryptocurrency markets, characterized by high volatility and 24/7 trading, particularly benefit from automated systems that can monitor multiple exchanges simultaneously and execute trades with millisecond precision. Research exploring neural network trading models reveals how advanced algorithms can successfully replicate adaptive trader behaviors in complex market environments. |

Key market domains leveraging automation include:

Real-world automation implementation spans a wide spectrum of trading methodologies, from conservative risk-management approaches to aggressive momentum-based strategies. Professional traders utilize automation to implement multi-layered trading strategies that would be impossible to execute manually. These systems can simultaneously monitor multiple technical indicators, assess market sentiment, manage position sizes, and implement sophisticated risk management protocols.

Automated systems excel in scenarios requiring rapid decision making, consistent rule adherence, and emotionless trade execution. By removing human psychological biases and limitations, these technological solutions enable traders to develop more disciplined, statistically rigorous investment approaches that can adapt dynamically to changing market conditions.

Are you frustrated by inconsistent results or overwhelmed by the complexity of building automated systems on TradingView? The article highlighted how difficult it is to continuously monitor price action, build reliable Pine Script code, and manage emotional decision-making during live trades. True automation requires tested strategies with robust performance and risk controls—something most manual or DIY solutions cannot deliver.

Now is your chance to leave guesswork and uncertainty behind. At PineIndicators.com, you gain instant access to exclusive, thoroughly backtested Pine Script strategies and indicators designed for real-world TradingView automation. Each tool is professionally developed and verified for accuracy, delivering non-repainting and real-time signals for stocks, forex, crypto, and more. Discover how our AI-powered systems take the emotional bias out of your trades, backed by 20 years of data and a risk-free 30-day money back guarantee. Experience seamless integration and dedicated support from setup to execution.

Upgrade your trading now by exploring our proven automated strategies and see the difference for yourself. Your path to consistent, automated trading results begins here.

TradingView automation refers to the use of algorithms and scripts to execute trading strategies systematically without constant human intervention. It allows traders to implement rule-based approaches to trading across various financial markets.

TradingView automation works by utilizing Pine Script, TradingView’s proprietary programming language, to create custom algorithms that define specific trading logic. These algorithms analyze market data, generate trade signals, and execute trades based on predefined conditions.

The benefits of TradingView automation include eliminating emotional biases in trading, ensuring consistent strategy implementation, executing trades faster, and enhancing risk management capabilities through predefined rules and automated processes.

Yes, TradingView automation allows traders to backtest their strategies using historical market data. This process helps validate and refine trading algorithms before deploying them in live trading environments, improving their effectiveness and reliability.

pineindicators.com

pineindicators.com

Wait! Before your leave, don’t forget to…

OR copy the website URL and share it manually:

https://pineindicators.com/free