Introduction

The MACD Pine Script strategy uses the Moving Average Convergence Divergence (MACD) indicator, a popular tool for identifying trends and momentum in trading. The MACD helps traders spot potential buy and sell signals by comparing two moving averages.

Pine Script, TradingView’s built-in scripting language, lets traders create their own trading strategies. By writing code for specific entry and exit conditions, you can automate and test your trading methods to make better decisions.

In this article, we’ll explore the MACD Pine Script strategy, including its components, how to implement it, and its benefits. Whether you’re a day trader or swing trader, this guide aims to provide valuable insights to refine your trading techniques.

Understanding the MACD Indicator

The Moving Average Convergence Divergence (MACD) indicator is a widely used tool in trading that follows trends and measures momentum. It helps traders identify changes in the strength, direction, momentum, and duration of a trend.

Components of MACD

- MACD Line

- Calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.

- Represents the convergence or divergence between the two EMAs.

- Signal Line

- A 9-period EMA of the MACD line.

- Used to generate buy or sell signals through crossovers with the MACD line.

- Histogram

- Illustrates the difference between the MACD line and the Signal line.

- Positive values indicate upward momentum while negative values suggest downward momentum.

Interpreting MACD Signals

- Bullish Crossover: Occurs when the MACD line crosses above the Signal line, suggesting a potential upwards price movement.

- Bearish Crossover: Happens when the MACD line crosses below the Signal line, indicating possible downwards price action.

- Histogram Analysis: Increasing positive values imply strengthening bullish momentum, whereas growing negative values depict intensifying bearish pressure.

Understanding these signals aids in making informed decisions for trade entries and exits. The MACD indicator’s ability to signal potential price movements through crossover points of moving averages makes it an invaluable tool for traders seeking to capitalize on market trends.

Building a MACD Pine Script Trading Strategy

1. Defining Entry Conditions

Long Entry Signal

To enter a long position, you look for a bullish crossover of the Exponential Moving Averages (EMAs). Specifically, this occurs when the 12-period EMA crosses above the 26-period EMA. This crossover indicates that recent prices are trending upward more significantly than older prices.

Criteria:

- 12-period EMA must cross above the 26-period EMA.

- The MACD line should be above the signal line, confirming upward momentum.

Short Entry Signal

For short positions, you need a bearish crossover of the EMAs. This happens when the 12-period EMA crosses below the 26-period EMA, indicating that recent prices are trending downward.

Criteria:

- 12-period EMA must cross below the 26-period EMA.

- The MACD line should be below the signal line, confirming downward momentum.

By combining these criteria with your MACD Pine Script strategy, you can generate more reliable trading signals across various markets.

2. Establishing Exit Strategies

Setting effective exit strategies is crucial for the success of the MACD Pine Script strategy. This involves determining stop loss levels and target profit objectives for both long and short trades.

Stop Loss Levels:

- Long Trades: A common approach is to set the stop loss just below the recent swing low or a predefined percentage below the entry point. This protects against significant downward movements. Implementing effective swing trading strategies can further enhance your trade management.

- Short Trades: Set the stop loss just above the recent swing high or a predefined percentage above the entry point. This helps to mitigate risk if the price moves against your position.

Target Profit Objectives:

- Long Trades: Define a target profit level based on key resistance levels, Fibonacci retracement levels, or a fixed reward-to-risk ratio (e.g., 2:1). Monitoring MACD signals can also help determine when to exit.

- Short Trades: Target profit can be set at key support levels, Fibonacci extensions, or using a fixed reward-to-risk ratio. Keep an eye on MACD signals for potential early exits.

Combining these elements with technical analysis tools and market structure insights provides a robust framework for managing trades effectively. By adhering to these guidelines, you enhance your ability to protect capital while maximizing potential returns within your MACD Pine Script strategy.

Implementing the Strategy in TradingView with Pine Script Code Examples

To implement the MACD Pine Script strategy in TradingView, follow this step-by-step guide. This will help you to code a basic version of the strategy using TradingView’s Pine Editor.

1. Open Pine Editor

Access the Pine Editor by navigating to TradingView, opening any chart, and selecting “Pine Editor” at the bottom of the screen.

2. Define the Study and Inputs

Begin by defining your study and input parameters. This includes setting default values for fast and slow EMAs:

pine //@version=4 study(“MACD Strategy Example”, shorttitle=”MACD_Strategy”, overlay=true) fastLength = input(12, title=”Fast EMA Length”) slowLength = input(26, title=”Slow EMA Length”) signalSmoothing = input(9, title=”Signal Smoothing”)

3. Calculate EMAs and MACD Components

Calculate the necessary components of the MACD indicator:

pine fastMA = ema(close, fastLength) slowMA = ema(close, slowLength) macdLine = fastMA – slowMA signalLine = sma(macdLine, signalSmoothing) histLine = macdLine – signalLine

4. Define Entry Conditions

Set your conditions for entering long and short positions based on EMA crossovers confirmed by the MACD indicator:

pine longCondition = crossover(macdLine, signalLine) and crossover(fastMA, slowMA) shortCondition = crossunder(macdLine, signalLine) and crossunder(fastMA, slowMA)

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text=”BUY”) plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text=”SELL”)

5. Establish Exit Strategies

Define your exit conditions using stop loss levels or when the EMA crosses back:

pine longExitCondition = crossunder(macdLine, signalLine) or crossunder(fastMA, slowMA) shortExitCondition = crossover(macdLine, signalLine) or crossover(fastMA, slowMA)

plotshape(series=longExitCondition, location=location.abovebar, color=color.blue, style=shape.labeldown,text=”EXIT LONG”) plotshape(series=shortExitCondition , location=location.belowbar , color=color.orange , style=shape.labelup , text=”EXIT SHORT”)

6. Visualizing on Chart

Use plot functions to visualize MACD components directly on your chart:

pine plot(macdLine,color=color.blue ) plot(signalLine,color=color.red ) hline(0)

// Histogram plot(histLine,color=color.gray , style=plot.style_histogram)

7. Complete Script

Combine all sections into a complete script:

pine //@version=4 study(“MACD Strategy Example”, shorttitle=”MACD_Strategy”, overlay=true)

// Input Parameters fastLength = input(12,title=”Fast EMA Length”) slowLength

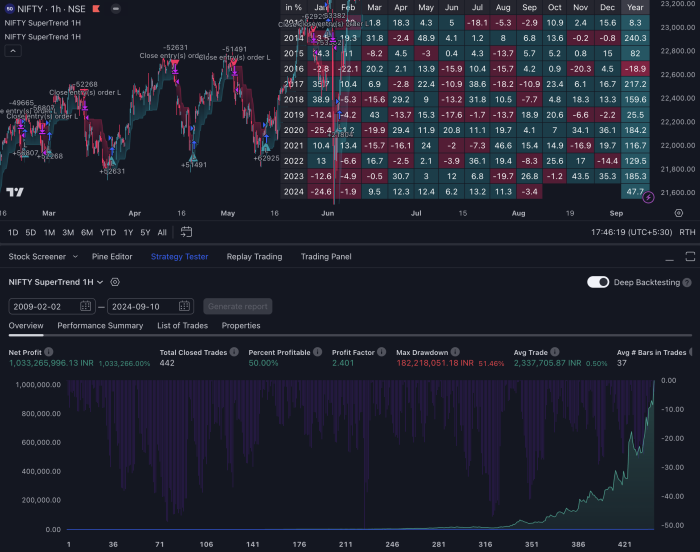

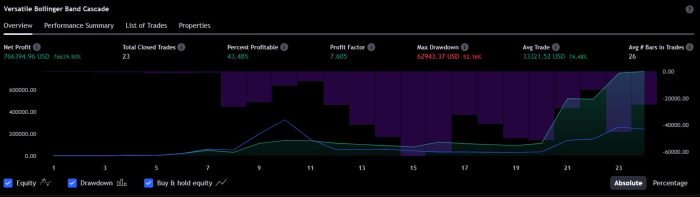

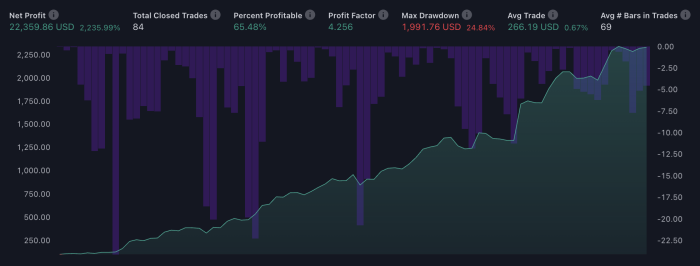

Backtesting and Optimizing the Strategy for Better Performance Results in TradingView’s Strategy Tester Tool

Thorough backtesting is essential before deploying any trading strategy live. It ensures the strategy’s viability across different market conditions. The MACD Pine Script strategy is no exception. Testing your strategy on historical data allows you to evaluate how it would have performed and identify potential improvements.

Using TradingView’s Strategy Tester Tool

TradingView provides a built-in Strategy Tester tool that facilitates performance evaluation. Here’s a step-by-step guide to using this tool effectively:

- Load Your Script: Begin by loading your MACD Pine Script strategy into TradingView’s Pine Editor.

- Apply to Chart: Apply the script to your desired chart and time frame.

- Access Strategy Tester: Click on the ‘Strategy Tester’ tab at the bottom of the chart.

For more detailed instructions, you can refer to this comprehensive guide on backtesting strategies with TradingView.

Key Performance Metrics

The Strategy Tester tool evaluates several key performance metrics:

- Profitability: Measures the overall profit or loss generated by your strategy over the tested period.

- Drawdown Levels: Indicates the maximum observed loss from a peak to a trough during the backtesting period.

- Win Rate Percentage: The ratio of winning trades to total trades, providing insight into the strategy’s reliability.

For instance, if your MACD Pine Script shows a high win rate but significant drawdowns, you may need to refine your stop-loss levels or entry criteria.

To gain deeper insights into your strategy’s performance, it’s crucial to understand how to interpret strategy performance reports.

Tips for Effective Backtesting

- Use Multiple Time Frames: Test your strategy on various time frames to ensure its robustness.

- Adjust Parameters: Experiment with different MACD settings (e.g., Fast Length, Slow Length) and observe how changes affect performance.

- Simulate Different Market Conditions: Backtest across various market phases—bullish, bearish, and sideways—to gauge consistency.

Backtesting is not just about validating your current setup; it’s an iterative process. Continuous optimization based on backtest results can significantly enhance your strategy’s performance and reliability in live trading environments. Remember, understanding charts in the strategy tester can provide valuable insights during this process.

Enhancing Automation Capabilities with PineConnector Tool Integration for Seamless Trade Execution Across Multiple Platforms like MT4/MT5 etc.

Automated trading has changed the way traders execute their strategies. PineConnector is a powerful tool designed to connect TradingView with third-party platforms such as MT4/MT5, enabling smooth trade execution.

What PineConnector Does:

- Automates Trade Execution: PineConnector ensures that trades triggered by your coded strategy in TradingView are automatically executed on your chosen platform.

- Real-Time Alerts and Actions: Upon receiving an alert from TradingView, PineConnector translates it into executable commands for MT4/MT5.

- Cross-Platform Compatibility: It supports multiple trading platforms, making it versatile for various trading environments.

- Streamlined Workflow: This tool eliminates manual intervention, reducing the likelihood of human error and allowing you to focus on strategy optimization.

By integrating PineConnector with your MACD Pine Script strategy, you can enhance your trading efficiency and accuracy across different markets and instruments.

Exploring Different Market Applications and Trading Styles for the MACD Pine Script Strategy

The MACD Pine Script strategy can be used in a wide range of financial markets, making it highly flexible. Whether you’re trading forex pairs, stocks, commodities, futures contracts, or cryptocurrencies, this strategy provides strong signals for potential trade entries and exits.

Market Applications

Forex Pairs

The strategy works effectively with major and minor currency pairs, providing reliable signals during high volatility periods.

Stocks

Apply the strategy to individual stocks or indices to capture trends and momentum shifts.

Commodities

Use it to trade gold, silver, oil, and other commodities by identifying key crossover points.

Futures Contracts

Implement the strategy in futures markets to benefit from leveraged positions and hedging opportunities.

Cryptocurrencies

Given the high volatility in crypto markets, the MACD Pine Script strategy can help identify significant price movements.

Trading Styles

Day Trading

For traders who prefer shorter holding periods, this strategy can generate quick entry and exit signals based on intraday market movements.

Swing Trading

If you favor holding positions over several days or weeks, the MACD indicator’s ability to detect longer-term trends provides valuable insights for timing your trades.

This flexibility makes the MACD Pine Script strategy an invaluable tool for traders with different preferences in terms of market selection and trading style.

Conclusion

The MACD Pine script strategy offers a structured approach to trading by leveraging the Moving Average Convergence Divergence indicator. Its main benefits include:

- Clear Entry and Exit Signals: Based on EMA crossovers, providing straightforward trade execution.

- Versatility: Applicable across various markets such as forex, stocks, futures, and cryptocurrencies.

- Customizability: Parameters like fast length and slow length can be adjusted to fit different trading styles.

- Automation: Integration with tools like PineConnector for seamless trade execution.

However, this strategy is not without its challenges. Its effectiveness largely depends on market conditions, requiring thorough backtesting to ensure reliability. Traders are encouraged to explore additional strategies and continuously refine their approach.

By understanding the pros and cons of the MACD Pine script strategy, you can better navigate your personal trading journey and make informed decisions. Dive deeper into this area of study to uncover more advanced techniques and tools that complement your trading style.

FAQs (Frequently Asked Questions)

What is the MACD indicator and why is it significant in trading?

The Moving Average Convergence Divergence (MACD) indicator is a trend-following momentum tool that helps traders identify potential buy and sell signals. Its significance lies in its ability to provide insights into market trends through its three main components: the MACD line, signal line, and histogram.

How does Pine Script contribute to developing trading strategies?

Pine Script is a domain-specific language used in TradingView that allows traders to create custom technical indicators and trading strategies. It facilitates the automation of trading decisions based on predefined criteria, enabling users to implement and backtest their strategies effectively.

What are the entry conditions for long and short positions in a MACD Pine Script strategy?

For long positions, traders typically look for bullish EMA crossover signals confirmed by the MACD indicator. Conversely, for short positions, bearish EMA crossover signals confirmed by the MACD serve as the criteria for entry.

How can I establish exit strategies using the MACD Pine Script strategy?

Exit strategies can be established by setting stop loss levels and target profit objectives based on technical analysis tools and market structure analysis. This ensures that both long and short trades are managed effectively to maximize profitability while minimizing risk.

What is backtesting, and why is it important for a trading strategy?

Backtesting involves testing a trading strategy against historical data to evaluate its performance before deploying it live. It is crucial because it helps traders understand how their strategy would have performed under various market conditions, allowing them to refine their approach for better results.

Can the MACD Pine Script strategy be applied across different trading styles?

Yes, the MACD Pine Script strategy can be effectively utilized across various financial instruments and is adaptable to different trading styles such as day trading or swing trading. This versatility makes it suitable for diverse market applications including forex pairs, stocks, commodities, futures contracts, and cryptocurrencies.