Introduction

Automated crypto strategies involve the use of algorithms and computer programs to trade cryptocurrencies on your behalf. These strategies aim to maximize profits and mitigate risks by analyzing market data, executing orders, and identifying profitable trading opportunities.

This blog will explore different types of automated trading strategies, the importance of market analysis in automated trading, and how to effectively implement risk management tools in your automated trading systems.

Understanding Automated Crypto Strategies

Automated crypto strategies involve the use of trading algorithms to make decisions in the cryptocurrency market. These algorithms analyze vast amounts of market data to identify profitable trading opportunities and execute trades on behalf of users.

How Algorithms Work

Trading algorithms:

- Analyze Market Data: They continuously gather data from various sources, including price movements, trading volumes, and market trends.

- Make Trading Decisions: Based on predefined criteria, they determine when to enter or exit trades. For instance, an algorithm might buy a cryptocurrency when its price crosses above a moving average and sell when it falls below.

- Execute Trades: They automatically place orders on exchanges without any human intervention. This ensures quick execution and helps capitalize on fleeting market opportunities.

Continuous Market Analysis

Continuous market analysis is crucial for successful automated trading:

- Real-Time Data Processing: Algorithms process real-time data to adapt to changing market conditions.

- Trend Identification: They can spot emerging trends or reversals faster than human traders.

- Risk Management: By analyzing historical data and current market dynamics, these systems can implement risk management tools like stop-loss orders.

Understanding how trading algorithms work and the importance of constant market analysis is key to leveraging automated crypto strategies effectively.

Types of Automated Trading Strategies You Can Use

1. Moving Average Trading Strategy

Moving Average Trading is a foundational strategy in automated crypto trading. It relies on the calculation of averages over a specified period to smooth out price data, making it easier to identify trends.

Types of Moving Averages

- Simple Moving Average (SMA): This is calculated by taking the average of a selected range of prices, typically closing prices, over a specified number of periods. For example, a 50-day SMA will average the closing prices over the past 50 days.

- Exponential Moving Average (EMA): Unlike SMA, EMA gives more weight to recent prices, making it more responsive to new information. This can be particularly useful in volatile markets where timely reactions are crucial.

Determining Entry and Exit Points

- Entry Points: Traders often look for moments when the price crosses above the moving average as a signal to buy. For instance, if the price crosses above the 50-day SMA, it may indicate an upward trend.

- Exit Points: Conversely, when the price falls below the moving average, it could signal an exit point. For example, if the price drops below the 200-day EMA, it might suggest a downward trend.

Using automated systems, you can set up algorithms to monitor these moving averages continuously and execute trades based on predefined criteria. This reduces emotional biases and ensures that trading decisions are made swiftly, leveraging market opportunities efficiently.

This strategy forms a basic yet effective approach in automated crypto strategies due to its simplicity and proven track record in identifying market trends.

2. Relative Strength Indicator (RSI) Strategy

Relative Strength Indicator (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market.

Calculation Method

- RSI = 100 – (100 / (1 + RS))

- RS (Relative Strength) = Average Gain / Average Loss over a specified period, usually 14 days.

Key Points About RSI in Trading

- Overbought Conditions: When RSI exceeds 70, it may indicate that an asset is overbought and could be due for a price correction.

- Oversold Conditions: When RSI drops below 30, it suggests that an asset is oversold and might experience a price upturn.

Using RSI can help traders identify potential market reversals and make informed trading decisions. By integrating RSI into your automated crypto strategies, you can enhance the timing of your trades and improve profitability.

3. Moving Average Convergence Divergence (MACD) Strategy

The Moving Average Convergence Divergence (MACD) is a popular trend-following indicator used in automated crypto strategies. This tool consists of two primary components:

- Signal Line: An Exponential Moving Average (EMA) of the MACD line, typically set to 9 periods.

- Histogram: Represents the difference between the MACD line and the signal line, providing visual cues for trend momentum.

Utilizing MACD for trend analysis involves observing crossovers between the MACD line and the signal line. A bullish crossover occurs when the MACD line crosses above the signal line, suggesting a potential upward trend. Conversely, a bearish crossover happens when the MACD line falls below the signal line, indicating a possible downward trend.

Spotting divergences is another key aspect of using MACD. Divergences happen when price movements and the MACD indicator show conflicting directions. For instance, if prices are making higher highs while the MACD makes lower highs, it could signal an impending reversal.

In summary, MACD aids in generating trade signals by analyzing trends and momentum shifts, making it an essential component of many automated trading strategies.

4. Fibonacci Retracement Strategy

Fibonacci retracement is a tool widely used within automated crypto strategies to identify potential support and resistance levels. Traders apply this technique by plotting key Fibonacci levels—23.6%, 38.2%, 50%, 61.8%, and 100%—on a price chart to predict areas where price might retrace before continuing its trend.

Using Fibonacci Levels:

- Identify Swing Highs and Lows: Start by marking the recent significant high and low points on a price chart.

- Plot Fibonacci Levels: Draw horizontal lines at each Fibonacci level between the swing high and low.

- Analyze Price Movements: Monitor how the price reacts at these levels; common strategies include entering trades when prices bounce off these levels or break through them.

Combining Fibonacci retracement with other indicators like Simple Moving Average (SMA), Exponential Moving Average (EMA), or Relative Strength Indicator (RSI) can enhance predictive accuracy, making it an invaluable tool in your automated trading arsenal.

5. Bollinger Bands Strategy

Bollinger Bands are a versatile tool in automated crypto strategies, incorporating the Simple Moving Average (SMA) and standard deviations to gauge market volatility.

How Bollinger Bands Work

Bollinger Bands consist of three lines:

- A middle band, which is typically a 20-day SMA.

- An upper band, calculated as the SMA plus two standard deviations.

- A lower band, calculated as the SMA minus two standard deviations.

Identifying Market Conditions with Bollinger Bands

- Overbought: When prices touch or exceed the upper band, the asset may be overbought, signaling a potential reversal.

- Oversold: When prices hit or drop below the lower band, it might indicate an oversold condition, suggesting a possible breakout.

Using Bollinger Bands in Automated Crypto Strategies

The flexibility of Bollinger Bands makes them suitable for various trading strategies such as moving average trading and relative strength indicator (RSI) analysis. The dynamic nature of the bands helps traders adapt to changing market conditions, enhancing decision-making in both trending and ranging markets.

For those implementing automated crypto strategies like moving average convergence divergence (MACD) or other techniques, Bollinger Bands can provide valuable insights into potential price movements and trend shifts.

Exploring Arbitrage Opportunities with Automated Strategies

1. Cross-Exchange Arbitrage Strategy Using Bots

Cross-exchange arbitrage exploits price discrepancies between exchanges to generate profits. Here’s how it works:

How It Works

Traders buy a cryptocurrency at a lower price on one exchange and simultaneously sell it at a higher price on another exchange. This process demands sufficient liquidity on both platforms to execute trades quickly and efficiently.

Benefits of Using Bots

- Quick Execution Times: Automated bots can perform these trades almost instantaneously, capturing fleeting opportunities that human traders might miss.

- 24/7 Operation: Unlike human traders, bots can operate around the clock, taking advantage of market inefficiencies at any time.

- Reduced Emotional Bias: Automated systems minimize emotional decision-making, adhering strictly to predefined algorithms.

However, several risks need consideration:

Risks Involved

- Transfer Delays: Cryptocurrency transfers between exchanges can experience delays due to network congestion or confirmation times. This delay can negate the arbitrage opportunity if prices normalize before the transfer completes.

- Transaction Fees: Each trade incurs fees, which can erode profit margins. It’s vital to account for these costs when calculating potential gains.

- Regulatory Risks: Different exchanges operate under varying regulatory frameworks. Understanding these legal implications is crucial to avoid compliance issues.

By employing automated crypto strategies like cross-exchange arbitrage, you can capitalize on price inefficiencies across multiple platforms. The key lies in balancing quick execution with risk management to maximize profitability effectively.

2. Triangular Arbitrage Strategy Using Bots

Triangular arbitrage is an advanced automated crypto strategy that takes advantage of differences in exchange rates among three different currencies. Unlike cross-exchange arbitrage, which looks at price differences between exchanges, triangular arbitrage targets inefficiencies within currency pairs quoted against each other.

How It Works:

- Identifying Opportunities: The bot identifies three cryptocurrencies that have a cyclical relationship. For instance, BTC/ETH, ETH/USD, and USD/BTC.

- Executing Trades: The bot executes trades simultaneously across multiple exchanges:

- Exchange BTC for ETH.

- Convert ETH to USD.

- Finally, trade USD back to BTC.

Steps Involved:

- Market Analysis: Continuous monitoring of exchange rates to identify profitable opportunities.

- Execution: Simultaneous trading across multiple exchanges to exploit identified inefficiencies.

- Profit Calculation: Calculate potential profit margins by considering transaction costs.

This strategy can yield profits without taking on directional risk, making it an attractive option for automated trading systems.

The Role Of Market Analysis In Successful Implementation Of Automated Strategies

Real-time data gathering is crucial for the effectiveness of automated crypto trading bots. These bots rely on continuous and accurate market data to make informed trading decisions without human intervention. Integrating a live market data feed into bot software ensures that the bots can:

- Monitor price movements: Bots need up-to-the-second information to detect price changes and trends, enabling them to react swiftly to market fluctuations.

- Execute trades efficiently: Real-time data allows for immediate action, minimizing delays that could affect trade outcomes.

- Reduce emotional biases: Automation removes human emotions from trading decisions, ensuring that trades are based purely on data and predefined algorithms.

- Optimize strategies: Continuous data analysis helps in refining and adjusting trading strategies dynamically as market conditions change.

Bots equipped with live data integration can perform complex tasks such as:

- Technical analysis: Utilizing indicators like moving averages, RSI, MACD, Fibonacci retracement, and Bollinger Bands to identify trading opportunities.

- Arbitrage calculations: Identifying and exploiting price discrepancies across different exchanges instantaneously.

Incorporating real-time data feeds into your automated trading system enhances its ability to gather insights and execute trades effectively, ensuring you stay ahead in the highly volatile cryptocurrency market.

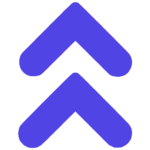

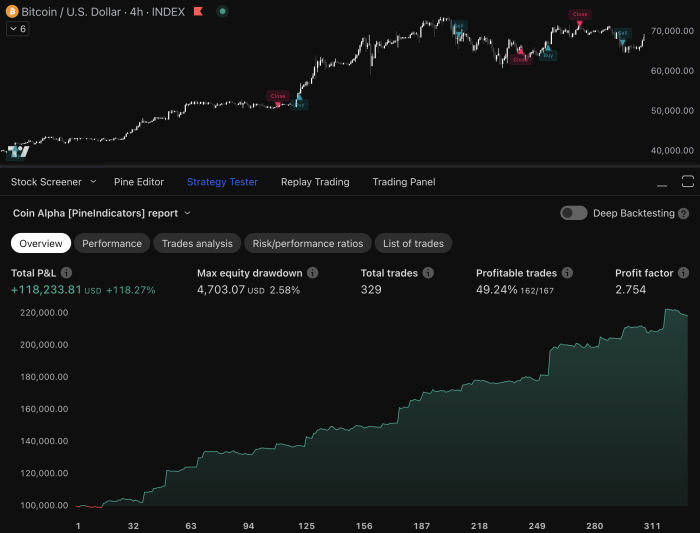

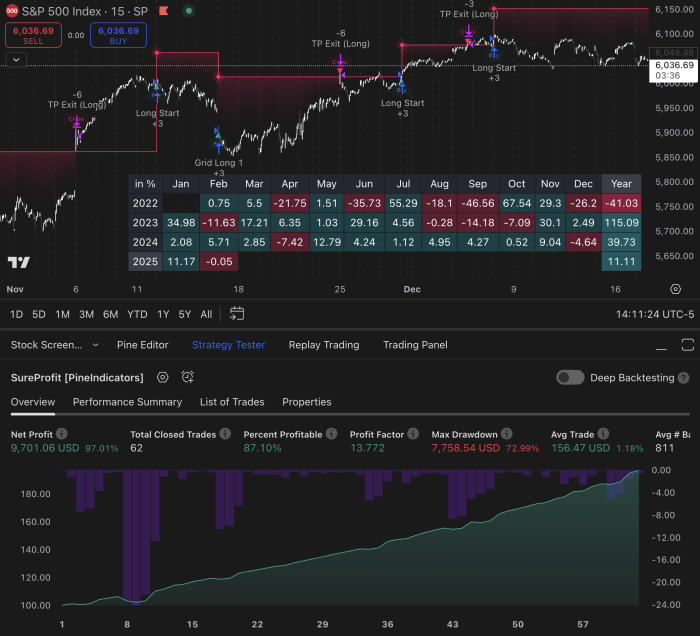

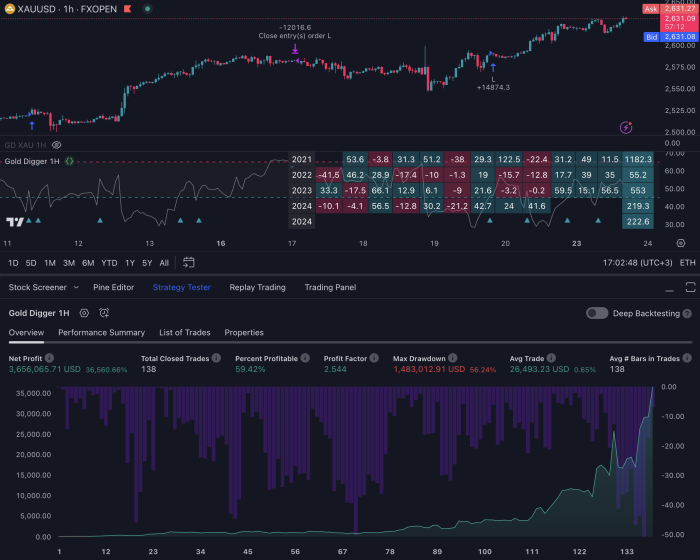

Backtesting Your Automated Strategies Before Going Live With Them

Backtesting is a crucial step in the development of automated crypto strategies. By using historical data, you can assess how your strategy would have performed under different market conditions over time. This process helps validate the effectiveness of your strategy before deploying it in live trading environments.

To backtest a strategy:

- Gather Historical Data: Obtain relevant historical price data for the cryptocurrency you’re interested in. This could include minute-by-minute data or daily prices.

- Implement the Strategy: Code the algorithm to apply your strategy to this historical data.

- Analyze Key Metrics: Evaluate performance through key metrics like:

- Win Rate: The percentage of profitable trades versus total trades.

- Maximum Drawdown: The largest peak-to-trough decline during the testing period, indicating potential risk.

- Adjust and Optimize: Based on results, tweak parameters to optimize performance while minimizing risks.

Using these steps ensures that your automated trading system is robust and capable of handling various market scenarios effectively.

User-Friendly Interfaces For Implementing Your Own Custom-Built Or Pre-Built Automated Trading Solutions

Modern trading platforms offer a range of customizable solutions provided by popular bot platforms available today. These user-friendly interfaces simplify the process of setting up automated trading strategies, even for those with limited technical expertise.

Key Features:

- Parameter Selection: Traders can easily select their preferred trading pairs, ensuring that their strategies focus on specific cryptocurrencies.

- Risk Management: Platforms allow users to set risk management levels per trade, such as stop-loss and take-profit points, which are crucial for minimizing potential losses.

- Strategy Customization: Users can implement both custom-built and pre-built strategies. This flexibility caters to different skill levels, offering basic templates for beginners and advanced configurations for experienced traders.

- Real-Time Data Access: Continuous access to live market data enables the algorithms to make informed decisions based on current market conditions.

- Backtesting Tools: Many platforms include backtesting features, allowing traders to validate their strategies using historical data before going live.

- User Support: Comprehensive tutorials, community forums, and customer support help users navigate the platform and optimize their trading strategies.

With these features, user-friendly platforms empower traders to automate their crypto trading processes efficiently and effectively. The automation process relies heavily on algorithmic trading concepts, which form the backbone of these customizable solutions.

Risk Management Tools Integrated Within Most Reliable Platforms

Using automation technology in cryptocurrency markets demands robust risk management tools. Reputable bot providers often include a variety of features designed to safeguard against potential losses.

Key risk assessment tools commonly found within reputable bot providers’ offerings:

- Stop-Loss Orders: Automatically sell assets when prices fall to a predetermined level, limiting potential losses.

- Take-Profit Orders: Secure profits by selling assets once they reach a target price.

- Trailing Stops: Adjust stop-loss levels according to market movements, locking in gains while minimizing losses.

- Position Sizing: Manage the amount of capital allocated to each trade based on risk tolerance and market conditions.

- Diversification Settings: Spread investments across multiple assets to reduce exposure to any single asset’s volatility.

Automated crypto strategies benefit significantly from these integrated risk management tools. Traders can set parameters that align with their risk tolerance, ensuring that trades are executed according to predefined rules. This minimizes emotional decision-making and enhances trading discipline.

By leveraging these tools, you can protect your investments while pursuing profitable opportunities in the ever-evolving cryptocurrency market.

FAQs (Frequently Asked Questions)

What are automated crypto strategies?

Automated crypto strategies refer to trading algorithms that analyze market data and execute trades without human intervention. They play a crucial role in cryptocurrency trading by enabling traders to capitalize on market opportunities efficiently and consistently.

What types of automated trading strategies are commonly used?

Common types of automated trading strategies include Moving Average Trading, Relative Strength Indicator (RSI) Strategy, Moving Average Convergence Divergence (MACD) Strategy, Fibonacci Retracement Strategy, and Bollinger Bands Strategy. Each of these strategies utilizes specific indicators to determine entry and exit points for trades.

How does market analysis contribute to successful automated trading?

Continuous market analysis is essential for successful automated trading as it provides real-time data that algorithms rely on to make informed trading decisions. This analysis helps identify trends, reversals, and potential price movements without the influence of human emotions.

What is cross-exchange arbitrage in automated trading?

Cross-exchange arbitrage involves buying a cryptocurrency at a lower price on one exchange and simultaneously selling it at a higher price on another. Automated strategies can execute these trades quickly, taking advantage of price discrepancies between exchanges while considering risks like transfer delays.

Why is backtesting important for automated trading strategies?

Backtesting is vital as it allows traders to validate their automated strategies using historical data. By assessing performance under various market conditions, traders can evaluate key metrics such as win rate and maximum drawdown before deploying their strategies in live markets.

What risk management tools are available in automated trading platforms?

Reliable automated trading platforms offer integrated risk management tools designed to safeguard against potential losses. These tools include risk assessment features that help traders set appropriate parameters for each trade according to their individual risk tolerance.