Introduction to Pine Script Trading Strategies

Pine Script is a programming language created by TradingView, specifically for building custom trading strategies and technical indicators. Its importance lies in its ability to automate trading strategies, analyze market data, and display results directly on TradingView charts. This powerful tool allows traders to create personalized solutions that suit their individual trading styles and preferences.

You can use Pine Script to improve your trading performance on the TradingView platform. By automating entry and exit signals, testing strategies on past data, and testing in real-time situations, Pine Script provides comprehensive insights into strategy effectiveness. This capability not only saves time but also helps in making more informed trading decisions.

Key takeaway:

- Enhance trading performance: Automate strategies, perform detailed analysis, and visualize outcomes.

- Custom solutions: Tailor your scripts to match specific trading needs and styles.

- Comprehensive insights: Utilize both historical backtesting and real-time forward testing for robust strategy validation.

By embracing Pine Script, traders can unlock a new level of precision and sophistication in their trading endeavors.

Understanding the Basics of Pine Script

Pine Script is a domain-specific language developed by TradingView, tailored specifically for creating custom technical indicators and automated trading strategies. It empowers traders to script bespoke solutions that cater to their unique trading needs, enabling more sophisticated analysis and strategy development.

What is Pine Script?

Pine Script is a programming language designed exclusively for financial market analysis and trading strategy development. It allows traders to:

- Write scripts to automate their trading strategies

- Analyze market data

- Visualize results directly on TradingView charts

With Pine Script, you can create custom technical indicators that provide unique insights into market conditions.

Why Use Pine Script?

There are several advantages to using Pine Script over other programming languages for trading:

- Integrated with TradingView: Direct integration with the TradingView platform makes it easy to apply and visualize your strategies.

- Ease of Use: Pine Script’s syntax is simple and intuitive, making it accessible even to those with basic programming knowledge.

- Comprehensive Toolset: Pine Script offers robust functionalities such as backtesting, forward testing, and real-time data analysis without needing complex setups or additional software.

- Designed for Traders: Unlike other programming languages that may require extensive coding knowledge, Pine Script is specifically designed for traders rather than programmers.

By leveraging Pine Script’s capabilities, you can gain an edge in the markets through enhanced strategy precision and efficiency.

Why Pine Script is Essential for Traders

Pine Script has several unique features that make it an essential tool for traders. These features allow you to create highly customized trading strategies tailored to your specific needs.

Order Management

One of Pine Script’s main strengths is its detailed order management system. It supports different types of orders, such as:

- Market Orders: Executed immediately at the current market price.

- Limit Orders: Executed when the market reaches a specified price.

- Stop Orders: Triggered when the market hits a certain level.

- Stop-Limit Orders: Combines aspects of both stop and limit orders, providing more control over execution conditions.

These order management features give you the flexibility to design complex trading strategies with precise entry and exit points.

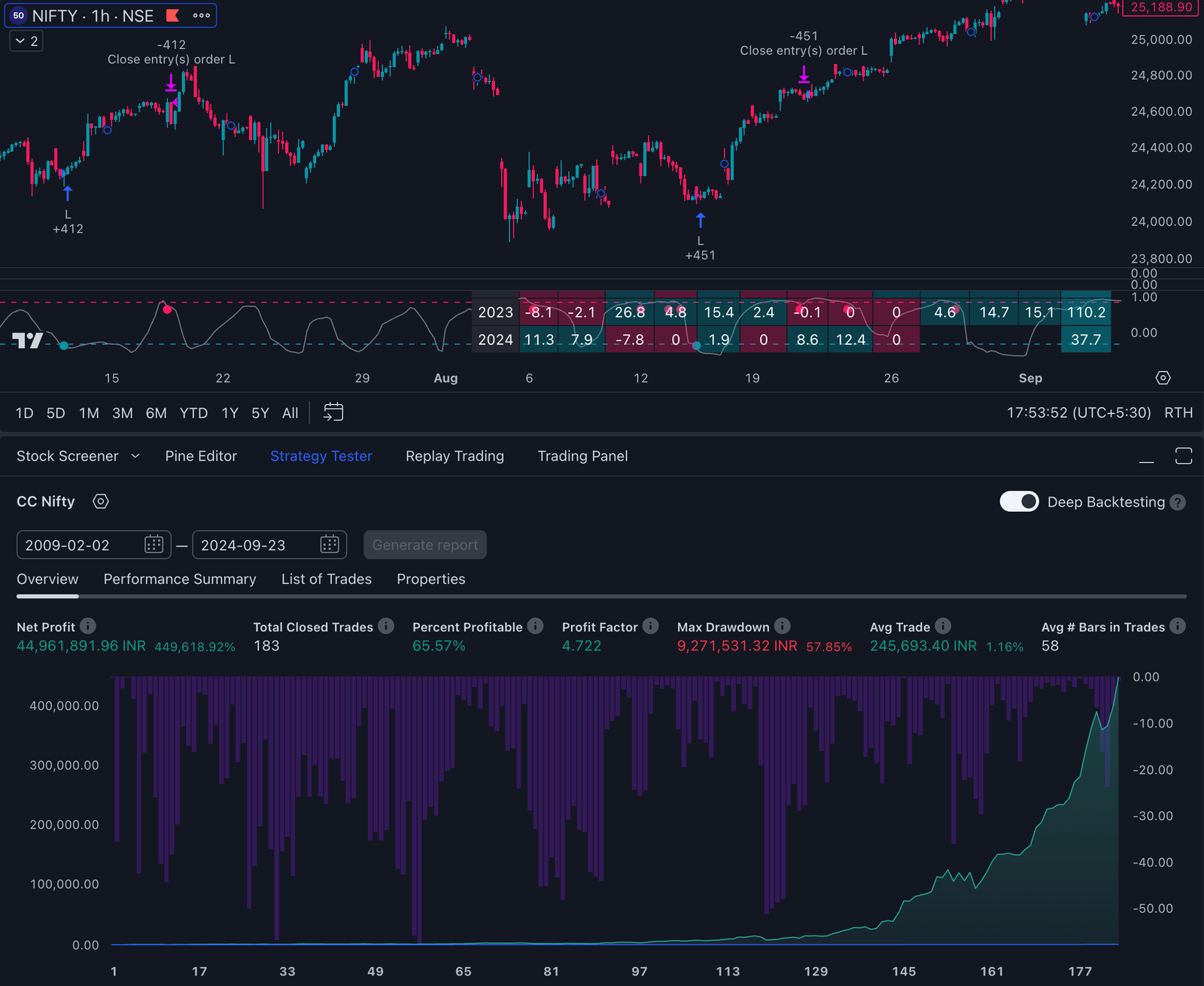

Performance Summary

Another useful feature is the performance summary tool. This module provides a detailed overview of all trades executed during a simulation. Key metrics displayed include:

- Execution Dates

- Order Types

- Trade Metrics

You can analyze each trade’s performance, helping to identify strengths and weaknesses in your strategy. The performance summary is crucial for understanding how your strategy performs under different market conditions.

Intrabar Price Movement Handling

Intrabar price movement handling is another important feature that improves strategy accuracy. By default, TradingView’s broker emulator assumes price movement within bars based on open/high/low/close prices. However, Pine Script allows you to override these settings for more detailed control. This capability is particularly useful for strategies that depend on intraday price variations.

pine //@version=5 strategy(“My Strategy”, overlay=true)

The snippet above shows how easily you can start customizing intrabar behaviors using Pine Script.

These features together make Pine Script a powerful tool for developing advanced trading strategies on TradingView.

Building Your First Trading Strategy with Pine Script: A Step-by-Step Guide

Creating a trading strategy in Pine Script begins with a simple but effective concept: moving averages. Moving averages help smooth out price data and identify trends over a specific period. Let’s walk through the process of building a moving average-based strategy, defining entry and exit conditions, and conducting backtests to evaluate its effectiveness.

Step 1: Setting Up Your Environment

- Open TradingView and navigate to the Pine Editor.

- Create a new script by clicking on the “New” button.

pine //@version=4 strategy(“Simple Moving Average Strategy”, overlay=true)

Step 2: Define Moving Averages

Calculate two moving averages: a short-term (e.g., 50-period) and a long-term (e.g., 200-period).

pine short_ma = sma(close, 50) long_ma = sma(close, 200) plot(short_ma, title=”50-period MA”, color=color.blue) plot(long_ma, title=”200-period MA”, color=color.red)

Step 3: Define Entry and Exit Conditions

- Enter a long position when the short-term moving average crosses above the long-term moving average.

- Exit the long position when the short-term moving average crosses below the long-term moving average.

pine // Entry condition if crossover(short_ma, long_ma) strategy.entry(“Long”, strategy.long)

// Exit condition if crossunder(short_ma, long_ma) strategy.close(“Long”)

Step 4: Backtesting Your Strategy

- Run your script by clicking on “Add to Chart”. This will execute your strategy on historical data available in TradingView.

- Evaluate performance using the Strategy Tester module.

Key metrics to observe:

- Net Profit: The total profit or loss generated by your strategy.

- Max Drawdown: The largest peak-to-trough decline during the backtest period.

- Win Rate: The percentage of profitable trades compared to total trades.

Example Output

plaintext Net Profit: $5000 Max Drawdown: -10% Win Rate: 60%

Enhancing Your Strategy

Consider tweaking parameters such as:

- Adjusting the periods for short-term and long-term moving averages.

- Adding additional conditions like stop-loss or take-profit levels to refine risk management.

The simplicity of this approach makes it an excellent starting point for those new to Pine Script trading strategies. By understanding these fundamental steps, you can build more complex strategies tailored to your specific trading style and goals.

For those interested in delving deeper into algorithmic trading, I highly recommend exploring this comprehensive guide on [Successful Algorithmic Trading](https://raw.githubusercontent.com/englianhu/binary.com-interview-question/fcad2844d7f10c486f3601af9932f49973548e4b/reference/Successful%

Taking Your Trading Strategies to the Next Level with Advanced Techniques in Pine Script

1. Pyramiding for Profit Maximization

Pyramiding is a technique that allows you to open multiple positions in the same direction, maximizing potential profits. In Pine Script, you can control pyramiding by setting the pyramiding parameter within your strategy definition. For instance:

pine strategy(“My Strategy”, pyramiding=3)

This line permits up to three consecutive orders in the same direction. This technique can significantly enhance your strategy’s profitability by leveraging favorable market conditions.

2. Utilizing Debugging Labels for Trade Monitoring

Debugging labels are invaluable for tracking and debugging trades. They assist in monitoring entry prices, stop-loss levels, and other critical data points directly on the chart. You can create debugging labels using the label.new function:

pine if (strategy.opentrades > 0) label.new(x=bar_index, y=high, text=”Entry: ” + tostring(strategy.opentrades.entry_price(0)))

This script snippet places a label at each trade entry point, showing the entry price. Such labels help you visualize and verify trade executions and conditions, ensuring your strategy operates as intended.

3. Implementing Visual Indicators to Improve Strategy Clarity

Visual indicators like background colors and plot shapes enhance the clarity of your trading strategy by making buy/sell conditions more apparent on charts. For example, you can use bgcolor to change the chart’s background color based on specific conditions:

pine bgcolor(condition ? color.green : na)

In addition to background colors, shape plotting makes signals more visible. The plotshape function lets you add custom shapes where certain criteria are met:

pine plotshape(series=condition, location=location.belowbar, color=color.red, style=shape.labeldown)

This line plots a red downward label below bars where your condition holds true. Using visual indicators ensures that you can quickly assess market conditions and make informed decisions based on your strategy.

By integrating these advanced techniques—pyramiding for profit maximization, debugging labels for effective trade monitoring, and visual indicators for enhanced clarity—you elevate your Pine Script trading strategies to a professional level.

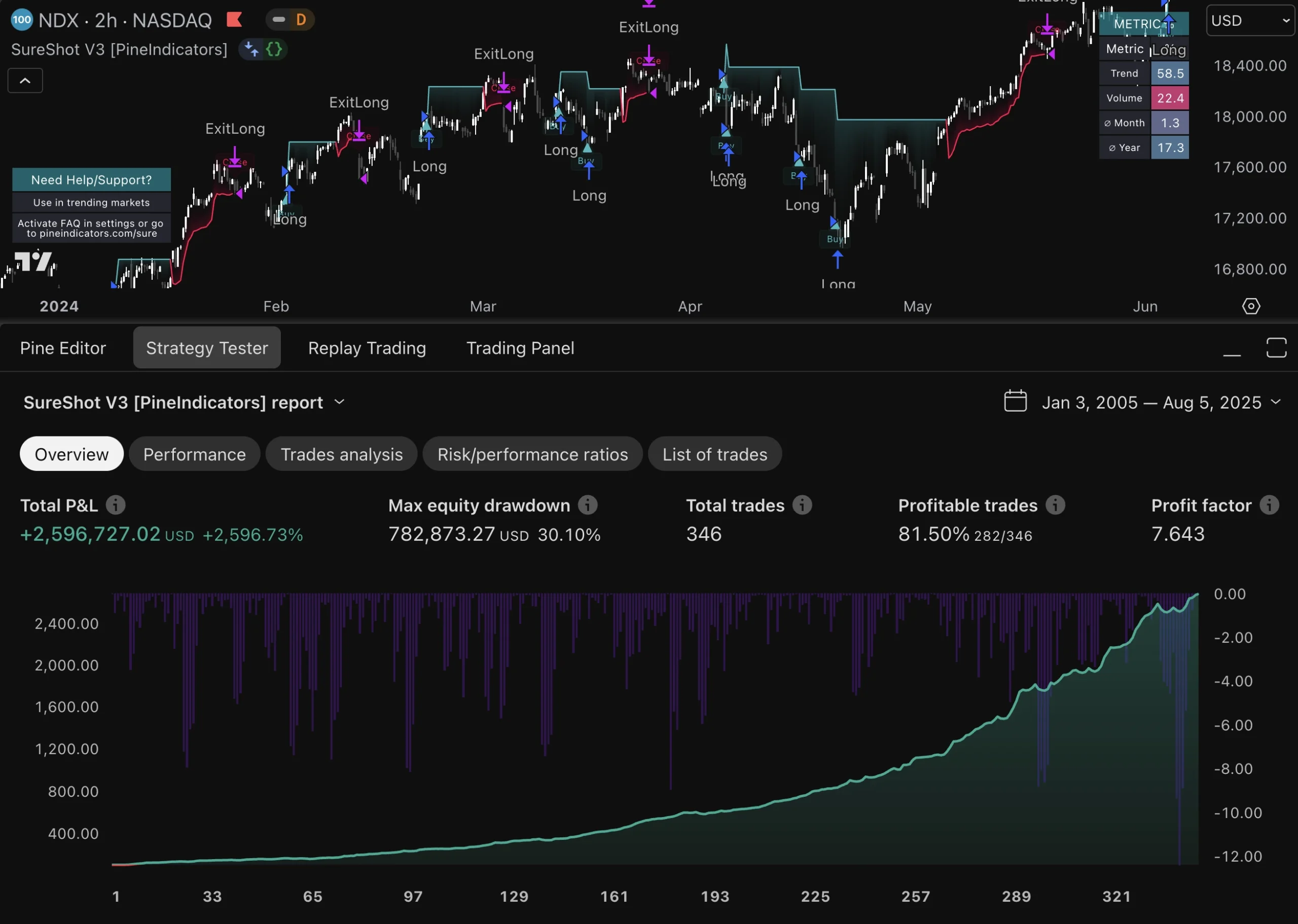

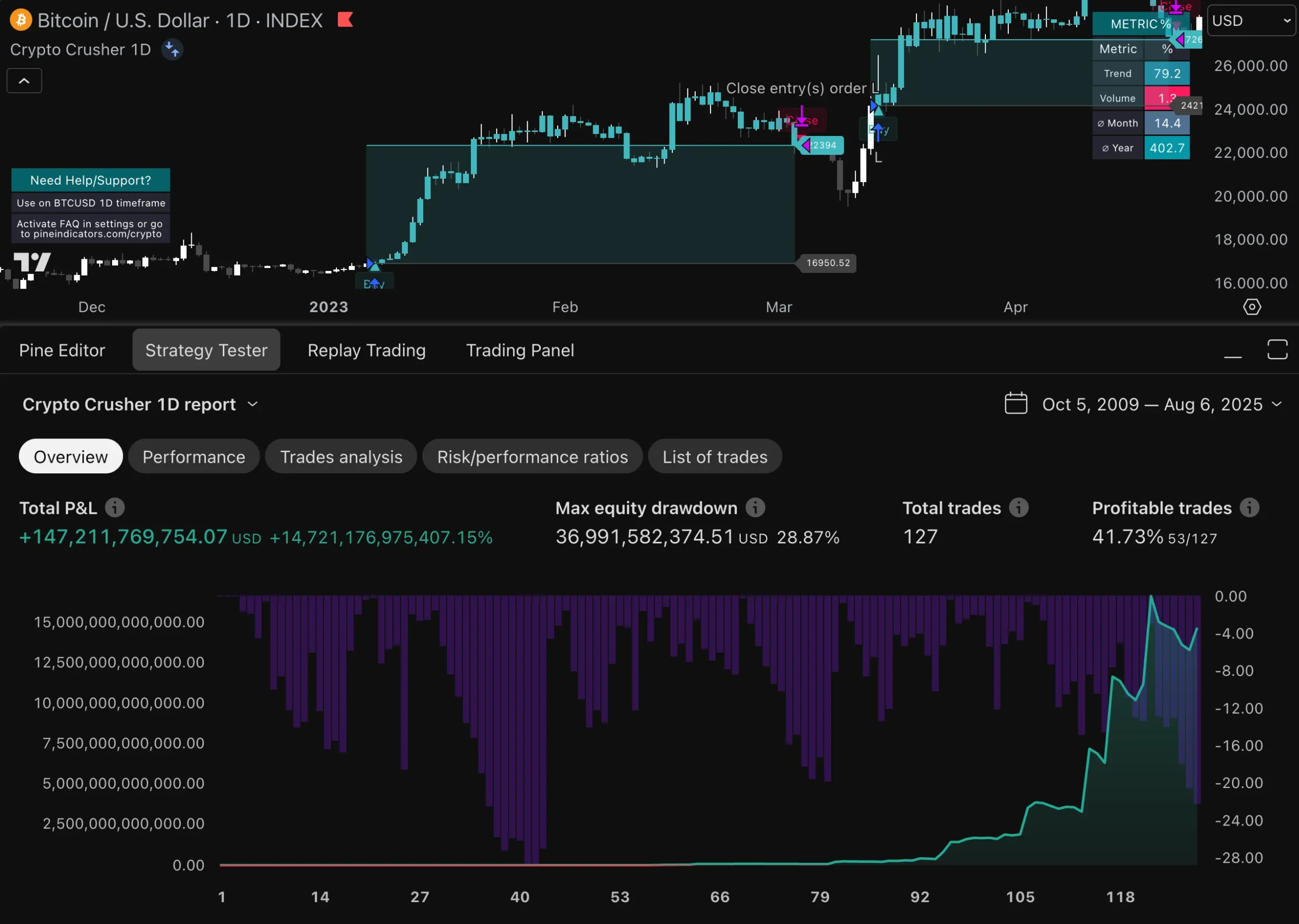

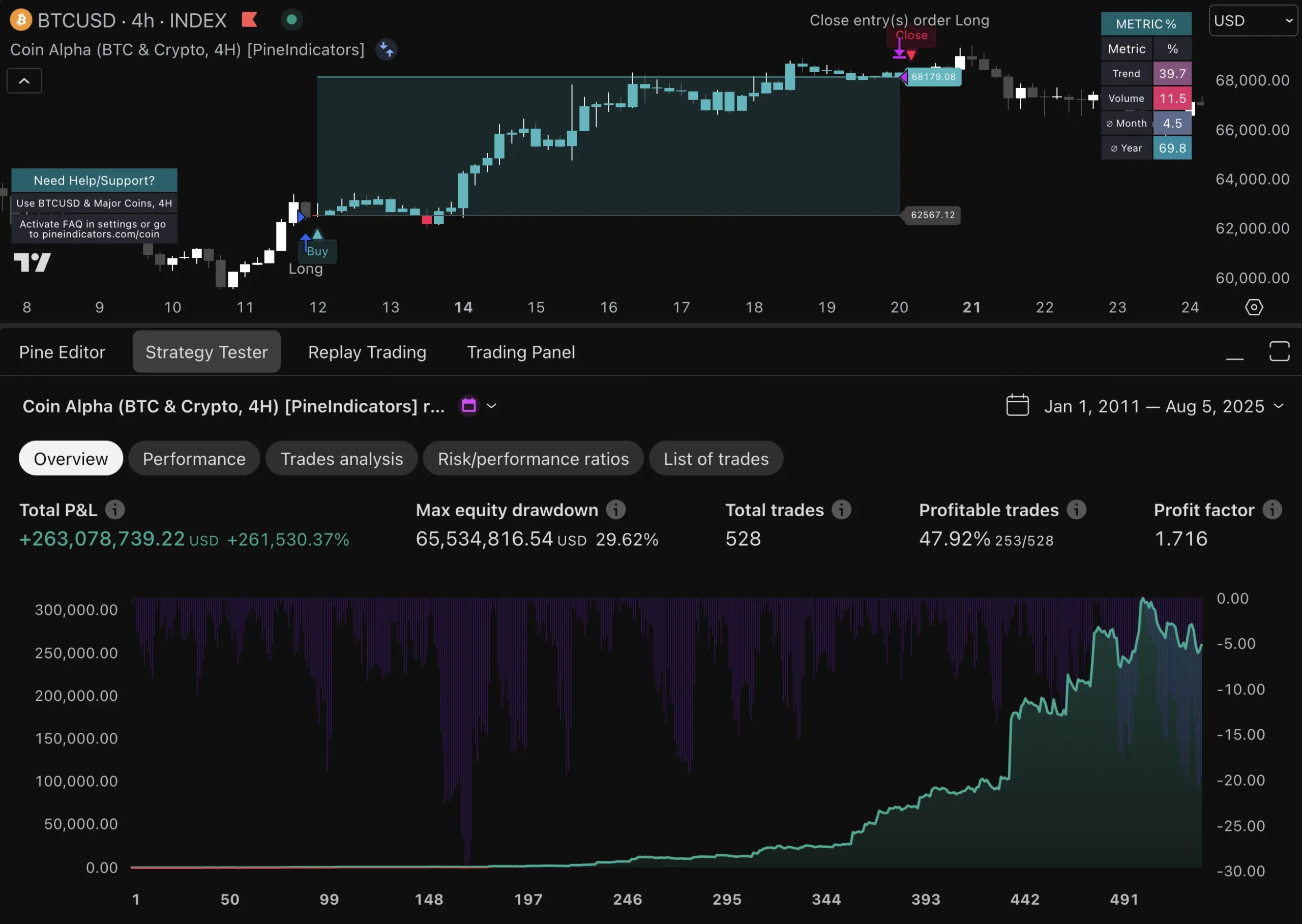

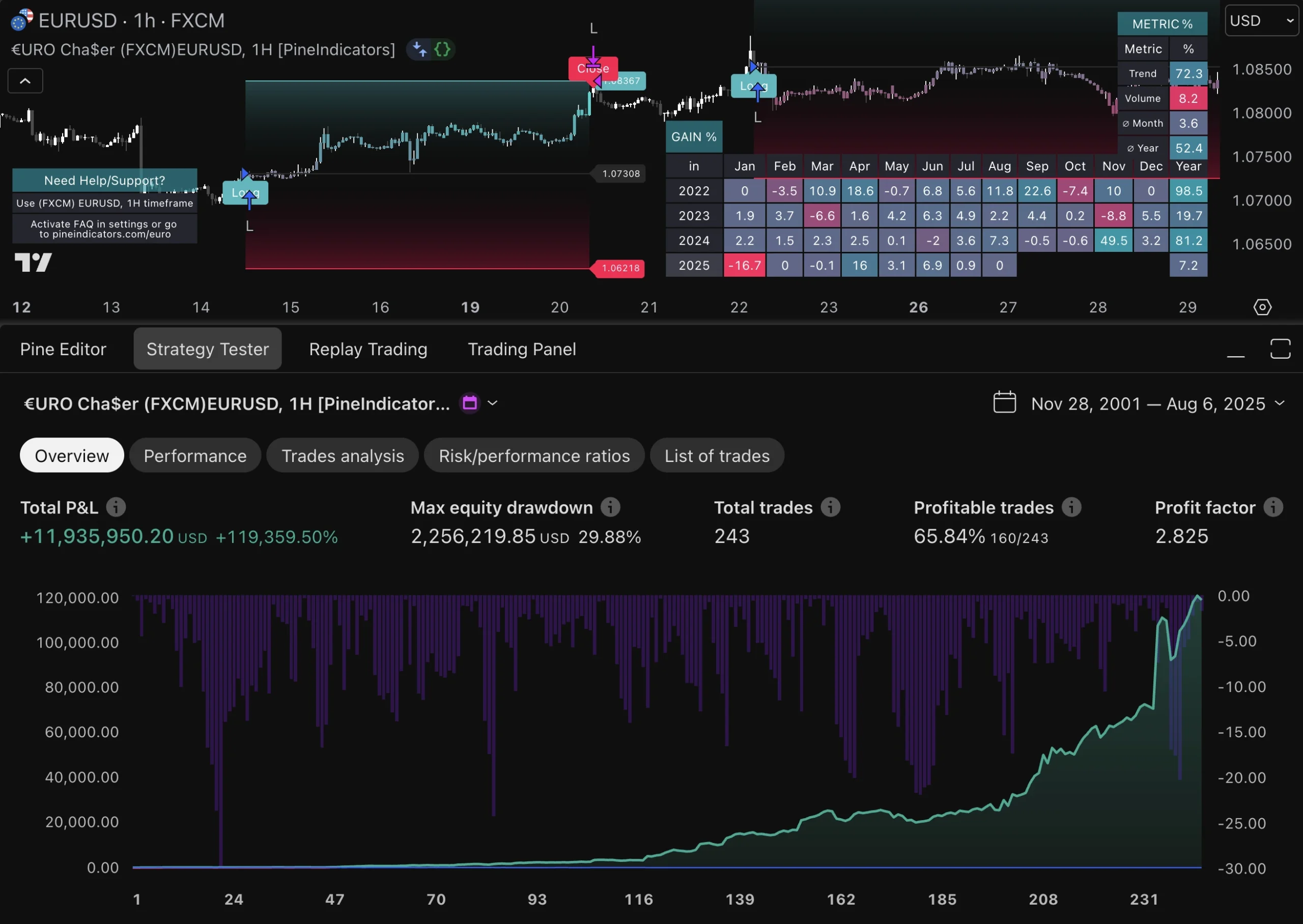

Analyzing Strategy Performance: Key Metrics to Consider in Pine Script Trading Strategies

Evaluating the performance of your trading strategy in Pine Script requires a thorough analysis of several key metrics. The Strategy Tester module in TradingView offers detailed insights that can help you fine-tune your approach.

Equity Curves

One of the most critical metrics is the equity curve, which graphically represents the change in your account balance over time. An ideal equity curve should display consistent growth with minimal drawdowns.

- Consistent Growth: A steadily rising equity curve indicates a well-balanced strategy that performs well across different market conditions.

- Minimal Drawdowns: Sharp declines or prolonged periods without new equity highs signal potential weaknesses that need addressing.

Drawdowns

Drawdown measures the peak-to-trough decline during a specific period and is crucial for assessing risk. Significant drawdowns can erode confidence and capital, making it essential to keep them under control.

- Max Drawdown: Represents the largest drop from a peak to a trough, giving you an idea of the worst-case scenario.

- Average Drawdown: Provides an average measure of all drawdowns, helping you understand the typical risk level.

Additional Metrics

In addition to equity curves and drawdowns, other metrics provided by the Strategy Tester module can offer valuable insights:

- Win/Loss Ratio: Indicates the proportion of winning trades relative to losing ones.

- Profit Factor: The ratio of gross profit to gross loss, showing how much profit you’re making per unit of risk.

- Sharpe Ratio: Measures risk-adjusted return, helping compare strategies on a like-for-like basis.

By closely monitoring these metrics, you can better understand your strategy’s strengths and weaknesses. This analytical approach ensures that your Pine Script trading strategies are both robust and adaptable in varying market conditions.

Real-time vs Historical Data Testing: Finding the Right Balance in Your Strategy Validation Process Using Pine Script

Evaluating trading strategies in Pine Script involves balancing between backtesting on historical data and forward testing in real-time scenarios. Each method has its own strengths and limitations, offering unique insights into the robustness of your strategies.

Backtesting on Historical Data

Backtesting is the process of testing a trading strategy using historical market data to simulate how it would have performed in the past. This method allows you to:

- Analyze Long-term Performance: Gain insights into how your strategy would have behaved over different market conditions.

- Identify Weaknesses: Spot potential flaws or weaknesses by observing past performance.

- Optimize Parameters: Adjust and optimize various parameters to improve the strategy’s effectiveness based on historical outcomes.

However, backtesting has its limitations. Historical data analysis may not account for all market conditions, and there’s always a risk of overfitting—a scenario where a strategy performs exceptionally well on past data but poorly in real-time markets.

Forward Testing in Real-time Scenarios

Forward testing, also known as paper trading or live simulation, involves applying your trading strategy to real-time market conditions without risking actual capital. Key benefits include:

- Real-world Validation: Test your strategy under current market conditions to gauge its practicality.

- Immediate Feedback: Receive instant feedback on how your strategy performs in a live environment.

- Adaptability: Make real-time adjustments based on evolving market trends and behavior.

Despite these advantages, forward testing requires more time since it relies on live data streams. It may also expose your strategy to unforeseen events that did not occur during backtested periods.

Tips for Effective Strategy Validation

To achieve comprehensive validation of your Pine Script trading strategies, consider these tips:

- Combine Both Methods: Use backtesting for initial development and optimization, then forward test to confirm real-world applicability.

- Monitor Key Metrics: Keep an eye on metrics like equity curves and drawdowns during both backtesting and forward testing phases.

- Stay Updated: Regularly update your scripts to reflect changes in market conditions and incorporate new insights gained from forward testing.

Balancing between historical data analysis and forward testing ensures a thorough validation process, providing confidence that your strategies can perform effectively across different market scenarios.

Avoiding Common Pitfalls When Developing Trading Strategies with Pine Script

Creating robust trading strategies with Pine Script requires careful attention to avoid common pitfalls. Here are some key mistakes to watch out for:

Scripting Errors

Errors in scripting can lead to unexpected behavior and inaccurate backtest results. Double-check your code for:

- Syntax errors: Misspelled functions or variables.

- Logical errors: Incorrectly defined conditions or loops.

- Data type mismatches: Using incompatible data types in calculations.

Using the Pine Editor’s built-in error-checking tools can help catch many of these issues early on.

Overfitting Strategies

Overfitting occurs when a strategy is excessively optimized for past data, making it less effective in real-time scenarios. To prevent overfitting:

- Avoid over-tuning parameters: Fine-tuning too many parameters can make the strategy fit historical data too closely.

- Use out-of-sample testing: Validate your strategy on different time periods not used during the initial development phase.

Overfitted strategies often perform well in backtests but fail under live market conditions.

Lack of Risk Management

Neglecting proper risk management can lead to significant losses. Incorporate these techniques into your strategies:

- Position sizing: Define how much capital to allocate per trade based on account size and risk tolerance.

- Stop-loss orders: Automatically exit trades at predefined loss levels to limit potential losses.

- Take-profit orders: Secure profits by exiting trades once they reach target levels.

Implementing strong risk management rules can protect your capital and improve long-term performance.

By addressing these common pitfalls, you can develop more reliable and effective trading strategies with Pine Script.

The Future of Trading Strategies Lies in Custom Solutions Built with Pine Scripts

Embrace innovation by exploring personalized approaches through leveraging the capabilities offered by TradingView’s platform. Custom trading solutions developed with Pine Script empower you to tailor strategies that align perfectly with your unique trading style and objectives.

By harnessing the power of Pine Script, you can:

- Automate complex trading strategies: Streamline your trading process and eliminate emotional decision-making.

- Optimize performance: Use advanced features like pyramiding and intrabar price movement handling to maximize profitability.

- Visualize market data effectively: Implement visual indicators that enhance clarity and quick decision-making on charts.

Experimentation is key. Start creating your own custom scripts today, test them rigorously using both historical and real-time data, and continuously refine them based on performance metrics.

Begin experimenting with your own unique ideas today! Unlock the potential of Pine Script and revolutionize your trading approach.

FAQs (Frequently Asked Questions)

What is Pine Script and why is it significant for traders?

Pine Script is a domain-specific language designed for traders to develop custom trading strategies on the TradingView platform. It allows traders to create personalized scripts that enhance their trading performance by utilizing technical indicators and automated trading functionalities.

What are the advantages of using Pine Script over other programming languages?

Pine Script is specifically tailored for trading, making it easier for traders to implement technical analysis without needing extensive programming knowledge. Its built-in functions and features streamline the development of trading strategies, which may be more complex in general-purpose programming languages.

How can I build my first trading strategy using Pine Script?

To build your first trading strategy with Pine Script, you can start by defining a simple moving average-based strategy. This involves setting entry and exit conditions, coding these conditions in Pine Script, and then backtesting the strategy to evaluate its effectiveness against historical data.

What key metrics should I analyze when evaluating my Pine Script trading strategies?

Important metrics to consider include equity curves, which show the growth of your investment over time, and drawdowns, which indicate the potential risk of loss during adverse market conditions. Analyzing these metrics helps traders assess the performance and viability of their strategies.

What common pitfalls should I avoid when developing trading strategies with Pine Script?

Common mistakes include errors in scripting that can lead to incorrect signals, overfitting strategies to past data which may not perform well in future markets, and neglecting proper risk management techniques. It’s crucial to be mindful of these issues to create robust trading strategies.

How does real-time testing compare with historical data analysis in strategy validation?

Backtesting on historical data allows you to see how a strategy would have performed in the past, while forward testing provides insights into how it performs in real-time market conditions. A balanced approach utilizing both methods ensures comprehensive validation of your Pine Script trading strategies.