EMA crossover strategy is a popular trading method that uses different Exponential Moving Averages (EMAs) to create buy and sell signals. The EMA crossover strategy is a type of ma crossover strategy, which uses average crosses—when one moving average crosses over another—to generate trading signals. By looking at where a shorter EMA crosses a longer EMA, traders can spot possible market trends and turning points, as these average crosses are key indicators for identifying potential entry or exit points. This makes the strategy useful for both beginners and experienced traders.

Using Pine Script, TradingView’s own scripting language, has several advantages for implementing trading strategies like the EMA crossover. Pine Script allows you to:

- Create custom scripts for indicators and strategies.

- Automate trade execution based on specific conditions.

- Set up alerts when certain crossover situations occur.

In this article, you’ll learn how to:

- Understand what EMAs are and how they are calculated.

- Discover why crossover signals are important in trading.

- Build an EMA crossover strategy using Pine Script with detailed instructions.

- Improve your strategy with customization options.

- Apply and test your strategy on the TradingView platform.

- Fix common problems to boost performance.

By the end of this guide, you will have a thorough understanding of creating an effective EMA crossover Pine script to enhance your trading decisions.

Understanding the Exponential Moving Average (EMA)

What is EMA and How is it Calculated?

Exponential Moving Average (EMA) is a type of moving average that places a greater weight and significance on the most recent data points. Here’s how you can calculate it:

- Calculate the Simple Moving Average (SMA) for the initial EMA value.

- Determine the multiplier for weighting the EMA, which is typically calculated as:

- [ text{Multiplier} = frac{2}{text{Period} + 1} ]

- Apply the EMA formula: [ text{EMA} = left[ frac{text{Price} – text{Previous EMA}}{text{Multiplier}} + text{Previous EMA} right] ]

The main difference between EMA and Simple Moving Average (SMA) lies in how they react to price changes:

- EMA: It gives more importance to recent price changes because of its weighting factor. This makes it quicker to react to price movements.

- SMA: It treats all data points equally over a given period, which means it responds more slowly compared to EMA.

- Medium-term moving average: Traders sometimes use a medium-term moving average to balance the responsiveness of the EMA and the stability of the SMA in their analysis.

How Can Traders Use EMA?

- Market Trends: By smoothing out price data, EMAs help traders see the underlying trend direction. An upward-sloping EMA indicates an upward trend, while a downward-sloping EMA suggests a downward trend.

- Reversal Points: When shorter and longer EMAs cross each other, it can signal potential trend reversals. For example, when a short-term EMA crosses above a long-term EMA, it might indicate the beginning of a new trend or an upward trend. Conversely, when the short-term EMA crosses below the long-term EMA, it may signal a downward trend.

With this knowledge, traders can make better decisions about when to enter or exit trades based on their strategies.

Understanding Crossover Signals in Trading

Crossover signals are crucial in trading strategies, providing clear indicators for potential buy and sell opportunities. These signals occur when two moving averages of different lengths intersect, suggesting a change in market direction. In trading, these are also known as ma cross signals, which help identify potential shifts in market momentum.

How Crossover Signals Work

When it comes to identifying trading signals, crossover events play a crucial role. A crossover signal is generated when a shorter-term Exponential Moving Average (EMA) crosses above or below a longer-term EMA:

- Buy Signal: Occurs when the shorter EMA crosses above the longer EMA. This upward crossover is often interpreted as a bullish signal, suggesting the potential for upward price movement.

- Sell Signal: Happens when the shorter EMA crosses below the longer EMA. This downward crossover is viewed as a bearish signal, indicating possible downward price movement.

Specifically, a buy signal is generated when the shorter EMA closes above the longer EMA, while a sell signal is triggered when the shorter EMA closes below the longer EMA.

These crossovers provide traders with actionable insights into market trends, enabling timely entry and exit from trades.

Popular EMA Combinations

Different combinations of EMAs are used to generate reliable crossover signals. These setups typically involve two EMAs with different periods, often referred to as ‘two EMAs.’ Some commonly used setups include:

- 9-period vs 21-period EMAs: A classic combination where the 9-period EMA (short-term) crossing above the 21-period EMA (long-term) generates a buy signal, while crossing below generates a sell signal.

- 5-period vs 13-period EMAs: A more responsive setup that offers quicker signals but may result in more false positives due to its sensitivity.

- 50-period vs 200-period EMAs: Often used for long-term trend analysis, this setup filters out short-term noise and provides strong confirmation of trend changes.

Each combination has its own strengths depending on trading style and market conditions. By understanding these setups, you can tailor your strategy to suit specific trading objectives.

Using these principles, traders can develop robust strategies that leverage the power of crossover signals to make informed decisions in dynamic markets.

Developing an EMA Crossover Strategy Using Pine Script

Creating a basic EMA crossover strategy using Pine Script involves several key steps. This guide will walk you through the process, providing code snippets to help illustrate each step. In this section, you will also find the source code for the EMA crossover strategy.

- Define inputs to allow users to customize EMA lengths and other parameters.

- Calculate the EMAs based on the selected lengths.

- Identify crossover points to generate buy and sell signals.

- Implement entry and exit rules for trades.

- Test and optimize the strategy.

Step-by-Step Guide

1. Initialize Your Script

Start by setting up your Pine Script environment. Use the following code to initialize your script:

pinescript //@version=4 strategy(“EMA Crossover Strategy”, overlay=true)

2. Define EMA Lengths

Specify the lengths of the EMAs you want to use for your crossover strategy:

pinescript fastLength = 9 slowLength = 21

3. Calculate EMAs

Use Pine Script’s built-in ema function to calculate the EMAs based on the specified lengths:

pinescript fastEMA = ema(close, fastLength) slowEMA = ema(close, slowLength)

4. Plot EMAs on Chart

To visualize the EMAs on your chart, use the plot function:

pinescript plot(fastEMA, title=”Fast EMA”, color=color.blue) plot(slowEMA, title=”Slow EMA”, color=color.red)

5. Set Trade Conditions

Define conditions for entering and exiting trades based on the crossover signals:

pinescript // Buy condition: Fast EMA crosses above Slow EMA longCondition = crossover(fastEMA, slowEMA)

// Sell condition: Fast EMA crosses below Slow EMA shortCondition = crossunder(fastEMA, slowEMA)

// The strategy can be configured to use a fixed position size for each trade, helping to manage risk and maintain consistent exposure.

Setting Conditions for Trade Execution

Conditions for executing trades are crucial in any trading strategy development. In this example:

- A buy signal occurs when the 9-period EMA crosses above the 21-period EMA. This indicates potential bullish momentum, which can be leveraged in a scalping trading strategy.

- A sell signal occurs when the 9-period EMA crosses below the 21-period EMA, signaling bearish momentum that could be utilized in a momentum trading approach.

After identifying a buy or sell signal, it is important to set a stop loss to manage risk. The stop loss price should be determined based on your entry price and a predefined risk ratio, such as 1% or 2% of your trading capital. By calculating the stop loss price relative to your entry, you can limit potential losses and optimize your trade management.

6. Execute Trades

Execute trades when the defined conditions are met:

pinescript if (longCondition) strategy.entry(“Long”, strategy.long)

if (shortCondition) strategy.entry(“Short”, strategy.short)

Traders can set profit targets to lock in gains and measure the effectiveness of their strategy, ensuring that profit is a key metric in evaluating trading performance.

Complete Code Snippet

Combining all steps together, your complete Pine Script code would look like this:

pinescript //@version=4 strategy(“EMA Crossover Strategy”, overlay=true)

// Define EMA lengths fastLength = 9 slowLength = 21

// Calculate EMAs fastEMA = ema(close, fastLength) slowEMA = ema(close, slowLength)

// Plot EMAs on chart plot(fastEMA, title=”Fast EMA”, color=color.blue) plot(slowEMA, title=”Slow EMA”, color=color.red)

// Set trade conditions longCondition = crossover(fastEMA, slowEMA) short

Enhancing Your EMA Crossover Strategy with Customization Techniques

Optimizing Parameters

Fine-tuning the lengths of your EMAs can significantly boost the performance of your strategy. Shorter EMAs respond quickly to price changes but may produce more false signals. Longer EMAs are slower to react, providing more reliable signals but potentially missing early trend movements. Finding the right balance between sensitivity and reliability is key.

- Short-term traders might use combinations like 9-period and 21-period EMAs.

- Long-term investors often prefer setups like 50-period and 200-period EMAs.

Using parameter optimization tools available in Pine Script, you can test various EMA length combinations to identify the most effective setup for your trading style.

Incorporating Additional Indicators

In choppy markets and during periods of high volatility, EMA crossovers can generate false signals due to increased market noise and unpredictable price swings. To enhance trade accuracy and minimize false signals, integrating other indicators or filters into your EMA crossover strategy can be beneficial:

- Relative Strength Index (RSI): This momentum oscillator helps determine overbought or oversold conditions, adding a layer of confirmation to your crossover signals.

- Volume Indicators: High trading volume often validates price movements. Using volume-based filters ensures that crossovers supported by substantial market activity are considered.

- Moving Average Convergence Divergence (MACD): By combining MACD with EMA crossovers, you gain insights into both trend direction and momentum, refining entry and exit points.

Here’s an example of how you might incorporate RSI with your EMA crossover in Pine Script:

pinescript //@version=4 study(“EMA Crossover with RSI”, shorttitle=”EMA+RSI”, overlay=true) fastLength = input(9, title=”Fast EMA Length”) slowLength = input(21, title=”Slow EMA Length”) rsiLength = input(14, title=”RSI Length”) rsiOverbought = input(70, title=”RSI Overbought Level”) rsiOversold = input(30, title=”RSI Oversold Level”)

fastEma = ema(close, fastLength) slowEma = ema(close, slowLength) rsi = rsi(close, rsiLength)

plot(fastEma, color=color.blue) plot(slowEma, color=color.red)

// Buy Signal longCondition = crossover(fastEma, slowEma) and rsi < rsiOversold plotshape(series=longCondition ? low : na, title=”Buy Signal”, location=location.belowbar, color=color.green, style=shape.labelup) // Sell Signal shortCondition = crossunder(fastEma, slowEma) and rsi > rsiOverbought plotshape(series=shortCondition ? high : na, title=”Sell Signal”, location=location.abovebar, color=color.red, style=shape.labeldown)

By adjusting these parameters and incorporating additional indicators like RSI or volume metrics, you can create a more robust and accurate trading strategy tailored to your specific needs.

Implementing Your Strategy on TradingView Platform

Implementing your EMA crossover strategy on the TradingView platform involves a few straightforward steps. Once you have developed your strategy using Pine Script, follow these instructions to put it into action:

1. Paste Your Pine Script Code

- Open TradingView.

- Navigate to the Pine Editor tab at the bottom of the screen.

- Paste your EMA crossover Pine Script code into the editor.

2. Add the Script to Your Chart

- Click on the Add to Chart button located at the top of the Pine Editor. This will apply your custom indicator or strategy directly onto your chart.

3. Setting Up Alerts for Crossover Conditions

- Select the Alerts tab in TradingView.

- Click on Create Alert and choose your EMA crossover script from the list.

- Define specific conditions such as when the short EMA crosses above or below the long EMA.

- Customize alert actions (e.g., pop-up, email notification) to stay informed about potential trading signals.

4. Utilizing Custom Indicators

- Adjust settings within your custom indicators by clicking on the gear icon next to them in your chart.

- Fine-tune parameters like EMA lengths or additional filters based on market conditions and backtesting results.

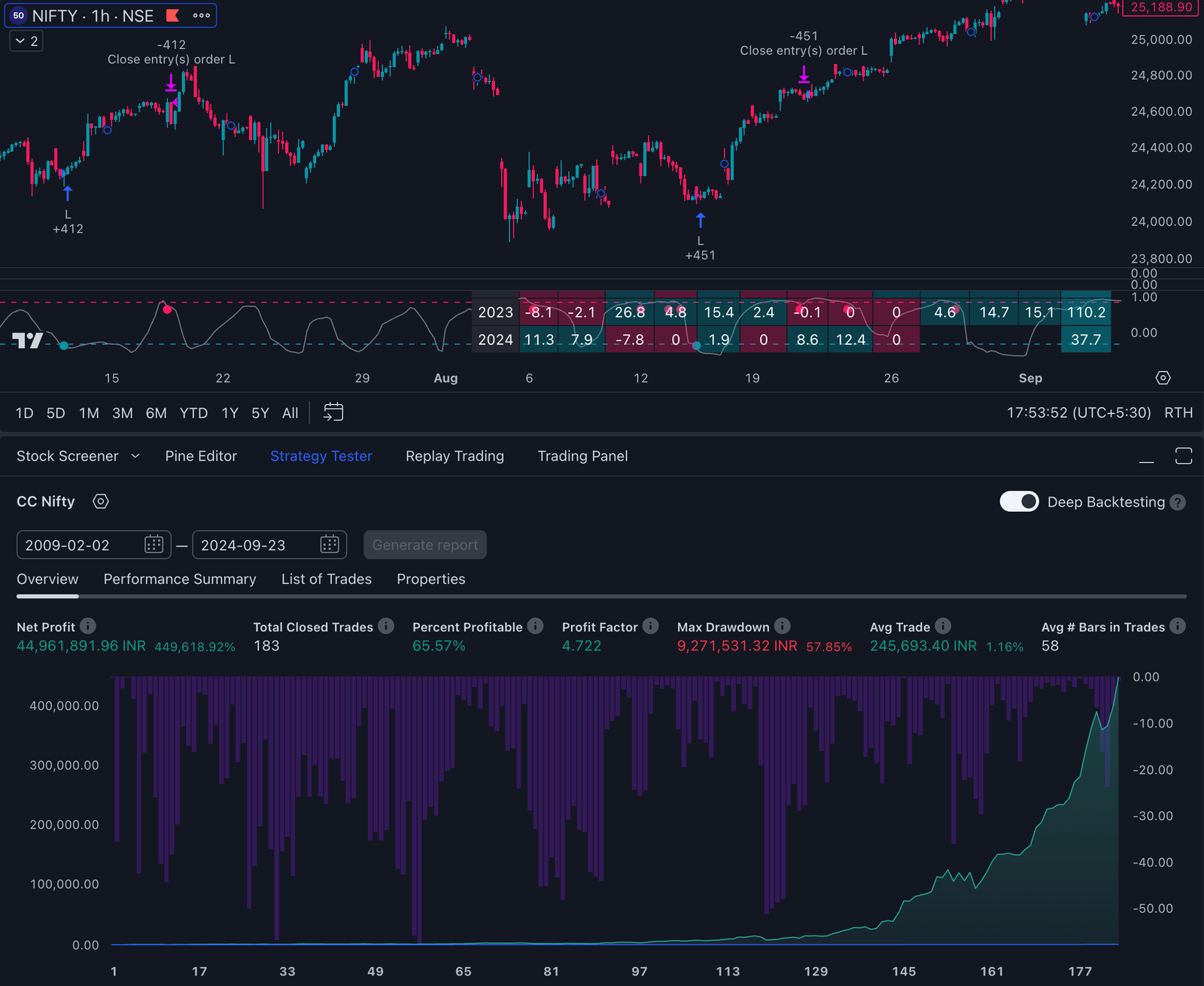

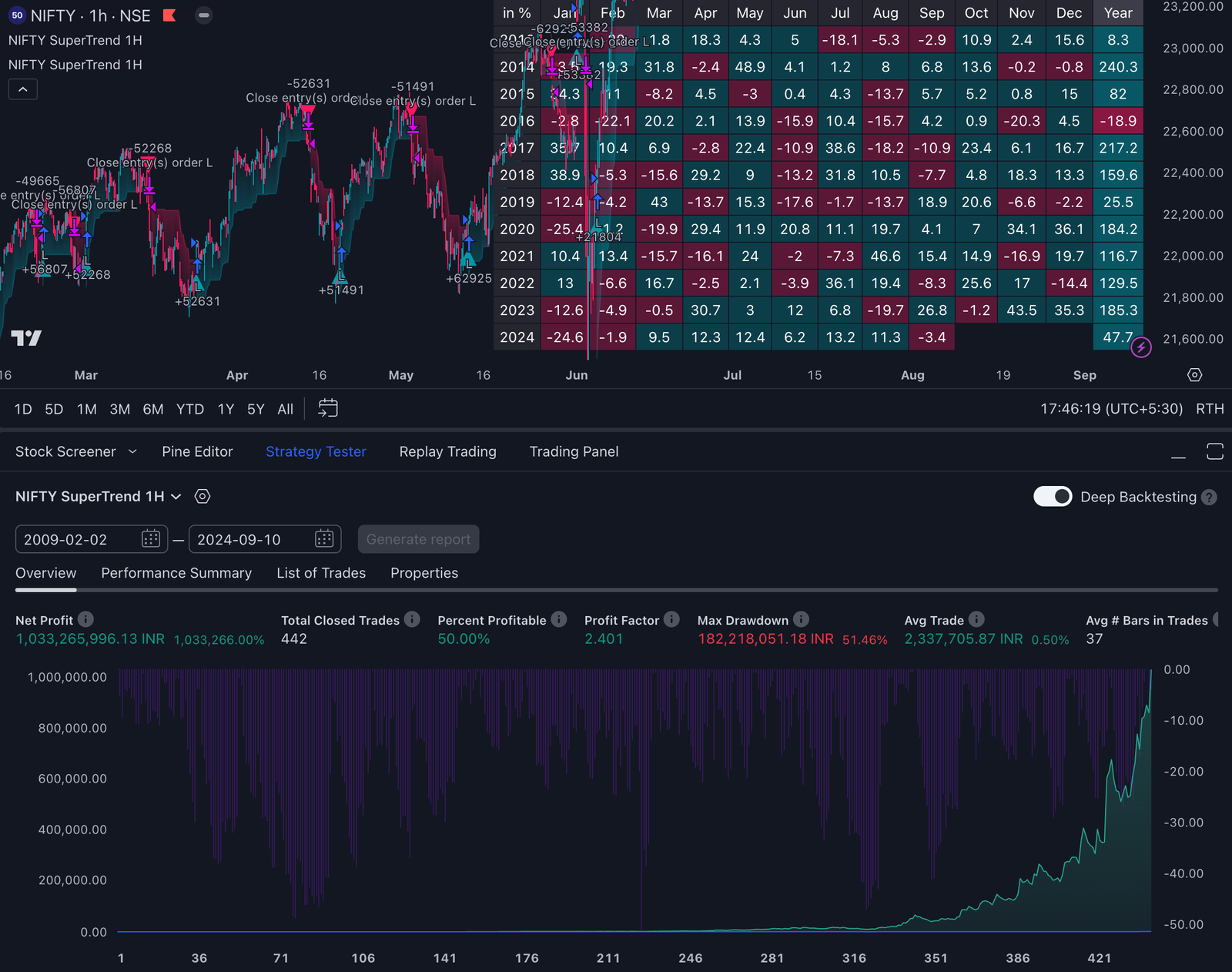

5. Backtesting and Optimization

- Use TradingView’s built-in backtesting tools to evaluate how well your strategy performs over historical data.

- Optimize by tweaking key parameters and running simulations to identify areas for improvement.

Implementing these steps ensures that you can efficiently monitor and execute trades based on your EMA crossover strategy, leveraging TradingView alerts and custom indicators for enhanced trading performance.

Troubleshooting Common Issues in EMA Crossover Strategies with Pine Script

When implementing an EMA crossover strategy in Pine Script, traders may face several challenges. Here are some common issues and practical solutions to address them:

1. Incorrect Condition Setups

- Issue: Missing buy or sell signals due to improperly defined conditions.

- Solution: Double-check the logic of your crossover conditions. Ensure that your syntax correctly specifies when the shorter EMA crosses above or below the longer EMA.

2. False Signals

- Issue: Whipsaws and false signals leading to unprofitable trades.

- Solution: Optimize your EMA lengths and consider using additional filters like RSI or MACD to confirm signals before executing trades.

3. Lagging Indicators

- Issue: Delayed signals making it difficult to enter or exit trades at optimal times.

- Solution: Test different EMA periods to find a balance between responsiveness and stability. Shorter EMAs can provide quicker signals but may also generate more noise.

4. Conflicting Exit Strategies

- Issue: Multiple exit conditions causing confusion or missed exits.

- Solution: Simplify your exit strategy by prioritizing key conditions. Use comments within your script to clearly outline the logic behind each condition.

5. Performance Issues

- Issue: Slow execution or errors due to complex scripts.

- Solution: Break down your script into smaller, manageable functions. Optimize loops and avoid redundant calculations to improve performance.

By addressing these common issues, you can enhance the reliability and effectiveness of your EMA crossover strategy in Pine Script. Regularly backtest and refine your script based on real-market data for continuous improvement.

What is the EMA crossover strategy and why is it significant in trading?

The EMA crossover strategy involves using two or more Exponential Moving Averages (EMAs) to identify potential buy or sell signals. It is significant in trading as it helps traders capture market trends and reversals, allowing for informed decision-making.

How does the Exponential Moving Average (EMA) differ from the Simple Moving Average (SMA)?

The EMA gives more weight to recent prices, making it more responsive to price changes compared to the SMA, which treats all prices equally over its period. This responsiveness allows the EMA to better identify market trends and potential reversal points.

What are crossover signals and how do they generate trading signals?

Crossover signals occur when a shorter-term EMA crosses above or below a longer-term EMA. A crossing above typically generates a buy signal, while a crossing below generates a sell signal. These signals help traders make timely decisions based on market movements.

Can you provide an overview of developing an EMA crossover strategy using Pine Script?

Developing an EMA crossover strategy in Pine Script involves creating a script that defines your EMAs, sets conditions for crossovers, and executes trades based on these conditions. The process includes writing code snippets for each step to ensure proper implementation.

Why is parameter optimization important in an EMA crossover strategy?

Parameter optimization, such as adjusting EMA lengths, is crucial as it enhances the performance of your trading strategy. By fine-tuning these parameters, traders can reduce false signals and improve overall trade accuracy.

What common issues might arise when implementing EMA crossover strategies on TradingView?

Common issues include incorrect alert settings, misconfigured indicators, or misunderstanding of crossover signals. To troubleshoot these problems, traders should review their script logic, ensure proper parameter settings, and test their alerts thoroughly.