Introduction

The Relative Strength Index (RSI) is a tool used in technical analysis to measure how fast and how much prices are changing. Traders mainly use RSI to spot when the market might be too high (overbought) or too low (oversold). The RSI scale goes from 0 to 100, with 70 indicating overbought and 30 indicating oversold.

TradingView is a top choice for using RSI strategies. It offers powerful charting tools and customizable indicators, making it easy for traders to apply different RSI strategies effectively. This can help improve their decision-making in both real-time trading and testing past data.

Understanding the Basics of RSI

The Relative Strength Index (RSI) is a widely-used momentum oscillator that helps traders identify potential overbought and oversold conditions in the market. Developed by J. Welles Wilder, RSI measures the speed and change of price movements, providing critical insights into market dynamics.

How RSI Works as a Momentum Oscillator

RSI operates on a scale from 0 to 100:

- Above 70: Indicates overbought conditions, suggesting that the asset may be due for a price correction.

- Below 30: Signals oversold conditions, implying that the asset might be undervalued and poised for a price increase.

The formula calculates RSI based on average gains and losses over a specified period, typically 14 days. This calculation smooths out random price fluctuations and highlights genuine trends.

Significance of Different RSI Values

Different RSI values have distinct implications:

- 70 and Above: When the RSI breaches this level, it often suggests an asset is overbought. Traders might consider selling or shorting positions.

- 30 and Below: A dip below this threshold usually indicates oversold conditions. This could be a buy signal for traders looking to capitalize on potential upward price movement.

- Between 30 and 70: Represents neutral territory where the market isn’t strongly trending in either direction.

Understanding these values helps traders make informed decisions, leveraging RSI to gauge market momentum accurately.

Setting Up RSI on TradingView: A Step-by-Step Guide

To effectively use the Relative Strength Index (RSI) on TradingView, follow these steps to add and customize this powerful indicator:

1. Accessing TradingView

Log in to your TradingView account. If you don’t have an account, sign up for free.

2. Navigating to the Chart

Open the chart of the asset you wish to analyze. Use the search bar at the top of the interface to find specific stocks, forex pairs, or cryptocurrencies.

3. Adding the RSI Indicator

- Click on the Indicators button located at the top of the chart.

- Type “Relative Strength Index” in the search bar within the Indicators window.

- Select Relative Strength Index (RSI) from the list of results.

4. Customizing RSI Settings

Once added, click on the RSI indicator settings icon (gear symbol) next to its name in the chart’s overlay.

You can adjust parameters such as:

- Length: Default is 14 periods; modify based on your trading strategy.

- Overbought/Oversold Levels: Default levels are set at 70 and 30; customize these thresholds as needed.

5. Enhancing Visibility & Analysis

In the settings window, navigate to the Style tab.

Customize visual elements like line color, thickness, and background shading for overbought/oversold zones.

6. Saving Your Workspace

Click on Save Layout to preserve your customized RSI settings for future use.

By following these steps, you ensure that your RSI setup on TradingView is tailored for optimal analysis and decision-making.

Implementing a Basic RSI Strategy with TradingView

Executing a simple yet effective RSI strategy on TradingView can be straightforward. This guide outlines the steps to follow for entering long and short positions using the Relative Strength Index (RSI).

Step-by-Step Instructions:

- Open Your Chart:

- Navigate to TradingView and open the chart of your desired financial instrument.

- Add the RSI Indicator:

- Click on the Indicators button at the top of the chart.

- Search for “Relative Strength Index” and select it from the list. For detailed instructions on how to add the RSI line to your chart in TradingView, refer to this guide.

- Customize RSI Settings:

- Access the settings by clicking on the gear icon next to the RSI indicator.

- Set the period to 14 (default), and adjust overbought and oversold levels to 70 and 30, respectively. More information about customizing RSI settings can be found in this article.

- Identify Entry Points:

- Long Positions: Look for instances where the RSI crosses above the 30 level, indicating an oversold condition.

- Short Positions: Watch for when the RSI crosses below the 70 level, signaling an overbought condition.

- Execute Trades:

- Place a buy order when you identify a long position signal.

- Place a sell order when you spot a short position signal.

- Monitor and Adjust:

- Continuously monitor your positions, making adjustments as needed based on price movements and RSI readings.

- Set Stop-Loss and Take-Profit Levels:

- Protect your trades by setting stop-loss orders below recent lows for long positions or above recent highs for short positions.

- Define take-profit levels to lock in gains once your target is reached.

This basic strategy leverages clear signals provided by RSI values, helping traders make informed decisions. Customizing parameters and consistently monitoring trades ensures better alignment with market conditions.

Exploring Advanced RSI Strategies for Enhanced Trading Performance

1. Combining RSI with Exponential Moving Average (EMA) Filter for Confirmation Signals

Integrating an Exponential Moving Average (EMA) filter with the RSI can significantly enhance the reliability of your trading signals. The EMA, which places more weight on recent price data, helps smooth out price fluctuations and provides a clearer trend direction.

Benefits of Combining RSI with EMA

- Improved Signal Accuracy: By filtering RSI signals through the EMA, you can reduce false signals caused by short-term market noise.

- Trend Confirmation: The EMA confirms the prevailing trend, allowing traders to align their trades with the broader market direction.

- Enhanced Entry and Exit Points: Combining these indicators can refine your entry and exit points, leading to better trade timing.

Implementing the Strategy on TradingView

To set up this strategy on TradingView:

- Add Indicators:

- Open your TradingView chart.

- Click on the Indicators button.

- Search for and add both Relative Strength Index (RSI) and Exponential Moving Average (EMA).

- Customize Settings:

- For RSI: Adjust the period settings to your preference, typically 14 periods.

- For EMA: Set a period that complements your trading style; common choices are 20 or 50 periods.

- Set Criteria:

- Enter a long position when:

- The RSI crosses above the 30 level (oversold).

- The price is above the EMA line, indicating an upward trend.

- Enter a short position when:

- The RSI crosses below the 70 level (overbought).

- The price is below the EMA line, indicating a downward trend.

Real-Life Examples

Consider a scenario where you have set a 14-period RSI and a 50-period EMA:

Long Trade Example

- The RSI dips below 30, signaling an oversold condition.

- Simultaneously, the price moves above the 50-period EMA, confirming an upward trend.

- This alignment suggests a high-probability entry point for a long position.

Short Trade Example

- The RSI rises above 70, indicating overbought conditions.

- At the same time, the price falls below the 50-period EMA, confirming a downward trend.

- This setup presents an optimal opportunity to enter a short position.

These steps demonstrate how combining RSI with an EMA filter can help identify more reliable trading signals. This approach leverages both momentum and trend-following principles to enhance your decision-making process.

2. Using Volume Weighted RSI Strategies to Improve Trading Decisions

Adding volume to RSI analysis can give traders valuable insights. A Volume Weighted RSI strategy looks at both price movements and trading volume, giving a more detailed view of market conditions.

How It Works:

- Volume Analysis: By considering trading volume, you get a better idea of the strength behind price movements. This helps in spotting real momentum changes.

- Better Signals: Volume-weighted calculations can filter out noise, making RSI signals more reliable.

Practical Implementation Steps:

- Add RSI and Volume Indicators: On TradingView, start by adding both the RSI and volume indicators to your chart.

- Apply Volume Weighting: Use built-in scripts like the Dynamic Volume RSI (DVRSI) or create a custom script to weight the RSI based on trading volume.

- Set Up Alerts: Configure alerts for when the volume-weighted RSI crosses key levels (e.g., 30 for oversold, 70 for overbought).

Case Study:

Imagine a situation where the traditional RSI shows an overbought condition at level 75. However, adding volume—perhaps through an On-Balance Volume analysis—shows that this spike is backed by significant trading activity. In this case, relying only on the traditional RSI might cause you to miss a continued upward trend supported by high volume.

This strategy makes sure you’re not just reacting to price movements but understanding their underlying momentum, giving you an advantage in decision-making processes.

3. Identifying Divergence Signals between Price Action and RSI Readings as Potential Reversal Indicators

Spotting divergences between price action and RSI readings is an advanced strategy that can effectively signal potential reversals. Divergence occurs when the price of an asset moves in the opposite direction of the RSI, indicating a possible shift in momentum.

Types of Divergences:

- Bullish Divergence: This happens when the price makes lower lows while the RSI forms higher lows. It suggests that despite the falling prices, the momentum is gaining strength, potentially heralding a bullish reversal.

- Bearish Divergence: This occurs when the price makes higher highs while the RSI posts lower highs. It indicates weakening momentum despite rising prices, often forewarning a bearish reversal.

Techniques to Visualize Divergence Patterns on TradingView:

- Add RSI Indicator: Begin by adding the RSI indicator to your TradingView chart.

- Identify Peaks and Troughs: Look for peaks (highs) and troughs (lows) in both the price chart and RSI indicator.

- Draw Trendlines: Use trendlines to connect these peaks and troughs on both charts to easily spot divergences.

- Confirm with Candlestick Patterns: Enhance accuracy by confirming divergence signals with candlestick patterns or other technical indicators.

Practical Example:

Consider a scenario where Bitcoin’s price is making consecutive higher highs, but its RSI is showing lower highs. This bearish divergence can be visualized on TradingView by plotting trendlines, signaling traders to anticipate a potential downturn.

These advanced techniques amplify the effectiveness of RSI in trading by providing early warnings of trend reversals, allowing traders to make more informed decisions.

Using Customizable Time Frames in TradingView for Effective Risk Management and Strategy Testing with RSI Approaches

Choosing the right time frames is essential when implementing RSI strategies in live trading. Different time frames can yield different signals, impacting the reliability and timeliness of your trades. For instance:

- Short-term traders might utilize 1-minute or 5-minute charts to capture rapid price movements.

- Swing traders could favor 4-hour or daily charts to identify longer-term trends.

- Long-term investors might depend on weekly or monthly charts to make decisions based on broader market trends.

Optimizing Risk Management with Custom Time Frames

With TradingView’s customizable time frames, traders can enhance their risk management strategies. Here’s how:

- Set stop-loss and take-profit levels tailored to each time frame.

- Mitigate potential losses while maximizing gains.

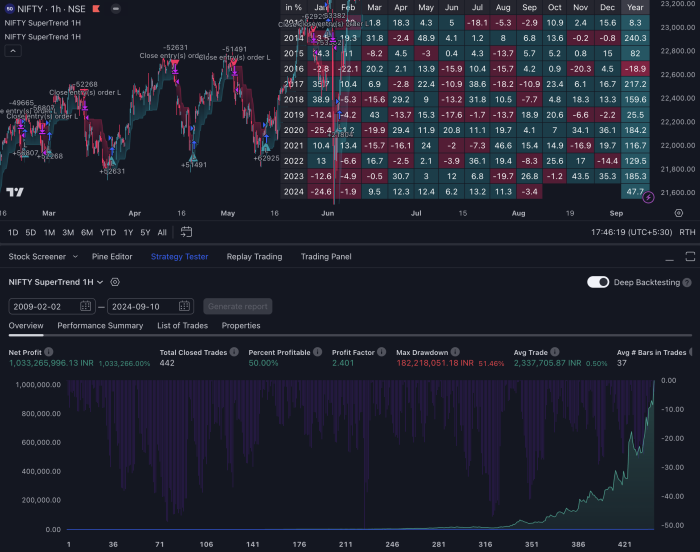

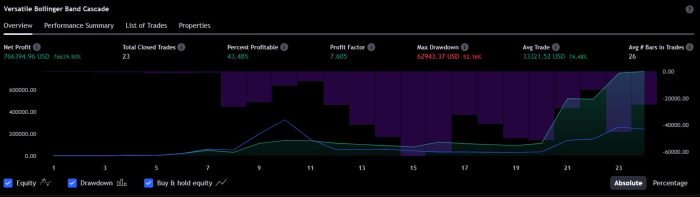

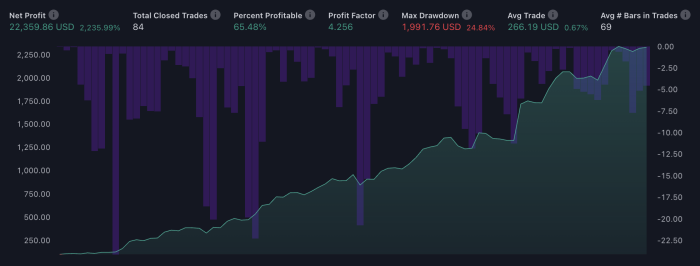

The Power of Backtesting

Another advantage of using TradingView’s customizable time frames is the opportunity to conduct comprehensive backtests before executing trades solely based on RSI signals. By backtesting, you can:

- Assess how your RSI strategy would have performed historically across various time frames.

- Determine which time frame offers the most reliable signals for your trading style.

- Modify your strategy parameters to improve performance and reduce risks.

TradingView provides robust tools for this purpose, enabling you to simulate trades and analyze outcomes without risking real money. This approach ensures that you make informed trading decisions supported by historical data and current market conditions.

Conclusion: Making Informed Trading Decisions Using RSI Strategies on TradingView

Combining technical analysis tools like the Relative Strength Index (RSI) with robust platforms such as TradingView can significantly enhance your trading outcomes. TradingView’s diverse functionalities allow you to:

- Implement basic and advanced RSI strategies seamlessly.

- Customize time frames for optimized risk management.

- Leverage integrated tools for comprehensive strategy testing.

Effective trading decisions are rooted in understanding market conditions and utilizing reliable indicators. By integrating RSI strategies on TradingView, traders gain a powerful edge in identifying potential market movements and executing well-informed trades. This synergy between RSI insights and TradingView capabilities ensures that you are equipped to navigate the complexities of trading with confidence and precision.

FAQs (Frequently Asked Questions)

What is the Relative Strength Index (RSI) and why is it important in trading?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in a market. RSI is significant in trading as it helps traders determine potential reversal points, allowing for more informed decision-making.

How can I set up RSI on TradingView?

To set up RSI on TradingView, you need to access the platform, open your desired chart, click on ‘Indicators’, search for ‘Relative Strength Index’, and add it to your chart. You can customize its settings by clicking on the indicator’s name after adding it, allowing you to adjust parameters like period and style for optimal analysis.

What are some basic RSI strategies I can implement using TradingView?

A basic RSI strategy involves looking for overbought or oversold signals based on RSI values. For long positions, consider entering when RSI falls below 30 (oversold), while for short positions, look for entries when RSI rises above 70 (overbought). These thresholds can help identify potential trade opportunities.

How can I enhance my trading performance with advanced RSI strategies?

Advanced RSI strategies include combining RSI with an Exponential Moving Average (EMA) filter for confirmation signals, leveraging volume-weighted RSI strategies to improve decision-making, and identifying divergence signals between price action and RSI readings as potential reversal indicators. These techniques can provide deeper insights and improve trade reliability.

Why is it important to select appropriate time frames when using RSI strategies?

Selecting the right time frame is crucial when applying RSI strategies because different time frames can yield varying results. Customizable time frames on TradingView allow traders to optimize their risk management techniques and conduct thorough backtests, ensuring that their strategies are effective in live trading scenarios.

What should I keep in mind when making trading decisions using RSI on TradingView?

When making trading decisions using RSI on TradingView, it’s essential to combine technical analysis tools like the RSI with robust platforms for better outcomes. Always consider market conditions, use additional indicators for confirmation, and practice sound risk management techniques to enhance your chances of success.