Description

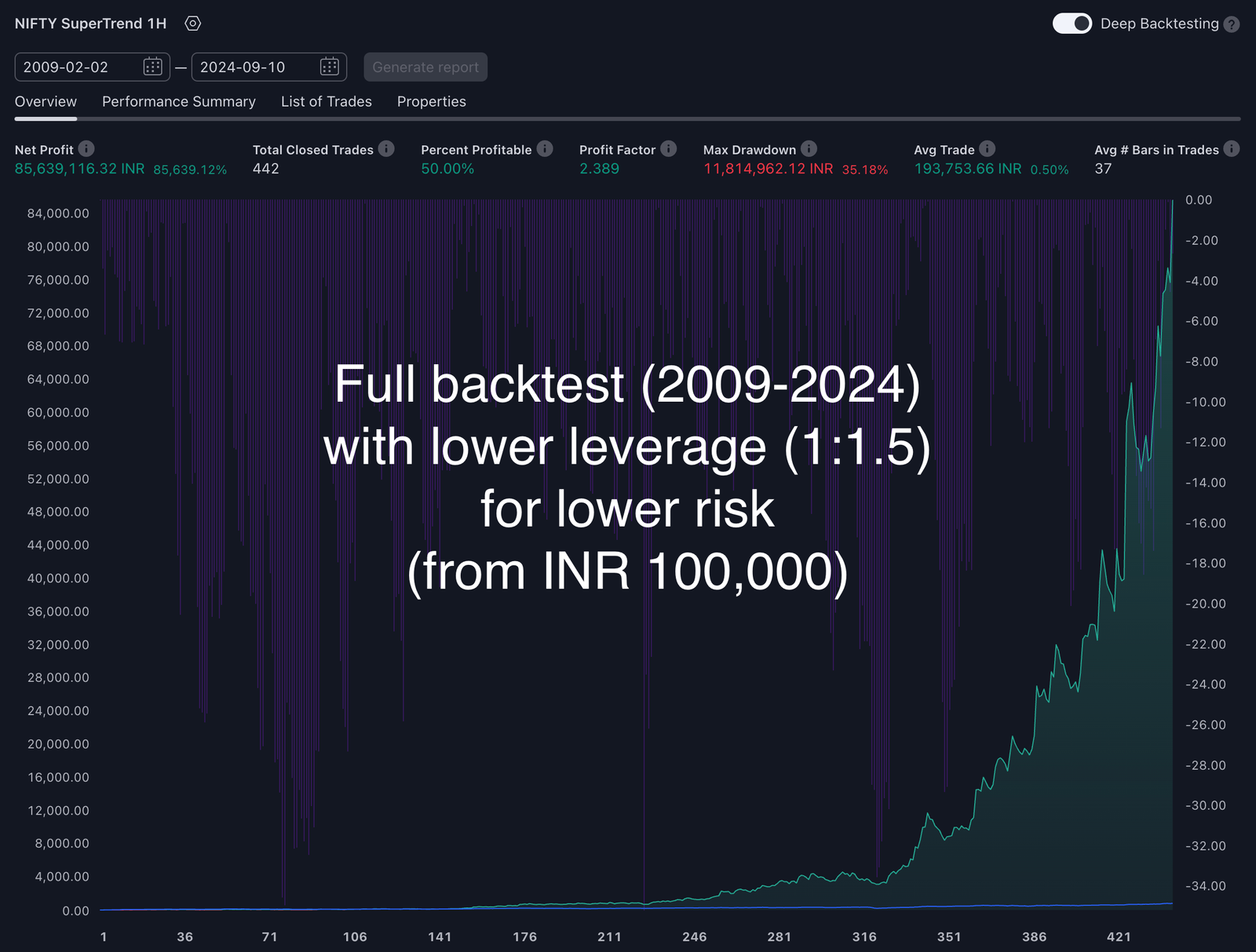

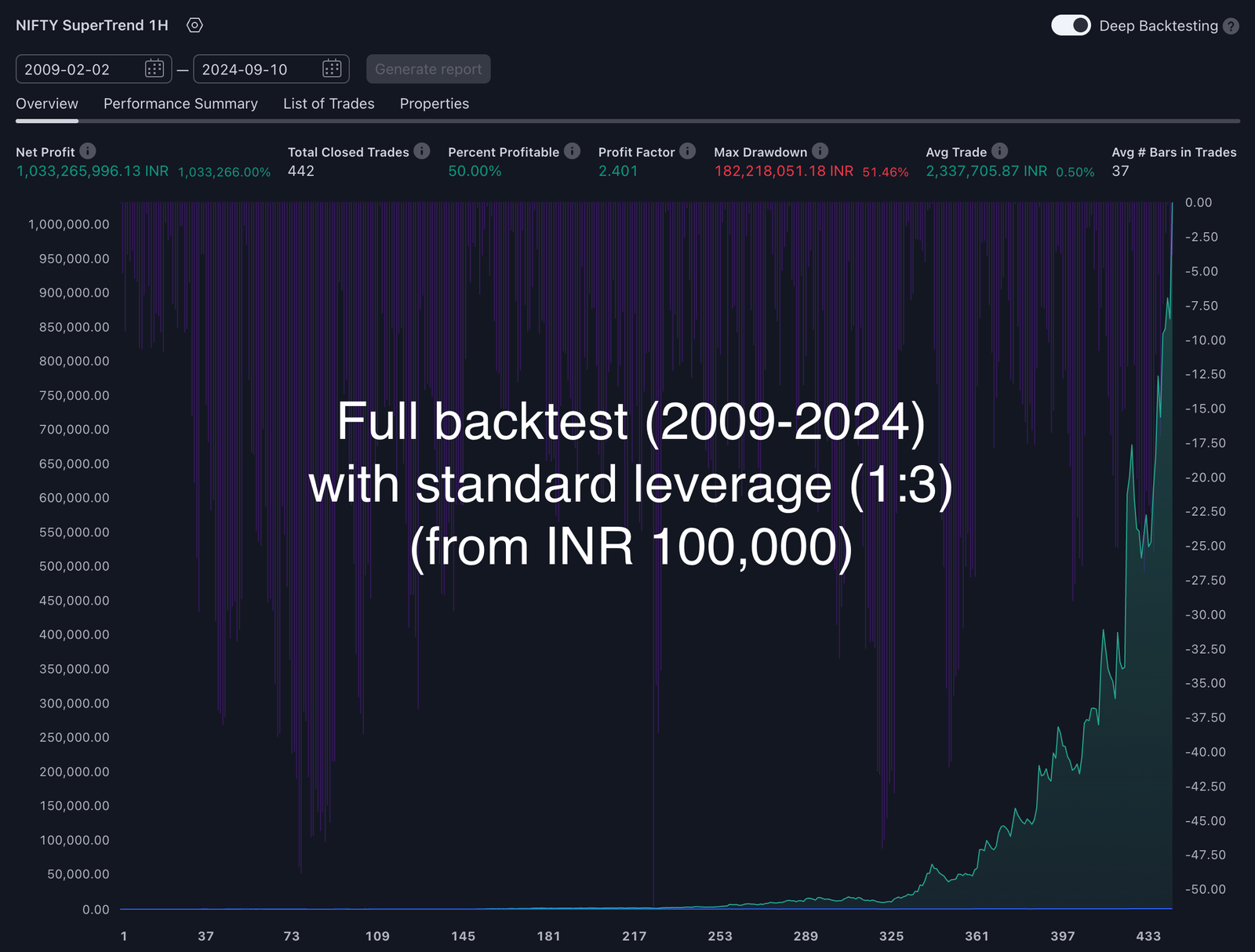

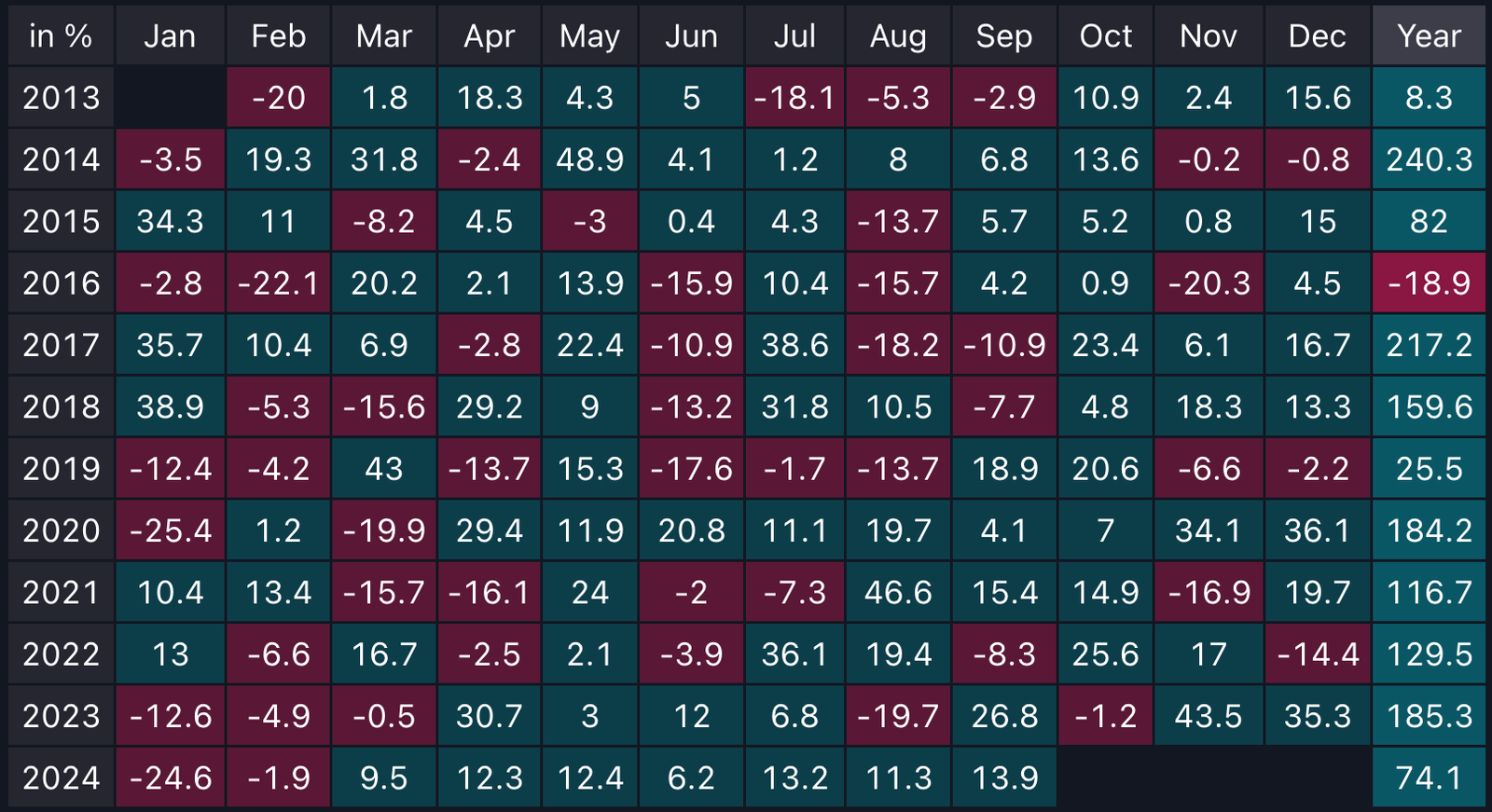

The NIFTY SuperTrend trading strategy is especially optimized for the indian market “NIFTY” in the 1H timeframe with outstanding results of over 1,000,000% profit over the full backtesting period from 2009–2024.

Real results! Test it yourself on TradingView.

DEMO & HOW TO USE:

NIFTY SuperTrend – 1-Hour Volatility-Aware Trend Catcher

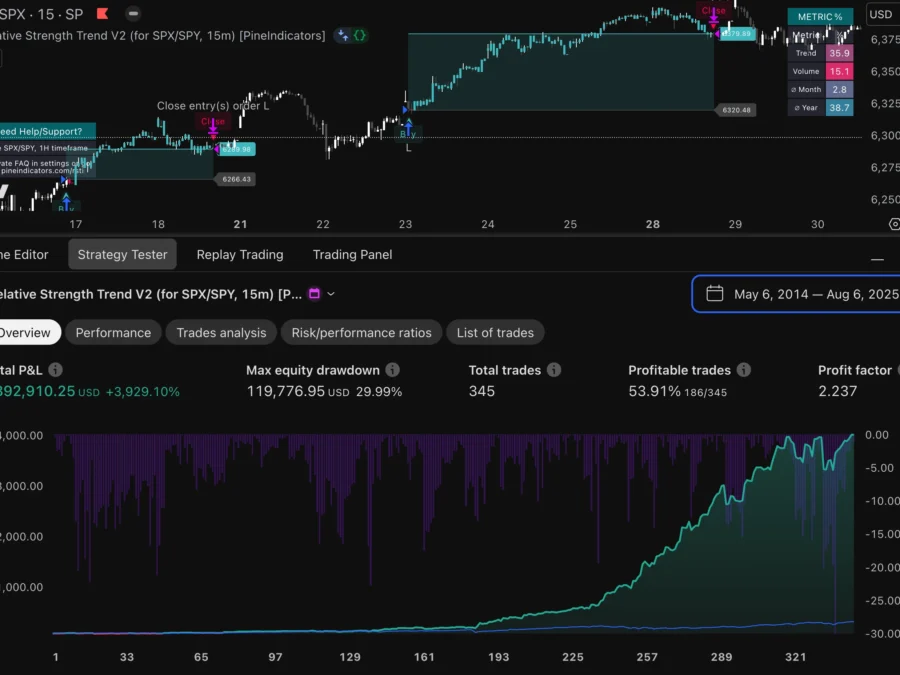

| Metric | Value |

|---|---|

| Net return | +15 287 % |

| Profit factor | 1.64 |

| Win-rate | ≈ 51 % (165 / 324) |

| Max drawdown | -29.9 % |

| Avg trades / year | ≈ 27 |

*TradingView Strategy Tester · 0.01 % commission · 2-tick slippage · continuous compounding.

Why NIFTY SuperTrend Elevates Index Swing-Trading

- Cluster-adapted ATR — every bar is classified into

low, mid or high volatility using an unsupervised

K-means routine.

The SuperTrend band then re-scales automatically, giving tight stops during quiet

sessions and wider room when India VIX spikes. - One-direction focus — code deliberately takes

long-only trades.

That lines up with the structural upward bias of NIFTY 50 and

keeps margin requirements simple. - Position-sizing slider — choose Fixed Lot,

% of Equity or the built-in Optimised mode that scales lots by

ATR.

A single number lets you dial risk up or down; profits expand accordingly. - ATR-smart entries & exits — the moment price flips from

below to above the adaptive band, a buy order fires.

Reversal of that same band prints the exit – no subjective second-guessing

required. - Instant visual feedback — a teal-to-magenta ribbon hugs the

candles, darkening as the buffer tightens so you always know where the invalidation

point sits. - JSON webhooks pre-packed — alerts are ready to plug into

any broker automation service. Simply paste your webhook URL, click “Create

Alert” and enjoy hands-free execution. - On-chart safety hints — lot below platform minimum?

Drawdown nearing your equity?

A discreet pop-up reminds you to adjust before things get out of hand.

Adjust Risk in Seconds

The Order Size box is the strategy’s heartbeat.

At 25 % you risk a quarter of equity per signal; at 150 % you’re leaning on

leverage for aggressive growth.

Because sizing is driven by equity and ATR, the system stays proportionate

whether NIFTY is at 8 000 or 24 000.

Quick-Start Checklist

- Apply NIFTY SuperTrend 1H to the NSE:NIFTY 1-hour chart.

- Pick your preferred order-size mode and value.

- Press ⌥ + B to open the Strategy Tester and verify the

equity curve before going live. - (Optional) set up a webhook alert to auto-forward each trade

to Zerodha, Upstox, Fyers, etc.

From intraday positional players to longer-term swing traders, the NIFTY

SuperTrend strategy offers a disciplined, volatility-aware roadmap for

compounding returns on India’s flagship index.

Add it to your toolkit and let the adaptive band do the heavy lifting.

If you need help or if you have questions please send us an email or use our support chat!

Reviews

There are no reviews yet.