CYBER WEEK -70%

Overall Profit

or $ 2,596

Avg. Profit

Win Rate

Profit Factor

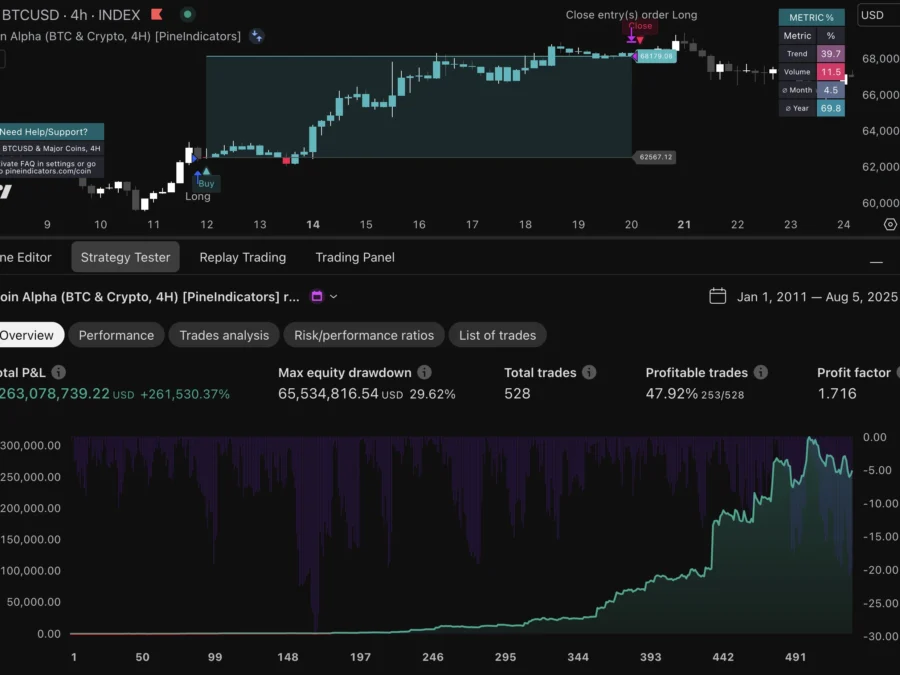

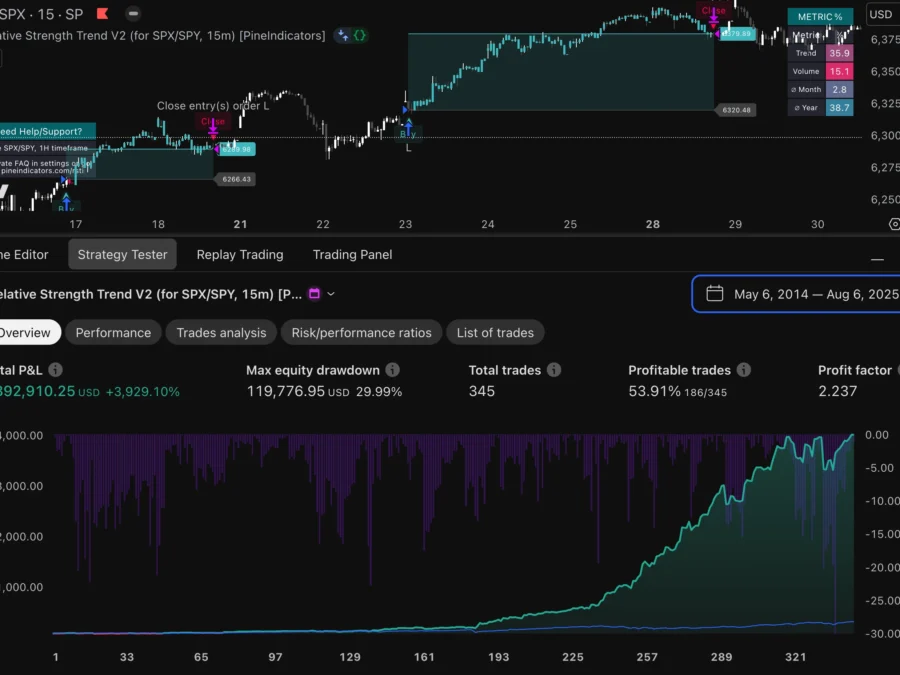

MAR Art 20 Disclosure Date/Time: 2025‑07‑26 14:00 CET Instrument: Nasdaq 100 Index (NDX) – 2 hour timeframe Information: Backtest result (2005-2025) Methodology: Historical simulation via TradingView Strategy Tester Interests: No holdings; no conflicts of interest Source: © PineIndicators | MAR Art 20 Disclosure Date/Time: 2025‑07‑26 14:00 CET Instrument: S&P 500 Index (SPX) – 15 minute timeframe Information: Backtest result Methodology: Historical simulation via TradingView Strategy Interests: No holdings; no conflicts of interest Source: © PineIndicators | MAR Art 20 Disclosure Date/Time: 2025‑07‑26 14:00 CET Instrument: Nasdaq 100 Index (NDX) – 2 hour timeframe (Only Long variant) Information: Backtest result Methodology: Historical simulation via TradingView Strategy Tester Interests: No holdings; no conflicts of interest Source: © PineIndicators

Hypothetical performance results have many inherent limitations. Past performance is not a reliable indicator of future results. Educational Use Only. Not financial advice.

Watch the DEMO + How to use video:

V2 Out Now! Here are the updates:

| Metric | Value |

|---|---|

| Net return | +2 596 % |

| Profit factor | 7.64 |

| Win-rate | 81.5 % (282 / 346) |

| Max drawdown | -30.1 % |

| Avg trades / year | ≈ 17 |

*TradingView Strategy Tester · 0.01 % commission · 1-tick slippage · continuous compounding.

step × φn.The Order Size slider is your master dial.

Move it to 20 % and SureShot allocates one-fifth of equity per entry grid-layer;

bump it to 80 % and the same setup compounds dramatically faster.

The underlying maths stay identical, so you can A/B test position sizing

without re-optimising parameters.

Whether you run a portfolio of trends or focus solely on the NASDAQ,

SureShot V3 provides an adaptive, rules-based way to scale positions

intelligently while maintaining tight risk discipline.

Subscribe today and let the grid work for you.

If you need more info please send a message through our live chat – We’re happy to help!

If you see this message just increase your initial capital and/or position size.

This error occurs because TradingView has a minimum positions size and if it’s too small it won’t open trades.

If you see this message just increase your initial capital and/or decrease position size or change the strategy-mode.

This error occurs when the drawdown is too high and your equity falls under 100%. Then it’s not possible to open new positions.

Only logged in customers who have purchased this product may leave a review.

Cancel anytime

#1 TradingView marketplace | ★★★★★ 4.88/5 stars | Trusted by 1.000+ traders

It was never so easy to get access to professional, backtested trading strategies:

Subscribe to an indicator/strategy and test it risk free with 30-day money-back guarantee (cancel anytime)

Go to TradingView (open an account) and add the strategy/indicator to your chart

Set up alerts and/or automate your strategy with out own strategy automation service.

Should the trading indicator/strategy not work as described, you will get your money back instantly.

All strategies are working real time with immediate buy and sell signals

We deeply backtested and verified all strategies manually to ensure they work smoothly

We provide backtested profitable strategies for all major markets like Indices, Forex, Crypto & more

You can test every strategy/indicator risk free with 30-day money-back guarantee. If you shouldn’t be satisfied you can just cancel your subscription within 1 click in your dashboard.

Just send us a message and you will get your money back instantly.

We deeply tested every strategy, so you can be sure that the results are 100% real and they function like intended.

Our strategies are top notch and one of the best in the trading space – The backtests have shown positive results in most cases with realistic conditions, like commissions, spreads, fees and slippage. However markets are volatile and there is no strategy that can ensure profits long term.

We try to provide best quality and profitable indicators and strategies. But historical data never ensures future results. No indicator or strategy will ensure profit.

Please check our indicators and strategies, find the one(s) you like to use and investigate yourself before taking real trades.

Please understand that this is no investing or financial advise. Only invest capital that you are able to lose and test indicators and strategies yourself. We assume no liability for positive or negative results.

1. Find a strategy/indicator you like and test it risk free with 30-day money-back guarantee

2. Go to TradingView and check our strategies, find one or more you like to use.

If you subscribe to a strategy you get access to it on TradingView within 24 hours. When you have access you will get an email. Then just search for the strategy on TradingView and add to chart.

Now you can setup the strategy with your broker’s settings and setup alerts.

Here is a video tutorial of how to use

(if you are not satisfied with the strategy/indicator you can cancel your subscription within 1 click)

When they are so profitable why should they sell them? Good question and it’s a valid point, but it can indeed make sense for profitable traders to sell their scripts.

The answer is pretty simple: A second income stream.

While markets are volatile and no indicator or strategy works perfectly, even top traders have bad times with drawdowns and losses. Selling scripts provide them another income stream that helps them to earn money even in bad market times.

Also consider that traders normally have a bunch of indicators and strategies, allowing them to sell some of them and keep others.

Just go to “Subscription” in your user dashboard and click on “cancel subscription” – That’s it!

“Best” is really subjective and depends on your own trading style.

But in terms of profit the “Relative Strength Trend Strategy” is the most profitable right now.

If you like to trade specific markets and instruments, we have especially optimized strategies for that:

Yes, you can!

All of our strategies are built in a way so you can automate them with nearly any automation service out there.

What you need is:

– One of our strategies

– Any PAID TradingView plan (to be able to send webhooks. “Premium” for non expiring alerts)

– An automation service (Like 3commas, PineConnector, etc. Some crypto exchanges even have this already integrated)

– An account at a broker or exchange

Our strategies are deeply backtested and optimized, as well as risk adjusted (You can also set your own risk level).

You can test them yourself deeply on TradingView.

But of course trading is risky and in bad market conditions it can come to drawdowns. Only risk capital you are able to lose. Historical results never ensure future profits.

You find all information about the right settings on the details page of the strategy (on pineindicators.com).

When you want to change the currency it can come to an error of the script. This happens because some of our strategies use the initial capital to calculate order size (to be more profitable, have less drawdowns and let you set your own risk level), but this changes the value of the ratio between risk multiplier and initial capital and can result in an error.

But here is the solution to it:

Here is a video tutorial on how to change currency and get rid of errors

Don’t worry, this is easy to fix!

Depending on your stand it can one of the following reasons:

Still not working? Send us a message, we are happy to help!

Don’t worry, this is also easy to fix!

Choose the correct instrument, timeframe and settings for your strategy. You find all information on the details page of the strategy on pineindicators.com

The most common error is when you don’t use enough or too much risk per trade. Try to increase/decrease the initial capital and/or change risk per trade.

Here is a video tutorial on how to change currency and get rid of errors

Of course not. All strategies are deeply backtested to make sure they are non repainting, giving real time alerts and signals and have build in risk management, so you can just focus on trading and don’t need to worry about any technical stuff.

Cancel anytime

Wait! Before your leave, don’t forget to…

OR copy the website URL and share it manually:

https://pineindicators.com/free

Reviews

There are no reviews yet.