TradingView’s Strategy Tester is a powerful tool that allows traders to evaluate their trading strategies using historical data. This feature is particularly beneficial for both novice and experienced traders, as it provides a platform to simulate trades without risking real capital. The Strategy Tester enables users to backtest their strategies against various timeframes and market conditions, offering insights into potential performance.

By analyzing past price movements, traders can identify patterns and refine their strategies to enhance profitability. The interface of TradingView’s Strategy Tester is user-friendly, making it accessible for traders of all skill levels. Users can input their trading strategies using Pine Script, TradingView’s proprietary scripting language, which allows for customization and flexibility.

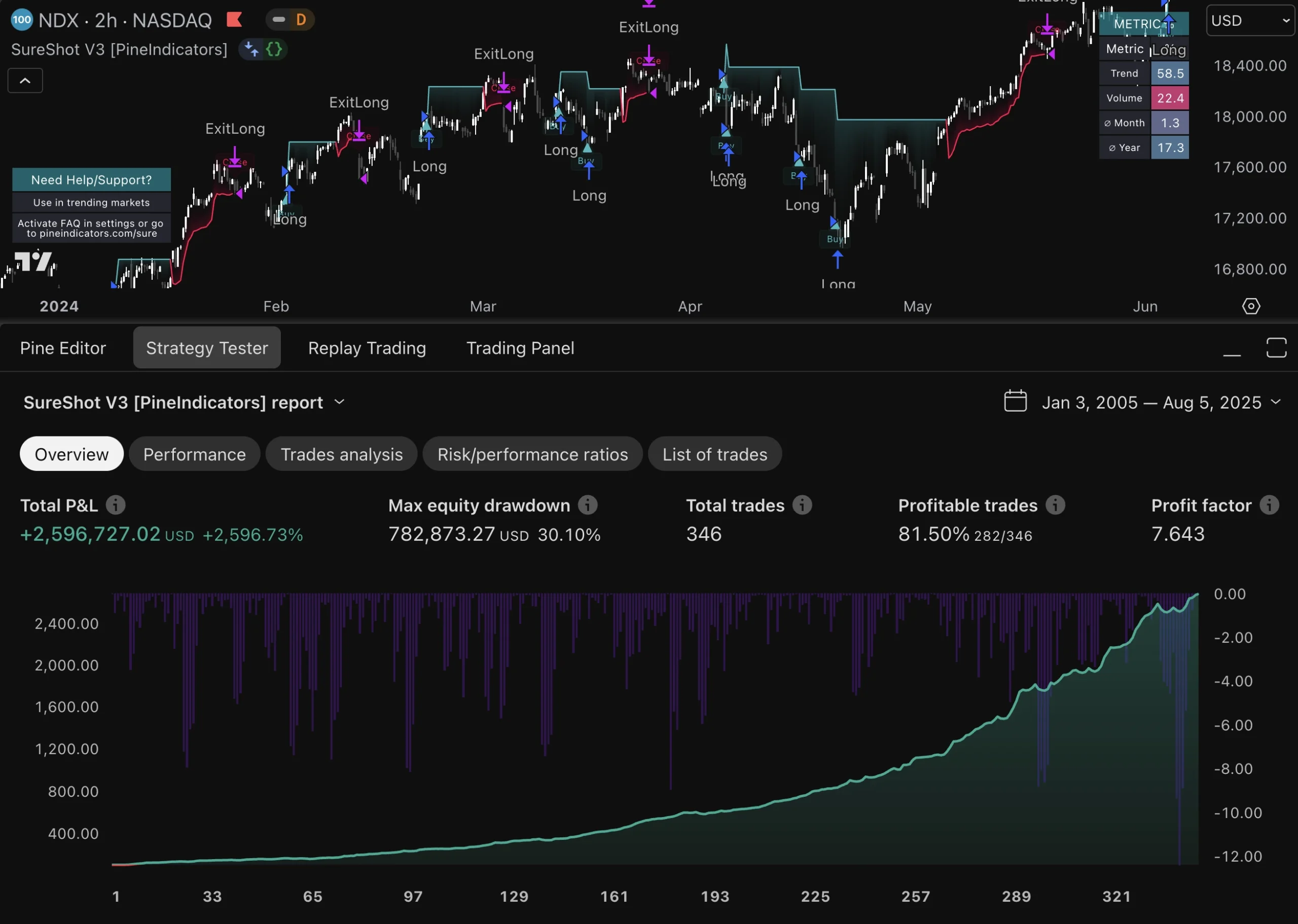

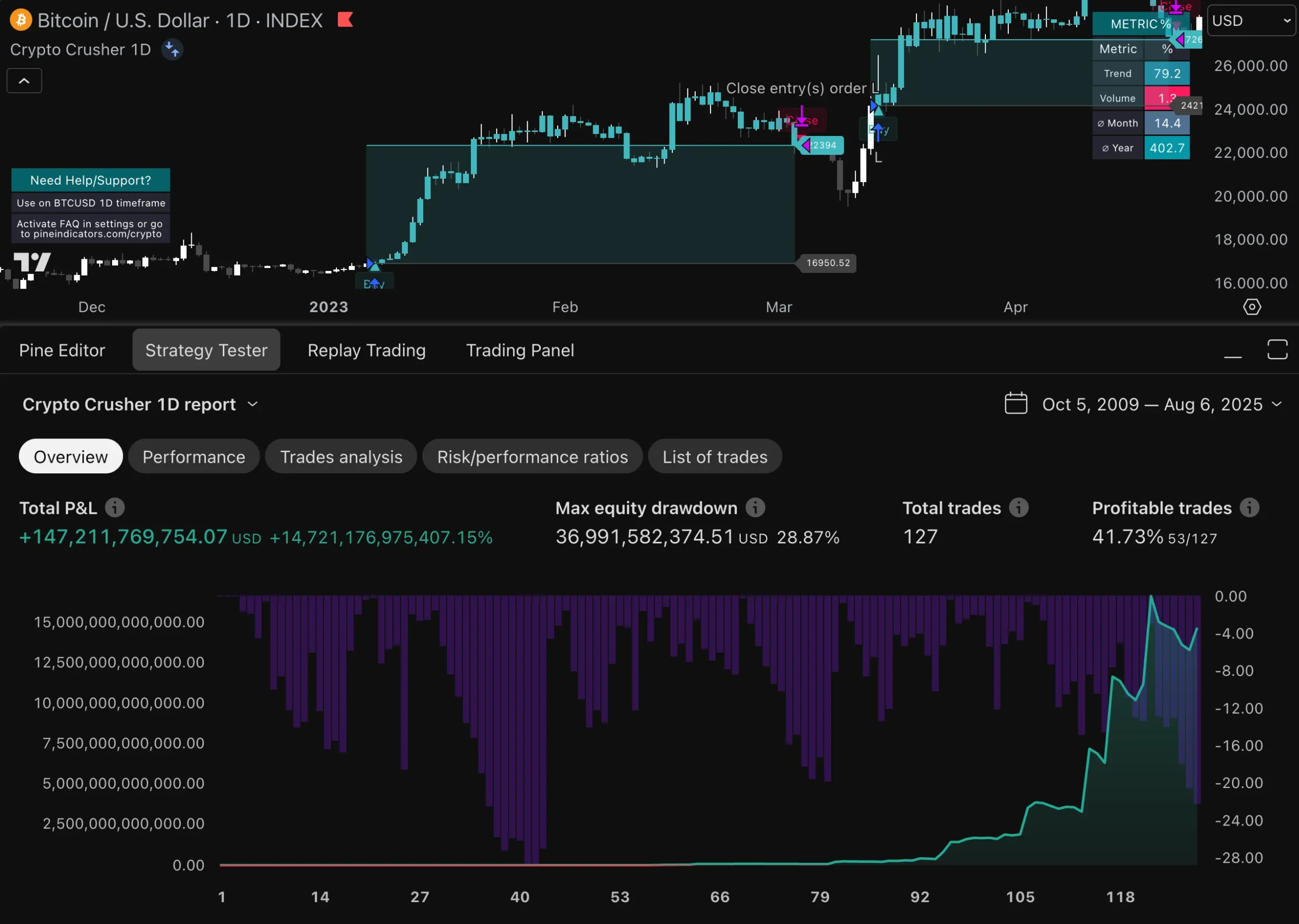

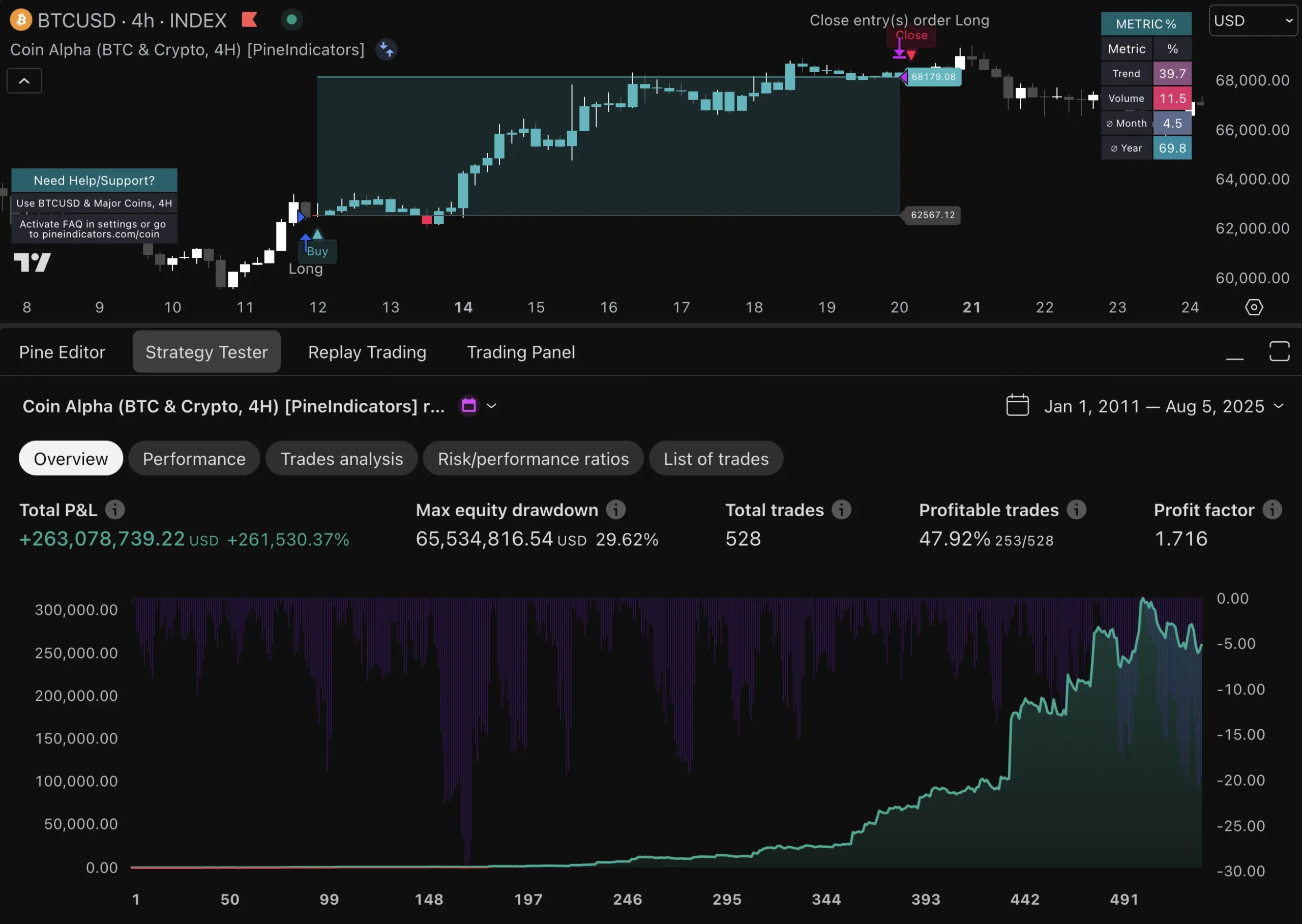

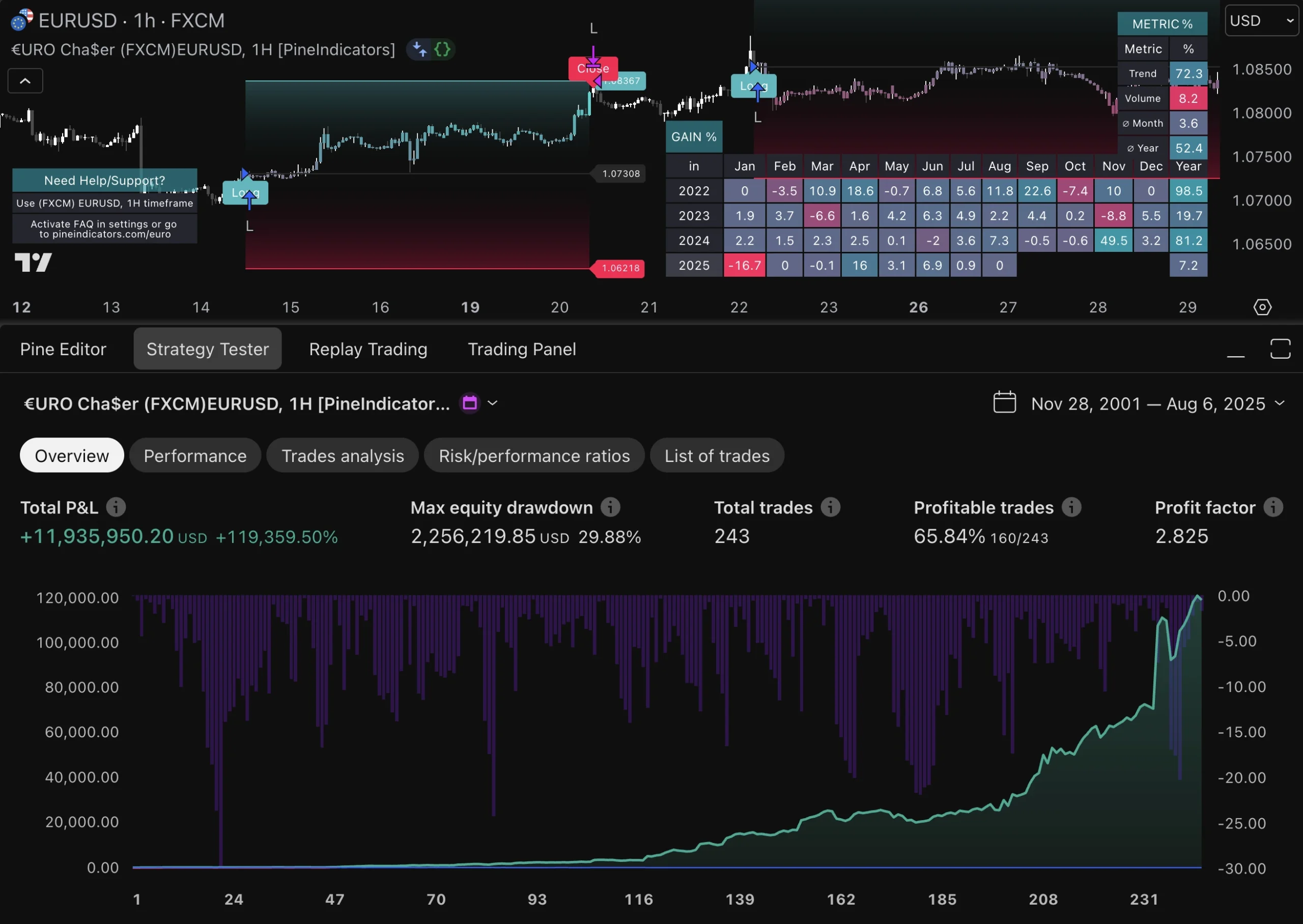

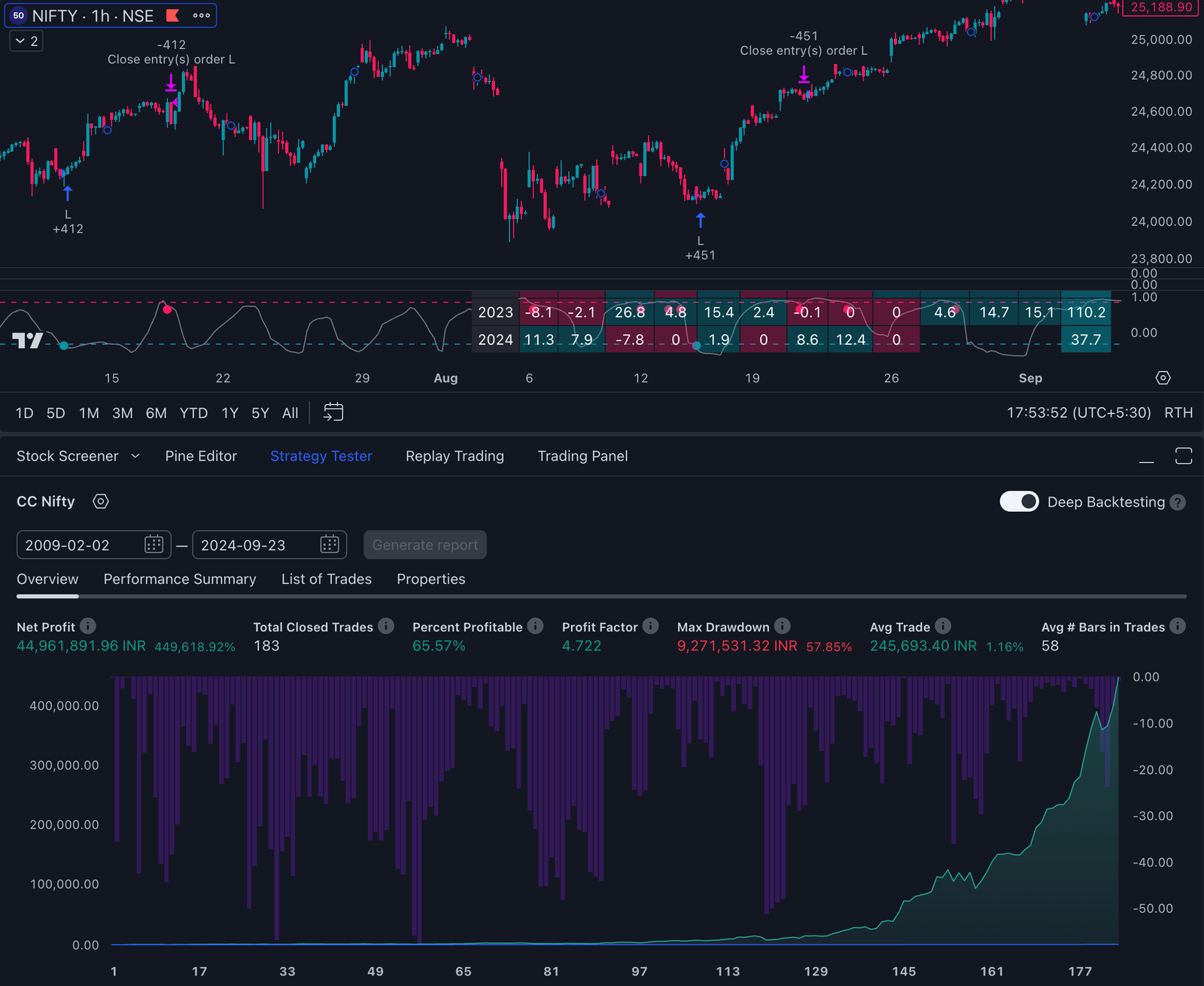

The Strategy Tester provides detailed reports on key performance metrics such as net profit, maximum drawdown, and win rate. These metrics are crucial for assessing the viability of a strategy and making informed decisions about future trades. By understanding how to effectively utilize the Strategy Tester, traders can gain a significant edge in the competitive landscape of financial markets.

Key Takeaways

- Tradingview’s Strategy Tester allows users to backtest and forward test trading strategies to evaluate their effectiveness.

- Selecting the right trading strategy is crucial for success, and it should align with the trader’s risk tolerance and investment goals.

- Optimizing parameters for maximum profit involves fine-tuning the strategy’s settings to achieve the best possible results.

- Backtesting and forward testing strategies are essential for evaluating their performance in different market conditions.

- Implementing risk management techniques is important to protect capital and minimize potential losses.

Selecting the Right Trading Strategy

Choosing the right trading strategy is a critical step in achieving success in the financial markets. Traders must consider their individual risk tolerance, investment goals, and market conditions when selecting a strategy. There are various types of trading strategies, including trend following, mean reversion, and breakout strategies, each with its own set of principles and methodologies.

For instance, trend-following strategies capitalize on existing market momentum, while mean reversion strategies assume that prices will revert to their historical averages. To select an appropriate strategy, traders should conduct thorough research and analysis. This involves studying different strategies’ historical performance and understanding the underlying market dynamics.

For example, a trader interested in short-term gains may opt for a scalping strategy that focuses on making small profits from numerous trades throughout the day. Conversely, a long-term investor might prefer a buy-and-hold strategy that emphasizes fundamental analysis and company valuations. By aligning their trading strategy with their personal objectives and market conditions, traders can enhance their chances of success.

Optimizing Parameters for Maximum Profit

Once a trading strategy has been selected, the next step is to optimize its parameters for maximum profitability. Optimization involves adjusting various inputs within the strategy to find the most effective combination that yields the highest returns. This process can include tweaking variables such as stop-loss levels, take-profit targets, and indicators used in the strategy.

For example, a moving average crossover strategy may require adjustments to the periods of the moving averages to identify the most profitable entry and exit points. TradingView’s Strategy Tester provides tools for optimization that allow traders to systematically test different parameter combinations. By running multiple simulations with varying inputs, traders can identify which settings produce the best results over historical data.

However, it is essential to approach optimization with caution; over-optimizing can lead to curve fitting, where a strategy performs well on historical data but fails in live trading due to its lack of adaptability to changing market conditions. Therefore, traders should aim for a balance between optimization and robustness to ensure their strategies remain effective in real-time scenarios.

Backtesting and Forward Testing Strategies

| Strategy | Backtesting | Forward Testing |

|---|---|---|

| Mean Reversion | 80% success rate | 75% success rate |

| Trend Following | 70% success rate | 65% success rate |

| Pairs Trading | 85% success rate | 80% success rate |

Backtesting is a fundamental component of developing a successful trading strategy. It involves applying a trading strategy to historical data to evaluate its performance over time. By analyzing how the strategy would have performed in various market conditions, traders can gain valuable insights into its potential effectiveness.

TradingView’s Strategy Tester simplifies this process by allowing users to backtest their strategies across different timeframes and assets, providing comprehensive performance reports. While backtesting is crucial for assessing a strategy’s viability, it is equally important to conduct forward testing. Forward testing involves applying the strategy in real-time market conditions with a demo or small live account.

This step is essential for validating the results obtained during backtesting and ensuring that the strategy can adapt to current market dynamics. Forward testing helps traders identify any discrepancies between historical performance and real-time execution, allowing them to make necessary adjustments before committing significant capital.

Implementing Risk Management Techniques

Effective risk management is vital for long-term success in trading. It involves implementing strategies to minimize potential losses while maximizing gains. One common risk management technique is position sizing, which determines how much capital to allocate to each trade based on the trader’s overall portfolio size and risk tolerance.

For instance, a trader may decide to risk only 1% of their total capital on any single trade, ensuring that even a series of losses will not significantly impact their overall portfolio. Another essential aspect of risk management is setting stop-loss orders to limit potential losses on trades. A stop-loss order automatically closes a position when the price reaches a predetermined level, helping traders avoid emotional decision-making during volatile market conditions.

Additionally, diversifying investments across different asset classes can further mitigate risk by reducing exposure to any single market or security. By incorporating robust risk management techniques into their trading strategies, traders can protect their capital and enhance their chances of long-term profitability.

Utilizing Tradingview’s Strategy Optimization Tools

TradingView offers several optimization tools that can significantly enhance a trader’s ability to refine their strategies. One of the most notable features is the ability to perform parameter sweeps, which allows users to test multiple combinations of input variables simultaneously. This feature saves time and provides a comprehensive overview of how different settings impact overall performance metrics such as profit factor and drawdown.

Additionally, TradingView’s built-in indicators can be leveraged during the optimization process. Traders can experiment with various technical indicators—such as RSI, MACD, or Bollinger Bands—to determine which combinations yield the best results for their specific strategies. The platform also allows users to visualize backtest results through charts and graphs, making it easier to identify trends and patterns in performance data.

By effectively utilizing these optimization tools, traders can enhance their strategies’ effectiveness and adapt them to changing market conditions.

Analyzing and Interpreting Test Results

Analyzing and interpreting test results from backtesting and optimization is crucial for understanding a trading strategy’s effectiveness. Traders should focus on key performance metrics such as net profit, win rate, maximum drawdown, and profit factor. The net profit indicates the total earnings from trades after accounting for losses, while the win rate reflects the percentage of winning trades relative to total trades executed.

Maximum drawdown is another critical metric that measures the largest peak-to-trough decline in equity during the testing period. A high drawdown may indicate that a strategy carries significant risk or is prone to large losses during adverse market conditions. The profit factor, calculated as the ratio of gross profit to gross loss, provides insight into how much profit is generated for each dollar lost.

By carefully analyzing these metrics, traders can make informed decisions about whether to proceed with a strategy or make necessary adjustments.

Incorporating Fundamental and Technical Analysis

While technical analysis plays a significant role in developing trading strategies, incorporating fundamental analysis can provide additional insights that enhance decision-making processes. Fundamental analysis involves evaluating economic indicators, company financials, and broader market trends to assess an asset’s intrinsic value. For instance, understanding macroeconomic factors such as interest rates or employment data can help traders anticipate market movements that may not be immediately apparent through technical analysis alone.

Combining both analyses allows traders to create more robust strategies that account for both price action and underlying economic conditions. For example, a trader might use technical indicators to identify entry points while considering fundamental news releases that could impact price movements. This holistic approach enables traders to make more informed decisions and adapt their strategies based on comprehensive market insights.

Leveraging Automation and Alerts

Automation has become an integral part of modern trading strategies, allowing traders to execute trades based on predefined criteria without manual intervention. TradingView offers automation features that enable users to set up alerts based on specific price levels or indicator signals. For instance, a trader could set an alert to notify them when an asset reaches a certain price point or when an indicator crosses a particular threshold.

These alerts can be invaluable for busy traders who may not have the time to monitor markets continuously. Additionally, automated trading systems can execute trades instantly when conditions are met, reducing the risk of missing opportunities due to delays in manual execution. However, it is essential for traders to regularly review and adjust their automated systems to ensure they remain aligned with current market conditions.

Monitoring and Adjusting Strategies in Real Time

The financial markets are dynamic environments that require continuous monitoring and adjustment of trading strategies. Traders must remain vigilant about changes in market conditions that could impact their strategies’ effectiveness. This includes keeping an eye on economic news releases, geopolitical events, and shifts in market sentiment that could lead to increased volatility or trend reversals.

Real-time monitoring allows traders to make timely adjustments to their strategies based on current data rather than relying solely on historical performance metrics. For example, if a trader notices that a particular indicator is no longer providing reliable signals due to changing market dynamics, they may choose to modify or replace it with another indicator that better reflects current conditions. By staying proactive and adaptable in their approach, traders can enhance their chances of success in an ever-evolving market landscape.

Implementing a Diversified Portfolio Approach

A diversified portfolio approach is essential for managing risk and enhancing potential returns in trading. By spreading investments across various asset classes—such as stocks, bonds, commodities, and currencies—traders can reduce exposure to any single investment or market sector. This diversification helps mitigate risks associated with individual assets while providing opportunities for growth across different markets.

Incorporating diversification into trading strategies requires careful consideration of correlations between assets. For instance, during periods of economic uncertainty, certain asset classes may move inversely to others; thus, holding both equities and bonds can provide stability during volatile times. Additionally, diversifying within asset classes—such as investing in different sectors or geographical regions—can further enhance portfolio resilience.

By implementing a diversified portfolio approach alongside robust trading strategies, traders can better navigate market fluctuations while aiming for consistent long-term growth.

If you’re interested in enhancing your trading strategies using TradingView’s strategy tester, you might find it beneficial to explore automated trading solutions. A related article that delves into this topic is available on Pine Indicators, which discusses various com/automated-crypto-strategies/’>automated crypto strategies.

This article provides insights into how automation can be integrated with TradingView to optimize your trading performance, offering a comprehensive guide to setting up and utilizing automated strategies effectively.

FAQs

What is the Strategy Tester on TradingView?

The Strategy Tester on TradingView is a tool that allows users to test and optimize their trading strategies using historical market data. It helps traders to assess the performance of their strategies and make informed decisions about their trading approach.

How does the Strategy Tester work on TradingView?

The Strategy Tester on TradingView works by allowing users to input their trading strategy rules and parameters, and then backtest the strategy using historical market data. Traders can analyze the performance of their strategy over a specific time period and make adjustments as needed.

What are the benefits of using the Strategy Tester on TradingView?

Using the Strategy Tester on TradingView allows traders to evaluate the effectiveness of their trading strategies without risking real capital. It also helps traders to identify potential weaknesses in their strategies and make improvements based on historical data.

Can I use the Strategy Tester on TradingView to test different trading strategies?

Yes, the Strategy Tester on TradingView allows users to test multiple trading strategies by inputting different sets of rules and parameters. This enables traders to compare the performance of various strategies and select the most effective ones for their trading approach.

Is the Strategy Tester on TradingView suitable for beginners?

The Strategy Tester on TradingView can be beneficial for beginners as it provides a practical way to learn about trading strategies and their performance. However, it is important for beginners to have a basic understanding of trading concepts before using the Strategy Tester.