Introduction

Automated Pine Script strategies have transformed algorithmic trading by allowing traders to execute trades based on predefined criteria without human intervention. These strategies analyze market data and generate trading signals, eliminating emotional biases from trading decisions.

TradingView stands out as a premier platform for implementing these strategies. It offers a user-friendly interface, extensive charting tools, and a robust community of traders sharing insights and ideas. By leveraging TradingView’s capabilities, you can seamlessly develop and execute automated Pine Script strategies to enhance efficiency and consistency in your trading activities.

Understanding Pine Script Language and TradingView Features

Pine Script language is a specialized scripting language developed by TradingView, designed for creating custom technical indicators and automated trading strategies. Its syntax is intuitive, offering simplicity for beginners while retaining the flexibility needed by experienced traders.

Key Features of Pine Script

- Built-in functions and libraries: These simplify the process of coding complex strategies by providing pre-written code snippets for common tasks.

- Real-time data access: Pine Script allows you to access real-time market data, crucial for executing timely trading decisions.

- Backtesting capabilities: You can simulate your strategies on historical data to evaluate their performance before deploying them in live markets.

Benefits of TradingView’s Platform

- User-friendly interface: TradingView provides an intuitive charting interface that makes it easy to visualize and test your scripts.

- Community support: A large community of traders shares scripts and ideas, fostering collaboration and learning.

- Cross-platform integration: TradingView supports integration with various brokerage accounts and trading platforms through tools like PineConnector. This ensures seamless execution of trades directly from TradingView alerts.

By leveraging Pine Script within TradingView, you can create robust automated trading systems that capitalize on market opportunities efficiently.

1. The Role of Education in Automated Trading Success

Financial markets education and technical analysis are essential for any successful automated trading strategy. Understanding market dynamics, price movements, and different asset classes is crucial. This knowledge enables you to develop strategies that can be effectively implemented using Pine Script.

Automation can streamline your trading process, but it doesn’t replace the need for comprehensive market knowledge. Here’s why:

- Market Dynamics: Knowing how various markets work, like stocks, forex, and cryptocurrencies, helps you create strategies tailored to each market’s unique behavior.

- Technical Analysis: Being skilled in technical analysis tools such as trend lines, support and resistance levels, and chart patterns allows you to generate more advanced and trustworthy trading signals.

“A well-informed trader is better equipped to develop robust automated systems.”

While Pine Script handles the execution, your understanding ensures these strategies are based on solid trading principles. Automation removes emotional biases but doesn’t eliminate the need for strategic oversight. Therefore, continuous learning and staying updated with market trends remain crucial for long-term success.

2. Defining and Implementing a Profitable Trading Strategy with Pine Script

Creating a profitable trading strategy requires precision and clarity. Here are practical steps to formulate a strategy that can be effectively coded into Pine Script:

- Identify Your Objectives: Determine your trading goals, such as target profit margins, risk tolerance, and preferred trading timeframes.

- Select Technical Indicators: Choose indicators like Moving Averages, RSI, or MACD that align with your strategy’s objectives.

- Define Entry and Exit Criteria: Establish clear rules for when to enter and exit trades based on indicator signals or price levels.

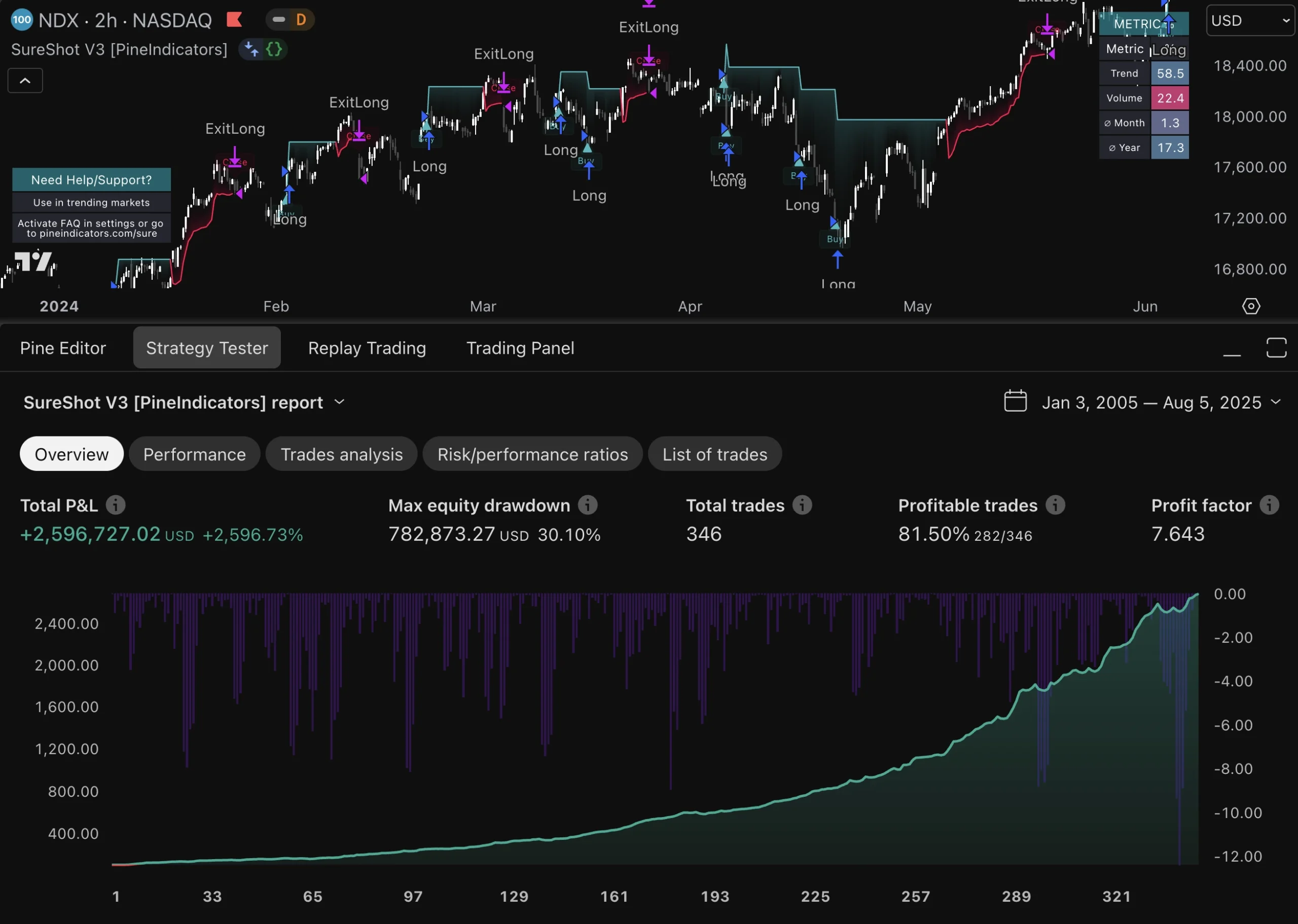

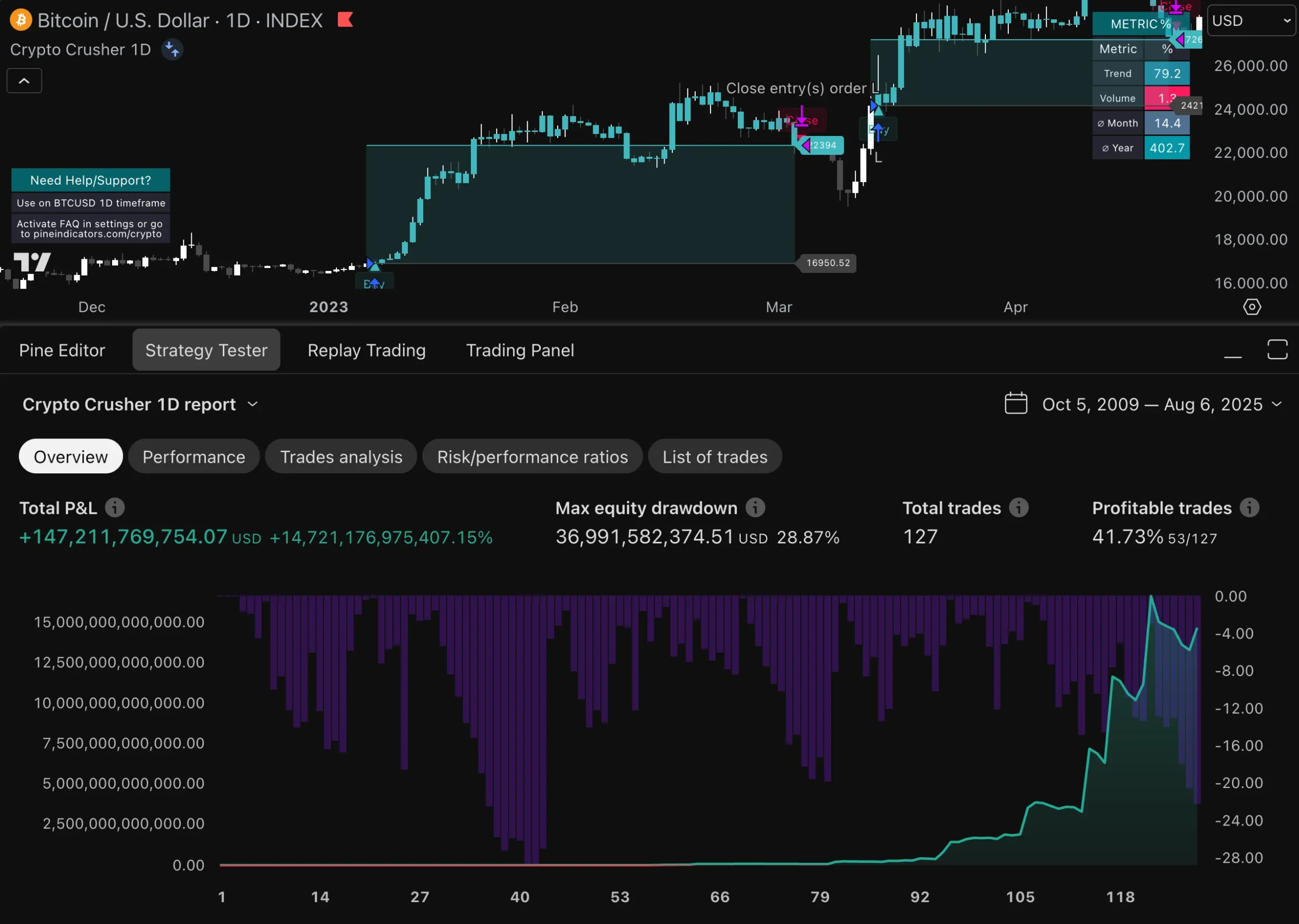

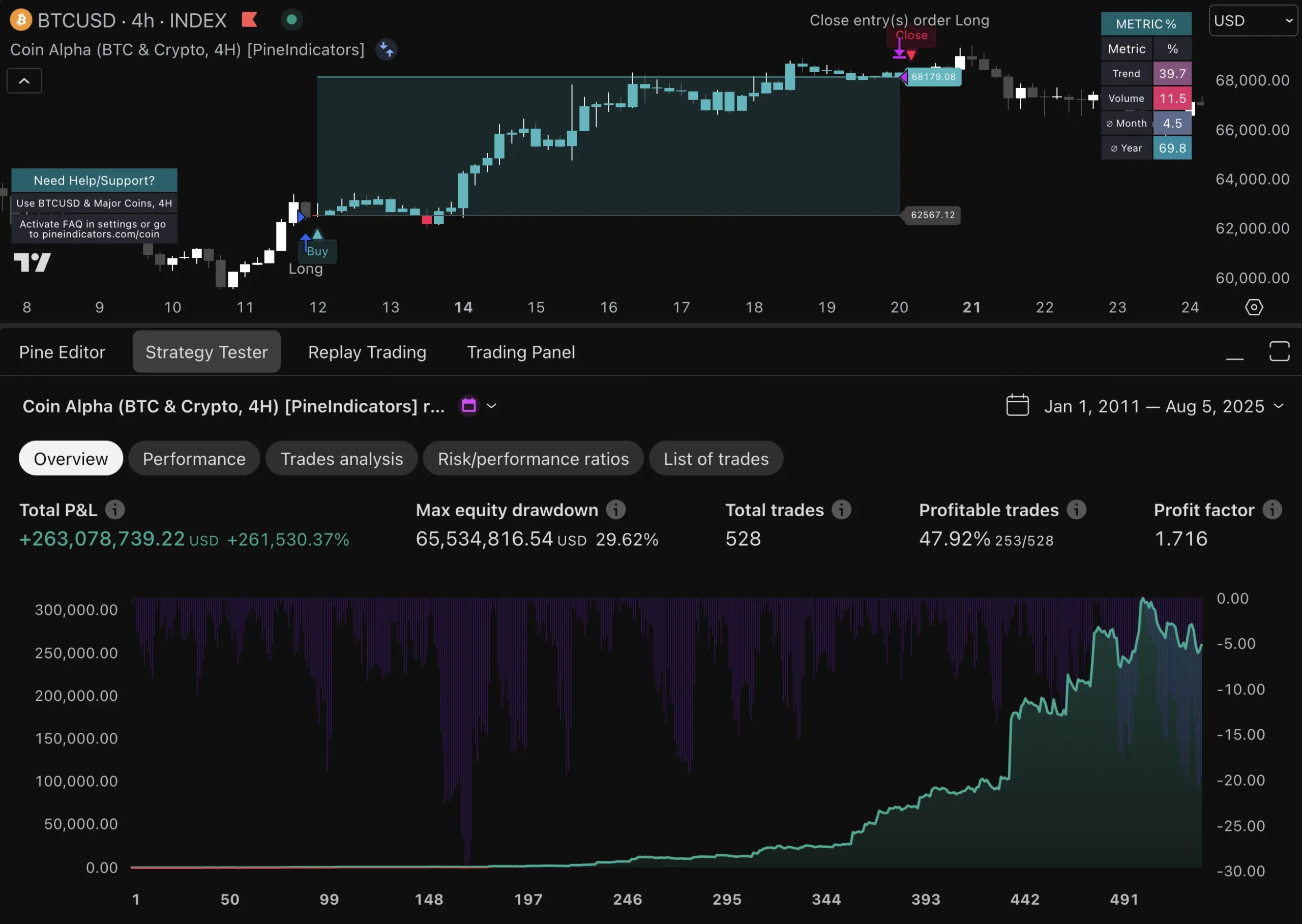

- Backtest the Strategy: Use historical data to test the strategy’s performance and refine parameters for optimal results.

- Code the Strategy in Pine Script: Translate your defined rules into Pine Script code. For instance: pinescript //@version=4 strategy(“Simple Moving Average”, overlay=true) smaShort = sma(close, 9) smaLong = sma(close, 21)

- if (crossover(smaShort, smaLong)) strategy.entry(“Buy”, strategy.long)

- if (crossunder(smaShort, smaLong)) strategy.close(“Buy”)

Clear trade execution rules are critical for consistency and objectivity. Consistent rules prevent emotional decision-making and ensure that trades are executed based on predefined criteria. This consistency is essential for the success of Automated Pine script strategies.

Using these steps, you can develop a robust trading strategy that leverages the power of automation in TradingView.

3. Using Technical Indicators for Automated Market Analysis

Technical indicators are crucial in algorithmic trading, providing objective data for making informed decisions. Some of the most commonly used indicators include:

- MACD (Moving Average Convergence Divergence): This momentum indicator highlights changes in the strength, direction, momentum, and duration of a trend. Integrating MACD into your Pine Script can help determine entry and exit points by analyzing the relationship between two moving averages.

- RSI (Relative Strength Index): RSI measures the speed and change of price movements, oscillating between zero and 100. It is particularly useful for identifying overbought or oversold conditions. In Pine Script, you can use RSI to automate trades based on predefined thresholds.

- Bollinger Bands: These bands consist of a middle band (a simple moving average) and two outer bands that represent standard deviations from the middle band. Bollinger Bands can be coded into Pine Script to automate trades based on volatility and price levels.

Here’s an example of integrating the RSI indicator into a Pine Script strategy:

pinescript //@version=4 strategy(“RSI Strategy”, overlay=true) rsi = rsi(close, 14) buySignal = crossover(rsi, 30) sellSignal = crossunder(rsi, 70) if (buySignal) strategy.entry(“Buy”, strategy.long) if (sellSignal) strategy.close(“Buy”)

This script generates buy signals when RSI crosses above 30 and sell signals when it crosses below 70, automating trade decisions based on market analysis.

Using these technical indicators in your automated strategies provides a structured way to analyze the market, leading to more consistent and objective trading decisions.

4. Enhancing Trade Decision-Making with Price Action Analysis Techniques

Price action analysis techniques offer a different perspective on market analysis compared to traditional indicator-based methods. Instead of relying on lagging indicators, price action focuses on the actual movement of prices over time. This approach can lead to a more immediate understanding of market dynamics and trends.

Key Concepts in Price Action Analysis:

- Support and Resistance Levels: Identifying key price levels where the asset has historically faced buying or selling pressure.

- Candlestick Patterns: Observing formations like Doji, Hammer, and Engulfing patterns that suggest potential market reversals or continuations.

- Trend Lines: Drawing lines to connect significant highs or lows, helping to visualize the direction of the market.

Benefits of Combining Automation with Price Action:

- Real-Time Decision Making: Automated systems can quickly react to price action signals, executing trades faster than manual methods.

- Objective Criteria: Predefined rules for recognizing patterns eliminate emotional biases from trading decisions.

- Flexibility: Traders can customize their algorithms to adapt to different market conditions by adjusting criteria based on real-time price movements.

Example:

pinescript //@version=5 strategy(“Price Action Strategy”, overlay=true)

// Example: Simple Moving Average Crossover with Price Action Confirmation smaShort = ta.sma(close, 50) smaLong = ta.sma(close, 200) priceAboveSMA = close > smaShort and close > smaLong

// Example: Engulfing Pattern Detection bullishEngulfing = open < close[1] and close > open[1] and close > open bearishEngulfing = open > close[1] and close < open[1] and close < open

if (priceAboveSMA and bullishEngulfing) strategy.entry(“Buy”, strategy.long)

if (close < smaShort and bearishEngulfing) strategy.entry(“Sell”, strategy.short)

Integrating these techniques within Pine Script enables traders to develop strategies that are both reactive and adaptable, aligning closely with market movements.

5. Automation Tools: Streamlining Trade Execution Process

Automation tools are essential for efficiently executing Automated Pine script strategies. One such tool, PineConnector, helps connect TradingView alerts with external trade execution platforms like MetaTrader.

Key Features of PineConnector:

- Integration: PineConnector connects TradingView and MetaTrader by interpreting alerts from TradingView and triggering trades on MetaTrader based on predefined criteria.

- Real-Time Execution: Ensures that trades are executed instantly upon receiving a signal, which is crucial for taking advantage of market opportunities.

- Customization: Offers extensive customization options, allowing you to adjust trade parameters such as stop-loss, take-profit levels, and position sizing directly from TradingView alerts.

Benefits:

- Efficiency: Automates the entire trading process, reducing the manual workload and enabling you to focus on strategy development.

- Consistency: By automating trade execution, it removes emotional biases, ensuring that your strategies are implemented consistently.

- Scalability: Supports executing multiple strategies simultaneously across different markets and asset classes.

For example, if your Automated Pine script strategy generates a buy signal when the RSI crosses above 30, PineConnector will automatically send this alert to MetaTrader, executing the trade without any manual intervention.

By using these automation tools, you make the trade execution process smoother, improving both efficiency and reliability in your algorithmic trading efforts.

6. Overcoming Challenges in Automated Trading Systems Management

Automated trading systems offer significant advantages, yet they come with their own set of challenges. Reducing emotional biases is one of the core benefits of automation, but this doesn’t mean automated systems are foolproof.

Common Challenges

- Market Volatility Impacts: Automated systems can struggle during periods of high market volatility. Rapid price swings can lead to unexpected trade executions, potentially causing significant losses. It’s essential to build robust strategies that account for these conditions.

- Technical Issues: Automated systems rely heavily on technology. Any technical malfunction—be it software bugs, server downtime, or connectivity issues—can disrupt trading activities and affect performance. Regular system checks and updates are crucial for minimizing these risks.

- Over-Optimization: Often referred to as “curve-fitting,” over-optimization happens when a strategy is too finely tuned to historical data, making it less effective in real-world trading scenarios. Balance backtesting with forward testing to ensure your strategy performs well under various market conditions.

Mitigation Strategies

- Implementing Stop-Loss and Take-Profit Orders: These mechanisms help manage risk by automatically closing trades at predefined levels.

- Diversification: Employing multiple strategies across different asset classes can reduce the impact of any single strategy’s failure.

- Continuous Monitoring: Even the best automated systems require oversight. Regularly review performance metrics and be prepared to intervene if necessary.

By understanding and addressing these challenges, you can better leverage automation for consistent and efficient trading outcomes.

7. Continuous Evaluation and Adaptation for Long-Term Success in Algorithmic Trading

Ongoing evaluation of your automated Pine Script strategies is crucial for sustained success. The financial markets are dynamic, necessitating regular performance reviews of your strategies to ensure they remain effective.

Key activities for ongoing evaluation:

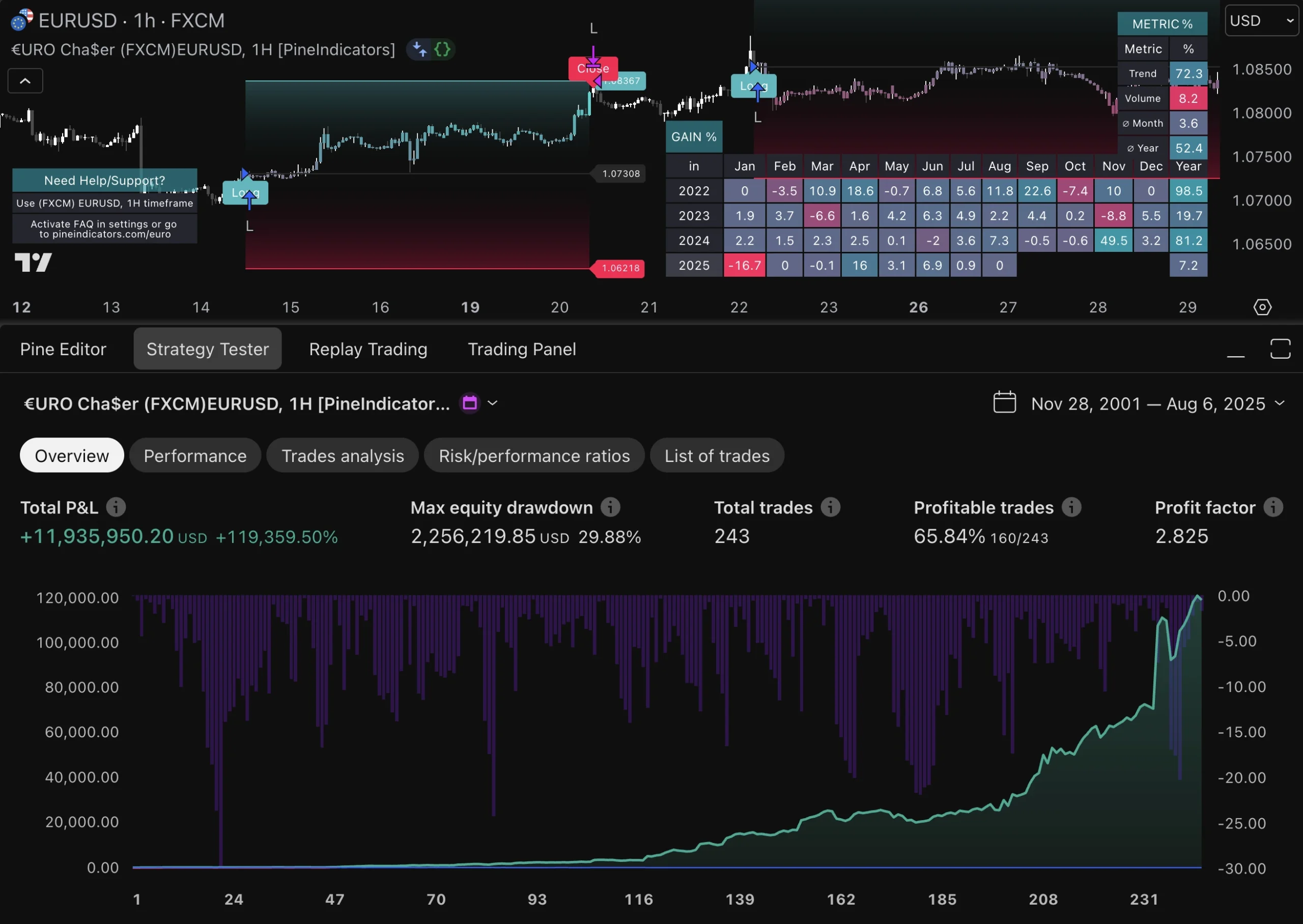

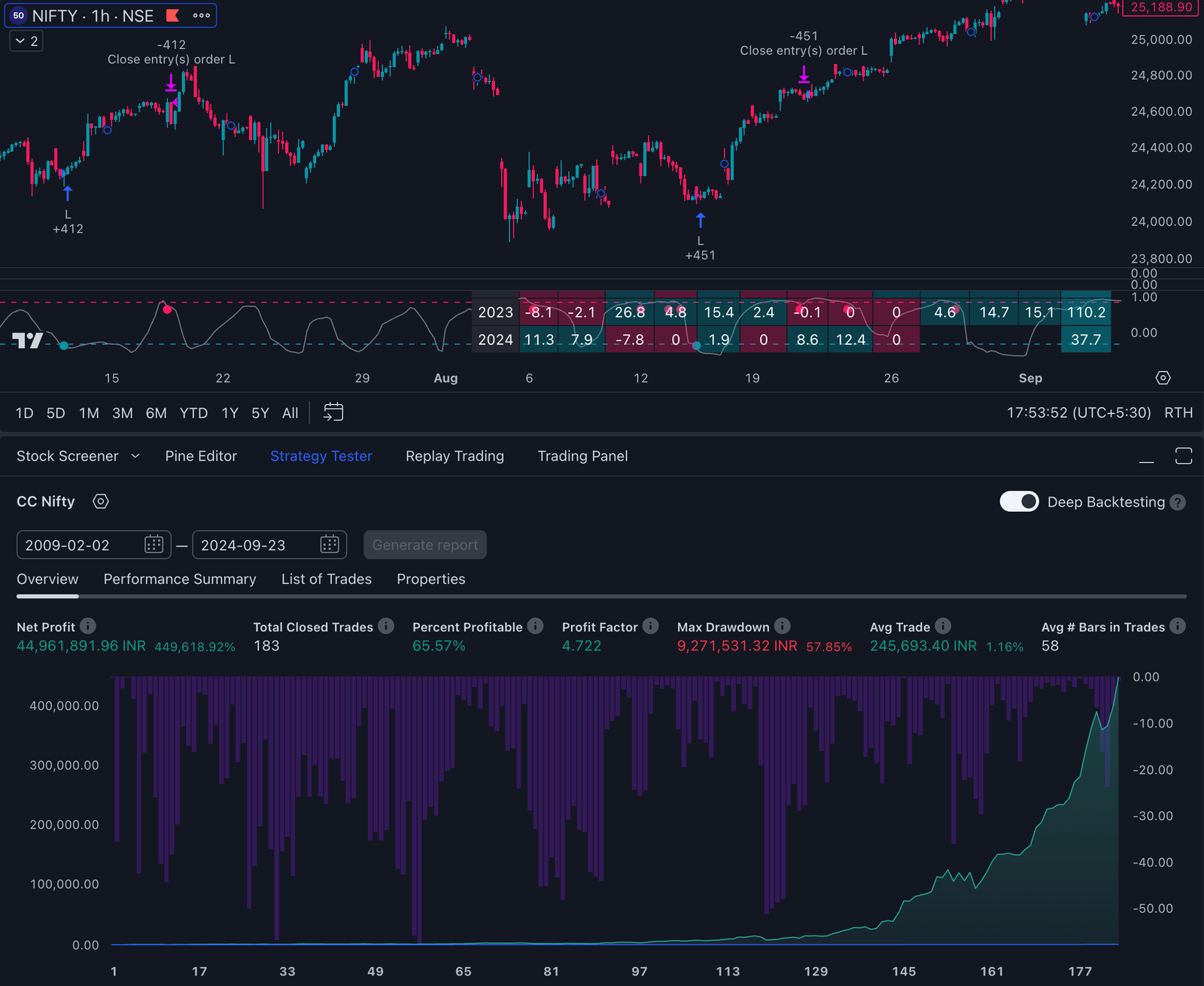

- Performance Monitoring: Regularly track the performance metrics of your trading strategies. Look at profit and loss statements, win/loss ratios, and other relevant indicators.

- Backtesting: Continuously backtest your strategies against historical data. This helps identify potential weaknesses and areas for improvement.

- Market Condition Analysis: Pay attention to changing market conditions. Economic events, geopolitical developments, and market sentiment can all impact the effectiveness of a strategy.

- Strategy Refinement: Use insights from ongoing evaluations to refine your strategies. Adjust parameters or incorporate new indicators as needed.

Example: If you notice that a strategy performs well in trending markets but poorly in sideways markets, consider integrating additional filters or complementary strategies to handle different market conditions.

Regular updates and refinements based on thorough analysis will help maintain the robustness of your automated trading system. This proactive approach ensures that your automated Pine Script strategies continue to deliver optimal results over time.

FAQs (Frequently Asked Questions)

What are automated Pine Script strategies and why are they significant in algorithmic trading?

Automated Pine Script strategies refer to trading strategies developed using Pine Script, a programming language designed for TradingView. These strategies automate the trading process, allowing traders to execute trades based on predefined rules without manual intervention. Their significance lies in enhancing efficiency, reducing human error, and enabling traders to capitalize on market opportunities quickly.

What is Pine Script and what features make it suitable for automated trading?

Pine Script is a domain-specific programming language created by TradingView for writing custom technical analysis indicators and strategies. Its key features include simplicity, ease of use, and the ability to integrate seamlessly with TradingView’s charting tools. These characteristics make it particularly suitable for developing automated trading strategies.

Why is education important for success in automated trading?

Having a solid understanding of financial markets and technical analysis concepts is crucial when working with automated trading strategies. While automation can enhance efficiency and speed, traders must possess the knowledge to effectively develop, manage, and refine their systems to adapt to changing market conditions.

How can I formulate a profitable trading strategy using Pine Script?

Formulating a profitable trading strategy involves defining clear trade execution rules that can be coded into Pine Script. This includes identifying entry and exit points based on specific criteria, risk management practices, and ensuring consistency in execution. The clarity of these rules is vital for maintaining objectivity in strategy implementation.

What role do technical indicators play in automated market analysis?

Technical indicators, such as MACD and RSI, are essential tools in algorithmic trading that help analyze market trends and potential price movements. They can be integrated into automated strategies using Pine Script to provide signals for trade entries or exits based on historical price data and statistical calculations.

What challenges might I face when managing automated trading systems?

Common challenges include emotional biases that may arise during periods of high market volatility and technical issues that could affect performance. Traders must be aware of these challenges and implement strategies to mitigate their impact, ensuring that the automated system continues to function effectively under varying market conditions.