Description

DEMO (from version V1)

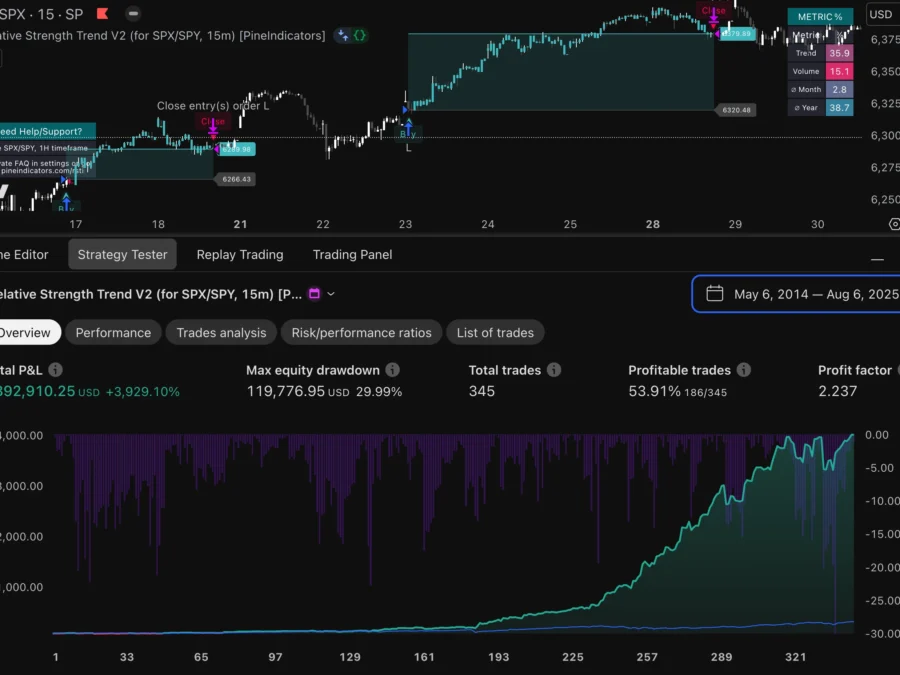

Black-Scholes Model 1H – Systematic Edge on SPX/SPY

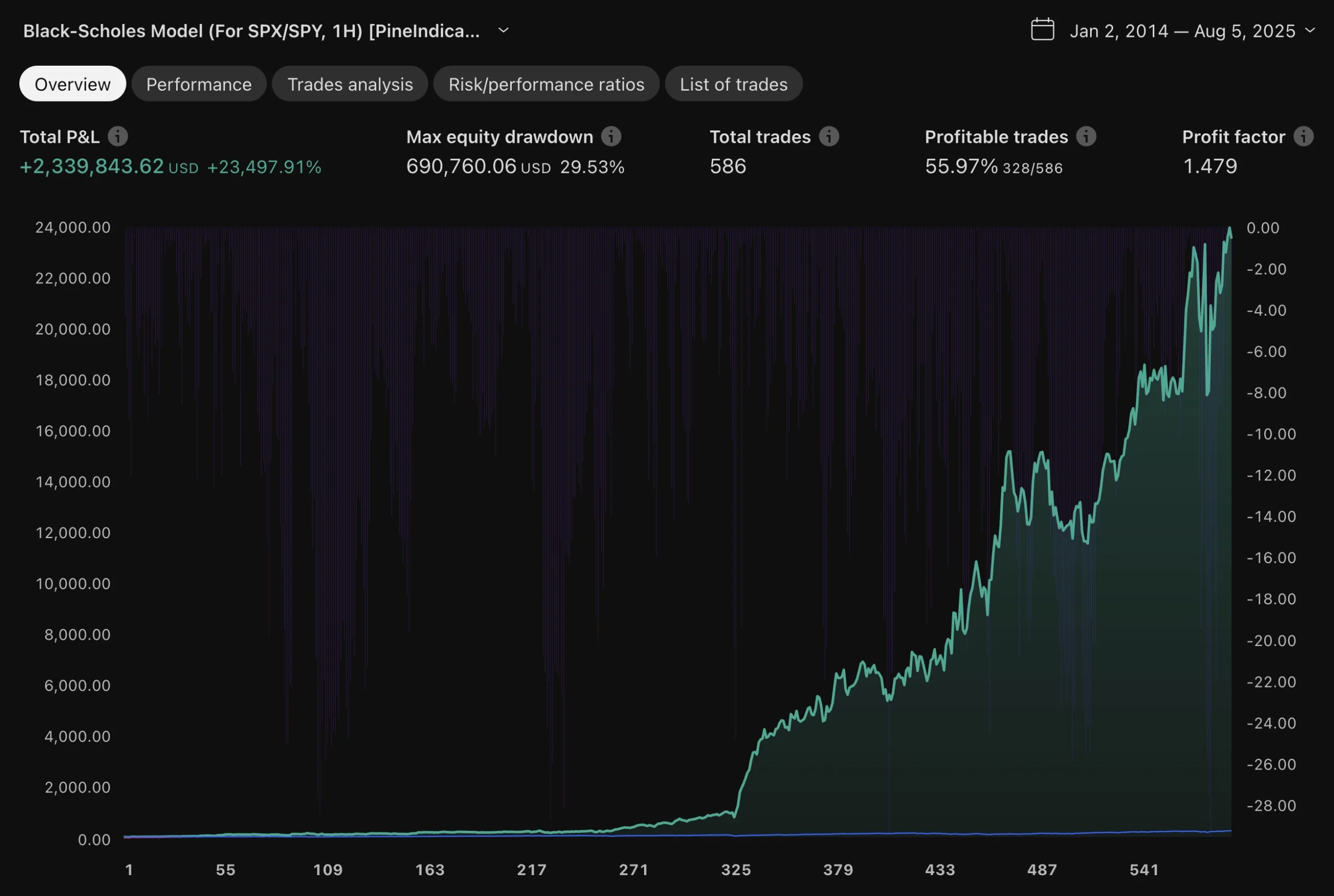

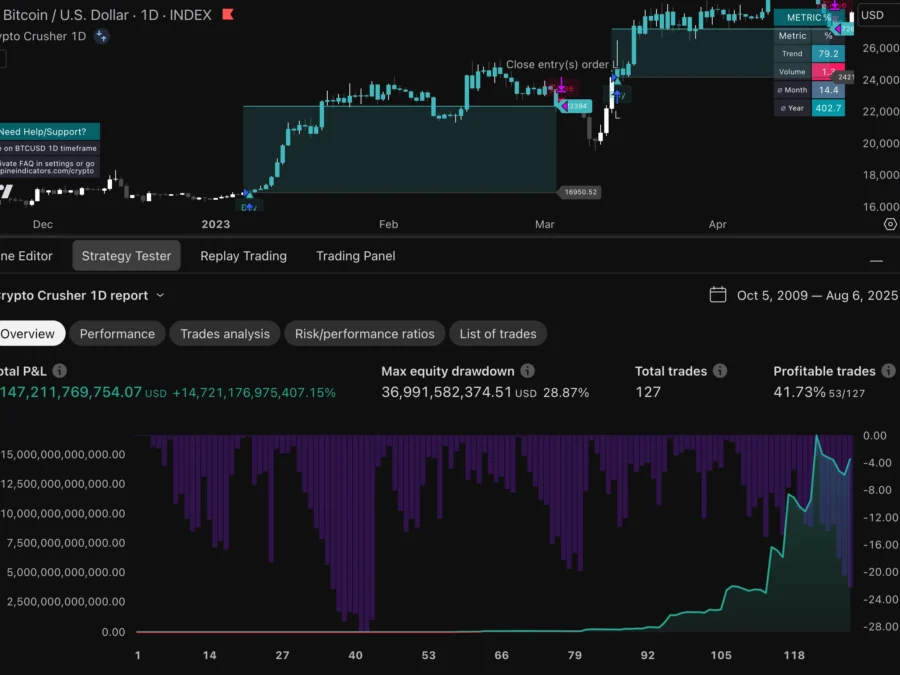

| Metric | Value |

|---|---|

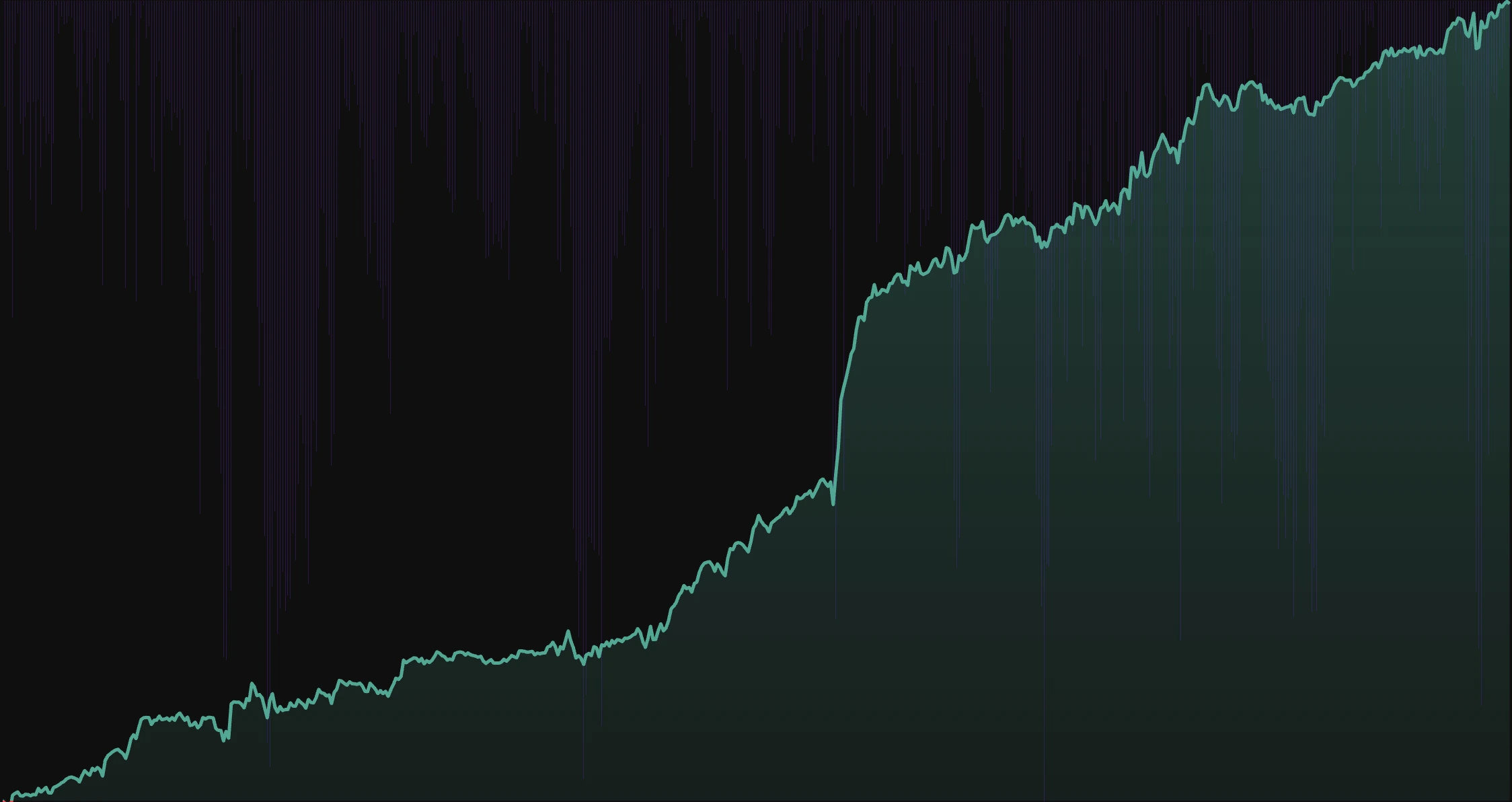

| Net return | +23,497.9 % (capital ×235) |

| Compound annual growth rate | ≈ 60 % p.a. |

| Max. equity drawdown | -29.5 % |

| Profit factor | 1.48 |

| Total trades | 586 (≈ 4.2 per month) |

| Winning trades | 56 % |

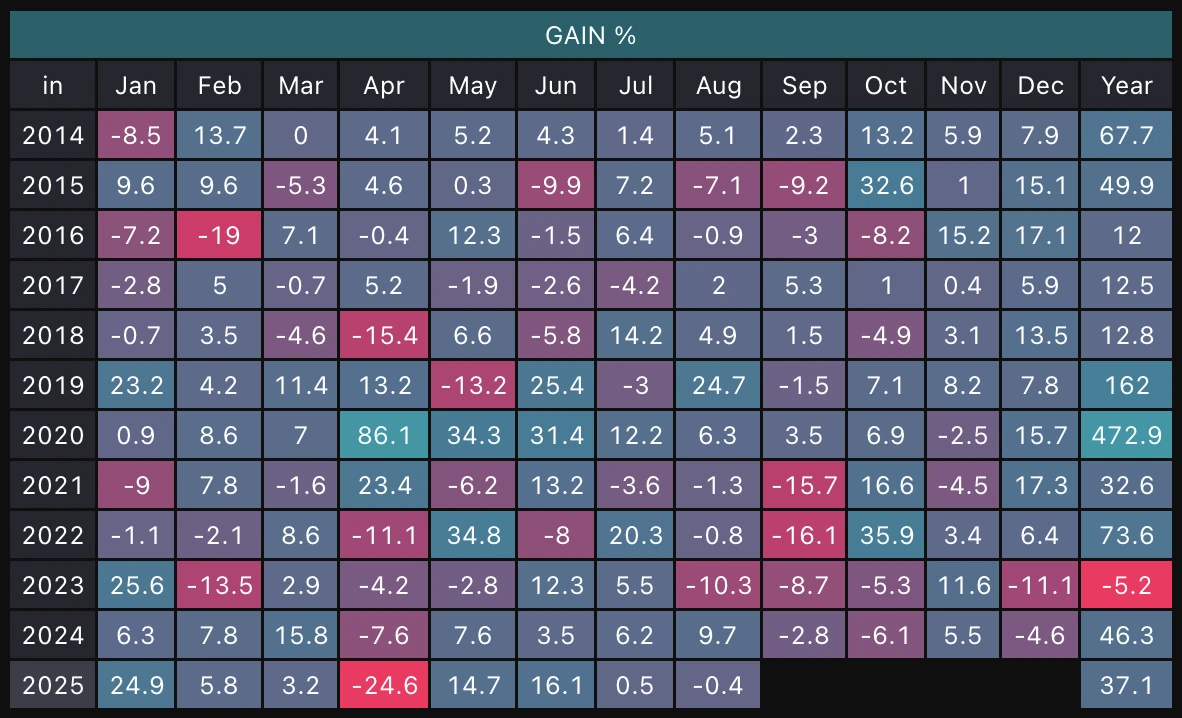

*for full deep backtest from 2014-2025, 0.01 % commission/side, 1-tick slippage, full compounding.

Figures taken directly from TradingView Strategy Tester; no walk-forward tweaking.

Exactly What You Get

- Invite-only indicator access – we whitelist your TradingView user; the closed-source strategy appears instantly in your indicator list.

- Adjustable risk-per-trade – a single slider lets you scale position size from very conservative to high-octane. Increase the percentage to target higher absolute returns (and deeper drawdowns); dial it back for smoother equity.

- Black-Scholes pricing filter – entries fire only when the theoretical option premium exceeds market price by a pre-set edge, cutting out low-value trades.

- One-click automation bundle – JSON alert templates pre-filled for AutoView, Alertatron, WunderTrading and similar services. Paste your webhook URL and you’re live.

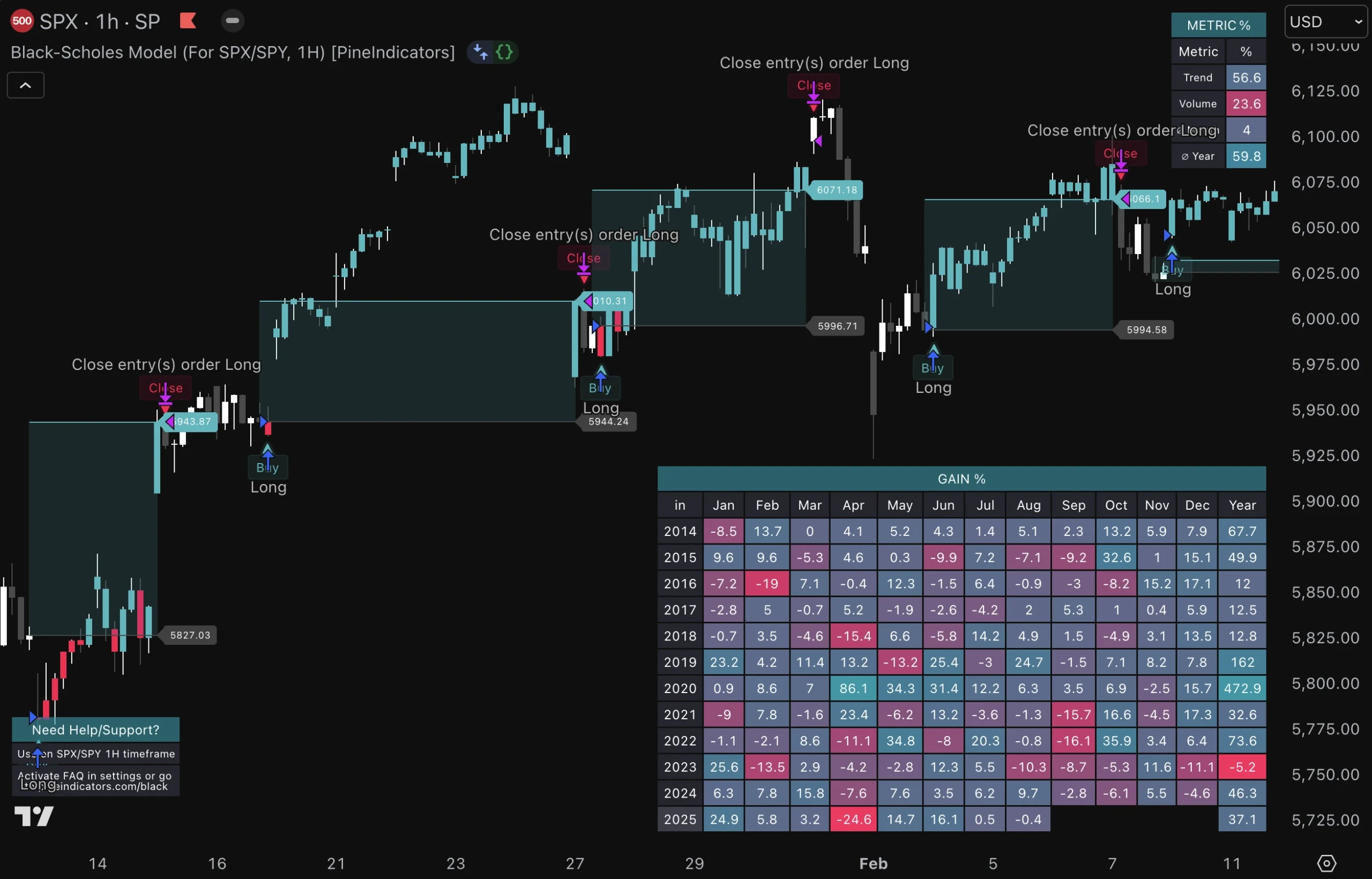

- Comprehensive on-chart analytics

- Equity & drawdown curve (11 + years)

- Monthly heat-map table for quick regime checks

- Live trend, volume, and geometric MTD/Y metrics

- Pop-up warnings for order-size or drawdown anomalies

- Zero noise workflow – only two mandatory inputs:

1) start-date; 2) risk-per-trade slider. Everything else ships with production-tested defaults. - Lifetime updates – refinements flow to your invite automatically.

How It Eases Common TradingView Frustrations

- Data limits on free plans? Strategy runs on free tier yet scales to full history on paid plans.

- Repainting doubts? All calculations use confirmed bars; signals never shift retroactively.

- Parameter overload? Two functional controls keep you out of optimisation rabbit-holes.

- Silent strategy stalls? Built-in warnings flag minimum-size issues or equity-threatening drawdowns.

- Webhook errors? Pre-formatted JSON eliminates trial-and-error.

Five-Minute Setup

- Send us your TradingView handle → receive invite-only access.

- Add Black-Scholes Model 1H to an SPX 1-hour chart.

- Set start-date to today and pick your desired risk-per-trade percentage.

- (Optional) Create an alert, paste the built-in JSON, add your webhook.

- Enable – the strategy now manages entries, exits and sizing automatically.

If you want a statistically vetted edge on the S&P 500 with full control over how much you put on the line each trade, the Black-Scholes Model 1H is a no-nonsense solution.

Reviews

There are no reviews yet.