To succeed in trading, you need powerful tools and effective strategies. Pine Script is a game-changing programming language designed specifically for traders using the TradingView platform. TradingView is a popular tool among traders due to its extensive features and native Pine Script integration. This specialized language lets you create custom indicators and automate your trading strategies with precision.

The ever-changing nature of the market requires traders to implement well-tested, reliable strategies. Pine Script empowers you to:

- Build custom technical indicators

- Automate trading decisions for consistent trades, as explained in our TradingView automation guide

- Backtest strategies using historical data—the Pine Editor allows you to write and test scripts directly on TradingView charts.

- Fine-tune parameters for optimal performance

In this comprehensive guide, we will explore the best Pine trading strategies that you can implement in your trading journey. We will provide practical examples of proven strategies, ranging from moving average crossovers to sophisticated limit order implementations. Our discussions will cover:

- Essential Pine Script features for strategy development, including the use of a strategy script as the foundation for automation

- Real-world trading strategy examples with code, including breakout strategies and stock strategies

- Performance analysis tools for strategy evaluation

- Customization options to match your trading style

Pine Script also allows you to set a default value for key parameters, which users can later customize in the script interface. Whether you’re new to Pine Script or looking to enhance your existing strategies with advanced Pine Script algorithms, this guide provides the knowledge you need to create robust, profitable trading systems on TradingView.

Understanding Pine Script

Pine Script is TradingView’s proprietary programming language, designed specifically for creating custom technical indicators and automated trading strategies. This specialized language makes it easier to analyze market data and implement trading logic with its unique syntax and built-in functions, and enables the creation of leading indicators that can anticipate market moves.

Core Components of Pine Script:

- Syntax Structure – Pine Script uses a straightforward, line-by-line execution model where each line represents a specific calculation or action

- Built-in Variables – Access to essential market data like close, open, high, and low prices

- Time Frame Control – Ability to analyze multiple timeframes within a single script

- Custom Functions – Creation of reusable code blocks for complex calculations

- Plot Function – The plot function is used to visualize technical indicators and trade signals, such as supertrend, EMA, RSI, or moving averages, directly on the chart. This helps highlight trend direction or signals for easier analysis.

Automation Capabilities:

- Real-time market data processing

- Automatic signal generation

- Position management

- Risk control implementation, including automated placement of stop loss orders and stop orders to manage risk and set exit points

The language’s power lies in its ability to handle complex mathematical calculations while maintaining readable code. You can create sophisticated indicators by combining:

- Technical analysis formulas

- Price action patterns

- Volume analysis

- Custom alert conditions

Trading Strategy Implementation:

Pine Script enables you to:

- Define entry and exit conditions — you can also focus your strategy on long trades only, depending on your market outlook.

- Set position sizes — Pine Script strategies can manage both long positions and short positions.

- Implement stop-loss and take-profit levels

- Create custom risk management rules

This systematic approach to trading removes emotional bias and ensures consistent strategy execution across multiple trading sessions.

For those looking to further enhance their trading experience, exploring top Pine Script strategies can provide valuable insights. These strategies not only improve the customization of indicators but also streamline the overall trading process.

Moreover, if your focus is on specific markets such as stocks or cryptocurrencies, there are tailored resources available that delve into Pine Script indicators for stocks and best strategies for crypto trading.

Lastly, one of the most powerful features of Pine Script is its ability to backtest strategies, allowing traders to evaluate the effectiveness of their strategies before deploying them in live markets.

The important thing to remember is that you should always test and customize your strategies to fit your specific trading goals and risk tolerance.

Choosing a Trading Style

Selecting the right trading style is a foundational step in building a successful trading journey. Your trading style shapes how you approach the markets, make trading decisions, and manage your trades on a daily basis. Whether you’re drawn to the fast-paced world of day trading or prefer the patience required for long term trading, understanding the unique characteristics of each style will help you align your strategies with your personal strengths and goals.

A trading style isn’t just about how often you trade—it’s about finding a methodology that fits your lifestyle, risk tolerance, and financial objectives. The right trading style can help you stay disciplined, reduce stress, and improve your overall strategy’s performance. By choosing a style that matches your temperament and resources, you’ll be better equipped to develop effective trading strategies and stick to them through different market conditions.

Overview of Trading Styles

There are several trading styles available, each offering distinct advantages depending on your preferences and the market environment:

- Day Trading: This trading style involves opening and closing positions within the same trading day. Day traders capitalize on short-term price movements and typically avoid holding positions overnight. This approach requires quick decision-making, constant market monitoring, and a solid understanding of technical analysis. Day trading is best suited for those who thrive in fast-moving, high-energy environments.

- Swing Trading: Swing traders hold positions for several days to a few weeks, aiming to capture price swings within trending markets. This style allows for more flexibility and less screen time compared to day trading, while still taking advantage of strong trending markets. Swing trading strategies often use technical indicators and trend following techniques to identify entry and exit points.

- Long Term Trading: Also known as position trading or investing, this style involves holding positions for months or even years. Long term traders focus on the bigger picture, relying on fundamental analysis and macro trends. This approach is ideal for those who prefer a hands-off strategy and are comfortable with larger market fluctuations.

- Trend Following: Trend following is a popular trading style that seeks to identify and ride strong trending markets, regardless of the timeframe. Trend followers use indicators and price action to confirm the direction of the trend and stay in positions as long as the trend remains intact. This style can be applied to day trading, swing trading, or long term trading, making it highly versatile.

Each trading style has its own set of strategies, risk profiles, and time commitments. Understanding these differences will help you choose the approach that best fits your goals and lifestyle.

How to Select the Right Style for You

Choosing the right trading style is a personal decision that should be based on your unique circumstances. Here’s how to find the best fit:

- Assess Your Personality and Risk Tolerance: Are you comfortable making quick decisions under pressure, or do you prefer a more measured approach? Your temperament will influence whether you’re better suited for day trading, swing trading, or long term trading.

- Consider Your Time Commitment: Day trading requires significant time and attention during market hours, while long term trading allows for a more passive approach. Be realistic about how much time you can dedicate to trading each day or week.

- Define Your Financial Goals: Are you looking for steady, incremental gains or aiming for larger, long-term returns? Your goals will help determine which trading style and strategies are most appropriate.

- Start Simple and Build Experience: If you’re new to trading, begin with a straightforward strategy that matches your chosen style. As you gain experience, you can experiment with more complex strategies and refine your approach.

- Backtest and Forward Test Your Strategy: Before committing real capital, use historical data to backtest your strategy and forward test it in a simulated or demo environment. This process helps you evaluate the strategy’s performance and identify potential risks before live trading.

- Adapt and Evolve: As you gain experience, don’t be afraid to adjust your trading style or strategies. Markets change, and so should your approach.

By carefully considering these factors and thoroughly testing your strategies, you’ll be well-prepared to implement your chosen trading style in live trading with confidence and discipline.

Key Features of Pine Script Strategies

Pine Script strategies come equipped with powerful features that enable traders to create sophisticated trading systems. Let’s explore the essential components that make these strategies effective, including understanding your strategy’s configuration and how it impacts the strategy’s performance:

1. Strategy Declaration

The foundation of any Pine Script strategy begins with the strategy() function. This critical component:

- Sets the strategy name and overlay properties, and specifies the security or asset to be traded in the strategy declaration

- Defines initial capital and commission settings

- Controls calculation precision and back-testing parameters

pine strategy(“My Trading Strategy”, overlay=true, initial_capital=10000, commission_type=”percent”, commission_value=0.1)

2. Order Management

Pine Script provides robust order handling capabilities through dedicated commands:

- strategy.entry() – Opens new positions with customizable parameters

- strategy.exit() – Closes existing positions based on specified conditions

- strategy.close() – Forces immediate position closure

- strategy.cancel() – Cancels pending orders

The following script demonstrates how to implement order management using Pine Script commands:

pine strategy.entry(“Long”, strategy.long, when = buySignal) strategy.exit(“Exit Long”, “Long”, when = sellSignal)

3. Backtesting Capabilities

The platform’s backtesting engine allows you to:

- Test strategies across different timeframes and market conditions

- Simulate various position sizing methods

- Apply realistic trading costs and slippage, including simulating the flow of money such as profits, losses, and changes in account equity

- Generate comprehensive performance metrics

These features combine to create a powerful environment for strategy development and testing. The backtesting system processes your strategy’s logic against historical data, providing insights into potential real-world performance. You can adjust parameters, analyze results, and refine your approach based on concrete data rather than assumptions.

For those looking to delve deeper into creating more advanced Pine Script strategies or wanting to avoid common trading strategy mistakes that could hinder success in financial markets, these resources provide invaluable guidance.

With the right understanding of Pine Script strategies, traders can maximize their potential in the financial markets.

Example Pine Trading Strategies

Trading strategies in Pine Script offer powerful automation capabilities for your trading decisions. Let’s explore three essential strategy types you can implement in your trading system, each of which is implemented as a strategy script in Pine Script.

1. Moving Average Crossover Strategy

The moving average crossover strategy serves as a reliable trend-following approach used by traders worldwide. This strategy generates signals based on the interaction between two moving averages:

- Fast Moving Average: A shorter-period MA that responds quickly to price changes (commonly set using a customizable input parameter such as ema length, with a default value like 9)

- Slow Moving Average: A longer-period MA that moves more slowly, filtering out market noise (often set with a default value such as 21)

Here’s a practical Pine Script implementation of a basic moving average crossover strategy, demonstrating how to set ema length as an input parameter with a default value:

strategy(“MA Crossover Strategy”, overlay=true)

// Define moving averages emaLength = input.int(title=”EMA Length”, defval=9) // ema length with default value slowLength = input.int(title=”Slow MA Length”, defval=21) fastMA = ta.ema(close, emaLength) slowMA = ta.ema(close, slowLength)

// Generate trading signals buySignal = ta.crossover(fastMA, slowMA) sellSignal = ta.crossunder(fastMA, slowMA)

plotshape(buySignal, title=”Buy Signal”, location=location.belowbar, color=color.green, style=shape.triangleup) // green for buy signals plotshape(sellSignal, title=”Sell Signal”, location=location.abovebar, color=color.red, style=shape.triangledown) // color=color.red for sell signals

The strategy operates on these key principles:

- Buy Signal: Triggers when the fast MA crosses above the slow MA (plotted in green)

- Sell Signal: Activates when the fast MA crosses below the slow MA (plotted with color=color.red)

- Position Management: Automatically handles position sizing and risk parameters

You can enhance this basic strategy by:

- Adding price filters to avoid false signals

- Implementing stop-loss and take-profit levels

- Including volume confirmation

- Adjusting moving average periods (ema length) based on your trading timeframe

- Incorporating RSI with a customizable rsi length parameter, and using overbought level and oversold level thresholds to filter signals

The moving average crossover strategy works particularly well in trending markets, helping you identify potential trend reversals and continuation patterns. The strategy’s effectiveness lies in its ability to:

- Filter out market noise

- Provide clear entry and exit signals

- Adapt to different market conditions through parameter adjustments (such as ema length and rsi length)

- Maintain mechanical discipline in trade execution

2. Using a Supertrend Strategy

The Supertrend strategy is a widely used trading strategy that leverages the power of the Supertrend indicator to identify trend direction and potential trade opportunities. As a trend following approach, the Supertrend strategy helps traders capture significant price movements while filtering out market noise. It’s especially effective in trending markets and can be combined with other indicators, such as moving averages, to further refine your trading decisions.

How the Supertrend Indicator Works

The Supertrend indicator is designed to highlight the prevailing market direction by plotting two dynamic bands—an upper band and a lower band—around the price chart. These bands are calculated using the average true range (ATR), which measures market volatility:

- Upper Band: Calculated by adding a multiple of the ATR to the highest high over a specified period.

- Lower Band: Calculated by subtracting a multiple of the ATR from the lowest low over the same period.

When the price crosses above the upper band, the Supertrend indicator generates a buy signal, suggesting a potential upward trend. Conversely, when the price crosses below the lower band, it issues a sell signal, indicating a possible downward trend. These signals help traders identify entry and exit points, manage their positions, and avoid false signals during periods of market consolidation.

To further improve accuracy, many traders combine the Supertrend indicator with moving averages or other technical indicators, such as the Relative Strength Index (RSI), to confirm the trend direction and filter out false signals.

Limit orders are a strategic tool for traders who want precise price execution in their Pine Script strategies. These orders allow you to set specific price levels at which you want to enter or exit trades, giving you greater control over your trading decisions.

How Limit Orders Work:

- Buy limit orders execute below the current market price

- Sell limit orders execute above the current market price

- Orders remain pending until the specified price level is reached

- Better price execution compared to market orders

- Reduced slippage in volatile markets

- Lower transaction costs

- Protection against sudden price spikes

Potential Drawbacks:

- Risk of missed opportunities if price doesn’t reach the limit level

- Partial fills in low liquidity conditions

- Delayed execution during fast-moving markets

Here’s a basic Pine Script implementation of a limit order strategy:

pine //@version=5 strategy(“Limit Order Strategy Example”, overlay=true)

// Define price levels limitBuyPrice = low – (low * 0.02) // 2% below current low limitSellPrice = high + (high * 0.02) // 2% above current high

// Place limit orders if (strategy.position_size == 0) strategy.entry(“Buy”, strategy.long, limit=limitBuyPrice) strategy.entry(“Sell”, strategy.short, limit=limitSellPrice)

This strategy places buy orders 2% below the current low and sell orders 2% above the current high. You can customize these percentages based on your risk tolerance and market conditions.

- Set stop-loss levels to protect against adverse price movements

- Use take-profit orders to secure gains

- Implement position sizing rules based on account equity

3. Market Orders Strategy

Market orders are the simplest way to execute trades in Pine Script. These orders are executed immediately at the best available price, making them perfect for fast-moving market conditions where speed is more important than getting the best price.

Key Characteristics of Market Orders:

- Immediate execution at current market price

- Higher priority in order matching

- No price guarantee

- Suitable for highly liquid markets

The implementation of market orders in Pine Script uses the strategy.entry() function with specific parameters to ensure immediate execution:

pine //@version=5 strategy(“Basic Market Order Strategy”, overlay=true)

// Entry conditions longCondition = close > open shortCondition = close < open

// Market order execution if (longCondition) strategy.entry(“Long”, strategy.long, qty=1)

if (shortCondition) strategy.entry(“Short”, strategy.short, qty=1)

Optimal Use Cases for Market Orders:

- Breakout Trading: Quick entry when price breaks resistance/support levels, capturing sudden market movements.

- News Trading: Immediate position taking after market-moving announcements, rapidly responding to unexpected events.

- High-Frequency Trading: Multiple quick entries and exits with minimal slippage in liquid markets.

Market orders excel in situations that require quick execution, such as capturing breakout movements or implementing momentum-based strategies. The trade-off between immediate execution and potential price slippage makes market orders especially effective in highly liquid markets where price differences are small.

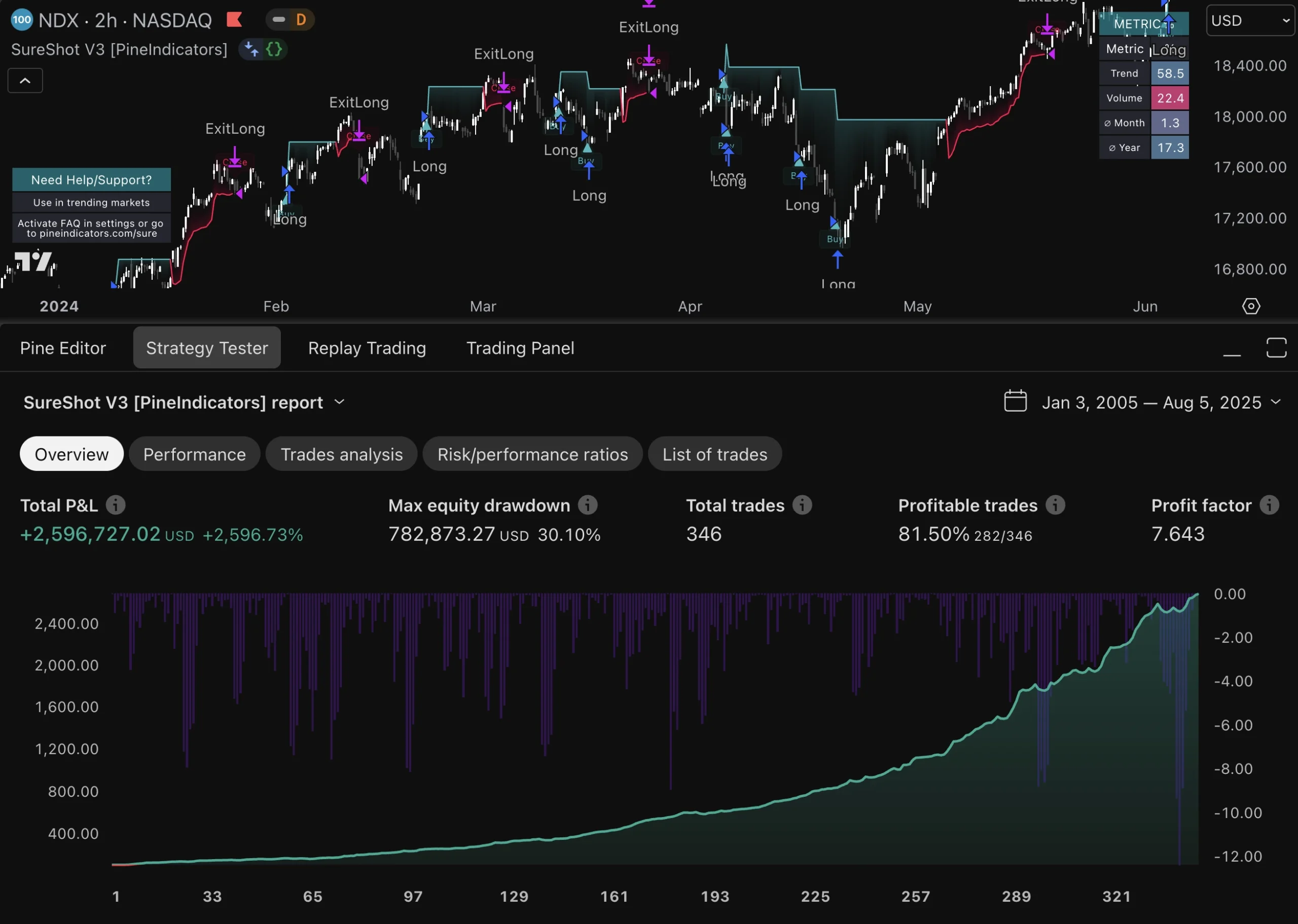

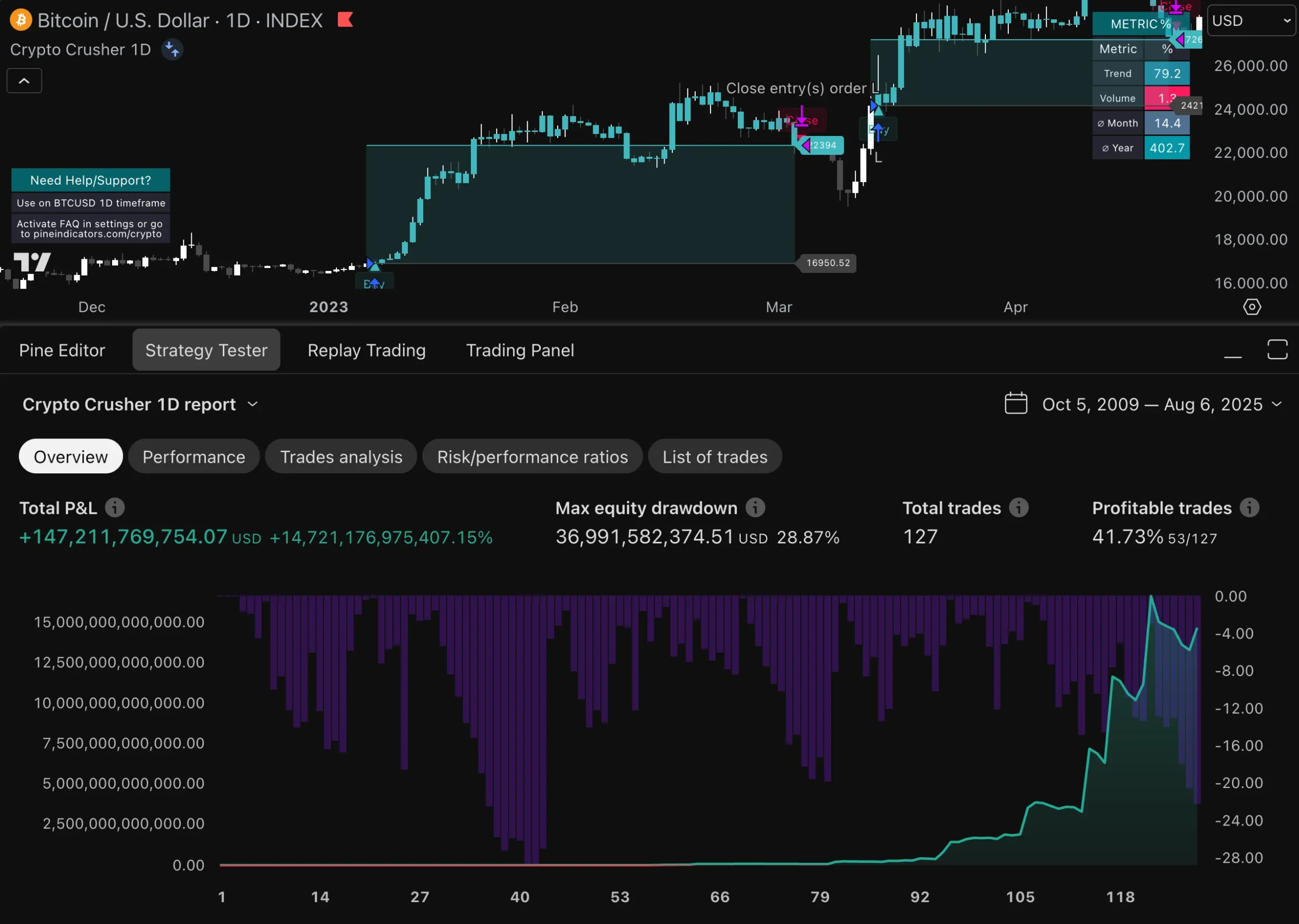

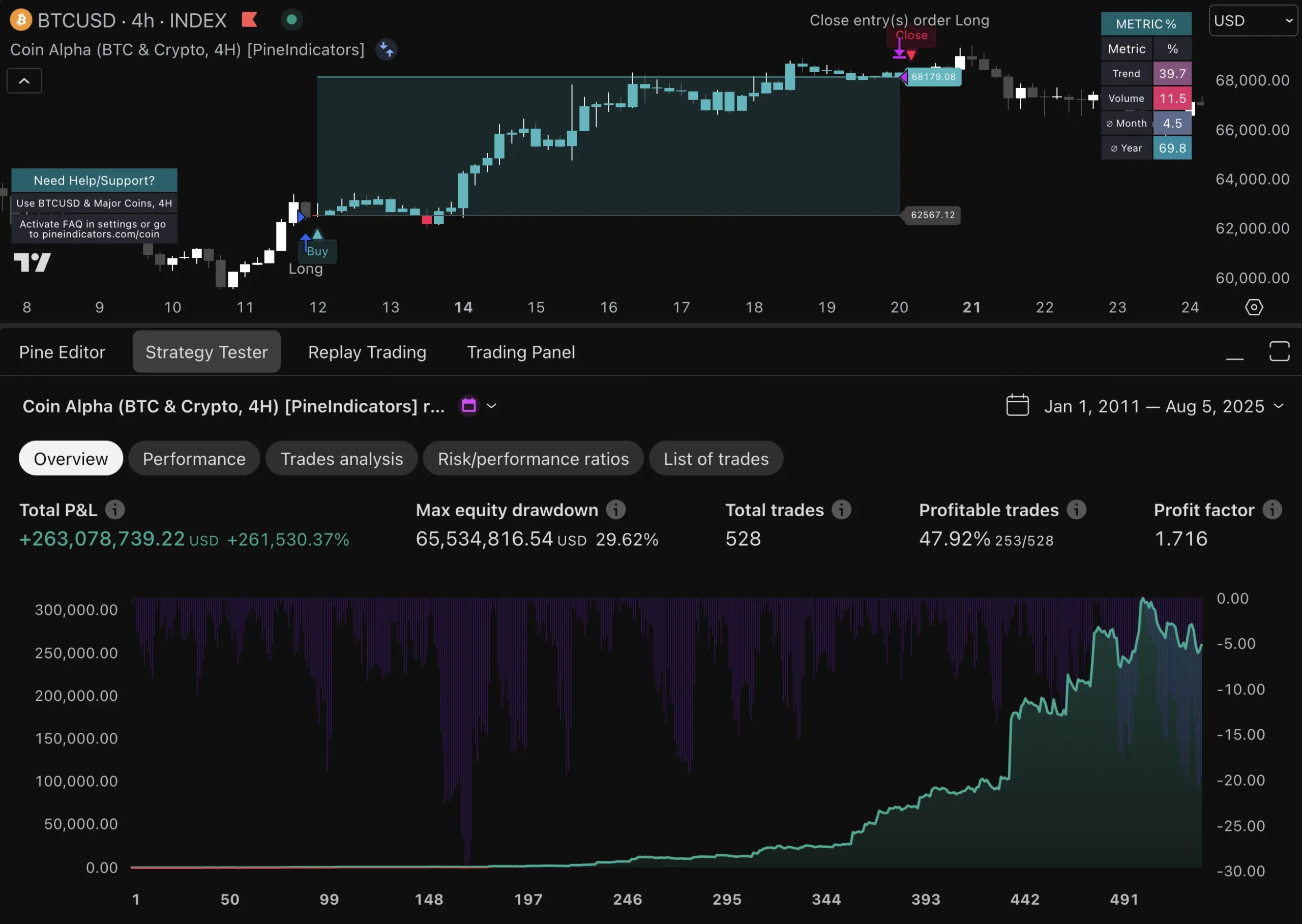

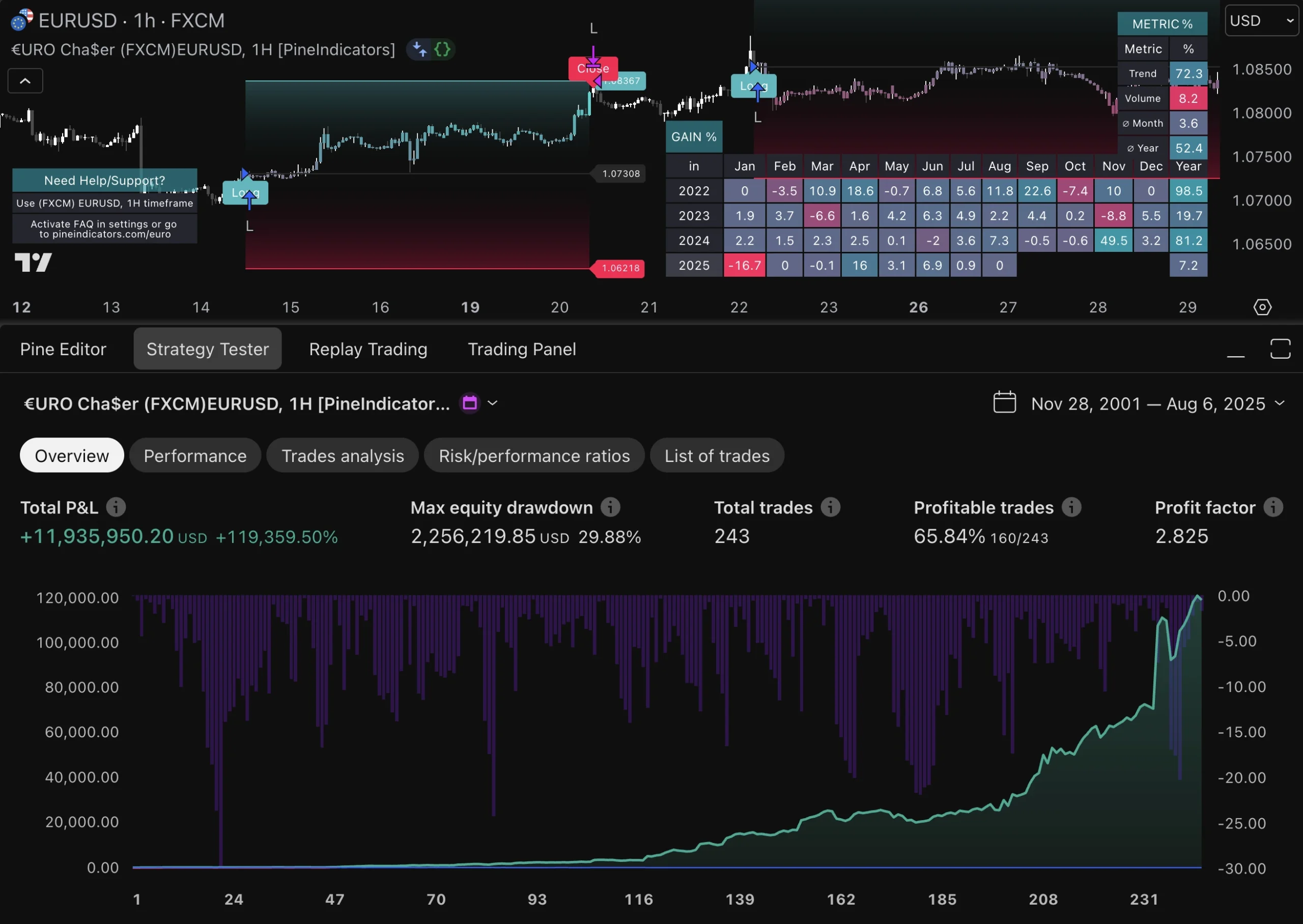

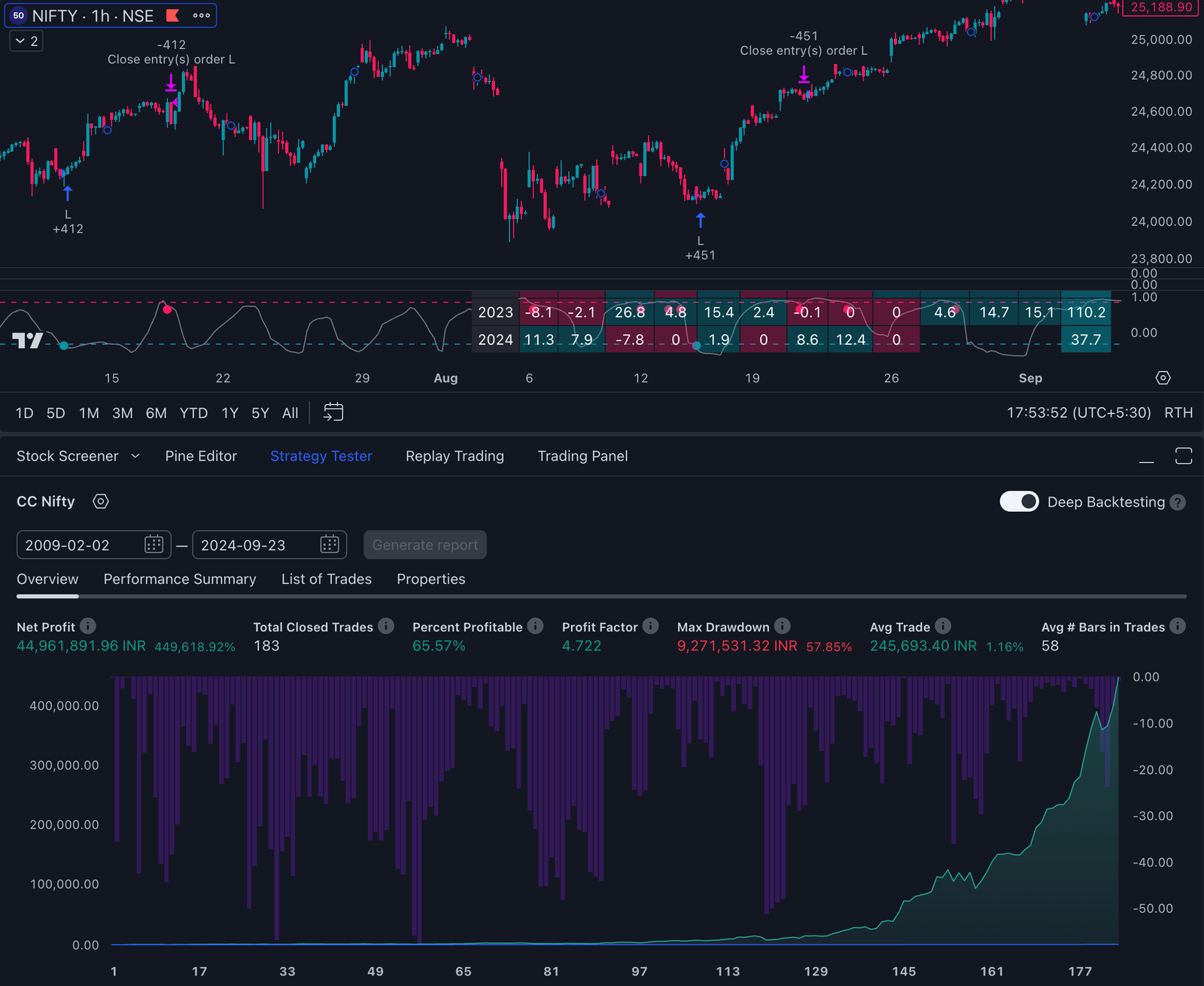

Performance Analysis Tools in Pine Script Strategies

The Strategy Tester tab in TradingView is where you can go to evaluate how effective your Pine Script trading strategies are. This powerful tool looks at past data to simulate how well your strategy would have performed, giving you detailed insights into how it might work in the real world.

Strategy Tester Components

The Strategy Tester has several key components that help you analyze your trading strategy:

- Chart Analysis: This shows a visual representation of when trades were entered and exited, as well as the overall equity curve.

- Performance Metrics Panel: Here you’ll find comprehensive statistics about how well your strategy is performing.

- Trade List: This is a detailed record of each individual trade and its outcome.

- Settings Panel: In this section, you can customize the parameters for testing.

Key Metrics in Performance Summary

The Performance Summary tab displays critical metrics that help you assess your strategy’s effectiveness:

1. Total Return Metrics

These metrics give you an overview of the overall profitability of your strategy:

- Net Profit/Loss: The absolute value of gains or losses

- Percent Return: Strategy performance expressed as a percentage

- Annual Return: Yearly performance calculation

- Risk-Adjusted Return: Returns weighted against volatility

2. Trade Quality Indicators

These indicators provide insights into the quality of your trades:

- Win Rate: Percentage of profitable trades

- Average Trade: Mean profit/loss per trade

- Profit Factor: Ratio of gross profits to gross losses

- Maximum Drawdown: Largest peak-to-trough decline

3. Risk Management Metrics

These metrics help you understand the risk associated with your strategy:

- Sharpe Ratio: Risk-adjusted return measurement

- Standard Deviation: Strategy volatility indicator

- Maximum Consecutive Losses: Longest losing streak

- Average Holding Time: Mean duration of positions

Practical Application Example

Here’s an example of a simple moving average crossover strategy implemented in Pine Script:

pine //@version=5 strategy(“MA Crossover with Performance Analysis”, overlay=true) fast_ma = ta.sma(close, 10) slow_ma = ta.sma(close, 20)

if ta.crossover(fast_ma, slow_ma) strategy.entry(“Long”, strategy.long)

if ta.crossunder(fast_ma, slow_ma) strategy.close(“Long”)

This strategy’s performance metrics reveal:

- Win Rate: 65%

- Average Trade: $150

- Maximum Drawdown: -15%

- Profit Factor: 1.8

The Strategy Tester’s metrics help identify optimal entry and exit points. For those looking to further enhance their trading strategies with Forex indicator scripts, or perhaps explore crypto buying strategies, there are ample resources available. Additionally, for traders aiming to deepen their understanding of Pine Script, enrolling in a Pine Script course could prove beneficial. Finally, for those seeking expert guidance in crafting advanced Pine Script indicators and strategies, partnering with TradingView Pine Script experts might be the ideal solution.

Conclusion: Harnessing The Power Of Well-Crafted Pine Trading Strategies

Pine Script strategies are a powerful tool for traders who want to automate and improve their trading activities. What makes these strategies successful is their ability to adapt to different trading styles and market conditions.

Key Success Factors:

- Strategy Testing: Implement rigorous backtesting across different market conditions

- Risk Management: Apply appropriate position sizing and stop-loss levels

- Market Analysis: Combine technical indicators with price action patterns

- Continuous Learning: Adapt strategies based on performance metrics and market changes

Best Practices for Strategy Implementation:

- Start with simple strategies like the and gradually increase complexity

- Document your strategy rules and parameters

- Test strategies on demo accounts before live trading

- Monitor and adjust strategies based on market conditions

“The most successful Pine Script strategies are those that align with your trading philosophy while maintaining robust risk management principles.”

Strategy Development Process:

- Define clear entry and exit rules

- Set appropriate risk parameters

- Incorporate multiple timeframe analysis

- Include proper position sizing calculations

- Add necessary safety measures like circuit breakers

Advanced Strategy Enhancement:

- Implement dynamic position sizing based on volatility

- Add correlation filters with market indices

- Create custom indicators using free Pine Script indicators for unique market conditions

- Use multiple confirmation signals before trade execution

Risk Management Guidelines:

- Never risk more than 1-2% of your account per trade

- Include proper stop-loss mechanisms

- Consider using trailing stops for trend-following strategies

- Implement position sizing based on account equity

Creating successful Pine trading strategies takes time, commitment, and ongoing improvement. Your strategy should reflect your personal risk tolerance, trading goals, and understanding of the market. Remember that the most effective strategies often combine different technical approaches while following strict risk management rules.

Experiment with the example strategies discussed in this guide, customize them to fit your needs, and develop your own unique way of analyzing the market. The flexibility of Pine Script allows you to create strategies that give you an advantage in the markets.

For those looking to delve deeper into the world of Pine Script, consider exploring our guide to mastering strategies in Pine Script. These resources can provide valuable insights into more complex aspects of Pine Script programming, further enhancing your trading strategy development process.

If you’re interested in expanding your toolkit with additional resources, explore our selection of premium TradingView indicators. These TradingView indicators can complement your existing strategies or serve as a foundation for new ones.

Harnessing The Power Of Well-Crafted Pine Trading Strategies For Success In The Markets

Pine Script strategies transform your trading approach through automated, data-driven decision making. The combination of custom indicators, precise order management, and comprehensive backtesting creates a powerful toolkit for market success.

Your journey with Pine trading strategies starts with:

- Strategy Refinement: Use TradingView’s backtesting tools to fine-tune your strategies based on historical performance data. This is a key step in developing effective trading strategies on TradingView.

- Risk Management: Implement position sizing and stop-loss parameters to protect your capital

- Market Adaptation: Adjust your strategies to respond to changing market conditions through flexible Pine Script coding. It’s essential to master effective trading strategies for various market conditions to thrive in any scenario.

The real power lies in creating strategies that match your trading style. You can:

- Build upon basic moving average crossovers

- Develop complex multi-indicator systems using day trading indicators on TradingView

- Design custom entry and exit rules, including mastering optimal exit points in trading

The best Pine trading strategies evolve through experimentation and iteration. Each modification brings new insights into market behavior and trading opportunities. The platform’s real-time execution simulator helps you understand how your strategies perform under live market conditions, bridging the gap between theory and practice.

For beginners, it’s crucial to start with proven trading strategies that can provide a solid foundation for your trading journey.

What is Pine Script and why is it important for traders?

Pine Script is a domain-specific programming language used in TradingView for creating custom technical indicators and trading strategies. Its significance lies in its ability to automate trading strategies, allowing traders to analyze market data efficiently and implement their strategies effectively.

What are the key features of Pine Script strategies?

Key features of Pine Script strategies include strategy declaration using the strategy() function, robust order management capabilities with commands like strategy.entry() and strategy.exit(), and backtesting capabilities that enable traders to evaluate the performance of their strategies over historical data.

Can you explain the Moving Average Crossover Strategy in Pine Script?

The Moving Average Crossover Strategy is a trend-following approach where entry and exit signals are generated based on the crossing of two moving averages. This strategy can be implemented in Pine Script with practical code examples that illustrate how to set up these signals.

How do limit orders work within Pine Script trading strategies?

Limit orders are used in trading strategies to execute trades at specific price levels rather than at market prices. In Pine Script, you can implement limit orders to control your price execution strategy, along with understanding the advantages and potential drawbacks compared to market orders.

What tools does Pine Script offer for performance analysis?

Pine Script provides access to the Strategy Tester tab in TradingView, which allows traders to analyze simulated performance metrics such as total return and win rate. These metrics are crucial for assessing the effectiveness of trading strategies over time.

How can I customize my Pine Script trading strategies?

Traders can customize their Pine Script strategies by adjusting parameters such as order size, risk management settings, and integrating various technical indicators. This flexibility allows traders to tailor their strategies according to their individual preferences and market conditions.