Introduction

Swing trading is a trading style that aims to capture profits from market movements over a period ranging from a few days to several weeks. Unlike day traders who open and close positions within the same day, swing traders hold onto their positions for longer durations to benefit from short-term fluctuations within a broader trend. This approach allows traders to potentially achieve significant returns over relatively short periods by capitalizing on larger price movements.

Swing trading strategies are crucial for success in this trading style. Effective strategies help traders identify potential entry and exit points, manage risk, and make informed decisions based on technical analysis. By employing well-defined strategies, you can improve your chances of making profitable trades while minimizing losses.

TradingView is an invaluable tool for swing traders. It provides a comprehensive suite of charting tools and indicators that can enhance your analysis and decision-making process. Key features include:

- Fibonacci retracement tool

- Bollinger Bands indicator

- Relative Strength Index (RSI)

- Keltner Channels

These tools enable you to customize your charts and develop personalized swing trading strategies tailored to your specific needs. TradingView’s user-friendly interface and robust functionalities make it an essential platform for anyone looking to excel in swing trading.

Understanding Swing Trading

Swing trading is a unique trading style that sets itself apart from day trading through its approach and timeframe. While day traders open and close positions within the same day, swing traders hold onto their positions for several days to weeks, allowing them to capture short-term market fluctuations within broader trends.

Swing Trading vs. Day Trading

- Day Trading: Involves executing multiple trades in a single day, capitalizing on small price movements. Requires constant monitoring of the market.

- Swing Trading: Positions are held longer, typically from a few days to several weeks. This strategy focuses on profiting from larger price swings and trends.

Timeframe for Swing Trades

Swing trades generally span:

- Short-term: A few days

- Medium-term: Up to several weeks

The extended timeframe allows you to analyze market trends more thoroughly without needing constant attention.

Benefits and Risks

Benefits:

- Profit Potential: By holding positions longer, you can benefit from significant price movements.

- Flexibility: Less time-intensive compared to day trading.

- Reduced Transaction Costs: Fewer trades mean lower commissions and fees.

Risks:

- Market Fluctuations: Holding positions overnight exposes you to risks from unexpected news or events.

- Capital Lock-Up: Funds are tied up in trades for longer periods, potentially missing other opportunities.

Understanding these aspects is crucial for developing effective swing trading strategies.

Fibonacci Retracement Strategy

Fibonacci retracement levels are essential tools for many swing traders, helping to identify potential support and resistance zones where price reversals may occur. These levels are derived from the Fibonacci sequence and typically include the 38.2%, 50%, and 61.8% retracement levels.

Explanation of Fibonacci Retracement Levels

- 38.2% Level: Often seen as the first significant retracement level, indicating a shallow pullback in an otherwise strong trend.

- 50% Level: Although not an official Fibonacci number, it is widely used by traders as it represents a halfway point of the previous move.

- 61.8% Level: Considered the “golden ratio,” this level often signals a deeper retracement and is closely watched for potential reversals.

Identifying Potential Reversal Points

To identify potential reversal points using Fibonacci retracement:

- Identify the Trend: Determine the high and low points of the recent trend.

- Apply Fibonacci Levels: Use TradingView’s Fibonacci retracement tool to plot these levels between the high and low points of the trend.

- Monitor Price Action at Key Levels: Watch how prices react when they approach these Fibonacci levels; look for signs such as candlestick patterns or volume changes that indicate possible reversals.

Examples of Successful Trades Using Fibonacci Retracement

Consider a scenario where you observe an uptrend in a stock’s price:

- The stock moves from $100 to $150, marking this range on your chart.

- After reaching $150, the price starts to pull back.

- You apply the Fibonacci tool from $100 (low) to $150 (high).

In this case:

- At the 38.2% level ($138), you might see initial support with minor pullbacks.

- If it reaches the 50% level ($125), traders may anticipate stronger support or resistance, depending on market conditions.

- At the 61.8% level ($115), any reversal pattern could signal a significant buying opportunity.

For example, if a stock’s price drops to $115 and forms a bullish engulfing candle, it might confirm that buyers are stepping in at this critical support level, presenting a viable entry point for swing traders.

Using these techniques on TradingView allows you to visualize these levels clearly and set up alerts for when prices approach your predefined zones, streamlining your trading process significantly.

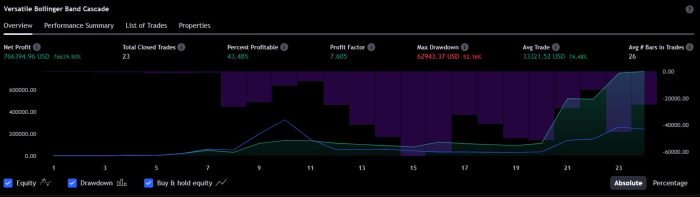

Bollinger Bands Strategy

Bollinger Bands are a popular volatility indicator widely used in swing trading strategies on TradingView. This tool comprises three main components:

- Middle Band: A simple moving average (SMA), typically set at 20 periods.

- Upper Band: Plotted two standard deviations above the middle band.

- Lower Band: Plotted two standard deviations below the middle band.

These bands expand and contract based on market volatility, providing traders with critical insights into potential entry points.

Identifying Trade Opportunities with Bollinger Bands

Using Bollinger Bands to identify trade opportunities involves observing price reactions when they touch or cross the bands. Here are some key signals:

- Overbought Conditions:

- When the price touches or crosses above the upper band, it indicates overbought conditions.

- Traders may consider this as a signal to prepare for potential selling opportunities.

- Oversold Conditions:

- When the price touches or crosses below the lower band, it suggests oversold conditions.

- This can signal a potential buying opportunity as a reversal might be imminent.

- Squeeze and Breakout:

- A “Bollinger Band Squeeze” occurs when the bands contract, indicating low volatility.

- A breakout from this squeeze often leads to significant price movements, offering lucrative trade setups.

Confirmation Techniques Using Impulse Candles

To enhance the reliability of Bollinger Bands signals, traders often use confirmation techniques like impulse candles:

- Impulse Candles: These are strong candlesticks that exhibit significant movement in one direction, confirming the strength of a trend.

- For instance, after identifying an overbought condition with Bollinger Bands, a bearish impulse candle can confirm a sell signal.

- Conversely, in oversold conditions, a bullish impulse candle can validate a buy signal.

Incorporating these methods helps improve trade accuracy by reducing false signals and aligning trades with market momentum.

Utilizing TradingView’s charting tools effectively allows you to customize Bollinger Bands according to your strategy and integrate them seamlessly with other indicators for comprehensive swing trading analysis.

Relative Strength Index (RSI) Strategy

Understanding the RSI and its Significance in Swing Trading

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps identify overbought or oversold conditions in the market:

- Overbought: RSI above 70 indicates that an asset may be overbought, suggesting a potential sell-off.

- Oversold: RSI below 30 suggests that an asset may be oversold, indicating a potential buying opportunity.

Swing traders use the RSI to gauge the momentum of price movements, which is crucial for timing entries and exits.

Identifying Divergences Between Price Movements and RSI Readings

Divergences occur when the price movement of an asset diverges from the RSI readings. This can signal potential reversals:

- Bullish Divergence: Price makes lower lows while RSI makes higher lows, indicating weakening downward momentum and a possible upward reversal.

- Bearish Divergence: Price makes higher highs while RSI makes lower highs, suggesting weakening upward momentum and a potential downward reversal.

Identifying these divergences allows traders to anticipate changes in trend direction before they become apparent on the price chart.

Incorporating Candlestick Patterns for Trade Confirmation

Combining RSI signals with candlestick patterns enhances trade confirmation. Some effective patterns include:

- Hammer: A bullish reversal pattern often found at the bottom of a downtrend.

- Shooting Star: A bearish reversal pattern typically seen at the top of an uptrend.

- Doji: Indicates indecision in the market and can precede reversals.

Practical Example

Assume you are analyzing a stock with an RSI reading below 30, indicating oversold conditions. Concurrently, you notice a bullish divergence where the price forms lower lows but the RSI forms higher lows. To confirm this signal, you look for a hammer candlestick pattern forming at key support levels. This confluence of signals – oversold RSI, bullish divergence, and confirming candlestick pattern – provides a strong indication to enter a long position.

By integrating these elements into your swing trading strategy, you can make more informed decisions and potentially increase your profitability.

Keltner Channels Strategy

Keltner Channels are a key tool for swing traders, used to measure market volatility and spot potential trade setups. They consist of three lines: a central line representing the exponential moving average (EMA) and two outer bands calculated based on the average true range (ATR). The ATR measures market volatility, making Keltner Channels adaptive to dynamic market conditions.

Construction of Keltner Channels

- Central Line: Typically a 20-period EMA.

- Upper Band: EMA + (ATR * multiplier)

- Lower Band: EMA – (ATR * multiplier)

The default multiplier is usually set at 2, but it can be adjusted based on individual trading preferences.

Identifying Trade Setups with Keltner Channels

Keltner Channels help you spot potential breakout opportunities and overbought or oversold conditions:

Breakout Identification

- When the price breaks above the upper band, it signals potential bullish momentum.

- Conversely, when the price breaks below the lower band, it indicates potential bearish momentum.

Overbought/Oversold Conditions

- Price consistently near the upper band can suggest overbought conditions.

- Price consistently near the lower band can indicate oversold conditions.

Entry Signals Based on Channel Closures and EMA Retracement

To refine entry points, consider these strategies:

Channel Breakouts

- Enter a long position when the price closes above the upper band and confirms bullish sentiment.

- Enter a short position when the price closes below the lower band and confirms bearish sentiment.

EMA Retracement

After a breakout, wait for a retracement back towards the EMA. This pullback offers a better entry point with reduced risk.

Example: If the price closes above the upper band and subsequently retraces back to touch or approach the central EMA line without breaking below it, this provides an optimal entry for a long position.

These techniques ensure you capitalize on market momentum while maintaining disciplined risk management. Adjusting settings like period length and multiplier allows for custom strategies tailored to specific trading styles.

How to Use TradingView for Swing Trading

TradingView is one of the best platforms for swing traders, offering a range of tools to improve technical analysis and strategy execution. Its easy-to-use interface and powerful features make it a must-have for traders looking to profit from market changes.

Important Charting Tools in TradingView

TradingView offers several charting tools that are essential for swing trading:

- Fibonacci Retracement Tool: This tool is easy to use and customize, helping you find possible reversal points at key levels (38.2%, 50%, 61.8%).

- Bollinger Bands Indicator: This indicator helps you understand market volatility and potential overbought or oversold conditions by drawing standard deviation bands around a moving average.

Customizing Indicators

Customizing your indicators is crucial for making them fit your specific swing trading strategies. In TradingView, you can:

- Change Periods and Levels: Adjust the default settings of indicators like the RSI or Bollinger Bands to better suit your trading style.

- Combine Multiple Indicators: Overlay different tools such as the Keltner Channels with Fibonacci retracement levels to develop a more comprehensive analysis.

- Create Alerts: Set up custom alerts based on your criteria to ensure you never miss a trading opportunity.

By using these features, you can create detailed and effective swing trading strategies within TradingView, improving both accuracy and performance in your trades.

Risk Management in Swing Trading

Risk management strategies are crucial for any swing trader’s success. Proper risk management helps you protect your capital and ensures longevity in the market. Here’s how you can integrate effective risk management into your swing trading approach:

Setting Stop-Loss Orders Effectively

Stop-loss orders are crucial in controlling potential losses. To set them effectively:

- Identify Key Levels: Place stop-loss orders at key support or resistance levels to minimize the chances of premature exits.

- ATR-Based Stops: Use the Average True Range (ATR) to gauge market volatility and set stops accordingly, ensuring they are neither too tight nor too loose.

- Percentage-Based Stops: Define a fixed percentage of your total capital that you are willing to risk on each trade, usually between 1% and 2%.

Calculating Position Sizes Based on Risk Tolerance

The size of your trading positions should align with your risk tolerance. Follow these steps:

- Determine Account Risk: Decide what fraction of your account equity you are willing to risk per trade (e.g., 2%).

- Calculate Trade Risk: Measure the distance between your entry point and stop-loss level.

- Position Sizing Formula: [ \text{Position Size} = \frac{\text{Account Risk}}{\text{Trade Risk}} ]

Example: If your account balance is $10,000 and you are risking 2% ($200) with a stop-loss set at $0.50 below your entry price, your position size would be: [ \frac{$200}{$0.50} = 400 \text{ shares} ]

Proper risk management strategies not only safeguard your investments but also enhance your trading discipline, leading to more consistent results over time.

Conclusion

Applying these effective swing trading strategies with TradingView tools can significantly enhance your trading outcomes.

- Utilize the comprehensive charting tools and customizable indicators available on TradingView to implement your strategies effectively.

- Embrace a disciplined approach to swing trading, focusing on consistent analysis and careful risk management.

Success in swing trading requires a blend of accurate strategy application and disciplined execution. With TradingView, you have a robust platform to support your journey toward long-term success in the dynamic world of trading.

FAQs (Frequently Asked Questions)

What is swing trading and how does it differ from day trading?

Swing trading is a trading style that aims to capture short to medium-term market movements, typically holding positions for several days to weeks. Unlike day trading, which involves making multiple trades within a single day to capitalize on small price movements, swing trading focuses on larger price swings over a longer timeframe.

How can I utilize Fibonacci retracement levels in my swing trading strategy?

Fibonacci retracement levels, such as 38.2%, 50%, and 61.8%, are used to identify potential reversal points in the market. By plotting these levels on your charts, you can find areas of support and resistance where price may reverse, helping you make informed decisions about entry and exit points in your trades.

What are Bollinger Bands and how can they assist in swing trading?

Bollinger Bands are volatility indicators that consist of a middle band (the moving average) and two outer bands that represent standard deviations from the average. They help traders identify overbought or oversold conditions and potential entry signals by observing price movements relative to the bands.

How does the Relative Strength Index (RSI) contribute to swing trading strategies?

The RSI is a momentum oscillator that measures the speed and change of price movements. It provides insights into overbought or oversold conditions and helps identify divergences between price action and RSI readings. Incorporating candlestick patterns alongside RSI can offer additional confirmation for trade entries.

What role do Keltner Channels play in identifying trade setups for swing traders?

Keltner Channels are volatility measurement tools constructed using the Average True Range (ATR). They help traders identify potential breakout opportunities when prices close outside the channels. Entry signals can be generated based on channel closures combined with EMA retracement strategies.

Why is risk management crucial for success in swing trading?

Risk management is essential for preserving capital and ensuring long-term success in swing trading. Effective techniques include setting stop-loss orders to limit potential losses and calculating position sizes based on individual risk tolerance, allowing traders to manage their exposure effectively.