Pine Script is TradingView’s programming language, designed to help traders create custom technical indicators and automated trading strategies. This lightweight yet powerful language brings professional-grade technical analysis capabilities to your fingertips.

Think of Pine Script as your personal trading assistant – it lets you transform complex trading ideas into actionable indicators right within the TradingView platform. You can craft anything from basic moving averages to sophisticated multi-factor trading systems.

What makes Pine Script particularly valuable:

- Simplified Syntax – Similar to Python, making it accessible for both beginners and experienced programmers

- Built-in Trading Functions – Ready-to-use technical analysis calculations

- Real-time Testing – Immediate visual feedback on your custom indicators

- Strategy Automation – Convert your trading rules into automated systems, which is crucial for achieving consistent trades

In this guide, you’ll discover how to use Pine Script to build personalized trading indicators. We’ll cover important features, practical examples, and proven development techniques to help you create indicators that suit your unique trading style.

Whether you’re looking to develop your first custom indicator or enhance your existing trading toolkit, this guide will equip you with the knowledge to use Pine Script effectively in your trading journey. For example, you could explore various breakout strategies or learn about Forex strategies designed for TradingView. If you’re interested in stock trading, we also have a wide range of resources on TradingView stock strategies that could be helpful.

Understanding Pine Script Indicators

Pine Script empowers you to harness popular technical analysis tools through built-in functions and customizable parameters. Let’s explore the essential indicators you can implement in your trading strategies:

1. Moving Averages (MA)

- Simple Moving Average (SMA): Calculates the average price over a specific period

- Exponential Moving Average (EMA): Places higher weight on recent price data

- Example usage:

ta.sma(close, 20)calculates a 20-period SMA

These moving averages are just a part of the free Pine Script indicators that you can use for your trading.

2. Relative Strength Index (RSI)

- Measures momentum by comparing upward and downward price movements

- Traditional settings use 14 periods and 70/30 overbought/oversold levels

- Pine Script syntax:

ta.rsi(close, 14)

3. Moving Average Convergence Divergence (MACD)

- Tracks the relationship between two moving averages

- Default parameters: 12-period EMA, 26-period EMA, and 9-period signal line

- Implementation:

ta.macd(close, 12, 26, 9)

4. Average True Range (ATR)

- Measures market volatility based on price ranges

- Helps determine position sizing and stop-loss levels

- Basic code:

ta.atr(14)

These indicators serve multiple strategic purposes:

- Signal potential entry and exit points

- Identify trend strength and direction

- Measure market volatility

- Spot price momentum shifts

- Generate automated trading signals

You can combine these indicators to create sophisticated trading systems. For example, using RSI to confirm MACD crossover signals or implementing ATR-based stop losses with moving average trend following strategies.

To further enhance your trading success, consider exploring some effective trading strategies on TradingView, which include notable examples and technical indicators.

Moreover, mastering buy/sell scripts for TradingView can provide you with a significant edge in your trading endeavors. These scripts leverage technical analysis with indicators like SMA, RSI, and VWAP for smarter trading.

Lastly, stay ahead of the curve by discovering the best TradingView indicators for 2024, which will undoubtedly enhance your trading strategies and improve market analysis.

Key Features of Pine Script

Pine Script has powerful built-in functions that make it easy to create advanced trading indicators. The language provides essential tools for technical analysis that can be implemented with minimal code, enabling you to master trading with custom scripts:

- Simple Moving Average (SMA): Calculate price averages over specific periods using

ta.sma(source, length) - Exponential Moving Average (EMA): Apply more weight to recent prices through

ta.ema(source, length) - Security Data Access: Retrieve data from different timeframes using

request.security()

Customization Capabilities through User Inputs

The true power of Pine Script lies in its ability to customize indicators through user inputs. This feature allows you to create dynamic indicators that can adapt to various trading preferences:

pinescript

//@version=5

indicator(“Custom MA Crossover”)

fastLength = input.int(9, “Fast MA Length”)

slowLength = input.int(21, “Slow MA Length”)

With these input dialogs, traders have the flexibility to:

- Adjust indicator parameters in real-time

- Test different settings without modifying the underlying code

- Save multiple versions of the same indicator for future use

- Create presets tailored for different market conditions

Simplifying Complex Calculations

Pine Script’s built-in functions handle intricate calculations behind the scenes, allowing you to concentrate on developing your trading strategies. For instance, the request.security() function adds versatility by enabling cross-timeframe analysis:

pinescript

htf_close = request.security(syminfo.tickerid, “1D”, close)

This means you can easily access and analyze data from higher timeframes within your indicators.

Flexibility in Indicator Development

The combination of built-in functions and customizable inputs creates a flexible environment for developing personalized trading tools. With Pine Script, you have the ability to construct indicators ranging from basic moving averages to intricate multi-timeframe strategies—all while keeping your code clean and efficient.

Furthermore, Pine Script supports the implementation of advanced strategies such as the Versatile Bollinger Band Cascade. This innovative and adaptable trading system incorporates distinctive features and customization options that set it apart in the competitive landscape of trading algorithms.

Creating Automated Strategies with Pine Script

Pine Script excels at transforming your trading ideas into automated strategies through well-defined entry and exit rules. Let’s break down the process of creating a basic automated trading strategy:

1. Define Strategy Settings

pinescript

strategy(“My Trading Strategy”, overlay=true)

2. Set Trading Parameters

pinescript

longStopLoss = input(2.0, “Long Stop Loss %”)

longTakeProfit = input(4.0, “Long Take Profit %”)

3. Create Entry Conditions

pinescript

// Simple moving average crossover strategy

fastMA = ta.sma(close, 10)

slowMA = ta.sma(close, 20)

longCondition = ta.crossover(fastMA, slowMA)

4. Implement Position Management

pinescript

if (longCondition)

strategy.entry(“Long”, strategy.long)

stopPrice = strategy.position_avg_price * (1 – longStopLoss/100)

profitPrice = strategy.position_avg_price * (1 + longTakeProfit/100)

5. Add Exit Rules with Optimal Points

pinescript

strategy.exit(“Exit”, “Long”, stop=stopPrice, limit=profitPrice)

Incorporating optimal exit point strategies into your trading can significantly enhance your results.

This basic example demonstrates a moving average crossover strategy with fixed stop-loss and take-profit levels. You can enhance your strategy by:

- Adding position sizing rules

- Implementing multiple timeframe analysis

- Creating custom risk management functions

- Setting up time-based filters

Real-World Application

pinescript

// RSI-based entry with trailing stop

rsiValue = ta.rsi(close, 14)

if (rsiValue < 30)

strategy.entry(“RSI Long”, strategy.long)

strategy.exit(“Trail Stop”, “RSI Long”, trail_points = 100)

The power of Pine Script lies in its ability to test these strategies across different market conditions. You can adjust parameters, add filters, and refine your strategy based on backtest results.

For those looking to streamline their trading process even further, consider utilizing an automated Pine crypto service or an automated crypto signal platform. These services can provide valuable insights and automate certain aspects of your trading strategy.

Additionally, setting up TradingView alerts for automated trading can further enhance your trading efficiency by notifying you of key market movements in real-time.

Workflow with Pine Script Editor

The Pine Script Editor serves as your command center for developing custom indicators and strategies. You’ll find a clean, intuitive interface designed to streamline your coding process.

Essential Editor Features:

- Syntax highlighting for improved code readability

- Auto-completion suggestions as you type

- Real-time error detection

- Built-in function documentation

- Version control capabilities

- A range of free HTML editors that can be used for coding purposes

Your typical development workflow in the Pine Editor follows these steps:

1. Script Creation

- Click “Pine Editor” in TradingView

- Choose “Create New Script”

- Select indicator or strategy template

2. Code Development

- Write your base logic

- Add visualization elements

- Set up input parameters

- Include necessary calculations

3. Testing Process

- Apply script to different timeframes

- Test on various symbols

- Check for runtime errors

- Verify indicator calculations

Debugging Best Practices:

- Use

plot()functions to visualize intermediate values - Add

label.new()for specific point analysis - Monitor script runtime performance

- Check error console for warnings

The Pine Editor includes powerful optimization tools to enhance your scripts:

pine

//@version=5

study(“My Script”)

src = input(close, “Source”)

len = input(14, “Length”)

// Debugging example

var_to_debug = ta.sma(src, len)

plot(var_to_debug, “Debug Value”, color.blue)

You can leverage the “Add to Chart” feature to test your indicator across different market conditions. The editor’s split-screen view allows simultaneous code editing and chart visualization, making it easier to spot potential issues in your calculations.

Modular Coding Practices in Pine Script Development

Writing clean, organized code in Pine Script sets the foundation for successful trading indicator development. Modular coding practices break down complex calculations into smaller, focused functions that serve specific purposes.

Key Benefits of Modular Coding:

- Enhanced Readability: Small, well-named functions make your code easier to understand at a glance

- Simplified Maintenance: Isolated functions allow you to update specific components without affecting the entire script

- Reusability: You can import and reuse functions across different indicators

- Efficient Debugging: Smaller code blocks help you identify and fix issues faster

Best Practices for Function Structure:

- Single Responsibility Principle: Each function should perform one specific task. Example: Separate functions for RSI calculation and signal generation.

- Descriptive Naming: Use clear function names that describe their purpose. Format:

calculate_rsi(),generate_buy_signal(),check_crossover(). - Input Parameters: Pass variables as parameters instead of using global variables. This makes functions more flexible and reusable.

pinescript

// Example of a well-structured modular function

calculateMA(source, length) =>

sum = 0.0

for i = 0 to length – 1

sum := sum + source[i]

sum / length

Code Organization Tips:

- Group related functions together

- Place utility functions at the top of your script

- Add comments to explain complex calculations

- Keep functions under 20 lines for better maintainability

- Use consistent indentation for nested code blocks

These modular coding practices create a solid foundation for building complex indicators while maintaining code quality and scalability.

Limitations and Considerations When Using Pine Script

Pine Script operates exclusively within TradingView’s ecosystem, bringing specific constraints you need to consider before diving deep into indicator development:

Platform-Specific Limitations:

- No external library integration capabilities

- Restricted to TradingView’s data feeds

- Limited historical data access based on your subscription level

- Real-time calculations bound by TradingView’s server resources

Technical Constraints:

- Maximum of 40 inputs per script

- Limited to 64 variables per scope

- Restricted memory allocation

- Fixed execution time limits per bar

The absence of external library support creates notable challenges for advanced trading applications. You can’t implement complex machine learning models or neural networks directly in Pine Script. The platform doesn’t support:

- Python libraries like TensorFlow or scikit-learn

- Custom C++ algorithms

- Direct API connections to external data sources

- Real-time data processing from multiple sources

These limitations impact your ability to create sophisticated trading systems that require:

- Deep learning implementations

- Natural language processing

- Complex statistical modeling

- Advanced pattern recognition algorithms

However, for basic to intermediate technical analysis, Pine Script remains a powerful tool. It’s particularly effective when used with high-profit trading strategies or trading signals specifically designed for the platform.

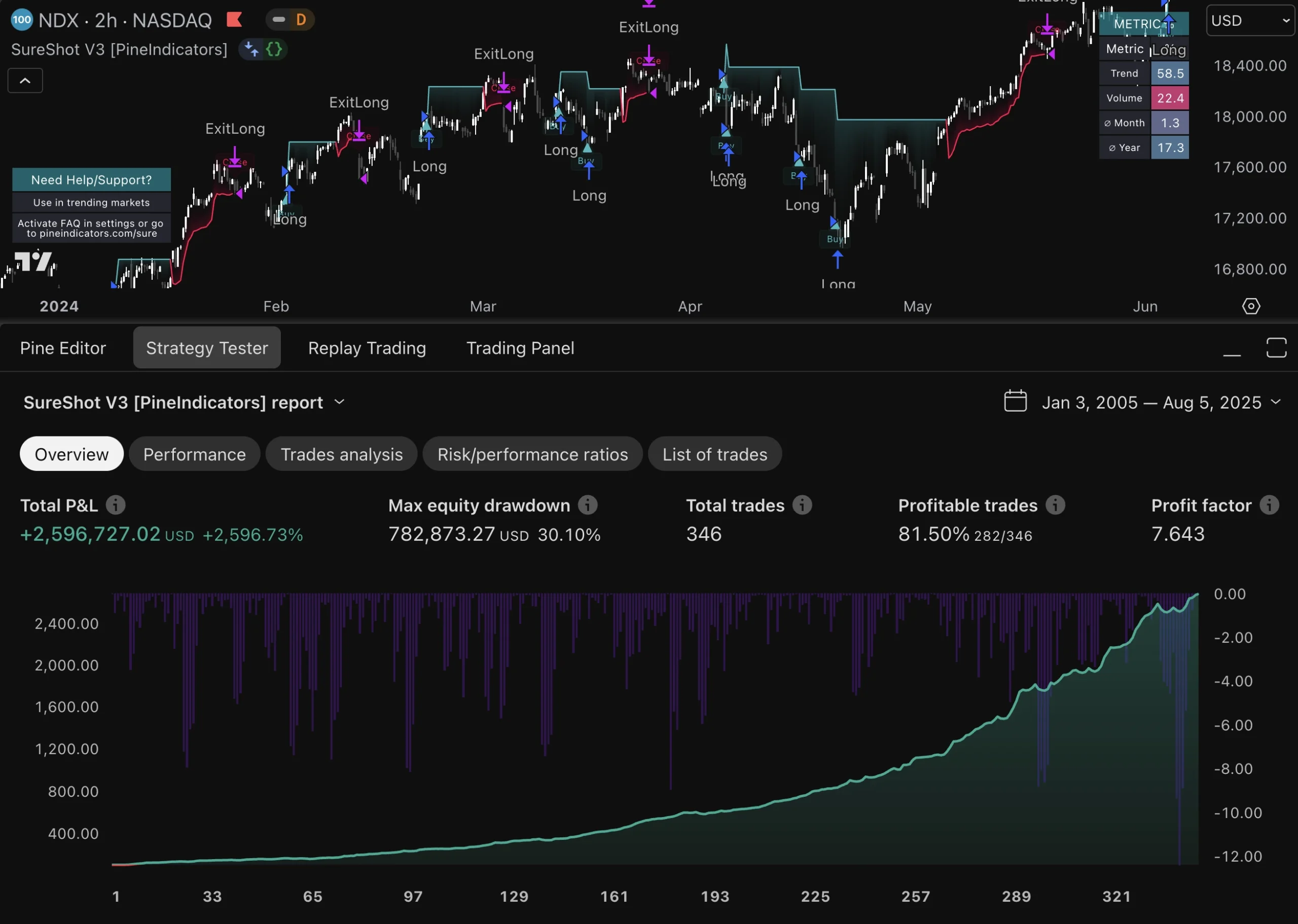

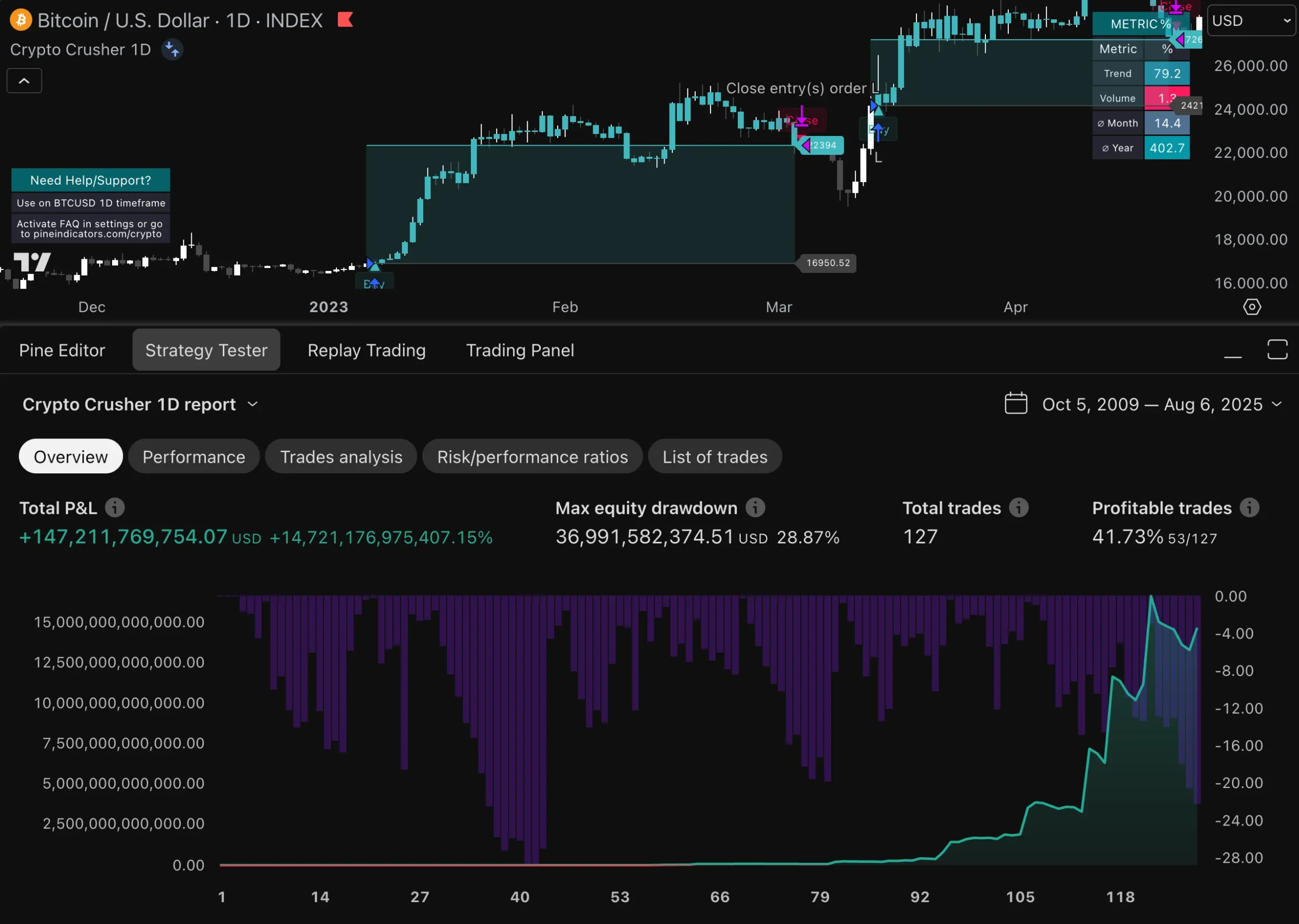

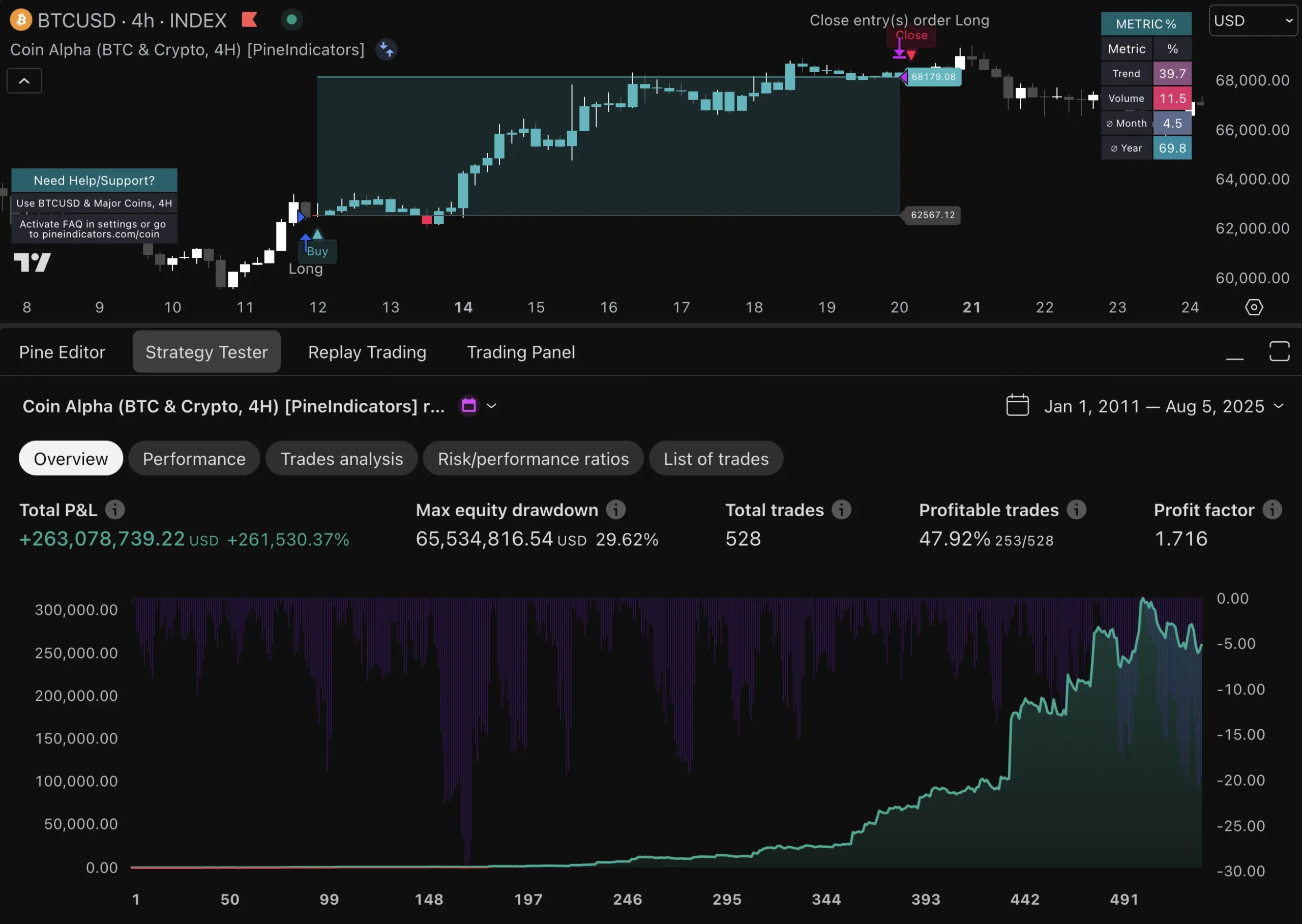

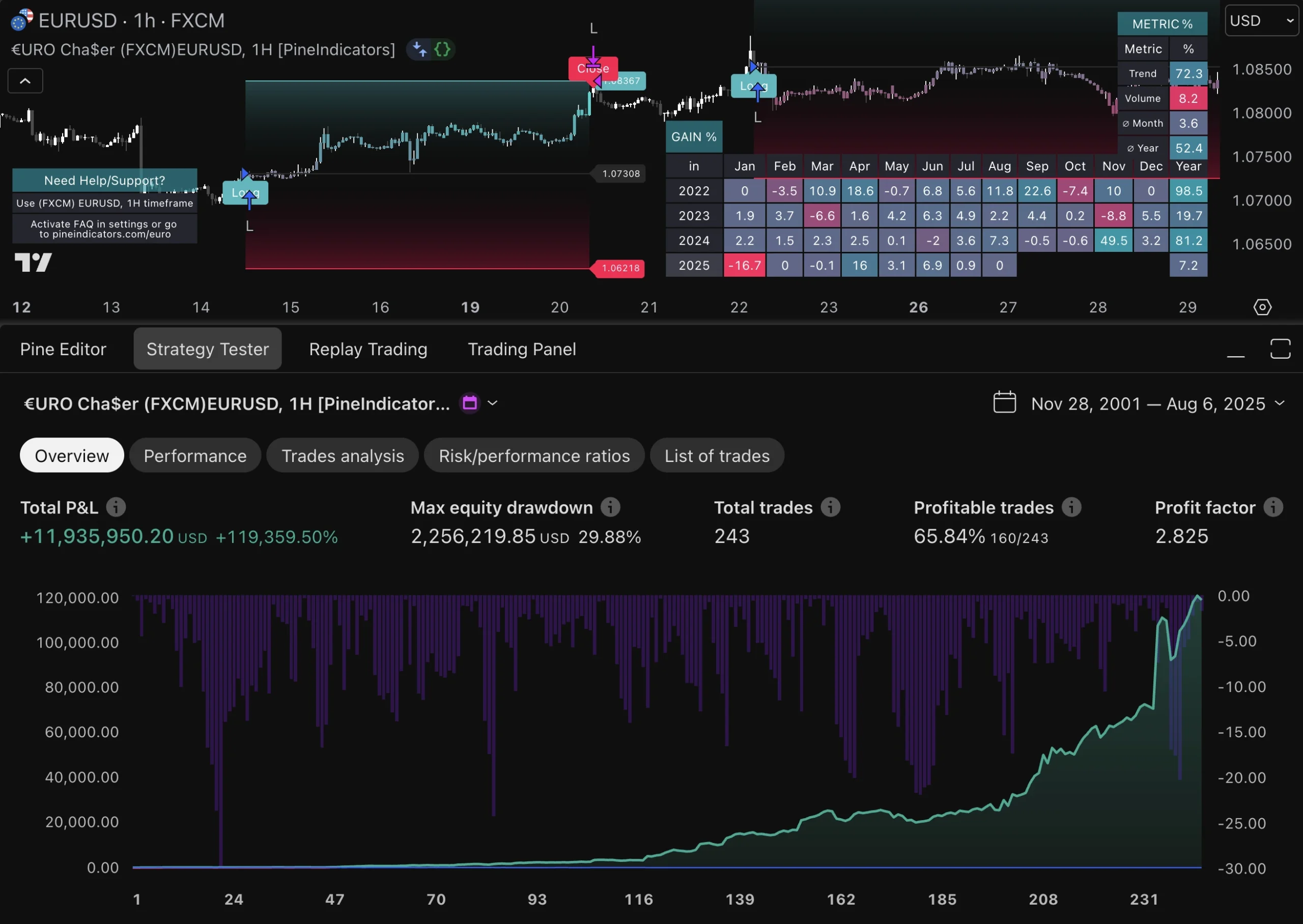

Advanced traders requiring complex computational capabilities often complement Pine Script indicators with external analysis tools or custom solutions built on other platforms. For instance, while Pine Script has its limitations, it can be used alongside crypto scalping strategies or buy strategy signals from trusted sources like PineIndicators.

Moreover, if you’re looking to enhance your skills in using Pine Script, consider enrolling in a comprehensive Pine Script course, which can provide valuable insights and techniques for maximizing the effectiveness of your trading strategies.

Conclusion

Pine Script is a game-changing tool for traders seeking personalized technical analysis solutions. This tool not only allows you to craft custom indicators tailored to specific trading preferences, but it also empowers you to move beyond standard indicators and develop unique market insights.

Your journey into Pine Script opens doors to:

- Creating specialized indicators that match your trading style

- Testing and refining trading strategies with precision

- Building a personal library of technical analysis tools

The power of Pine Script lies in its accessibility – you don’t need extensive programming knowledge to start developing effective trading tools. Each line of code you write brings you closer to a more refined trading approach.

With Pine Script, you can also explore various technical analysis methods that enhance your understanding of market trends. You can even automate your trading strategies using Pine strategy automation tools, making your trading process more efficient.

Ready to transform your trading journey? Start with simple indicators, experiment with different technical calculations, and gradually build more complex tools. The Pine Script community offers extensive resources and support to help you along the way.

Consider leveraging verified trading signals to boost your decision-making process and enhance your trading success. These signals cater to all experience levels, making them an invaluable resource.

Additionally, if you find yourself navigating through sideways markets, don’t worry! There are effective trading strategies for sideways markets that can help you achieve consistent profits while managing risks effectively.

Take control of your technical analysis today – your first custom indicator awaits.

FAQs (Frequently Asked Questions)

What is Pine Script and why is it important for creating custom indicators on TradingView?

Pine Script is a specialized scripting language designed for TradingView that enables traders to create personalized technical analysis tools and custom trading indicators. Its significance lies in providing a powerful platform to develop tailored strategies that suit individual trading preferences.

Which common technical analysis indicators can be implemented using Pine Script?

Pine Script supports the implementation of popular technical analysis indicators such as moving averages (SMA, EMA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average True Range (ATR). These indicators play a crucial role in formulating effective trading strategies.

How do user inputs enhance the customization of Pine Script indicators?

User inputs in Pine Script allow traders to interactively customize indicator parameters through input dialogs. This flexibility enables users to adjust settings like periods or thresholds without modifying the script code, enhancing usability and adaptability of custom indicators.

Can Pine Script be used to create automated trading strategies? If so, how?

Yes, Pine Script facilitates the creation of automated trading strategies by allowing users to define precise entry and exit rules within their scripts. Through step-by-step coding and examples, traders can implement these rules to automate decision-making processes directly on TradingView charts.

What are some best practices for developing maintainable Pine Script code?

Adopting modular coding practices by structuring scripts into focused functions improves readability and maintainability. This approach helps organize complex logic, simplifies debugging, and makes code optimization more efficient within the Pine Editor environment.

What limitations should traders consider when using Pine Script on TradingView?

While Pine Script offers robust features within TradingView, it has constraints such as limited support for external libraries and challenges integrating advanced machine learning applications. Users should be aware that these limitations may impact the complexity of strategies they can develop exclusively within this ecosystem.