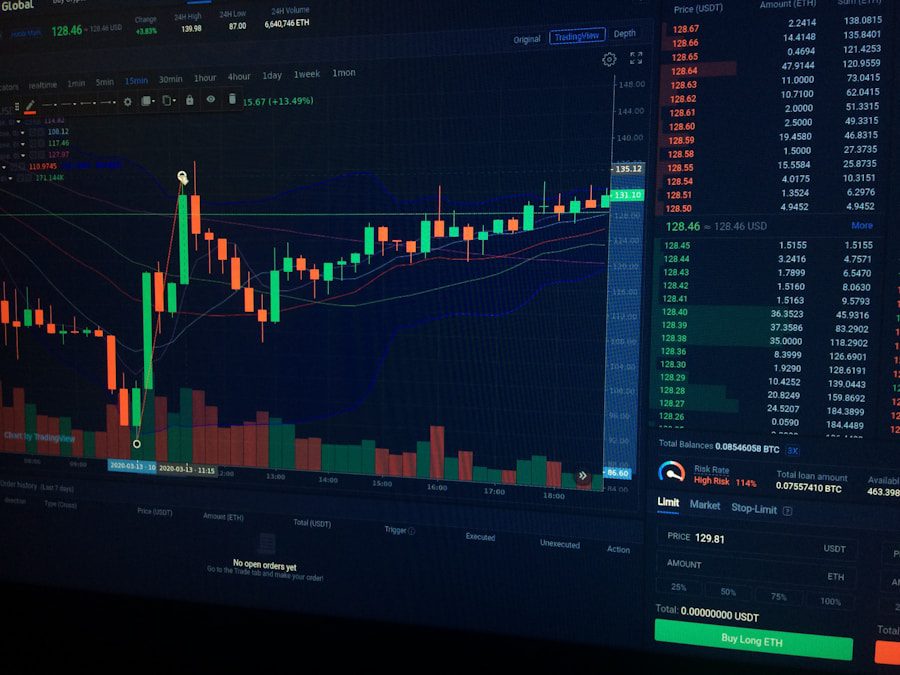

Automated TradingView scripts are powerful tools that allow traders to automate their trading strategies using the TradingView platform. These scripts are written in Pine Script, a domain-specific language designed specifically for creating custom technical indicators and strategies. By leveraging these scripts, traders can execute trades based on predefined criteria without the need for constant manual intervention.

This automation not only saves time but also helps in eliminating emotional biases that often cloud judgment during trading. The core functionality of TradingView scripts lies in their ability to analyze market data in real-time and generate signals based on specific conditions. For instance, a trader might create a script that buys a stock when its 50-day moving average crosses above its 200-day moving average, a common bullish signal known as a “golden cross.” Conversely, the script could also be programmed to sell when the opposite occurs.

This level of automation allows traders to capitalize on market movements swiftly, ensuring they do not miss out on potential opportunities due to human error or indecision.

Key Takeaways

- Automated TradingView scripts are pre-programmed strategies that can execute trades on the TradingView platform without manual intervention.

- Setting up automated TradingView scripts involves creating and customizing the script, setting entry and exit conditions, and backtesting the strategy.

- Choosing the right strategy for automated TradingView scripts requires considering factors such as market conditions, risk tolerance, and investment goals.

- Testing and optimizing automated TradingView scripts is essential to ensure the strategy performs well under different market scenarios and to fine-tune its parameters.

- Managing risk with automated TradingView scripts involves setting stop-loss orders, position sizing, and diversifying the portfolio to minimize potential losses.

Setting Up Automated TradingView Scripts

Setting up automated TradingView scripts begins with creating an account on the TradingView platform. Once registered, users can access the Pine Script editor, where they can write or modify scripts. The editor provides a user-friendly interface that includes syntax highlighting and error checking, making it easier for both novice and experienced programmers to develop their strategies.

Traders can start by using pre-existing scripts available in the TradingView community, which can serve as templates or inspiration for their own custom strategies. After accessing the Pine Script editor, traders can begin coding their automated strategies.

The process typically involves defining variables, setting up conditions for trade entries and exits, and specifying any additional parameters such as stop-loss or take-profit levels.

For example, a simple script might include variables for the closing price of a stock and its moving averages, followed by conditional statements that dictate when to enter or exit a trade. Once the script is complete, it can be saved and applied to any chart within TradingView, allowing traders to visualize their strategy’s performance in real-time.

Choosing the Right Strategy for Automated TradingView Scripts

Selecting an appropriate trading strategy is crucial for the success of automated TradingView scripts. Traders must consider their risk tolerance, investment goals, and market conditions when developing their strategies. Common approaches include trend-following strategies, mean reversion strategies, and breakout strategies.

Each of these methods has its own set of rules and indicators that can be programmed into a TradingView script. For instance, a trend-following strategy might utilize moving averages or the Average Directional Index (ADX) to identify prevailing market trends. A trader could create a script that generates buy signals when the price is above a certain moving average and sell signals when it falls below it.

On the other hand, a mean reversion strategy might focus on identifying overbought or oversold conditions using indicators like the Relative Strength Index (RSI) or Bollinger Bands. By understanding the nuances of each strategy type, traders can tailor their automated scripts to align with their trading philosophy and market outlook.

Testing and Optimizing Automated TradingView Scripts

| Metrics | Value |

|---|---|

| Profit factor | 1.5 |

| Winning trades percentage | 60% |

| Average trade duration | 2 days |

| Maximum drawdown | 5% |

Once an automated TradingView script has been developed, it is essential to test and optimize it before deploying it in live trading environments. This process typically involves backtesting the script against historical market data to evaluate its performance over various time frames and market conditions. TradingView provides built-in backtesting capabilities that allow traders to simulate trades based on historical price movements, enabling them to assess metrics such as win rate, profit factor, and maximum drawdown.

Optimization is another critical aspect of refining automated scripts. Traders can adjust parameters within their scripts—such as stop-loss levels, take-profit targets, or indicator settings—to find the optimal configuration that maximizes profitability while minimizing risk. This iterative process often requires multiple rounds of testing and adjustments to ensure that the strategy performs well across different market scenarios.

Additionally, traders should be cautious of overfitting their scripts to historical data, as this can lead to poor performance in live trading due to changing market dynamics.

Managing Risk with Automated TradingView Scripts

Risk management is a fundamental component of successful trading, and automated TradingView scripts can incorporate various risk management techniques to protect capital. One common approach is to set predefined stop-loss and take-profit levels within the script itself. By doing so, traders can ensure that losses are limited while profits are secured without needing constant monitoring of their positions.

Another effective risk management strategy involves position sizing, which determines how much capital to allocate to each trade based on the trader’s overall portfolio size and risk tolerance. Automated scripts can be programmed to calculate position sizes dynamically based on factors such as volatility or account equity. For example, a trader might set a rule that limits exposure to 1% of their total account balance per trade.

This systematic approach helps mitigate the impact of losing trades on overall capital and contributes to long-term trading success.

Monitoring and Adjusting Automated TradingView Scripts

Even though automated TradingView scripts are designed to operate independently, ongoing monitoring is essential to ensure they function as intended in real-time market conditions. Traders should regularly review their scripts’ performance metrics and make adjustments as necessary based on changing market dynamics or personal trading goals. This could involve tweaking parameters within the script or even revisiting the underlying strategy if it no longer aligns with current market conditions.

Additionally, traders should be aware of external factors that could impact their automated trading strategies. For instance, significant economic events such as earnings reports or central bank announcements can lead to increased volatility and may require temporary adjustments to trading parameters or even pausing automated trading altogether during these periods. By staying informed about market developments and being proactive in managing their automated scripts, traders can enhance their chances of achieving consistent results.

Integrating Automated TradingView Scripts with Brokerage Accounts

To fully leverage the capabilities of automated TradingView scripts, traders must integrate them with brokerage accounts that support automated trading functionalities. Many brokers offer APIs (Application Programming Interfaces) that allow for seamless communication between TradingView and the brokerage platform. This integration enables traders to execute trades automatically based on signals generated by their scripts without manual intervention.

The process of integration typically involves obtaining API keys from the brokerage account and configuring them within TradingView’s settings. Once connected, traders can set up their scripts to send buy or sell orders directly to their brokerage account when specific conditions are met. It is crucial for traders to ensure that they understand the terms and conditions associated with their brokerage’s API usage, including any limitations on order types or execution speeds.

Maximizing Profits with Automated TradingView Scripts

To maximize profits using automated TradingView scripts, traders should focus on continuous improvement and adaptation of their strategies. This involves regularly analyzing performance data and identifying areas for enhancement. For instance, if a particular strategy consistently underperforms during specific market conditions, traders may need to adjust their indicators or entry/exit criteria accordingly.

Moreover, diversifying trading strategies can also contribute to profit maximization.

Traders can develop multiple automated scripts that employ different strategies across various asset classes or time frames.

This diversification helps spread risk and increases the likelihood of capturing profitable opportunities in different market environments.

By maintaining a disciplined approach to strategy development and execution while leveraging the power of automation through TradingView scripts, traders can enhance their overall profitability in the financial markets.

If you are interested in learning more about creating TradingView indicators and strategies in Pine Script, you may want to check out this article on Pine Indicators. This article provides a comprehensive guide on how to develop custom indicators and strategies using Pine Script, which can be useful for automated trading on the TradingView platform. It also offers valuable insights into the best trading strategies for successful trading, as discussed in this related article.

FAQs

What is an Automated TradingView script?

An Automated TradingView script is a computer program that is designed to automatically execute trading decisions on the TradingView platform. These scripts are written in Pine Script, which is the programming language used on TradingView.

How does an Automated TradingView script work?

An Automated TradingView script works by analyzing market data and applying predefined trading rules to make buy or sell decisions. Once the script identifies a trading opportunity, it can automatically place orders on the user’s behalf.

What are the benefits of using Automated TradingView scripts?

Some benefits of using Automated TradingView scripts include the ability to execute trades without manual intervention, the potential for faster trade execution, and the ability to backtest trading strategies using historical data.

Are there any risks associated with using Automated TradingView scripts?

Yes, there are risks associated with using Automated TradingView scripts, including the potential for programming errors, technical issues with the TradingView platform, and the risk of losses due to market volatility.

Can anyone use Automated TradingView scripts?

Yes, anyone with a TradingView account can use Automated TradingView scripts. However, users should have a basic understanding of trading and programming in Pine Script in order to effectively use and customize these scripts.

Are there any limitations to Automated TradingView scripts?

Some limitations of Automated TradingView scripts include the need for a stable internet connection, the reliance on accurate market data, and the potential for limitations in the functionality of the TradingView platform.