CYBER WEEK -70%

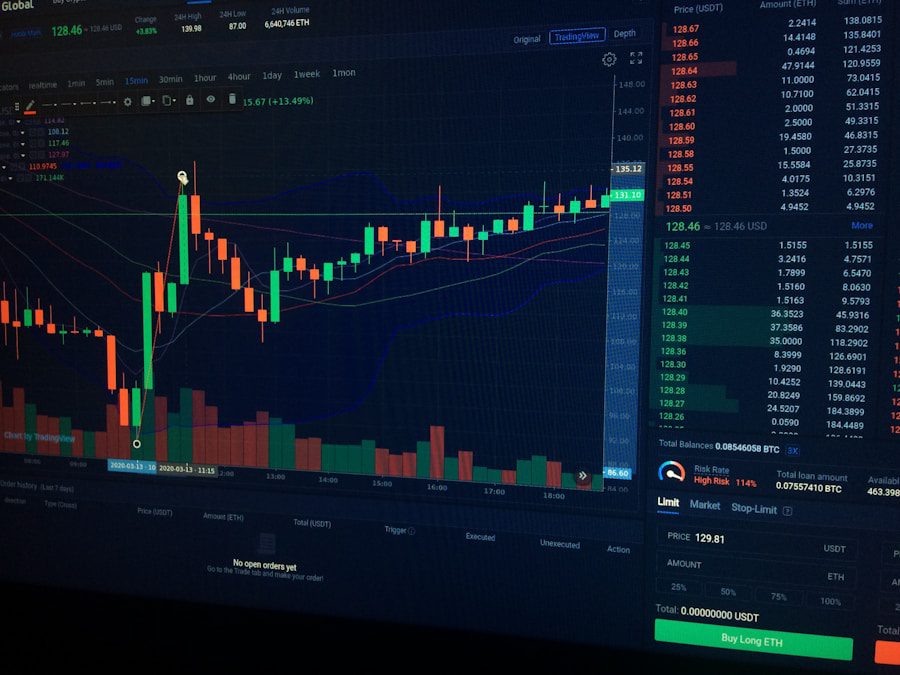

TradingView signals are a powerful tool for traders and investors, providing real-time alerts and insights based on market data. These signals can be generated from various technical indicators, price movements, and chart patterns, allowing users to make informed decisions in their trading strategies. The platform offers a wide array of indicators, including moving averages, Relative Strength Index (RSI), Bollinger Bands, and more, which can be customized to suit individual trading styles.

By understanding how these signals work, traders can better navigate the complexities of the financial markets. The essence of TradingView signals lies in their ability to distill vast amounts of market data into actionable insights. For instance, a trader might set up a signal to alert them when a stock’s price crosses above its 50-day moving average, indicating a potential bullish trend.

Conversely, a signal might notify them when the price falls below a certain threshold, suggesting a bearish outlook.

This capability to automate alerts based on specific criteria allows traders to focus on strategy development and execution rather than constantly monitoring charts.

Setting up TradingView signals is a straightforward process that can significantly enhance a trader’s efficiency. To begin, users must create an account on TradingView and familiarize themselves with the platform’s interface. Once logged in, traders can access the charting tools and select the asset they wish to analyze.

From there, they can choose from a variety of indicators available in the platform’s extensive library. For example, if a trader is interested in using the MACD (Moving Average Convergence Divergence) indicator, they can easily add it to their chart with just a few clicks. After selecting the desired indicators, traders can customize their settings to align with their trading strategies.

This customization may involve adjusting parameters such as the period for moving averages or the sensitivity of oscillators like RSI. Once the indicators are configured, traders can set up alerts based on specific conditions. For instance, they might create an alert that triggers when the MACD line crosses above the signal line, indicating a potential buy opportunity.

By taking these steps, traders can ensure that they receive timely notifications that align with their trading goals.

TradingView signals play a crucial role in determining optimal entry and exit points in trading. By analyzing the signals generated by various indicators, traders can identify favorable conditions for entering or exiting positions. For example, if a trader receives a signal indicating that the RSI has crossed above 70, it may suggest that the asset is overbought and could be due for a price correction.

This information can prompt the trader to consider selling their position or tightening their stop-loss orders to protect profits. Conversely, signals indicating bullish momentum can provide valuable insights for entry points. If a trader observes that the price has broken above a significant resistance level accompanied by high trading volume, this could signal a strong upward trend.

In such cases, traders may choose to enter long positions, capitalizing on the momentum while setting appropriate stop-loss levels to manage risk. The ability to use TradingView signals effectively for entry and exit points can significantly enhance a trader’s overall performance and profitability.

| Metrics | Results |

|---|---|

| Number of Signals | 50 |

| Success Rate | 75% |

| Average Profit per Trade | 3% |

| Maximum Drawdown | 5% |

To maximize profits using TradingView signals, traders must adopt a disciplined approach that combines technical analysis with sound risk management practices. One effective strategy is to use multiple indicators in conjunction with one another to confirm signals before making trading decisions. For instance, if both the MACD and RSI indicate bullish momentum simultaneously, this confluence of signals can provide greater confidence in entering a long position.

By waiting for confirmation from multiple sources, traders can reduce the likelihood of false signals and improve their chances of success. Additionally, traders should consider incorporating profit targets and trailing stops into their strategies when utilizing TradingView signals. Setting profit targets based on key resistance levels or Fibonacci retracement levels can help traders lock in gains as prices move in their favor.

Trailing stops allow traders to capture profits while still giving their positions room to grow. For example, if a trader enters a long position based on a bullish signal and sets a trailing stop at 5%, they can continue to benefit from upward price movements while protecting against sudden reversals.

Effective risk management is paramount in trading, and TradingView signals can assist traders in implementing robust risk management strategies. One fundamental principle is to determine position sizes based on risk tolerance and account size. Traders can use signals to identify stop-loss levels that align with their risk management rules.

For instance, if a signal indicates an entry point for a long position at $50 with a stop-loss set at $48, the trader can calculate their position size based on the difference between these two levels and their overall risk tolerance. Moreover, traders should regularly review and adjust their risk management strategies based on market conditions and performance metrics. If certain signals consistently lead to losses or underperformance, it may be necessary to reassess the indicators being used or modify the parameters of existing signals.

By maintaining flexibility and adapting to changing market dynamics, traders can better manage risk and protect their capital over time.

Customization is one of the standout features of TradingView signals that allows traders to tailor alerts according to their unique trading strategies. Each trader has different preferences regarding timeframes, indicators, and market conditions; thus, customizing signals is essential for aligning them with individual goals. For example, day traders may prefer shorter timeframes and more sensitive indicators like stochastic oscillators or short-term moving averages, while swing traders might opt for longer-term indicators such as the 200-day moving average.

In addition to adjusting indicator settings, traders can also create custom scripts using TradingView’s Pine Script language. This feature enables users to develop unique indicators or alerts that cater specifically to their trading methodologies. For instance, a trader might write a script that combines multiple conditions—such as price action patterns and volume spikes—to generate alerts only when all criteria are met.

This level of customization empowers traders to refine their strategies further and enhance their decision-making processes.

While TradingView signals are powerful on their own, leveraging additional tools within the platform can further enhance trading effectiveness. One such tool is the social aspect of TradingView, where traders can share ideas and insights with others in the community. By following experienced traders or engaging in discussions about specific signals or market trends, users can gain valuable perspectives that may inform their own trading decisions.

Furthermore, TradingView offers features like backtesting and paper trading that allow users to test their strategies without risking real capital. By simulating trades based on historical data using specific signals, traders can evaluate the effectiveness of their strategies before implementing them in live markets. This practice not only builds confidence but also helps identify potential weaknesses in trading plans that need addressing.

To use TradingView signals effectively, traders should adopt several best practices that enhance their overall trading experience. First and foremost is the importance of maintaining discipline; sticking to predetermined entry and exit points based on signals helps prevent emotional decision-making during volatile market conditions. Traders should also keep a trading journal documenting their trades based on signals—this practice allows for reflection on what worked well and what didn’t.

Another critical tip is to stay informed about broader market trends and news events that could impact asset prices. While technical signals provide valuable insights, external factors such as economic reports or geopolitical developments can significantly influence market behavior. By combining technical analysis from TradingView with fundamental analysis of relevant news events, traders can make more informed decisions that account for both technical indicators and market sentiment.

In conclusion, mastering TradingView signals requires an understanding of how they function within the broader context of trading strategies. By setting up alerts effectively, utilizing them for entry and exit points, managing risk prudently, customizing indicators to fit personal styles, leveraging additional tools available on the platform, and adhering to best practices—traders can significantly enhance their performance in financial markets.

If you are interested in TradingView signal subscription, you may also want to check out some free Pine Script indicators available at this link. These indicators can help enhance your trading strategies and improve your overall trading experience on TradingView.

Additionally, you can explore the best Pine Script indicators for 2024 at

pineindicators.com

pineindicators.com

Wait! Before your leave, don’t forget to…

OR copy the website URL and share it manually:

https://pineindicators.com/free