Introduction

Understanding financial markets can be tricky, and having the right tools is essential for making smart decisions. Buy and sell indicators play a crucial role here, offering traders essential signals to either enter or exit trades based on the current market situation. These indicators look at price changes, trading volume, and other market information to provide useful insights.

TradingView is a top choice when it comes to using these indicators. It has a wide variety of buy and sell indicators designed for different trading methods. Whether you’re someone who trades daily looking for quick profits or someone who trades over weeks hoping for bigger gains, TradingView’s flexible tools can boost your trading results.

By using these tools, you can gain an advantage over others, making decisions based on data that fit your trading objectives.

Understanding Buy and Sell Indicators

What Are Buy and Sell Indicators?

Buy and sell indicators are tools used in technical analysis to find the best times to start or end trades. These tools look at different parts of market data, like price changes, trading volume, and past trends, to create signals for trading. They tell you exactly when to buy or sell an asset based on set rules.

How Do They Help in Market Analysis?

In market analysis, buy and sell indicators are important because they:

- Find Trends: They show you if the market is going up (bullish) or down (bearish).

- Show When to Trade: By identifying when prices are likely to go up or down, these tools help you make timely trade decisions.

- Manage Risk: Good indicators help you set stop-loss levels to reduce possible losses.

How Do They Create Trading Signals?

These indicators generate trading signals using complex algorithms that consider several factors:

- Price Movements: Looking at how asset prices change over time.

- Trading Volume: Checking how much of an asset is being traded to understand market strength.

- Speed of Price Change: Measuring how quickly asset prices are moving.

You can see these signals on TradingView charts as arrows, color changes, or background highlights. This makes it easier for traders in different markets like stocks, forex, crypto, and futures to make decisions.

Top 6 Buy and Sell Indicators on TradingView You Should Know About

1. Buy Sell Indicator by FriendOfTheTrend

Overview of the Indicator’s Functionality

The Buy Sell Indicator by FriendOfTheTrend is a widely recognized tool on TradingView, prized for its ability to simplify trading decisions through clear visual signals. This indicator relies on price action calculations to assess the market’s bullish or bearish nature. It generates buy and sell signals using green and red arrows, making it straightforward for traders to interpret market conditions.

Different Modes for Various Trading Styles

This indicator caters to different trading preferences with its various modes:

- Scalp Mode: Ideal for short-term traders looking to capitalize on quick price movements.

- Swing Mode: Suitable for those who prefer holding positions for several days to capture larger price swings.

- Long Swing Mode: Designed for long-term traders aiming to exploit significant trends over extended periods.

Each mode adjusts its sensitivity to market fluctuations, allowing traders to align the indicator with their specific strategies.

Features like Automatic Trailing Stop Losses and Customizable Take Profit Levels

The Buy Sell Indicator by FriendOfTheTrend offers several advanced features that enhance trading efficiency:

- Automatic Trailing Stop Losses: Helps manage risk by automatically adjusting stop losses as the trade moves in favor.

- Customizable Take Profit Levels: Allows traders to set predefined profit targets, ensuring disciplined exits.

- Volatility Filters: Prevents signals during low volatility periods, reducing the chances of false alarms.

These features make this indicator versatile, applicable across various asset classes such as stocks, crypto, forex, and futures. By integrating these functionalities, the Buy Sell Indicator by FriendOfTheTrend equips you with robust tools for precise trading execution.

2. Ultimate Buy and Sell Indicator by Sherlock_MacGyver

The Ultimate Buy and Sell Indicator by Sherlock_MacGyver is a robust tool that merges the power of RSI (Relative Strength Index) with Bollinger Bands to generate accurate buy and sell signals.

Key Features and Benefits:

RSI and Bollinger Bands Combination:

By integrating RSI, which measures the speed and change of price movements, with Bollinger Bands that provide a relative definition of high and low prices, this indicator offers a comprehensive view of market conditions. This dual approach helps in identifying overbought or oversold conditions for initiating trades.

Customizable Options:

Designed to cater to advanced traders, it provides a variety of customization options. You can adjust the RSI period, Bollinger Band settings, and other parameters to match your trading style. Whether you’re using Scalp Mode for quick trades or Swing Mode for longer holds, this indicator can be tailored to suit your needs.

Alerts and Background Color Changes:

One of its standout features is the ability to set alerts for imminent buy/sell signals. The indicator also changes the background color based on market states, making it easier to visualize trading opportunities at a glance. This visual aid significantly enhances decision-making processes.

Divergence Detection:

It includes divergence detection between price movements and RSI levels, allowing you to spot potential reversals early. This feature can be particularly useful in volatile markets where rapid changes occur frequently.

Using the Ultimate Buy and Sell Indicator on TradingView, you gain access to a powerful toolset designed to enhance your trading decisions through comprehensive market analysis.

3. Ichimoku Kumo Cloud Crossover Indicator

The Ichimoku Kumo Cloud Crossover Indicator is one of the top buy and sell indicators on TradingView. It uses a combination of Ichimoku Cloud analysis and MACD (Moving Average Convergence Divergence) to give traders clear signals for buying and selling based on the direction of the trend.

Key Features:

Ichimoku Cloud Analysis:

The Ichimoku Cloud, also known as Kumo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals.

It consists of five main components:

- Tenkan-sen (conversion line)

- Kijun-sen (base line)

- Senkou Span A (leading span A)

- Senkou Span B (leading span B)

- Chikou Span (lagging span)

When the price is above the cloud, it indicates an uptrend; below the cloud suggests a downtrend. The cloud itself represents future support and resistance levels.

MACD Integration:

MACD is used alongside the Ichimoku Cloud to enhance signal accuracy. By analyzing the relationship between two moving averages of a security’s price, MACD helps in identifying potential buy/sell opportunities.

When the MACD line crosses above the signal line, it generates a bullish signal; conversely, when it crosses below, it generates a bearish signal.

Benefits:

- Trend Direction Identification: The combination of Ichimoku Cloud and MACD provides a dual-layered analysis for trend direction. This integration helps traders stay aligned with major market trends while making informed decisions.

- Enhanced Signal Accuracy: Utilizing both indicators together reduces false signals, offering more reliable entry and exit points.

- Applicability Across Markets: Suitable for various asset classes including stocks, crypto, forex, and futures. Traders can apply this indicator across different markets to identify strong trading opportunities.

By integrating the strengths of Ichimoku Cloud and MACD, this indicator offers robust tools for traders looking to capitalize on market trends with precision.

4. VWAP + 2 Moving Averages + RSI Indicator

The VWAP + 2 Moving Averages + RSI Indicator is a powerful tool on TradingView that combines several key technical analysis elements to provide clear buy and sell signals. This indicator integrates the Volume Weighted Average Price (VWAP), two moving averages, and the Relative Strength Index (RSI) to help traders identify potential entry points with precision.

Understanding the Components

Volume Weighted Average Price (VWAP)

Volume Weighted Average Price (VWAP) is a trading benchmark that calculates the average price weighted by volume. It provides insights into the true average price of an asset throughout the day, offering a more nuanced perspective than simple moving averages.

Moving Averages

By combining the VWAP with two moving averages, this indicator adds layers of trend-following analysis:

- Short-term Moving Average: Quick to respond to recent price movements.

- Long-term Moving Average: Smoother and slower to react, providing a broader view of the market trend.

Relative Strength Index (RSI)

Including the Relative Strength Index (RSI) enhances this setup by measuring the speed and change of price movements. RSI helps in identifying overbought or oversold conditions, which are crucial for timing market entries and exits.

Key Features

- Buy/Sell Arrows: The indicator generates visual buy/sell arrows on the chart, making it easy to spot potential trades.

- Entry Points Identification: By integrating VWAP and moving averages with RSI, it helps pinpoint precise entry points.

- Scalp Mode & Swing Mode: Customizable settings allow for adaptation to different trading styles, whether you are a scalper looking for quick gains or a swing trader focusing on longer trends.

- Versatility Across Markets: Suitable for stocks, forex, crypto, and futures trading.

Understanding how these components work together provides an edge in analyzing market trends. Using this combination of indicators can help you make informed decisions based on comprehensive market data while reducing the risk of false signals.

5. Parabolic SAR + EMA200 + MACD Signals Indicator

The Parabolic SAR + EMA200 + MACD Signals Indicator is designed to signal trend reversals with high precision. It integrates three powerful tools: Parabolic SAR (Stop and Reverse), EMA200 (Exponential Moving Average), and MACD (Moving Average Convergence Divergence).

How It Works

- Parabolic SAR: This component helps identify potential stop and reversal points in the market. It places dots above or below price bars to indicate the direction of a trend, assisting traders in setting stop-loss levels.

- EMA200: The EMA200 is a long-term moving average that smooths out price action to highlight the overall market trend. Using this indicator helps traders stay aligned with the dominant trend by filtering out noise from short-term fluctuations.

- MACD: As a momentum indicator, MACD measures the difference between two moving averages (usually 12-day and 26-day) and plots this as a histogram. The crossovers of the MACD line and its signal line (a 9-day EMA of the MACD) provide buy/sell signals.

Why Use This Combination?

Combining these three indicators enhances their strengths while compensating for their individual weaknesses. For instance, when the Parabolic SAR dots shift from above to below the price bars, aligning with an upward crossover of MACD over its signal line, it confirms a bullish trend reversal. Conversely, dots moving above the price bars along with a downward crossover of MACD signals a bearish reversal.

Example Scenarios

Illustrative Examples: A trader using this indicator might observe that during a strong uptrend, the EMA200 acts as dynamic support. When Parabolic SAR dots appear below price bars after touching EMA200, coupled with an upward MACD crossover, it signifies a robust buy signal. Conversely, in downtrends, if prices rally towards EMA200 but fail to break through, followed by Parabolic SAR dots appearing above price bars and a downward MACD crossover, it indicates a sell signal.

This combined approach provides clarity in decision-making by highlighting high-probability trade setups based on comprehensive analysis.

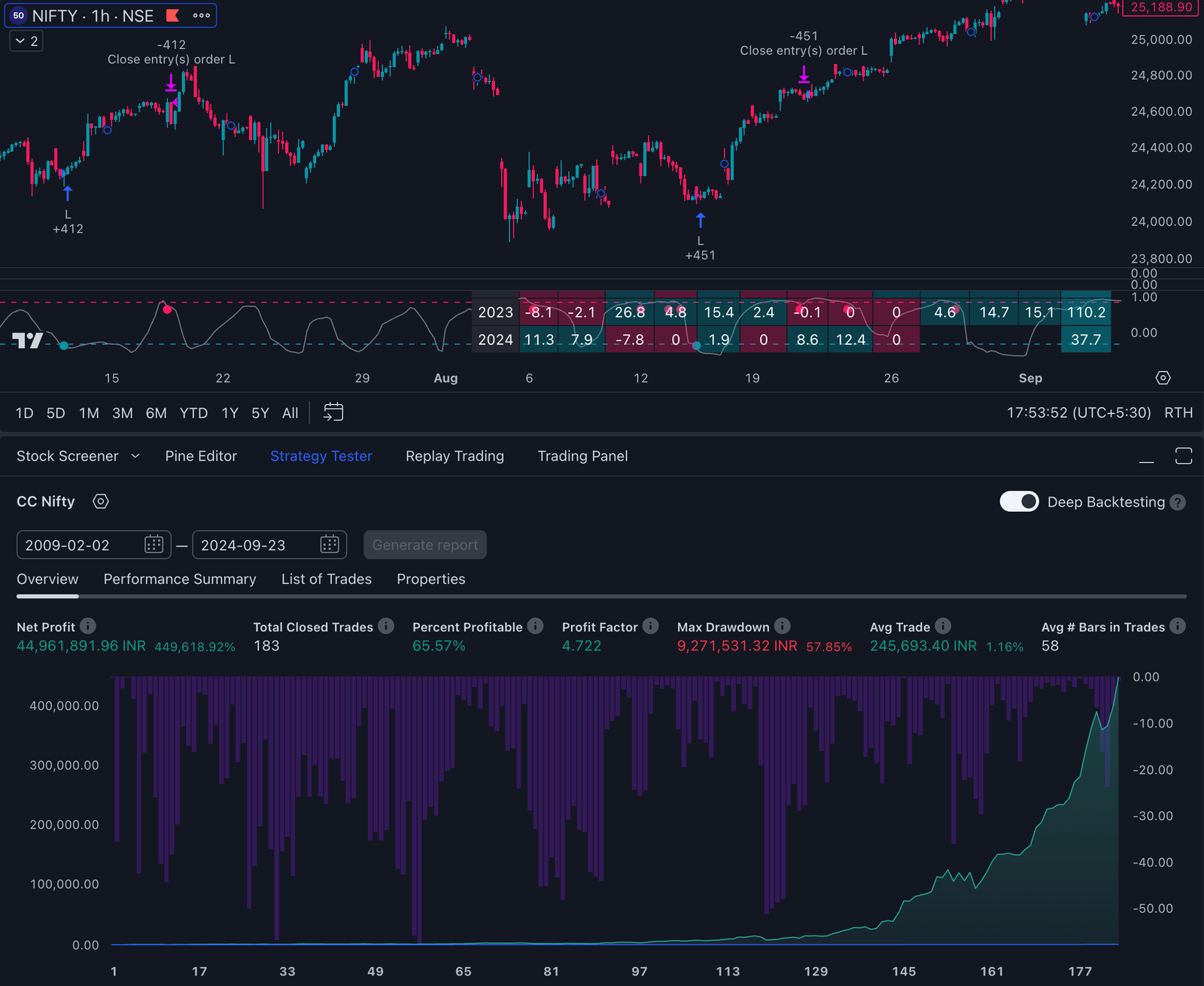

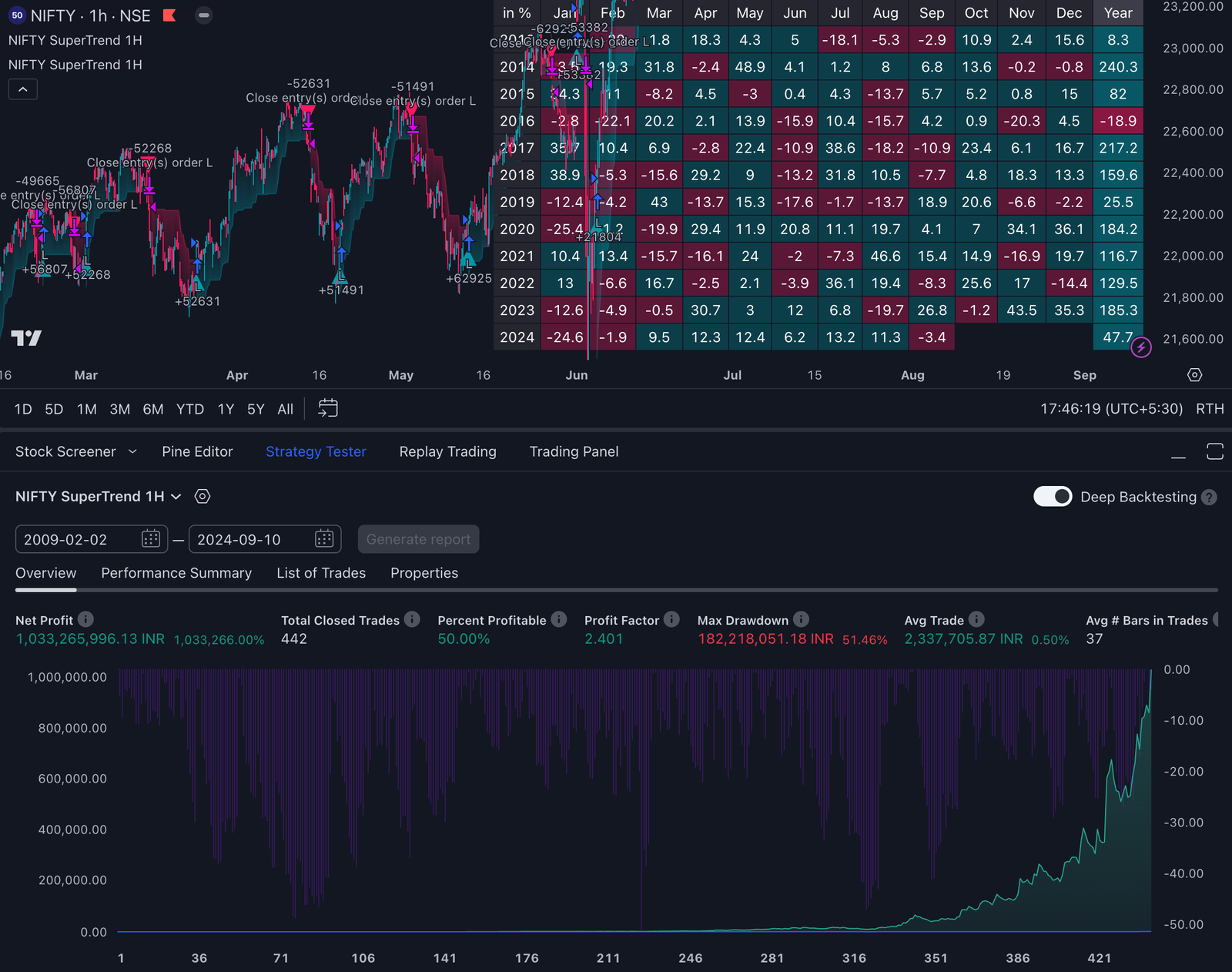

6. Buy Sell Calendar Wizard

The Buy Sell Calendar Wizard is a unique tool among buy and sell indicators on TradingView. This indicator uses a sentiment calendar to find buy and sell opportunities, offering a different way to analyze the market.

Sentiment Calendar Tool

The sentiment calendar is the main feature of this indicator. It systematically tracks market sentiments and highlights potential trading opportunities based on historical price action and market trends. By mapping out these sentiments over time, traders can gain insights into the probable direction of asset prices.

Analytical Methods

This indicator uses various analytical methods to improve signal accuracy:

- Trend Analysis: Identifies the prevailing trend in the market, helping traders align their strategies with broader market movements.

- Volatility Filters: Screens out signals during low volatility periods, ensuring that only high-probability trades are considered.

- Historical Data Integration: Utilizes past price data to forecast future movements, providing a context-rich trading environment.

These combined techniques enable traders to make more informed decisions, reducing the risk associated with trading in volatile markets.

Key Features

- Visual Signals: Clear visual cues on the chart indicate strong buy or sell signals.

- Customizable Alerts: Traders can set personalized alerts for significant calendar events or sentiment shifts.

- User-Friendly Interface: Easy-to-navigate interface makes it accessible even for novice traders.

Whether you’re a day trader in Scalp Mode or a long-term investor using Swing Mode, the Buy Sell Calendar Wizard offers versatile functionality tailored to different trading styles. This makes it a valuable addition to your TradingView toolkit.

Customizing Indicators for Personalized Trading Strategies on TradingView

Personalized trading strategies can significantly enhance your trading performance. Customizing buy and sell indicators on TradingView allows you to tailor these tools to fit your specific trading style and risk tolerance.

Key Benefits of Customization:

- Adaptability: Modify parameters to suit different market conditions, whether you’re dealing with high volatility or stable trends.

- Flexibility: Adjust settings such as time frames, sensitivity levels, and alert types to better match your trading strategy.

- Precision: Fine-tune entry and exit points to optimize profit potential and minimize risk.

For example:

1. Trading Styles: Scalping vs. Swing Trading

Scalpers may prefer shorter time frames and higher sensitivity in indicators like the Buy Sell Indicator by FriendOfTheTrend.

Swing traders might opt for longer time frames and less frequent signals, utilizing the Ultimate Buy and Sell Indicator by Sherlock_MacGyver.

2. Risk Management: Trailing Stops and Take Profit Levels

Customize automatic trailing stop losses and set take profit levels according to your comfort with risk.

3. Signal Filters: Avoid False Signals

Use filters to prevent signals during low volatility periods, ensuring more reliable trade entries.

TradingView’s extensive customization options empower you to create a trading system that aligns perfectly with your goals.

Conclusion: Maximizing Profits with Effective Trading Tools on TradingView

Exploring various buy and sell indicators on TradingView can significantly enhance your trading decisions. These tools are designed to help you make informed choices by analyzing market conditions and generating actionable signals. By keeping your risk tolerance levels in mind, you can tailor these indicators to align with your trading strategy.

Here are some key steps to effectively use these tools:

- Test different indicators: Experiment with multiple buy and sell indicators to find the ones that best suit your trading style.

- Customize settings: Adjust the parameters of each indicator to match your risk tolerance and market conditions.

- Stay informed: Regularly review the performance of your chosen indicators to ensure they continue to meet your trading needs.

Effective trading tools can make a significant difference in your trading outcomes. Using TradingView’s comprehensive suite of indicators, you have the potential to maximize profits and achieve greater success in the markets.

FAQs (Frequently Asked Questions)

What are buy and sell indicators?

Buy and sell indicators are tools used in trading to analyze market conditions and generate trading signals. They help traders determine the best times to enter or exit positions based on market trends and price action.

Why are buy and sell indicators important in trading?

These indicators play a crucial role in market analysis by providing traders with insights into potential price movements. They help in making informed decisions, improving the chances of successful trades, and managing risk effectively.

What is TradingView?

TradingView is a popular platform for traders that offers advanced charting tools, social networking features, and a wide range of buy and sell indicators. It allows users to implement various trading strategies and share insights with other traders.

Can you name some top buy and sell indicators available on TradingView?

Yes! Some top buy and sell indicators on TradingView include: 1) Buy Sell Indicator by FriendOfTheTrend, 2) Ultimate Buy and Sell Indicator by Sherlock_MacGyver, 3) Ichimoku Kumo Cloud Crossover Indicator, 4) VWAP + 2 Moving Averages + RSI Indicator, 5) Parabolic SAR + EMA200 + MACD Signals Indicator, and 6) Buy Sell Calendar Wizard.

How can I customize buy and sell indicators on TradingView?

Customizing indicators according to individual preferences is essential for enhancing their effectiveness. Traders can adjust settings such as sensitivity, time frames, or specific parameters to align the indicators with their unique trading strategies and market conditions.

What should I consider when choosing buy and sell indicators?

When choosing buy and sell indicators, consider factors such as your trading style (scalping or swing trading), risk tolerance levels, the specific markets you trade in, and how well the indicator’s features align with your overall trading strategy.