Introduction

Automated crypto signal platforms have changed the way traders approach cryptocurrency markets. These advanced tools analyze market data around the clock, sending real-time trading signals directly to your device. Using complex algorithms and machine learning capabilities, these platforms find potential trading opportunities across various cryptocurrency pairs.

Think of these platforms as your digital trading assistant – they watch price movements, study market trends, and generate buy or sell signals based on set rules. This automated method can help you:

- Save valuable time by reducing manual market analysis

- React faster to market opportunities

- Remove emotional bias from trading decisions

- Trade consistently across multiple markets

While automated crypto signal platforms offer significant advantages, they’re not a guaranteed path to trading success. The unpredictable nature of the cryptocurrency market means these tools can produce false signals or overlook sudden market changes. Your success depends on selecting the right platform, understanding its limitations, and maintaining a balanced approach to risk management.

To improve the effectiveness of these automated platforms, using advanced Pine Script indicators can provide more precise trading signals. For those interested in exploring the technical details further, there are many advanced Pine Script tutorials available online.

Additionally, if you’re looking to enhance your trading strategies even more, consider checking out options to buy TradingView indicators or forex indicator scripts for TradingView. These resources could be extremely helpful in refining your trading approach.

Lastly, it’s important to remember that while these automated tools and resources can greatly improve your trading experience, they should be used as part of a comprehensive strategy that includes careful risk management and a thorough understanding of the market.

Understanding Automated Crypto Signal Platforms

Automated crypto signal platforms are advanced online tools that analyze cryptocurrency market data to provide trading recommendations. These platforms use complex algorithms and real-time market analysis to find potential trading opportunities for different cryptocurrency pairs.

Key Features of Signal Platforms:

- Signal Generation Engine: Uses algorithms to process market data

- Trading Bot Integration: Automatically executes trades based on signals

- Risk Management Systems: Sets limits on losses and profits

- Analytics Dashboard: Shows performance metrics and market insights

The technology behind these platforms uses complex mathematical models to examine multiple data points at once. Machine learning algorithms adjust to market conditions by studying past price movements, trading volumes, and market sentiment indicators.

Data Analysis Capabilities:

- Price action patterns

- Volume fluctuations

- Market momentum indicators

- Social media sentiment

- News event impact

The signals generated by these platforms usually include specific entry points, exit targets, and risk management parameters. You can receive these recommendations through various methods:

- Mobile notifications

- Email alerts

- Platform dashboard updates

- API integrations with exchange accounts

Key Benefits for Traders:

- Time Efficiency: Automated analysis runs 24/7 without human intervention

- Emotion-Free Trading: Signals based purely on data-driven metrics

- Multiple Market Coverage: Simultaneous monitoring of numerous trading pairs

- Customizable Parameters: Ability to adjust strategies based on risk tolerance

- Historical Performance Tracking: Access to detailed analytics and success rates

These platforms are especially beneficial for traders who don’t have time to constantly monitor the market or those who want to enhance their trading strategies with data-driven insights. The automation feature allows you to take advantage of opportunities even while you’re sleeping, addressing the need for round-the-clock monitoring in the cryptocurrency markets.

The accuracy of signals varies among platforms, depending on how sophisticated their algorithms are and the quality of data sources they use. Professional traders often incorporate these signals as one part of a larger trading strategy, combining automated recommendations with manual analysis for better outcomes.

Enhancing Trading with Automation

One way traders can leverage automation is through TradingView automation for consistent trades. This approach not only streamlines the trading process but also significantly increases efficiency.

Utilizing Day Trading Indicators

For those interested in day trading, it’s essential to explore day trading indicators available on TradingView. These include powerful tools like Volume Profile HD and Supertrend which can greatly enhance your trading strategies.

Adapting Strategies for Market Conditions

Moreover, understanding how to master effective trading strategies for various market conditions is crucial. This knowledge enables traders to adapt their approach whether the market is trending, ranging, or experiencing high volatility.

Learning Pine Script for Custom Indicators

Additionally, learning Pine Script through specialized courses can empower traders to create custom indicators tailored to their specific needs. Such customization can provide a significant edge in the competitive cryptocurrency market.

Creating Custom Indicators for Stocks

Finally, the skills acquired from mastering Pine Script can also be applied beyond cryptocurrency into stock trading by utilizing Pine Script indicators for stocks. This versatility allows traders to leverage their expertise across different financial markets.

How Automated Crypto Signal Platforms Generate Trading Signals

Automated crypto signal platforms use advanced analytical methods to find potential trading opportunities in the cryptocurrency market. These platforms combine technical and fundamental analysis techniques to create precise trading signals.

Technical Analysis Components:

- Moving Averages (MA): Platforms track both simple and exponential moving averages to identify trend directions and potential entry points.

- Relative Strength Index (RSI): Measures cryptocurrency price momentum to determine overbought or oversold conditions.

- Bollinger Bands: Analyzes price volatility and potential breakout points.

- MACD (Moving Average Convergence Divergence): Identifies trend changes and momentum shifts.

To improve their technical analysis skills, many platforms use advanced tools and resources such as Pine Script from TradingView, which allows for customized technical indicators and strategies.

Fundamental Analysis Elements:

- Market sentiment analysis through social media monitoring.

- Trading volume analysis across multiple exchanges.

- News event impact assessment.

- Network activity metrics evaluation.

The signal generation process usually follows a systematic approach:

- Data Collection: Platforms gather real-time price data, volume information, and market metrics from various sources.

- Pattern Recognition: Advanced algorithms identify recurring price patterns and chart formations.

- Signal Validation: Multiple indicators are cross-referenced to confirm potential trading opportunities.

- Risk Assessment: Platforms evaluate market conditions and potential downsides before generating signals.

These platforms often allow traders to customize certain parameters such as sensitivity levels and risk tolerance. You can set specific criteria for:

- Minimum trading volume requirements

- Price movement thresholds

- Time frame preferences

- Risk-reward ratios

The signal generation process also takes into account market volatility by:

- Analyzing historical price movements

- Calculating volatility indices

- Monitoring liquidity levels

- Assessing current market conditions

Many platforms use machine learning algorithms to improve the accuracy of their signals by:

- Learning patterns from past data

- Adapting to changing market conditions

- Optimizing performance based on successful trades

- Continuously refining prediction models

Algorithms and Machine Learning in Automated Crypto Trading

The algorithmic backbone of automated crypto trading platforms consists of sophisticated mathematical models designed to identify profitable trading opportunities. These algorithms, such as those based on Pine Script, process vast amounts of market data in real-time, executing trades based on predefined parameters and historical patterns.

Common Trading Algorithms:

- Mean Reversion: Identifies price deviations from historical averages

- Momentum Trading: Captures trending markets by analyzing price velocity

- Arbitrage: Exploits price differences across multiple exchanges

- Market Making: Creates liquidity by placing simultaneous buy and sell orders

Machine learning algorithms enhance these traditional trading strategies by adapting to changing market conditions. Neural networks and deep learning models analyze patterns in:

- Price movements

- Trading volume

- Market sentiment

- Social media trends

- News events

The integration of machine learning brings several key advantages to automated crypto signal platforms:

Pattern Recognition

ML models excel at identifying complex market patterns that human traders might miss. These systems can process thousands of data points simultaneously, spotting correlations and potential trading opportunities.

Predictive Analytics

Advanced ML algorithms use historical data to forecast potential market movements. These predictions become more accurate as the system processes more data and learns from successful and unsuccessful trades.

Risk Management

Machine learning systems automatically adjust trading parameters based on market volatility and risk levels. This dynamic approach helps protect user investments during uncertain market conditions.

Real-Time Adaptation

Unlike traditional algorithms, ML-powered systems can adapt their strategies in response to:

- Market regime changes

- New trading patterns

- Evolving market dynamics

- Unexpected events

The combination of traditional algorithms, such as mean reversion or momentum trading, with machine learning creates a robust trading ecosystem that can operate 24/7, maintaining consistent performance across different market conditions. These systems continue to evolve, incorporating new data sources and improving their prediction accuracy through constant learning and optimization.

Moreover, the use of trading signals generated from these advanced algorithms further enhances the decision-making process for traders. The insights gained from these signals can significantly improve a trader’s ability to navigate the volatile crypto market successfully.

The landscape of automated crypto trading is being transformed by the integration of sophisticated algorithmic strategies and machine learning technologies. As these systems continue to evolve, they promise to deliver even greater efficiency and profitability for traders worldwide.

Popular Automated Crypto Signal Platforms to Consider

The cryptocurrency market offers several automated signal platforms, each with unique features and capabilities designed to enhance your trading experience. Let’s explore some of the leading platforms that have gained significant traction among traders.

1. Cryptohopper

Cryptohopper stands out as a versatile automated trading platform that caters to both beginners and experienced traders. The platform’s intuitive interface allows you to:

- Set up customized trading strategies

- Access pre-configured trading templates

- Track multiple cryptocurrencies simultaneously

- Deploy automated trading bots 24/7

Key Features:

- Social Trading Integration: Copy successful traders’ strategies and learn from their moves

- Mirror Trading: Replicate expert traders’ positions automatically

- Technical Analysis Tools: Access over 130 indicators and candlestick patterns

- Paper Trading: Test strategies without risking real money

- Multi-Exchange Support: Connect to major exchanges through a single interface

Trading Bot Capabilities:

- Real-time market monitoring

- Automated buy and sell orders

- Stop-loss and take-profit settings

- Position sizing management

- Risk management tools

The platform’s marketplace offers signal providers and trading strategies you can subscribe to, eliminating the need to develop your own trading system from scratch. Cryptohopper’s backtesting feature enables you to validate strategies using historical data before deploying them in live markets.

However, it’s essential to be aware of certain common trading strategy mistakes that could hinder your success in the financial markets.

Security Features:

- API key encryption

- Two-factor authentication

- Read-only API connections

- Regular security audits

The platform’s performance tracking dashboard provides detailed insights into your trading activities, helping you identify successful patterns and areas for improvement. You can customize alerts and notifications to stay informed about market movements and executed trades, even when you’re away from your screen.

2. Cornix

Cornix is a flexible automated trading platform that aims to connect both new and experienced cryptocurrency traders. With its trade copying service, users can replicate the strategies of successful traders directly into their own portfolios, generating passive income through automated trading.

Key features of Cornix include:

- Multi-channel signal support: Connect multiple trading signal providers simultaneously

- Custom strategy builder: Create personalized trading strategies with no coding required

- Risk management tools: Set stop-loss and take-profit levels automatically

- Cross-exchange compatibility: Trade across major cryptocurrency exchanges from one interface

The platform’s user-friendly dashboard allows you to track performance metrics in real-time and make adjustments to your trading settings as needed. You have the flexibility to customize entry points, position sizes, and risk levels for each automated strategy.

Cornix’s Smart Trade feature enables advanced order types:

- Trailing stop-losses

- DCA (Dollar-Cost Averaging) orders

- Multiple take-profit targets

- Position scaling options

For users seeking to further enhance their trading strategies, integrating advanced Pine Script strategies for TradingView can be advantageous. These strategies not only enhance trading performance but also include backtesting and risk management techniques.

The platform’s mobile app ensures that you stay connected to your automated trading systems around the clock. You’ll receive instant notifications for trade executions and market alerts, allowing you to take immediate action if necessary. Whether you’re at home or on the go, you can easily pause, resume, or modify your trading bots directly from your smartphone, giving you complete control over your automated strategies.

3. 3Commas

3Commas stands out as a powerful automated trading platform, offering a wide range of tools designed for both beginners and advanced traders. The platform can connect with 23 major cryptocurrency exchanges, including Binance, Coinbase Pro, and KuCoin.

Key Features:

- Smart Trading Terminal with Take Profit and Stop Loss

- Grid and DCA (Dollar Cost Averaging) bots

- Portfolio management tools

- Mobile app for iOS and Android

- Paper trading for risk-free practice

The platform’s SmartTrade terminal enables you to execute complex trading strategies across multiple exchanges from a single interface. You can set up automated trading bots that operate 24/7, implementing your chosen strategies without constant monitoring.

Security Measures:

- Two-factor authentication (2FA)

- API key encryption

- Regular security audits

- No direct access to user funds

- Cold storage protection for sensitive data

3Commas implements a strict security protocol where your exchange API keys remain encrypted and stored in secure servers. The platform operates on a read-only basis with your exchange accounts, meaning it can’t withdraw your funds without explicit authorization.

The platform’s pricing structure includes:

- Starter Plan: Basic bot functionality

- Advanced Plan: Additional indicators and strategies

- Pro Plan: Full platform access with unlimited bots

Users can test the platform’s capabilities through a free trial period, allowing you to explore the features before committing to a paid subscription.

Advantages and Risks of Using Automated Crypto Signal Platforms

Automated crypto signal platforms offer significant benefits for traders, yet they come with inherent risks that require careful consideration.

Key Advantages:

- 24/7 Market Monitoring: These platforms continuously scan markets, identifying opportunities even when you’re away

- Emotion-Free Trading: Automated systems execute trades based on pre-set parameters, eliminating emotional decision-making

- Rapid Trade Execution: Signals trigger instant responses, capitalizing on fleeting market opportunities

- Multi-Market Analysis: Platforms can simultaneously monitor multiple cryptocurrencies across different exchanges

- Time Management: You can focus on strategy development while the system handles routine trading tasks

Notable Risks:

- Technical Failures: System glitches or connectivity issues can lead to missed trades or incorrect executions

- Market Volatility Impact: Sudden price swings can trigger false signals, resulting in unnecessary trades

- Over-Optimization: Systems might perform well in backtesting but fail in live market conditions

- Security Vulnerabilities: API connections and automated trading expose accounts to potential cyber threats

- Signal Quality: Not all generated signals maintain consistent accuracy across different market conditions

Risk Management Considerations

- Start with small trading amounts to test system reliability

- Set strict stop-loss limits to protect against significant losses

- Monitor system performance regularly and adjust parameters as needed

- Maintain backup trading strategies for system downtime

- Keep detailed records of automated trading results for performance analysis

Successful implementation of automated crypto signal platforms requires a balanced approach between leveraging automation benefits and maintaining active risk management practices. Trading systems need regular monitoring and adjustment to adapt to changing market conditions.

Making Informed Decisions When Choosing an Automated Crypto Signal Platform

Selecting the right automated crypto signal platform requires careful research to protect your investments and maximize potential returns. Here’s what you need to evaluate:

1. Track Record Verification

- Check the platform’s historical performance data

- Look for independently verified results

- Read user testimonials from multiple sources

2. Security Features

- Two-factor authentication availability

- API integration security measures

- Fund storage and withdrawal protocols

3. Platform Transparency

- Clear pricing structure

- Detailed documentation of trading strategies

- Regular updates and communication channels

4. Technical Capabilities

- Exchange compatibility

- Signal generation methods

- Customization options for trading parameters

5. Support Infrastructure

- 24/7 customer service availability

- Educational resources

- Community forums or discussion groups

Before committing real funds, you should test platforms using demo accounts. Many reliable platforms offer free trial periods, which are perfect for evaluating the interface, signal quality, and execution speed. Pay attention to the platform’s response during different market conditions, particularly during high volatility periods.

Additionally, the selection process should include a thorough review of the platform’s risk management tools. Look for features like stop-loss settings, position sizing options, and portfolio diversification capabilities. These elements help protect your capital while maximizing the benefits of automated trading.

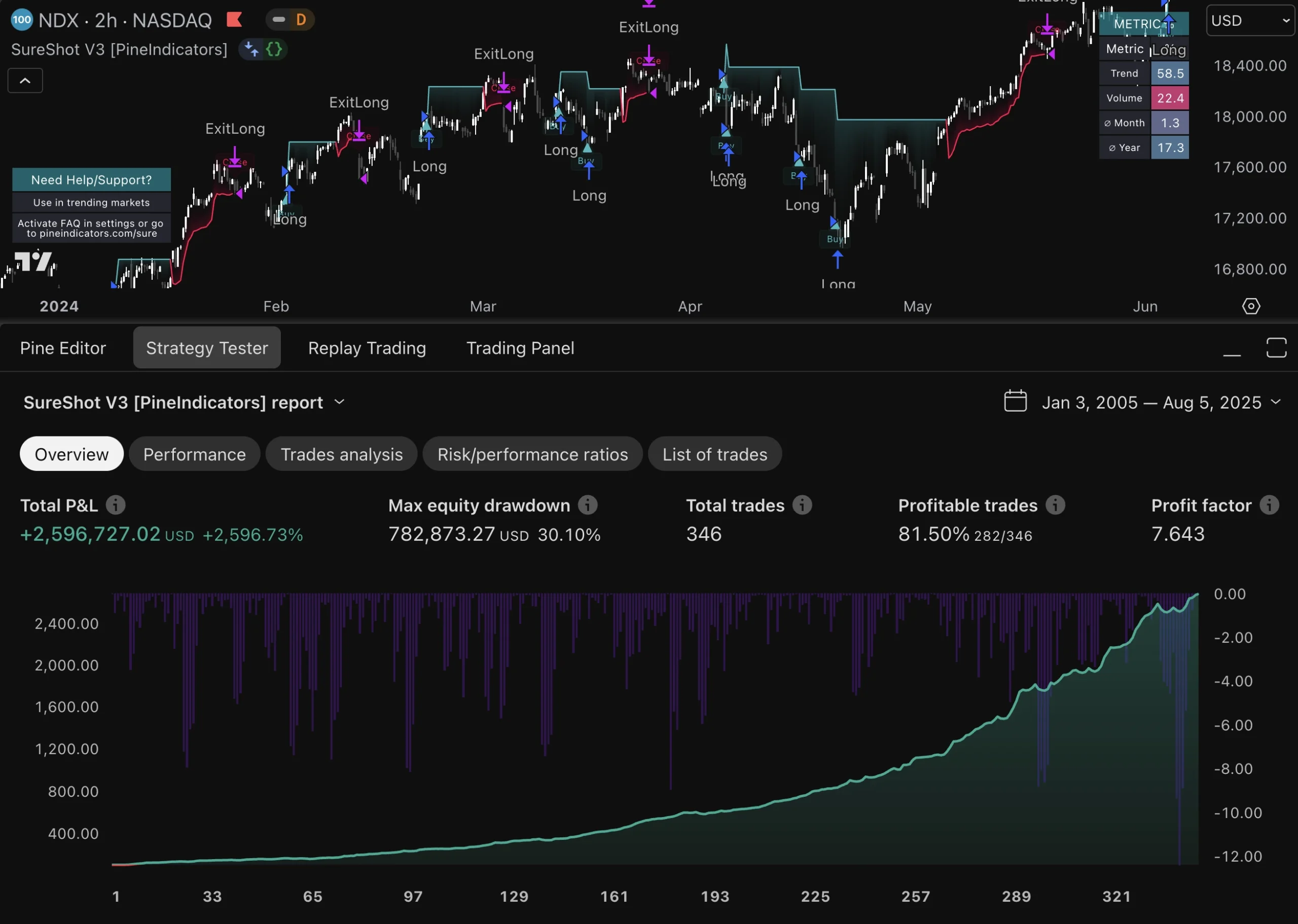

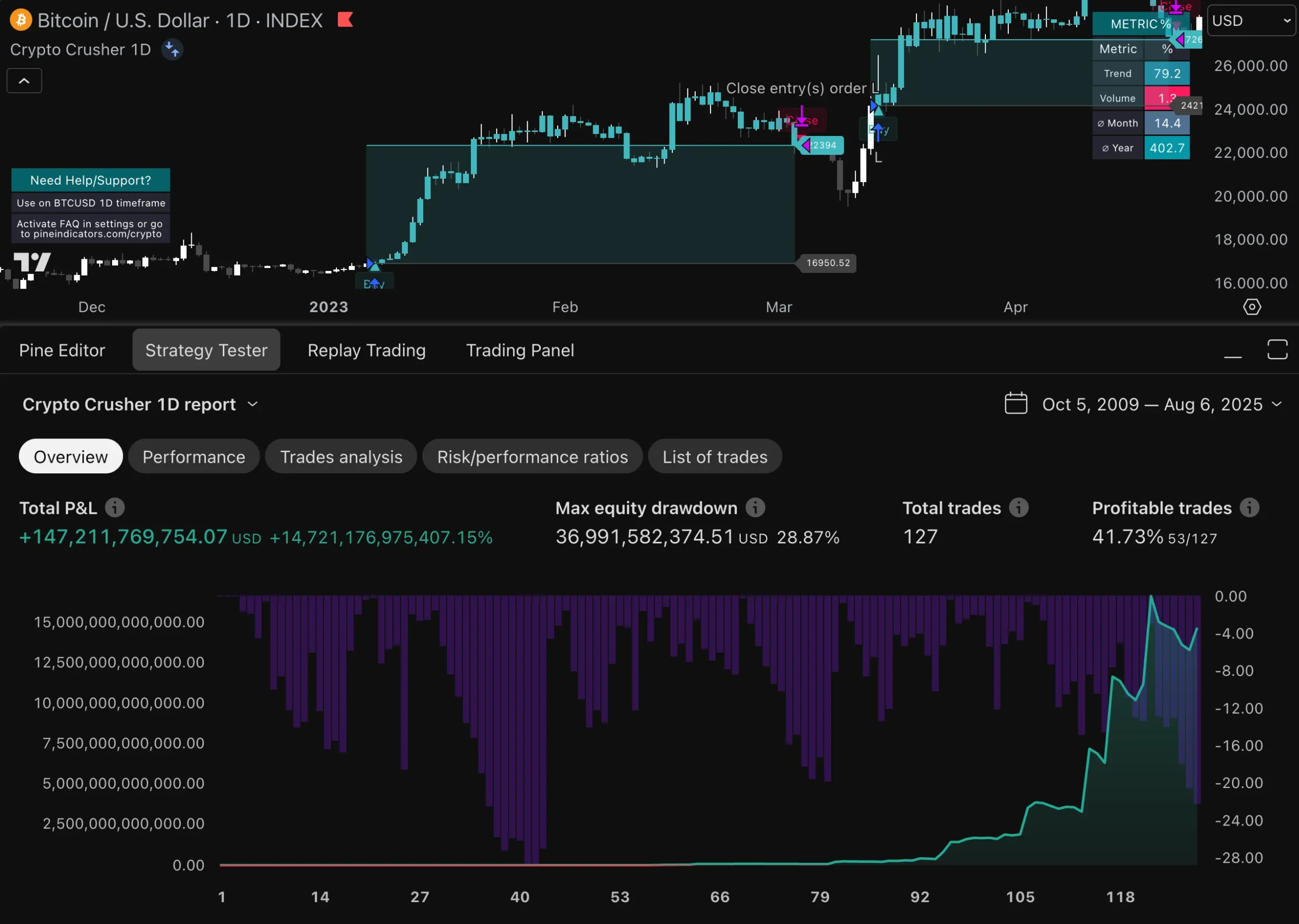

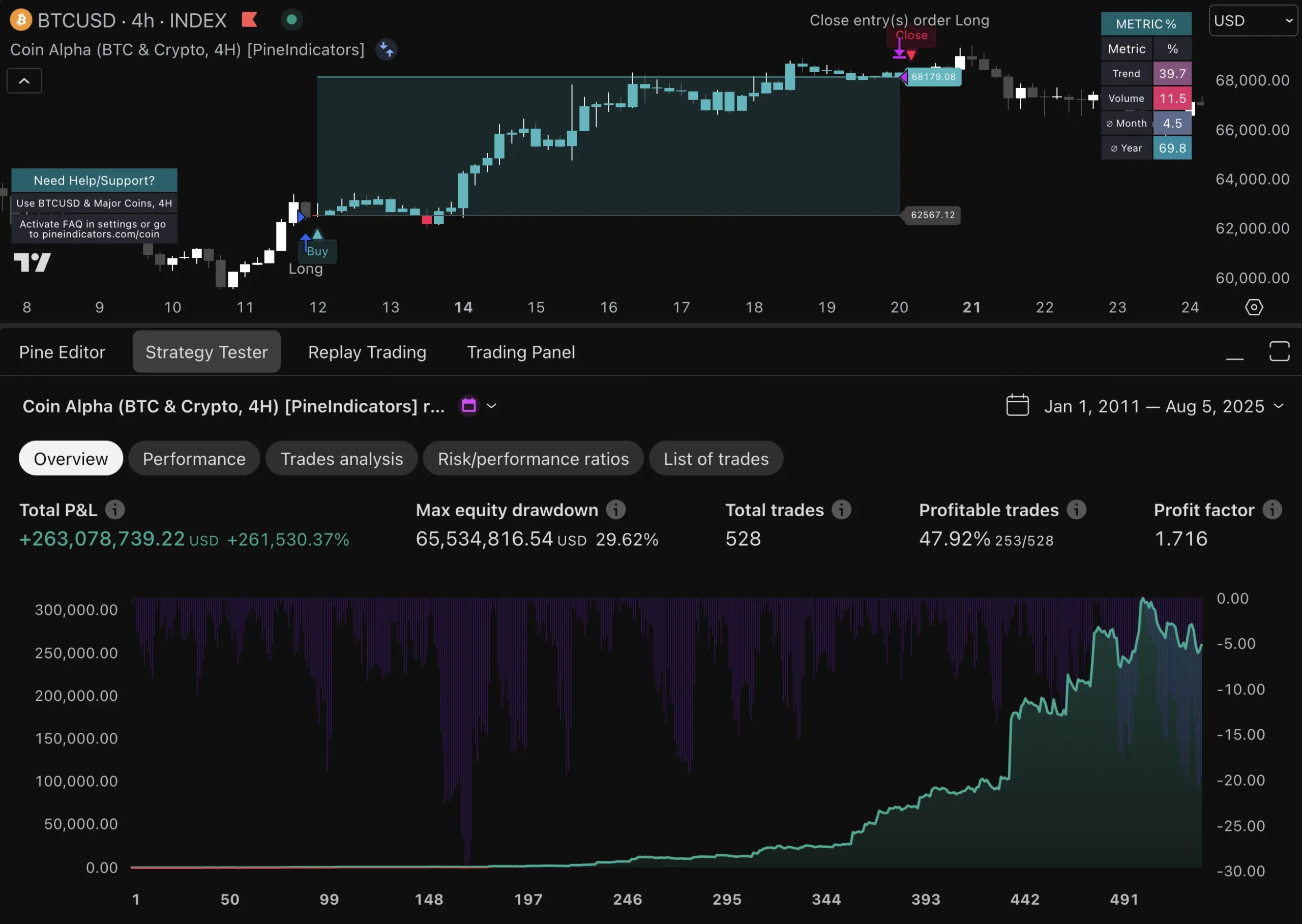

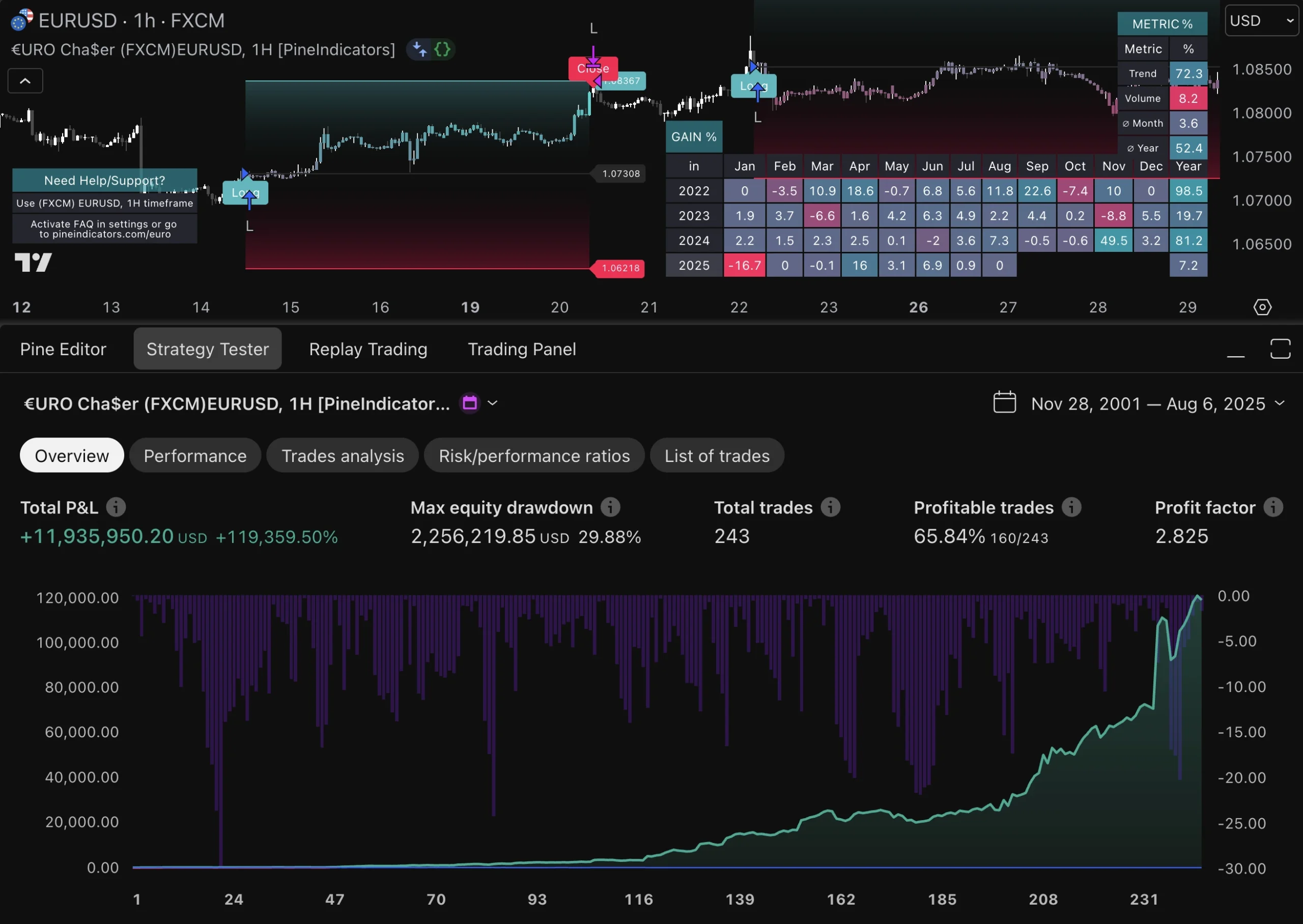

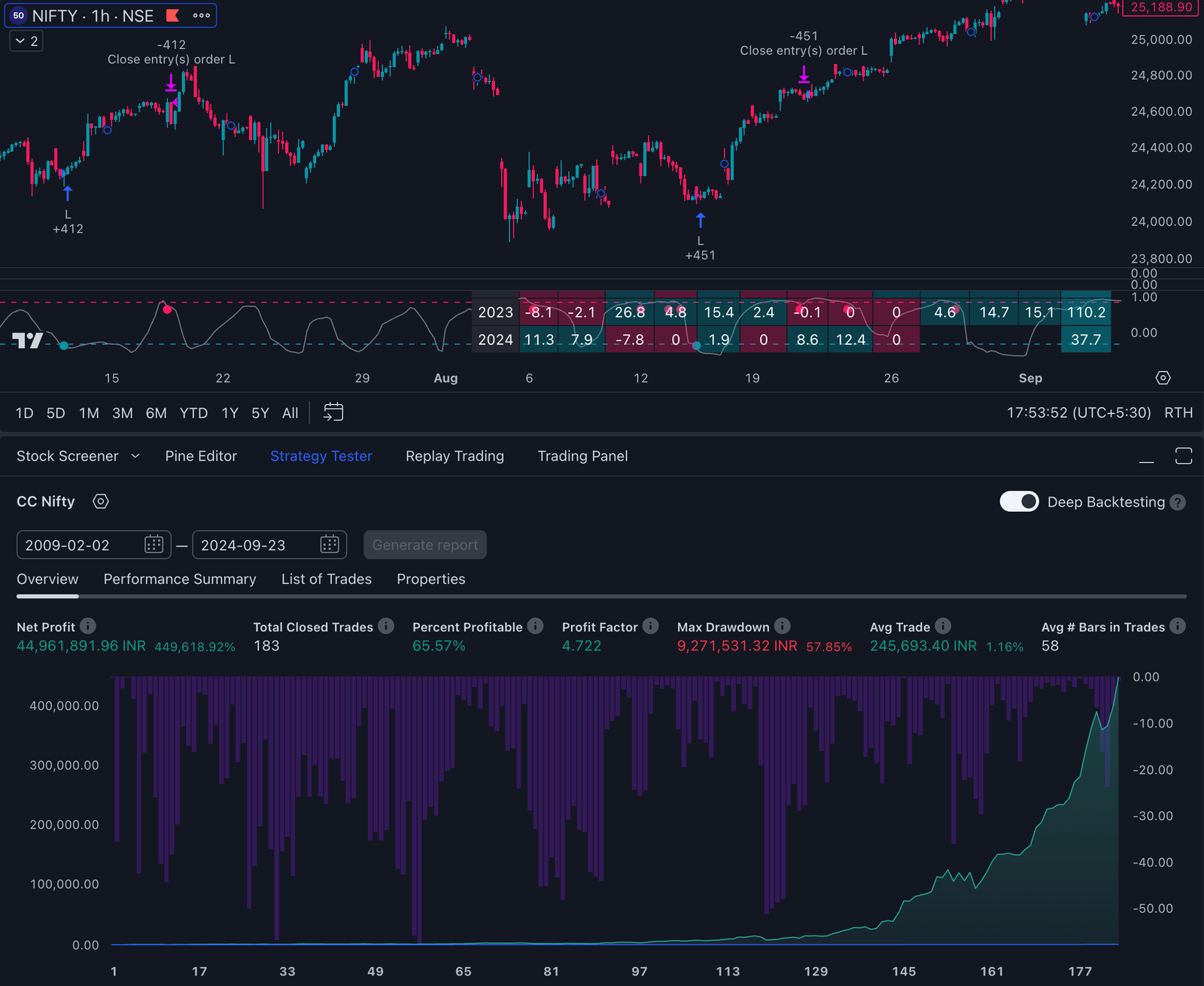

One useful feature to consider is a trading strategy tester, which allows you to backtest your strategies using historical data. This can provide valuable insights into how a particular strategy might perform in different market conditions.

The Future of Automated Trading in the Cryptocurrency Market

The cryptocurrency market’s rapid evolution signals exciting developments for automated trading platforms. Machine learning algorithms continue to become more sophisticated, enabling platforms to process complex market patterns with increasing accuracy.

Key developments shaping the future:

- Integration of advanced AI capabilities for enhanced market prediction

- Improved risk management features through smart contract automation

- Deeper customization options for individual trading strategies, such as those offered by Pine Script which allows users to create their own trading indicators and strategies.

- Cross-chain compatibility for broader market access

The rise of decentralized finance (DeFi) creates new opportunities for automated platforms to expand their capabilities. You’ll see platforms adapting to include yield farming strategies, liquidity pool management, and arbitrage opportunities across different protocols.

Emerging trends to watch:

- Social trading features with AI-powered trader ranking systems

- Real-time market sentiment analysis from social media

- Integration with traditional finance markets

- Enhanced security measures through blockchain technology

The future of automated crypto trading platforms points toward a more accessible, efficient, and sophisticated trading ecosystem. These platforms will play a crucial role in democratizing cryptocurrency trading while providing professional-grade tools to retail investors.

One area where these tools can significantly improve is in determining optimal exit points for trades. Understanding how to determine optimal exit points can help traders minimize losses and maximize profits regardless of their trading style.

Moreover, the integration of effective trading strategies on platforms like TradingView can further enhance trading success. This includes leveraging technical indicators and notable examples that have proven successful in the past.

Finally, mastering specific strategies like the EMA crossover, which is a popular method among traders, could also be beneficial. This strategy involves using two exponential moving averages (EMAs) and is known for its effectiveness when implemented correctly.

FAQs (Frequently Asked Questions)

What are automated crypto signal platforms?

Automated crypto signal platforms are tools that utilize algorithms and machine learning to analyze market data and generate trading signals for buying or selling cryptocurrencies. They aim to assist traders in making informed decisions by providing data-driven insights.

How do automated crypto signal platforms generate trading signals?

These platforms generate trading signals through various analytical processes, including technical and fundamental analysis. They assess market trends, price movements, and other indicators to identify potential buying or selling opportunities.

What are the benefits of using an automated crypto signal platform?

The primary benefits include time-saving automation of trading processes and improved decision-making based on accurate, data-driven signals. This can enhance a trader’s ability to capitalize on market opportunities without constant manual monitoring.

What risks should traders be aware of when using automated crypto signal platforms?

Traders should be cautious of potential risks such as market volatility, which can lead to false positives in trading signals. Relying solely on automated signals without proper oversight may expose traders to significant losses.

Which popular automated crypto signal platforms should I consider?

Some leading platforms include Cryptohopper, Cornix, and 3Commas. Each offers unique features such as social trading capabilities, trade copying services, and seamless integration with various exchanges for automation.

How can I make informed decisions when choosing an automated crypto signal platform?

Conducting thorough research is crucial. Consider factors like the platform’s features, user experience, security measures, and reviews from other traders to ensure you select a reliable service that meets your needs.