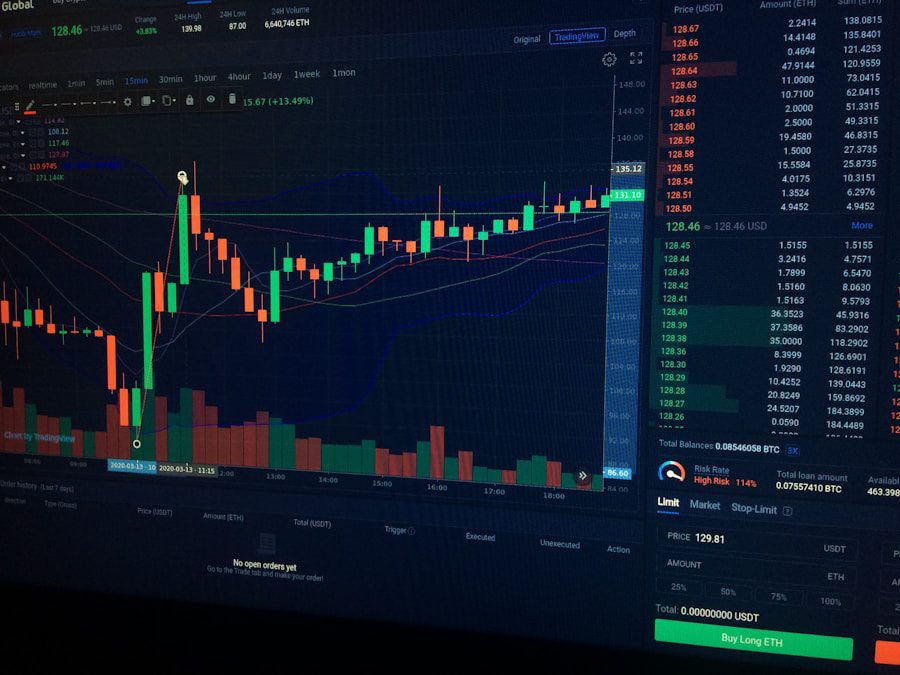

At its core, strategy trading involves the systematic approach to buying and selling financial instruments based on predefined criteria.

This method contrasts with impulsive trading, where decisions are often made based on emotions or market noise.

A well-structured trading strategy typically incorporates various elements, including technical analysis, fundamental analysis, and risk management principles.

Traders often develop their strategies by backtesting historical data to determine how their approach would have performed in different market conditions. This process not only helps in refining the strategy but also builds confidence in its potential effectiveness. Moreover, strategy trades can be categorized into several types, including day trading, swing trading, and position trading.

Day trading involves executing multiple trades within a single day, capitalizing on short-term price movements. Swing trading, on the other hand, focuses on holding positions for several days or weeks to benefit from expected price shifts. Position trading is a longer-term approach where traders hold assets for months or even years, relying on fundamental analysis to guide their decisions.

Understanding these distinctions is crucial for traders as it allows them to align their strategies with their risk tolerance, time commitment, and market outlook.

Key Takeaways

- Strategy trades involve making calculated decisions based on market analysis and research

- Identifying market trends and patterns can help in making informed investment decisions

- Setting clear and measurable goals is essential for tracking progress and making adjustments as needed

- Utilizing risk management techniques can help in minimizing potential losses

- Diversifying your portfolio can help in spreading risk and maximizing potential returns

Identifying Market Trends and Patterns

Trend Classification

Technical Analysis and Tools

Technical analysis plays a pivotal role in identifying these trends and patterns. Traders often utilize various tools such as moving averages, trend lines, and chart patterns like head and shoulders or double tops/bottoms to gauge market sentiment. For instance, a trader might employ a 50-day moving average to determine the overall trend direction; if the price consistently remains above this average, it suggests a bullish trend. Additionally, recognizing patterns such as flags or pennants can provide insights into potential continuation or reversal scenarios.

Mastering Trend Analysis for Informed Trading Decisions

By mastering these techniques, traders can make informed decisions about entry and exit points in their strategy trades.

Setting Clear and Measurable Goals

Establishing clear and measurable goals is essential for any trader looking to maintain focus and discipline in their strategy. Goals should be specific, achievable, relevant, and time-bound (SMART). For example, instead of setting a vague goal like “I want to make money trading,” a more effective goal would be “I aim to achieve a 10% return on my investment over the next six months.” This specificity not only provides a clear target but also allows traders to track their progress over time.

In addition to financial goals, traders should also consider non-financial objectives that contribute to their overall development. These might include improving technical analysis skills, enhancing emotional resilience during trading sessions, or learning new strategies. By diversifying their goals beyond mere profit-making, traders can cultivate a more holistic approach to their trading journey.

Regularly reviewing and adjusting these goals based on performance and market conditions is also crucial; this ensures that traders remain aligned with their evolving aspirations and the realities of the market landscape. (Source: Investopedia)

Utilizing Risk Management Techniques

| Technique | Effectiveness | Implementation Cost |

|---|---|---|

| Scenario Analysis | High | Medium |

| Monte Carlo Simulation | High | High |

| Decision Trees | Medium | Low |

| Hedging | High | High |

Risk management is an integral component of successful trading strategies. It involves identifying potential risks associated with trades and implementing measures to mitigate those risks effectively. One of the most common techniques is setting stop-loss orders, which automatically close a position when it reaches a predetermined loss level.

This tool helps traders limit their losses and protect their capital from significant downturns in the market. Another essential aspect of risk management is position sizing, which determines how much capital to allocate to each trade based on the trader’s overall portfolio size and risk tolerance. A common rule of thumb is to risk no more than 1-2% of the total account balance on any single trade.

This approach ensures that even a series of losing trades will not deplete the trader’s capital significantly. Additionally, employing diversification strategies—spreading investments across various asset classes or sectors—can further reduce risk exposure. By understanding and applying these risk management techniques, traders can navigate the complexities of the market with greater confidence and resilience.

Diversifying Your Portfolio

Diversification is a critical strategy for managing risk and enhancing potential returns in trading. By spreading investments across different asset classes—such as stocks, bonds, commodities, and currencies—traders can reduce the impact of poor performance in any single investment on their overall portfolio. For instance, if a trader holds both equities and bonds, a downturn in the stock market may be offset by gains in bond prices during periods of economic uncertainty.

Moreover, diversification can also be achieved within asset classes by investing in various sectors or geographic regions. For example, a trader might choose to invest in technology stocks alongside consumer goods or healthcare stocks to balance exposure across different industries. This approach not only mitigates risk but also allows traders to capitalize on growth opportunities in multiple areas of the market.

However, it is essential to strike a balance; over-diversification can lead to diluted returns and increased complexity in managing the portfolio.

Monitoring and Analyzing Performance

Recording Trading Activity

Traders should maintain detailed records of all trades executed, including entry and exit points, position sizes, and the rationale behind each decision. This data serves as a valuable resource for evaluating what works and what doesn’t within a given strategy.

Evaluating Performance Metrics

Performance metrics such as win rate, average gain per trade, and maximum drawdown provide insights into the effectiveness of a trading strategy. For instance, if a trader notices that their win rate is consistently low despite following their strategy diligently, it may indicate that adjustments are necessary—whether that means refining entry criteria or reassessing risk management practices.

Informing Trading Decisions

By regularly reviewing performance data, traders can make informed adjustments that enhance their overall trading effectiveness. Additionally, utilizing performance analysis tools or software can streamline this process by providing visual representations of trading results over time.

Adapting to Changing Market Conditions

The financial markets are inherently dynamic; thus, adaptability is crucial for traders seeking sustained success. Market conditions can shift due to various factors such as economic indicators, geopolitical events, or changes in investor sentiment. A strategy that works well in one environment may falter in another; therefore, traders must remain vigilant and responsive to these changes.

For example, during periods of high volatility—often triggered by economic announcements or geopolitical tensions—traders may need to adjust their strategies by tightening stop-loss orders or reducing position sizes to manage increased risk effectively. Conversely, in stable market conditions characterized by low volatility, traders might consider increasing their exposure to capitalize on gradual price movements. Staying informed about macroeconomic trends and utilizing tools such as economic calendars can help traders anticipate potential shifts in market dynamics and adjust their strategies accordingly.

Seeking Professional Advice and Mentorship

While self-education is invaluable in the world of trading, seeking professional advice and mentorship can significantly enhance one’s learning curve and overall success rate. Experienced traders or financial advisors can provide insights that may not be readily apparent through independent research alone. They can offer guidance on developing effective strategies tailored to individual goals and risk tolerance while sharing lessons learned from their own experiences.

Mentorship programs often provide structured learning environments where novice traders can gain practical knowledge through real-world scenarios. Engaging with a mentor allows for personalized feedback on trading strategies and performance analysis, fostering growth in areas that may require improvement. Additionally, participating in trading communities or forums can facilitate networking opportunities with like-minded individuals who share similar interests and challenges.

By leveraging professional advice and mentorship, traders can accelerate their development while navigating the complexities of the financial markets with greater confidence and clarity.

If you are interested in learning more about trading strategies for TradingView, you may want to check out this article on high win rate TradingView strategies. This article provides valuable insights into how to increase your chances of success in the stock market by implementing strategies with a high win rate. By combining the information from both articles, you can develop a comprehensive approach to trading on TradingView that maximizes your potential for profit.

FAQs

What is a strat trade?

A strat trade, short for strategic trade, refers to a trading strategy that involves making investment decisions based on a thorough analysis of market trends, economic indicators, and other relevant factors.

How does a strat trade work?

In a strat trade, traders use various analytical tools and techniques to identify potential opportunities in the market. They then develop a strategic plan to execute trades that align with their investment goals and risk tolerance.

What are the key components of a strat trade?

Key components of a strat trade include market analysis, risk assessment, trade execution, and ongoing monitoring and adjustment of the trading strategy as market conditions change.

What are the benefits of using a strat trade strategy?

Using a strat trade strategy can help traders make more informed investment decisions, manage risk more effectively, and potentially achieve better returns on their investments.

What are some common tools and techniques used in strat trade?

Common tools and techniques used in strat trade include technical analysis, fundamental analysis, charting patterns, trend analysis, and various quantitative models and algorithms.

What are some potential risks associated with strat trade?

Potential risks associated with strat trade include market volatility, unexpected economic events, and the possibility of losses due to incorrect analysis or execution of trades. It’s important for traders to have a clear risk management plan in place.