Introduction

Scalping strategies in trading involve executing a high volume of trades to capitalize on small price movements. These short-term trading techniques are significant for traders who aim to make quick profits and minimize market exposure. Scalping requires precision, speed, and a solid understanding of market conditions.

TradingView is a powerful tool for implementing scalping strategies in 2024. It provides a range of technical indicators, real-time data, and user-friendly charting capabilities that are essential for successful scalping. By leveraging TradingView’s advanced features, traders can develop and refine their scalping techniques to navigate the fast-paced trading environment effectively.

Understanding Scalping Strategies

Scalping is a high-frequency trading technique aimed at making profits from small price changes. This approach involves executing numerous trades within short time frames, often seconds to minutes, and capitalizing on the minor fluctuations in the market. Key characteristics of scalping include:

- High Trade Volume: Scalpers execute multiple trades daily.

- Quick Decision-Making: Rapid entry and exit points.

- Small Profit Margins: Each trade aims for minimal gains that accumulate over time.

Market volatility plays a crucial role in successful scalping endeavors. Volatile markets provide more opportunities for quick profits due to frequent price movements. When the market is stable, price changes are minimal, making it harder to achieve substantial gains through scalping.

A few essential aspects of market volatility in scalping:

- Increased Opportunities: Higher volatility leads to more frequent price swings.

- Risk Management: Volatile markets can also increase the risk of losses; hence, effective risk management is vital.

- Indicator Sensitivity: Adjusting indicator settings to account for rapid price movements ensures timely trade execution.

Understanding these fundamentals helps you leverage TradingView’s powerful tools to implement efficient scalping strategies tailored to your trading goals.

Essential Indicators and Tools for Effective Scalping

1. Moving Averages: Identifying Trends with Precision

Technical analysis tools are essential in scalping strategies, especially on platforms like TradingView. Among these tools, moving averages stand out for their ability to identify and confirm trends with precision.

Simple Moving Average (SMA) vs. Exponential Moving Average (EMA)

- Simple Moving Average (SMA): The SMA calculates the average of a selected range of prices by the number of periods in that range. For instance, a 10-day SMA sums up the closing prices of the past 10 days and divides by 10. This method provides a smooth representation of price movements but may lag due to its simplicity.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices, making it more responsive to new information. This is particularly useful in volatile markets where quick reaction times can make a significant difference. The EMA is often preferred for scalping due to its sensitivity to price changes.

Practical Tips for Utilizing Moving Averages

- Shorter Time Frames: For scalping, shorter time frames such as 1-minute or 5-minute charts are commonly used. Applying moving averages on these time frames can help identify short-term trends quickly.

- Combining SMAs and EMAs: Some traders use a combination of SMAs and EMAs to balance responsiveness and reliability. For example, a 50-period SMA can be paired with a 20-period EMA to capture broader trends while staying alert to recent price movements.

- Crossovers: One effective technique is using moving average crossovers as buy or sell signals:

- Golden Cross: Occurs when a short-term moving average crosses above a long-term moving average, indicating potential upward momentum.

- Death Cross: Happens when a short-term moving average crosses below a long-term moving average, suggesting downward momentum.

Example:

- Use a 9-period EMA with a 21-period SMA on a 5-minute chart.

- When the 9-period EMA crosses above the 21-period SMA, consider it as a buy signal.

- Conversely, when the 9-period EMA crosses below the 21-period SMA, it can be viewed as a sell signal.

- Support and Resistance Levels: Moving averages can also act as dynamic support and resistance levels. Price frequently respects these levels during pullbacks or rallies, providing potential entry or exit points.

Tip:

- Pay attention to how price reacts around the 200-period EMA on intraday charts. This level often serves as strong support or resistance.

Understanding and effectively utilizing moving averages can significantly enhance your scalping strategies on TradingView in 2024. These indicators offer clarity amidst market noise, helping you make informed trading decisions swiftly.

2. Relative Strength Index (RSI): Spotting Overbought and Oversold Conditions

The Relative Strength Index (RSI) is one of the key technical analysis tools, especially important for scalping strategies on TradingView in 2024. This momentum oscillator measures the speed and change of price movements, giving a clear view of whether an asset is overbought or oversold.

Why RSI Matters in Scalping:

- RSI Indicator: The RSI moves between 0 and 100. Normally, an asset is seen as overbought when the RSI is above 70 and oversold when it is below 30.

- Scalping Relevance: In the quick world of scalping, spotting these conditions can lead to very profitable entry and exit points.

How to Identify Overbought and Oversold Levels:

- Divergence: Look for divergence between the RSI and price. If the price is making a new high but the RSI isn’t, this could signal a potential reversal.

- Threshold Adjustments: Change RSI thresholds based on market conditions. For example, in a strong uptrend, you might see an asset as overbought at higher levels (e.g., above 80).

Using these methods ensures that you make the most of one of the most reliable indicators in your scalping efforts.

3. Bollinger Bands: Capitalizing on Volatility Breakouts

Bollinger Bands are an essential part of scalping strategies in TradingView 2024. They help traders spot potential breakouts during times of high market volatility. Bollinger Bands consist of a moving average (usually a simple moving average) and two standard deviation lines, creating a flexible range that adapts to market changes.

Key elements of Bollinger Bands strategy:

- Understanding Volatility: The bands expand when volatility increases and contract during low volatility. This characteristic allows traders to anticipate possible breakout points.

- Identifying Breakouts: When price moves forcefully beyond the upper or lower band, it often signals a potential breakout. Traders can capitalize on these movements by entering positions aligned with the direction of the breakout.

- Mean Reversion Tactics: Prices tend to revert to the mean (the middle band), making Bollinger Bands useful for spotting overbought or oversold conditions.

Practical tips:

- Combine Bollinger Bands with other technical indicators like RSI or MACD for confirmation.

- Use shorter time frames (e.g., 1-minute or 5-minute charts) for quicker scalp trades.

- Adjust band settings to match your trading style and market conditions.

These insights reinforce the importance of technical analysis tools, such as Bollinger Bands, in executing profitable scalping trades.

4. Moving Average Convergence Divergence (MACD): Confirming Trade Directions with Precision

Moving Average Convergence Divergence (MACD) is a powerful tool in technical analysis, especially for scalping strategies on TradingView in 2024. It helps traders confirm trade directions by combining two types of moving averages: the simple moving average (SMA) and the exponential moving average (EMA). This gives a clear picture of market momentum.

Key elements of MACD:

- MACD Line: The difference between the 12-period EMA and the 26-period EMA.

- Signal Line: The 9-period EMA of the MACD line.

- Histogram: The graphical representation of the difference between the MACD line and the Signal line.

How MACD confirms trade directions:

1. Crossover Signals

- Bullish Signal: When the MACD line crosses above the Signal line, indicating potential upward momentum.

- Bearish Signal: When the MACD line crosses below the Signal line, suggesting possible downward movement.

2. Histogram Analysis

- Positive values indicate bullish momentum.

- Negative values signal bearish momentum.

By effectively utilizing MACD signals, you can enhance your scalping strategies on TradingView, aligning trades with confirmed market trends and reducing exposure to false signals.

Exploring Popular Scalping Strategies on TradingView

1. The 5-Minute Scalper’s Playbook: Mastering Quick Trades with Precision

The 5-minute scalping strategy is a popular method for traders looking to make quick, frequent trades. This approach uses two RSI crossovers along with moving averages to generate buy and sell signals.

Detailed Explanation of the Strategy:

Indicators Setup:

- Relative Strength Index (RSI): Configure two RSI indicators with different sensitivity settings. Typically, one might be set at a 7-period to capture rapid price changes, while the other could be set at a 14-period for a more smoothed view.

- Moving Averages: Use both a short-term and a long-term moving average. For instance, a 5-period EMA (Exponential Moving Average) to gauge immediate price action and a 20-period SMA (Simple Moving Average) to understand the broader trend.

Entry Signals:

- RSI Crossovers: Look for instances where the faster RSI crosses above or below the slower RSI. An upward crossover can signal a buying opportunity, while a downward crossover may indicate a selling opportunity.

- Moving Averages Confirmation: Ensure the short-term EMA aligns with the direction of your trade. If you’re entering a buy position, the price should be above both EMAs; for a sell position, it should be below.

Trade Execution:

- Enter trades based on these dual confirmations from RSI crossovers and moving averages.

- Adjust sensitivity settings on the RSI to fit current market volatility.

Key Benefits:

- Minimized Exposure to Market Noise: By focusing on short timeframes and specific indicator confirmations, this strategy helps you avoid false signals that can occur in more volatile environments.

- Quick Reaction Time: The use of short-term indicators ensures that you can react swiftly to market changes, allowing for optimized entry and exit points.

Example:

Imagine you’re monitoring EUR/USD on TradingView using this strategy. You notice that the 7-period RSI crosses above the 14-period RSI while the price is trading above both the 5-EMA and 20-SMA. This combination signals a strong buy opportunity. You enter the trade and set your stop loss just below the recent swing low to manage risk effectively.

This precision-oriented approach is ideal for traders who thrive on rapid decision-making and enjoy staying actively engaged with the markets throughout their trading sessions. Adjusting indicator sensitivity according to market conditions amplifies its effectiveness, making it adaptable across various trading environments.

By employing this structured methodology, you can harness short-term price movements efficiently while maintaining control over potential risks, enhancing your overall trading performance on TradingView.

2. VWAP and RSI: A Dynamic Duo for Intraday Success

The combination of the Volume-Weighted Average Price (VWAP) and the Relative Strength Index (RSI) stands out as a powerful strategy for intraday traders. By leveraging both indicators, you can gain a comprehensive view of market dynamics, effectively identifying potential entry and exit points.

1. Utilizing VWAP for Intraday Trades

VWAP is a highly-regarded tool among traders due to its ability to provide insights into the average price based on volume. It helps you understand whether the current price is above or below the average value, thus indicating potential bullish or bearish trends. When the price is above VWAP, it suggests a buying opportunity; conversely, when it is below, it indicates a selling opportunity.

2. RSI for Confirmation of Overbought/Oversold Conditions

RSI, on the other hand, measures the speed and change of price movements, identifying overbought and oversold conditions. By setting RSI thresholds at levels such as 70 (overbought) and 30 (oversold), you can better time your trades and avoid entering positions prematurely.

3. Key Benefits of Combining VWAP and RSI

- Volume-Weighted Insights: VWAP provides a more accurate representation of average trading prices by considering volume.

- Momentum Confirmation: RSI adds an additional layer of confirmation by highlighting momentum shifts.

- Reduced Market Noise: This dual approach minimizes exposure to false signals often present in high-frequency trading environments.

For practical implementation:

- Monitor Intraday Charts: Focus on 5-minute or 15-minute charts to capture short-term price movements.

- Identify Divergence: Look for divergence between RSI levels and price trends to identify potential reversals.

- Adjust Sensitivity: Fine-tune your RSI settings based on your risk tolerance and trading style.

This strategy aligns well with other effective scalping strategies suitable for TradingView users, making it an indispensable addition to your trading toolkit.

3. Breakout and Retest Strategy: Riding the Waves of Price Action

Breakout and Retest Strategy focuses on identifying consolidation phases—periods when the price moves within a horizontal range before an expected breakout. This strategy is highly effective for traders using TradingView, providing an excellent opportunity to ride strong market trends while controlling risk.

Identifying Consolidation Phases

- Look for horizontal ranges where the price oscillates between support and resistance levels.

- Use tools like TradingView’s drawing tools to mark these key levels visually.

- Indicators such as Bollinger Bands can help confirm consolidation by showing constricted bands during low volatility periods.

Placing Limit Orders at Breakout Points

- Set limit orders just beyond resistance (for long trades) or support (for short trades) levels to catch the initial breakout.

- Ensure you have proper stop loss management. Place stop losses just inside the range boundaries to minimize potential losses if the breakout fails.

Managing Risk

- Key benefit: This strategy allows traders to enter positions early in strong trends while maintaining risk control measures.

- Adjust sensitivity settings on your indicators to match current market conditions, ensuring timely entry points.

Example Setup on TradingView

- Identify Horizontal Range: Use a 5-minute chart to spot consolidation phases.

- Set Limit Orders: Place your buy/sell orders slightly outside the identified range.

- Stop Loss Placement: Position stop losses within the range boundaries.

- Monitor Volatility: Utilize indicators like RSI crossovers for confirmation of breakout momentum.

This approach, combined with other strategies like the 5-minute scalping strategy or VWAP strategy, enhances your ability to capitalize on market movements effectively.

Effective Exit Strategies for Successful Scalpers

Profit-taking methods are crucial in scalping to lock in gains from small price movements. Effective exit strategies ensure that you maximize profits while minimizing losses. Here are some key techniques:

1. Predefined Profit Targets

Setting predefined profit targets helps you exit trades systematically:

- Define a fixed percentage profit (e.g., 1% or 2%) for each trade.

- Use technical levels such as support and resistance, Fibonacci retracements, or pivot points to determine exit points.

2. Trailing Stop-Loss Orders

Trailing stop-loss orders adjust dynamically with price movements, protecting your gains:

- Set a fixed distance from the current price to automatically adjust the stop-loss level.

- Utilize indicators like ATR (Average True Range) to set more adaptive trailing stops based on market volatility.

3. Exit Signals from Indicators

Indicators provide clear exit signals, ensuring timely exits:

- Exit when RSI reaches overbought or oversold conditions.

- Look for MACD crossovers signaling potential reversals.

- Exit when price touches or crosses the upper/lower bands.

4. Time-Based Exits

Time-based exits involve closing positions after a set period:

- Close trades after specific durations, such as 5 or 15 minutes.

- Align exits with market session changes to avoid low liquidity periods.

5. Partial Profits

Taking partial profits can balance risk and reward:

- Gradually sell portions of your position as the price moves favorably.

- Combine multiple exit strategies, such as taking partial profits at predefined targets and letting the rest run with a trailing stop.

Effective exit strategies in scalping not only protect your capital but also enhance overall trading performance by ensuring disciplined profit-taking methods.

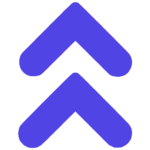

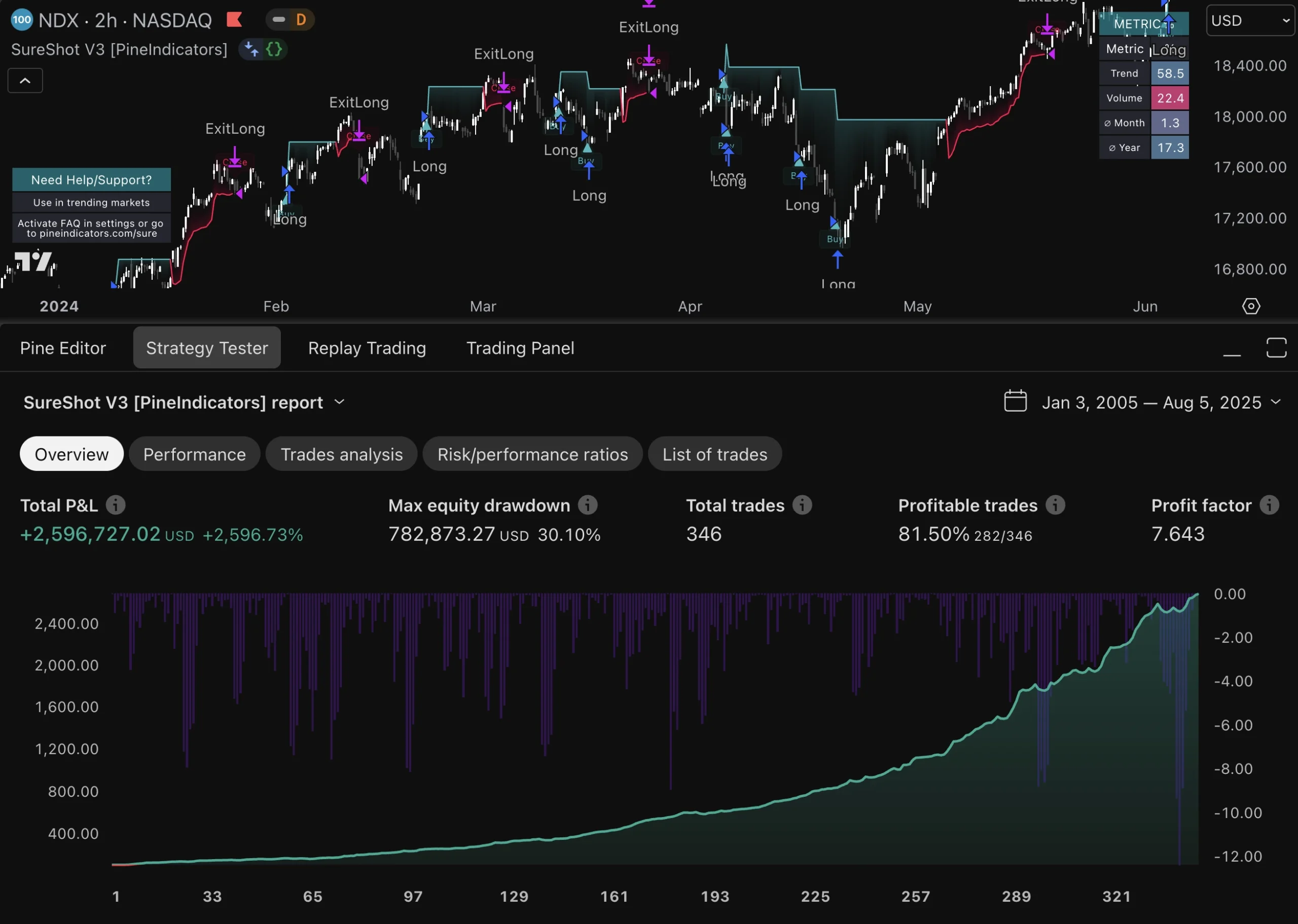

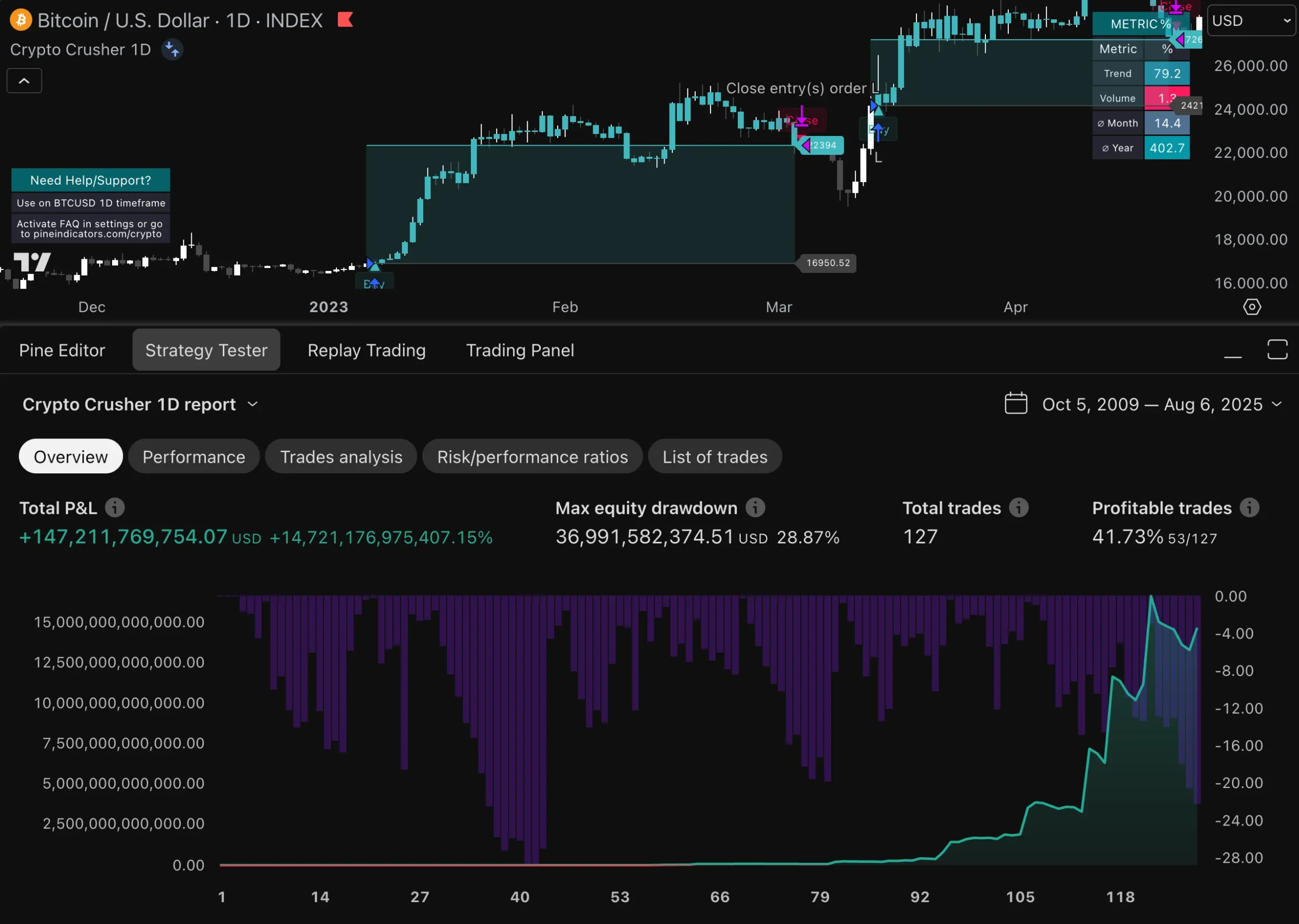

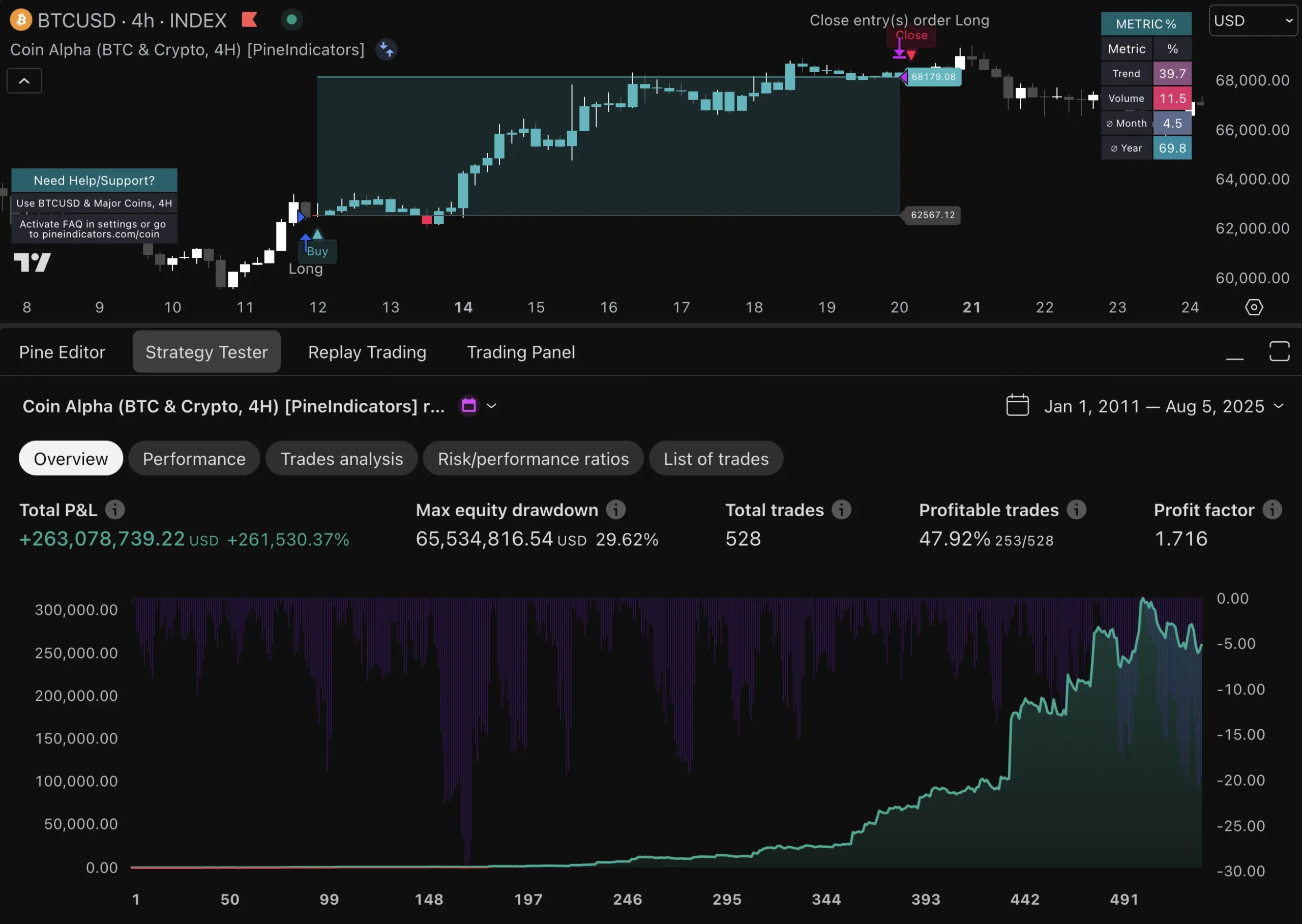

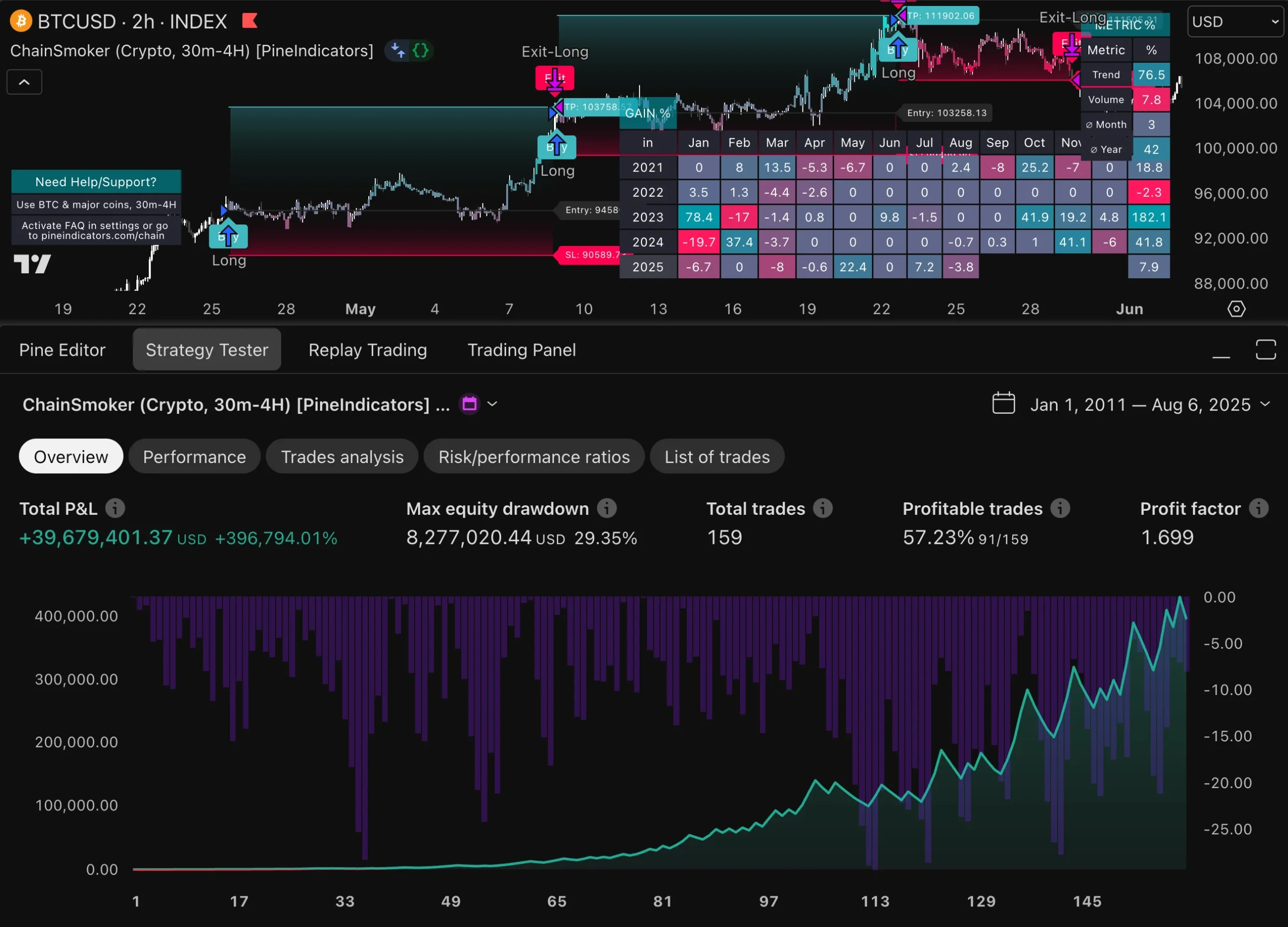

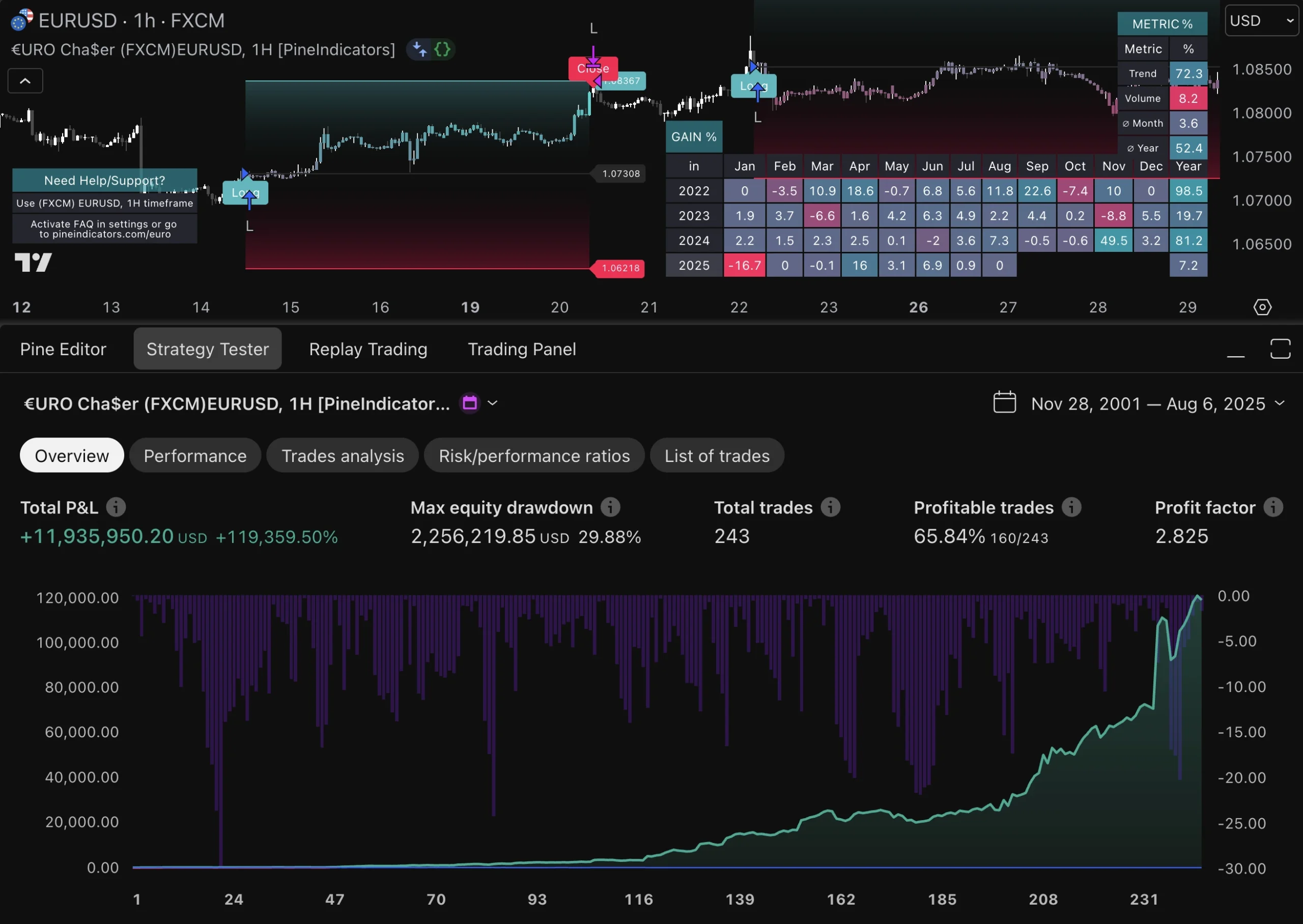

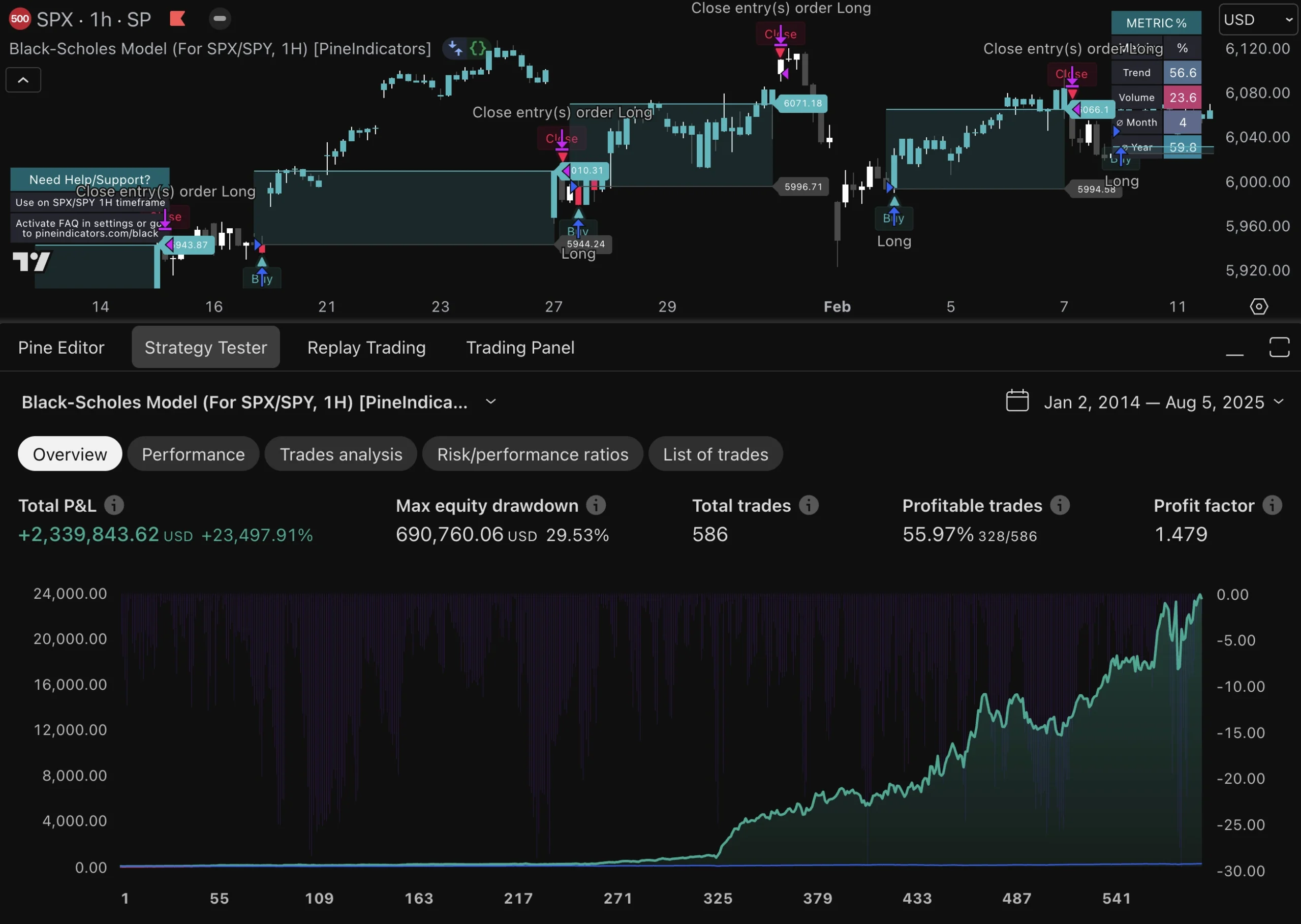

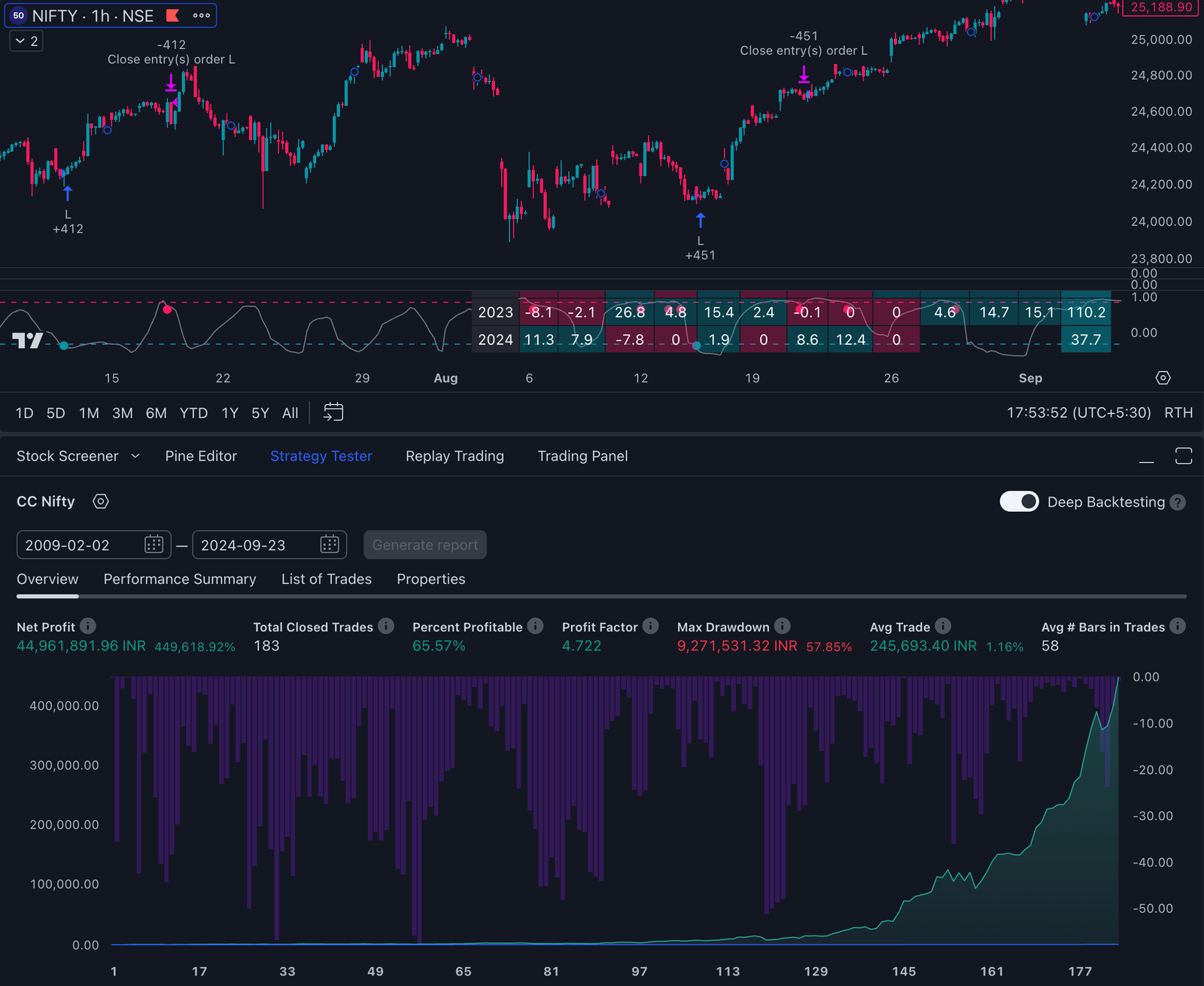

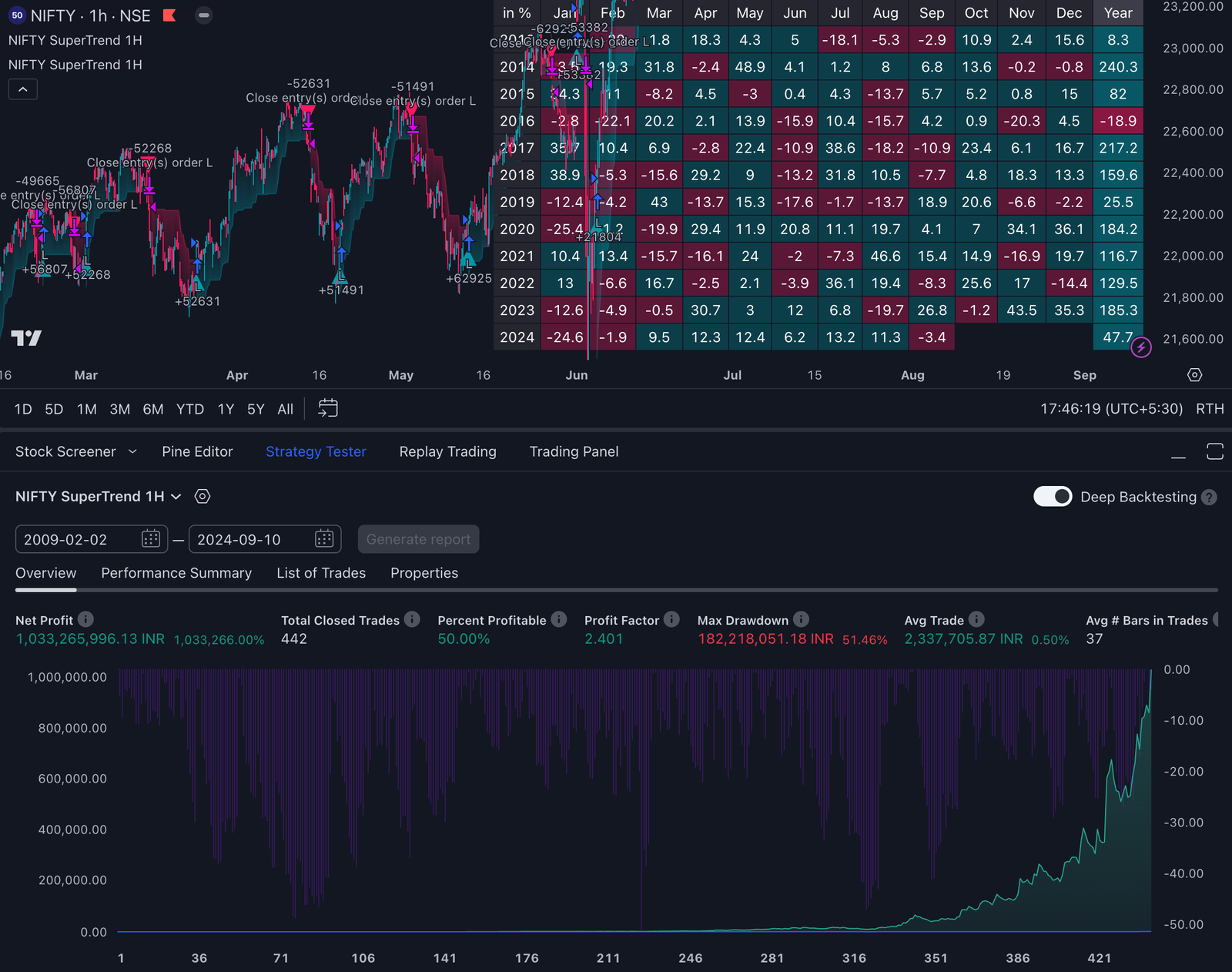

Backtesting Your Way to Scalping Success

Backtesting is a crucial step in refining and validating your scalping strategies on TradingView. By analyzing historical data, you can determine the viability of your strategy before risking real capital.

Key Benefits of Backtesting:

- Identify Strengths and Weaknesses: Historical data analysis helps you pinpoint which aspects of your strategy are robust and which need adjustment.

- Improve Confidence: Seeing how your strategy performs over past market conditions boosts confidence in live trading scenarios.

- Optimize Parameters: Fine-tune indicator settings such as moving averages or RSI levels to achieve better results.

Steps for Effective Backtesting:

- Define Your Strategy: Clearly outline the rules for entry, exit, and risk management.

- Collect Historical Data: Utilize TradingView’s extensive library of historical market data.

- Implement on TradingView: Use TradingView’s built-in backtesting tools to simulate trades based on past data.

- Evaluate Performance Metrics: Focus on metrics like profit factor, win rate, and drawdown to assess strategy effectiveness.

- Adjust and Repeat: Continuously refine your strategy based on backtesting results.

Incorporating rigorous backtesting into your trading routine ensures that your scalping strategies are well-vetted and optimized for success in 2024. This disciplined approach not only enhances strategy reliability but also equips you with the insights needed to adapt to changing market dynamics.

Conclusion

Scalping strategies on TradingView in 2024 promise to be even more refined and effective, using advanced indicators and tools. Embracing these techniques with a disciplined approach maximizes your potential for success.

- Stay Informed: Keep up with market trends and innovations.

- Practice Discipline: Stick to your strategy and avoid impulsive decisions.

- Backtest Rigorously: Validate your methods with historical data before live trading.

Adopting these practices ensures you are well-prepared to capitalize on the fast-paced world of scalping.

FAQs (Frequently Asked Questions)

What is scalping in trading?

Scalping is a short-term trading technique that involves making numerous trades throughout the day to capitalize on small price movements. It is significant for traders as it allows them to profit from market volatility and quick price fluctuations.

How does TradingView assist in implementing scalping strategies?

TradingView is a powerful tool for traders, providing advanced charting capabilities and a wide range of technical analysis tools. It enables traders to implement scalping strategies effectively by offering real-time data, customizable indicators, and a user-friendly interface.

What are some essential indicators for effective scalping?

Key indicators for effective scalping include Moving Averages (both simple and exponential), Relative Strength Index (RSI), Bollinger Bands, and Moving Average Convergence Divergence (MACD). These tools help traders identify trends, spot overbought or oversold conditions, and confirm trade directions.

Can you explain the 5-minute scalping strategy?

The 5-minute scalping strategy involves using two RSI crossovers along with moving averages to make quick trades. This strategy allows traders to capitalize on short-term price movements while minimizing exposure to market noise, making it effective for rapid trading environments.

What is the importance of backtesting in scalping?

Backtesting is crucial for scalpers as it allows them to analyze historical data and evaluate the effectiveness of their strategies before applying them in live markets. This process helps traders refine their techniques and improve their chances of success.

What are some effective exit strategies for scalpers?

Effective exit strategies for scalpers include profit-taking methods like setting specific target prices or using trailing stops. Additionally, recognizing exit signals based on technical indicators can help ensure that profits are secured before market reversals occur.