Introduction

TradingView is a powerful platform that offers a comprehensive suite of tools for backtesting trading strategies. As a trader, understanding how to evaluate your trading strategies using historical market data is crucial for long-term success. TradingView backtesting strategies provide you with the insights needed to refine and optimize your methods before deploying them in real-time.

Key Takeaways from This Article:

- Gain an understanding of what backtesting is and how it works.

- Learn how to develop and test trading strategies using Pine Script on TradingView.

- Discover the tools and features available in TradingView for effective backtesting.

- Identify common mistakes in backtesting and how to avoid them.

- Understand the importance of risk management and forward testing in strategy evaluation.

By the end of this article, you will have a solid foundation in using TradingView for backtesting your trading strategies, enabling you to make informed decisions and improve your trading performance.

Understanding Backtesting

What is Backtesting?

Backtesting involves applying a trading strategy to historical market data to evaluate its potential performance. This allows traders to see how their strategies would have performed in the past, offering insights into their effectiveness before applying them in real-time.

How Backtesting Works

- Historical Data Analysis: By using historical price data, you can recreate market conditions and simulate trades.

- Strategy Implementation: Develop a set of rules for entering and exiting trades, then apply these rules to the historical data.

- Performance Metrics: Analyze the results to gauge various performance metrics such as profitability, drawdowns, and win/loss ratios.

Benefits of Using Historical Market Data

- Risk Assessment: Understand the risks involved by analyzing past market behaviors.

- Strategy Refinement: Modify and optimize strategies based on historical performance.

- Confidence Building: Gain confidence in your strategies by validating them against real market conditions from the past.

Using these methods, you can significantly enhance your trading approach and make more informed decisions.

Key Components of Backtesting on TradingView

Strategies Development

Pine Script is the backbone of strategy creation on TradingView. This domain-specific language allows you to write custom scripts that can send, modify, and cancel buy/sell orders based on predefined criteria. You can create:

- Simple Buy/Sell Orders: Scripts that trigger trades based on conditions like moving average crossovers.

- Complex Strategies: Incorporate multiple technical indicators, risk management rules, and conditional logic.

To begin, you can use Pine Script’s built-in functions for common calculations or even write your own custom functions. For example:

pinescript //@version=4 strategy(“Simple Moving Average Strategy”, overlay=true) smaShort = sma(close, 10) smaLong = sma(close, 30)

if (crossover(smaShort, smaLong)) strategy.entry(“Buy”, strategy.long)

if (crossunder(smaShort, smaLong)) strategy.close(“Buy”)

This script executes a buy order when the short-term SMA crosses above the long-term SMA and closes it when it crosses below.

The Backtesting Process

Data Selection

Choosing the correct duration and type of historical data is crucial. The period should be long enough to capture various market conditions but relevant to your trading style. For instance:

- Day Traders: Might opt for minute-by-minute data spanning several months.

- Swing Traders: Could use daily data over a few years.

TradingView provides extensive historical data across different intervals, ensuring flexibility in backtesting.

Setting Entry and Exit Rules

Clearly defined entry and exit rules form the foundation of any backtesting process:

- Entry Rules: Conditions under which a trade is opened (e.g., RSI falls below 30).

- Exit Rules: Conditions under which a trade is closed (e.g., RSI rises above 70).

These rules are implemented within your Pine Script code to automate decision-making during backtesting.

Analysis of Results

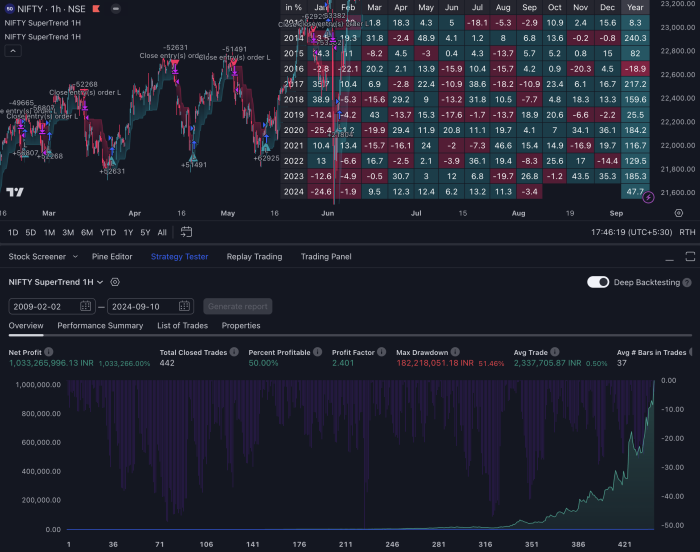

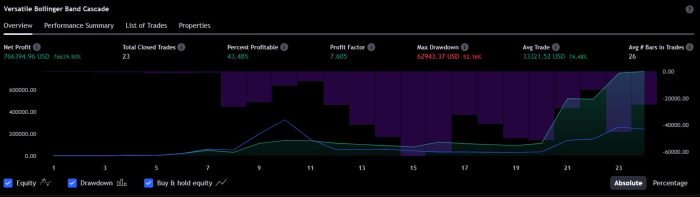

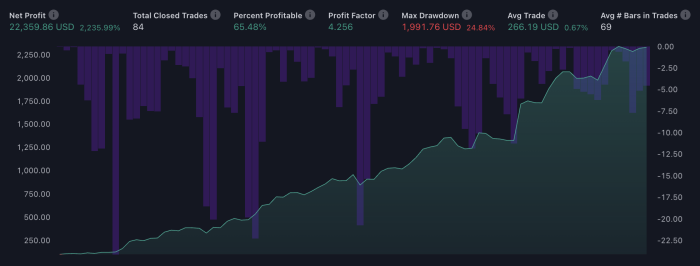

After running your backtest, the Strategy Tester tab becomes indispensable for analyzing the performance metrics. Key metrics include:

- Net Profit: Total profit or loss from all trades.

- Win Rate: Percentage of profitable trades.

- Max Drawdown: Largest peak-to-trough decline during the backtest period.

- Sharpe Ratio: Measure of risk-adjusted return.

These metrics help you assess the viability and robustness of your trading strategy. You can also visualize each trade on the chart to understand its context better.

plaintext “Net Profit”: $5000 “Win Rate”: 60% “Max Drawdown”: -10% “Sharpe Ratio”: 1.5

By analyzing these results, you can fine-tune your strategy for improved performance before considering live deployment.

Tools and Features in TradingView for Backtesting

Bar Replay Tool

TradingView’s Bar Replay tool is an invaluable feature for manual backtesting. This tool allows you to navigate through historical data one bar at a time, replicating the experience of live trading. By manually stepping through each bar, you can:

- Evaluate Strategy Performance: See how your strategy performs under different market conditions by replaying historical data.

- Identify Weak Points: Spot potential flaws in your trading plan by observing how well it adapts to various scenarios.

- Improve Timing: Fine-tune your entry and exit points by analyzing the market behavior leading up to trade signals.

Using the Bar Replay tool, traders gain a hands-on approach to testing, offering a deeper understanding of strategy dynamics. This feature is just one part of the broader process of backtesting, which is essential for any trader looking to refine their strategies.

Visualizing Trades

Visual feedback is crucial when evaluating TradingView backtesting strategies. TradingView allows you to visualize executed trades directly on the chart, enhancing your ability to assess your strategy’s effectiveness. Here’s how you can benefit from this feature:

- Immediate Insight: Colored arrows (typically green for buy and red for sell) mark where trades are executed, providing instant visual cues.

- Pattern Recognition: Quickly recognize patterns or recurring setups that lead to successful or failed trades.

- Strategy Refinement: Adjust your strategy based on visual feedback, making it easier to spot areas for improvement.

Visualization not only aids in understanding past performance but also builds confidence in deploying strategies in real-time.

With these tools and features, TradingView offers robust capabilities for manual backtesting and clear trade visualization, essential elements for refining trading strategies. However, it’s important to note that while TradingView is a powerful platform, there are also other alternatives available such as GoCharting, which offer similar functionalities and may suit different trading styles or needs better.

Common Mistakes in Backtesting

Short Time Frame Testing

Testing strategies over short time frames can lead to misleading results. Using limited data periods may not capture the full spectrum of market conditions, resulting in strategies that appear profitable but fail under different circumstances. Ensuring your backtest includes various market phases—bullish, bearish, and sideways trends—provides a more comprehensive assessment of your strategy’s robustness.

Overfitting Issues

Overfitting strategies to historical data is a common pitfall. This happens when a strategy is tailored too closely to past performance, capturing noise rather than underlying patterns. While an overfitted strategy may show strong historical returns, it often fails in real-world trading due to its lack of generalizability. To avoid this, ensure your strategy has simple rules and is tested on out-of-sample data.

Ignoring Transaction Costs

Neglecting transaction costs such as slippage and commissions can skew performance metrics significantly. Even the most promising strategies can turn unprofitable when these factors are considered. Incorporate realistic cost assumptions into your backtests to gauge the true viability of your trading approach.

In addition to these pitfalls, it’s crucial to be aware of the risks and limitations of backtesting. By avoiding these common mistakes and understanding the inherent risks, you can enhance the reliability of your backtesting efforts and develop strategies with a higher likelihood of success in live trading environments.

Considerations for Effective Backtesting

Importance of Extensive Historical Data for Robustness

Using a lot of historical data is crucial for conducting robust testing methods. When you backtest a strategy on a broad dataset, you can observe its performance across different market conditions, including various economic cycles, unexpected events, and periods of high volatility. This diversity ensures that your strategy is not just a one-hit-wonder but has the potential to perform consistently over time.

Splitting Data into Training and Testing Sets

To prevent curve fitting, it’s essential to split your historical data into training and testing sets. Curve fitting occurs when a strategy is excessively fine-tuned to match historical data, leading to excellent past performance but poor future results. By dividing the data:

- Training Set: Use this set to develop and refine your trading strategy. It allows you to identify promising patterns and rules without risking over-optimization.

- Testing Set: After developing the strategy, test it on a separate dataset that the model hasn’t seen before. This approach helps validate the strategy’s effectiveness in real-world scenarios.

This method ensures that your strategy is genuinely robust and not merely tailored to past market conditions.

Regularly Updating Strategies Based on New Performance Insights

The financial markets are dynamic, constantly evolving with new trends, technologies, and regulations. Regularly updating your strategies based on new performance insights is vital for staying relevant. Analyzing recent performance metrics can reveal how well your strategy adapts to current market conditions.

- Continuous Monitoring: Keep an eye on key performance indicators such as win rate, drawdowns, and risk-adjusted returns.

- Adjustments: Make necessary tweaks to account for changes in market behavior or unforeseen events.

- Iterative Testing: Re-run backtests periodically using updated data to ensure the strategy’s continued viability.

By embracing these practices, you can maintain a competitive edge in trading while mitigating risks associated with outdated strategies.

Risk Management in Backtesting

Risk management is crucial in protecting investments during live trading scenarios. By integrating risk management rules into your TradingView backtesting strategies, you can mitigate potential losses and enhance your strategy’s robustness.

Role of Risk Management Rules:

- Protects capital by setting predefined limits on losses.

- Helps maintain emotional discipline by adhering to strategic guidelines rather than reacting impulsively to market movements.

Integrating Risk Management:

- Stop-Loss Orders: Ensure each trade has a stop-loss order to limit potential downsides.

- Position Sizing: Determine the size of each trade based on risk tolerance and portfolio size.

- Diversification: Avoid over-concentration by diversifying across different instruments or sectors.

Incorporating these rules into your backtesting process helps simulate real-world trading conditions more accurately. This not only provides a clearer picture of potential outcomes but also prepares you for the psychological aspects of managing risk during live trading.

Forward Testing After Backtesting

Forward testing is the process of applying a backtested trading strategy in real-time conditions to validate its performance. This step is crucial for verifying that a strategy can handle live market dynamics, which often involve variables not present in historical data.

Key aspects of forward testing include:

1. Real-Time Conditions

During forward testing, you execute trades based on your strategy without making adjustments based on recent results. This approach ensures that the strategy’s performance is evaluated under genuine market conditions, providing a realistic assessment of its efficacy.

2. Strategy Validation

By observing how the strategy performs in real-time, you can determine whether it consistently meets your performance expectations. This process helps identify any potential flaws or areas for improvement that might not have been evident during backtesting.

Forward testing requires patience and discipline as it involves allowing the strategy to play out over a significant period. This method provides valuable insights into how well your trading plan holds up under live market pressures, ultimately assisting in making informed decisions about its deployment in actual trading scenarios.

Conclusion

Using TradingView backtesting strategies is essential for improving your trading approach. TradingView’s powerful tools and features let you simulate, test, and visualize your strategies with historical data.

Constantly improving your trading strategies is crucial. Regularly updating your methods based on new insights ensures you stay flexible in a changing market. Adopt a mindset of continuous learning and adaptation in your trading practices.

“The best traders are those who always seek to learn and evolve.”

Apply these practices for continued success in your TradingView trading journey.

FAQs (Frequently Asked Questions)

What is backtesting and how does it work?

Backtesting is the process of testing a trading strategy on historical data to evaluate its effectiveness. It involves applying the strategy to past market conditions to see how it would have performed, helping traders understand potential outcomes and refine their strategies.

What are the key components of backtesting on TradingView?

Key components include using Pine Script for strategy creation, selecting appropriate historical data, and defining clear entry and exit rules for trades. The backtesting process also involves choosing the duration and type of data to analyze results effectively.

How can I visualize trades during backtesting in TradingView?

TradingView offers tools for trade visualization that allow you to see executed trades during backtesting. This visual feedback is crucial for evaluating your strategy’s performance and understanding how it reacts in different market conditions.

What are common mistakes to avoid in backtesting?

Common mistakes include relying on misleading results from short time frame testing, overfitting strategies too closely to past performance, and ignoring transaction costs like slippage and commissions which can significantly impact performance metrics.

Why is risk management important in backtesting?

Risk management is vital as it helps protect investments during live trading scenarios. Integrating risk management rules into strategy development ensures that potential losses are minimized, enhancing the overall viability of trading strategies.

What is forward testing and why is it necessary after backtesting?

Forward testing involves applying a trading strategy in real-time market conditions without making adjustments based on recent results. It is essential for validating the strategy’s effectiveness outside of historical data, ensuring its robustness in live trading environments.