Introduction

TradingView is a powerful tool used by millions of traders around the world. It offers advanced charting features and in-depth technical analysis tools, making it an essential platform for anyone looking to trade effectively. With its web-based interface, TradingView has transformed the way traders engage with financial markets, providing them with real-time data across various asset classes.

The fast-paced nature of trading markets requires constant attention – a challenge that automation can effectively solve. By using automated trading strategies, you can:

- Execute trades at the perfect moment

- Eliminate emotional bias from your trading decisions

- Stick to your trading plan consistently

- Take advantage of opportunities 24/7

- Spend less time watching charts

By setting up TradingView alerts for automated trading, you can shift your trading approach from manual to systematic. These alerts serve as your virtual trading assistant, keeping an eye on market conditions and triggering actions based on the criteria you have set.

In this guide, you will learn:

- How to create custom alerts that align with your trading strategy

- How to connect TradingView alerts to automated trading systems

- How to configure alert messages for accurate trade execution

- How to manage and monitor your automated trading setup

Whether you’re a day trader looking for efficiency or an investor wanting to automate your long-term strategy, mastering TradingView alert setup opens up new opportunities in your trading journey.

To enhance your automated trading strategies, consider exploring some effective TradingView breakout strategies that can help you identify profitable market movements. Additionally, utilizing the best indicators for TradingView in 2024 can significantly improve your market analysis and decision-making process.

Moreover, if you’re interested in expanding your knowledge base, our advanced Pine Script tutorials offer valuable insights into customizing your TradingView experience. Lastly, remember that investing in high-quality TradingView indicators can further enhance your trading performance.

Understanding TradingView Alerts

TradingView alerts are like your personal trading assistant, always on the lookout for market changes and ready to notify you when certain conditions are met. These alerts work automatically, sending messages through different channels like email, mobile push notifications, or webhooks whenever your specified criteria are triggered.

Types of TradingView Alerts:

1. Price Alerts

Price alerts focus on specific price movements or levels. Here are some examples:

- Simple price crossovers

- Price reaching specific levels

- Percentage changes in price

- Volume thresholds

2. Indicator Alerts

Indicator alerts monitor various technical indicators for specific conditions. Some common examples include:

- Moving average crossovers

- RSI overbought/oversold conditions

- MACD signal line crossings

- Custom indicator signals

The alert system allows you to create complex conditions by combining multiple technical indicators, drawing tools, and price actions. You can set alerts based on mathematical formulas, candlestick patterns, or custom scripts written in Pine Script. For beginners on the platform, there are resources available such as Pine Script for beginners that provide a solid foundation.

Alert Delivery Methods:

You can choose how you want to receive your alerts through the following methods:

- Desktop notifications

- Mobile push notifications

- Email alerts

- SMS messages

- Webhook notifications for automated trading

TradingView alerts enhance your trading efficiency by eliminating the need for constant chart monitoring. You can focus on other tasks while your alerts scan the markets for potential trading opportunities. The system’s ability to integrate with automated trading platforms through webhooks enables seamless execution of trades based on your predefined strategies.

The alert setup process includes customizable features such as alert names, messages, and expiration dates. You can create multiple alerts across different timeframes and instruments, allowing you to track various trading scenarios simultaneously.

Furthermore, if you’re interested in exploring more advanced trading strategies such as buying crypto or utilizing specific forex indicator scripts, there are numerous resources available that cater to these needs. Additionally, for those looking to refine their Pine Script skills further or require assistance from experts in this area, platforms like Pine Indicators offer valuable insights and support.

Step-by-Step Guide to Setting Up TradingView Alerts for Automated Trading

Setting up effective alerts in TradingView requires a systematic approach to ensure your automated trading strategy performs optimally. Let’s dive into the essential steps to create a robust alert system that aligns with your trading objectives.

1. Creating Alerts Based on Your Trading Strategy

Before configuring any alerts, you need a well-defined trading strategy. Your strategy should specify:

- Entry conditions – specific price levels, indicator crossovers, or pattern formations

- Exit conditions – profit targets and stop-loss levels

- Risk management rules – position sizing and maximum drawdown limits

To set up your first alert:

- Open your preferred chart in TradingView

- Click the “Alerts” button in the top toolbar

- Select “Create Alert” from the menu

- Choose your alert trigger type:

- Price crossing a specific level

- Indicator value reaching a threshold

- Custom conditions using Pine Script

2. Applying Indicators and Timeframes

Select indicators that match your trading strategy:

- Technical indicators (RSI, MACD, Moving Averages)

- Volume indicators

- Custom indicators from Pine Script, such as those for EMA crossover strategies

Set appropriate timeframes:

- Lower timeframes (1m, 5m, 15m) – More frequent signals, higher noise

- Higher timeframes (1h, 4h, 1D) – Fewer signals, stronger trends

3. Alert Condition Configuration

Create precise alert conditions by:

- Selecting your trigger indicator

- Defining specific threshold values

- Adding multiple conditions using AND/OR operators

- Setting alert expiration times

Example alert setup:

IF RSI crosses below 30

AND 20 EMA is above 50 EMA

AND trading volume > 1000000

THEN trigger alert

Your alert settings should reflect real market conditions and avoid triggering during low-liquidity periods. Consider implementing:

- Price filters to avoid false signals

- Time filters for specific trading sessions

- Volume thresholds for trade validation

Remember to test your alert settings thoroughly in a demo environment before deploying them in live trading. Track alert performance metrics to fine-tune your configuration and improve signal accuracy.

4. Leveraging Advanced Strategies

You can also explore advanced Pine Script strategies to enhance your trading on TradingView with backtesting and risk management techniques. Moreover, incorporating high-profit trading strategies can further optimize your automated trading performance.

Additionally, consider integrating unique features of advanced systems like the Versatile Bollinger Band Cascade, which offers customization options that make it stand out in the crowded world of trading algorithms.

By leveraging advanced strategies and customizing indicators according to your trading objectives, you can significantly enhance the effectiveness of your automated trading system.

2. Integrating Webhooks for Real-Time Data Transmission

Webhooks serve as the vital communication bridge between TradingView and your automated trading system. Think of webhooks as digital messengers that instantly deliver your alert signals to your trading bot, enabling real-time trade execution.

Setting up webhook integration requires two key components:

- Webhook URL: This unique address comes from your trading bot platform

- Alert Message: The specific instructions your bot needs to execute trades

Here’s how to set up webhook integration in TradingView:

- Access your trading bot platform

- Navigate to the webhook settings or API section

- Copy the provided webhook URL

- Open TradingView and create a new alert

- Paste the webhook URL in the “Webhook URL” field

- Set the alert message format according to your bot’s requirements

Your webhook message structure might look like this:

json

{

“symbol”: “BTCUSDT”,

“side”: “buy”,

“quantity”: “0.01”,

“price”: “{{close}}”,

“stopLoss”: “{{plot(‘Stop Loss’)}}”,

“takeProfit”: “{{plot(‘Take Profit’)}}”

}

Different trading bots require specific message formats. Check your bot’s documentation for the exact structure needed. Common platforms like 3Commas, TradingView-Binance Bot, and Cornix each have their unique webhook requirements.

Pro Tip: Test your webhook integration with a small trade size before deploying your full strategy. This helps verify proper communication between TradingView and your trading bot while minimizing potential risks.

3. Configuring Alert Messages with Trade Parameters

Precise alert message configuration serves as the bridge between your trading strategy and automated execution. Your alert messages need to contain specific trade parameters that your bot can interpret and execute accurately.

Here’s a structured format for your alert messages:

{

“action”: “{{strategy.order.action}}”,

“symbol”: “{{ticker}}”,

“price”: “{{close}}”,

“sl”: “{{strategy.position_size}}”,

“tp”: “{{strategy.position_size}}”

}

The alert message structure includes essential parameters:

- Action: Buy/Sell command

- Symbol: Trading pair or asset

- Entry Price: Current market price

- Stop Loss: Risk management level

- Take Profit: Profit target level

Setting effective Stop Loss and Take Profit levels requires careful consideration of market volatility and risk tolerance. A common approach is using the Average True Range (ATR) indicator to determine these levels:

- Stop Loss = Entry Price ± (ATR × 2)

- Take Profit = Entry Price ± (ATR × 3)

You can customize these parameters based on your risk management strategy. The key is maintaining consistency in your message format to ensure your trading bot correctly interprets and executes the commands.

Risk management tip: Test your alert message configuration with small position sizes before scaling up to larger trades. This practice helps identify potential formatting issues without risking significant capital.

Remember to validate your alert messages through your trading bot’s testing environment. This step ensures your automated system correctly interprets and executes the trade parameters you’ve defined.

4. Launching Your Bot for Live Trading Execution

Launching your trading bot requires careful attention to detail and proper configuration of your automation platform. Here’s a practical guide to get your bot up and running:

Initial Setup Steps:

- Connect your trading account to your chosen automation platform

- Verify API keys and permissions

- Set trading limits and risk parameters

- Test webhook connections

Your trading bot acts as a bridge between TradingView alerts and your broker, executing trades based on the signals it receives. The bot maintains a constant connection to both platforms, ready to process incoming webhook data 24/7.

Key Bot Functions:

- Receives and decodes webhook messages from TradingView

- Validates signal parameters against predefined rules

- Executes trades through your broker’s API

- Manages position sizes based on your risk settings

- Tracks open positions and their performance

The bot’s execution process follows a specific sequence:

- Alert signal received from TradingView

- Signal validation against trading rules

- Risk calculation and position sizing

- Order placement through broker

- Trade confirmation and logging

Risk Management Features:

- Position size limits

- Maximum drawdown controls

- Daily loss limits

- Maximum open positions

- Spread filters

You can customize these parameters in your bot’s configuration panel to align with your trading strategy. The bot will automatically reject trades that don’t meet your specified criteria, adding an extra layer of protection to your automated trading system.

Remember to start with small position sizes during the initial live trading phase to verify proper execution and system reliability. This allows you to identify potential issues without risking significant capital.

5. Monitoring Executed Trades and Managing Open Positions

Active trade monitoring remains crucial even with automated systems. Your trading bot executes trades based on TradingView alerts, but market conditions can change rapidly, requiring human oversight and intervention.

Here’s what you need to monitor:

Trade Execution Accuracy

- Verify that entry prices match your strategy parameters

- Check if position sizes align with your risk management rules

- Confirm stop-loss and take-profit levels are correctly placed

Position Performance Tracking

- Monitor profit/loss metrics in real-time

- Track drawdown levels against your predetermined thresholds

- Analyze win rate and average trade duration

Risk Management Adjustments

- Modify stop-loss levels based on market volatility

- Scale in or out of positions when market conditions shift

- Close trades manually if technical issues arise

You can set up additional TradingView alerts to monitor your open positions:

- Price alerts near critical support/resistance levels

- Volatility threshold notifications

- Time-based reminders for position reviews

Create a monitoring dashboard in TradingView by:

- Adding relevant indicators to track market conditions

- Setting up multiple timeframe analysis

- Creating custom layouts for different trading sessions

Remember to document any manual interventions you make to improve your automated strategy. This data helps refine your alert parameters and trading rules for better future performance.

Regular system checks ensure your bot continues to execute trades according to your strategy while maintaining risk management protocols.

Best Practices for Using TradingView Alerts in Automated Trading Strategies

Implementing effective alert settings in TradingView requires a strategic approach to minimize false signals and optimize trading performance. Here are essential practices to enhance your automated trading strategy:

Filter Out Market Noise

- Set minimum price movement thresholds to avoid triggering alerts on minor fluctuations

- Use multiple timeframe analysis, including technical analysis strategies, to confirm signals

- Implement indicator combinations, such as RSI strategies, to validate trade signals

Strategic Alert Placement

- Position alerts at key support and resistance levels

- Place alerts slightly before expected trigger points to account for market volatility

- Set buffer zones around critical price levels to prevent premature triggering

Risk Management Integration

- Calculate position sizes based on your risk tolerance

- Set stop-loss levels at technically significant points

- Use trailing stops to protect profits in trending markets

Alert Message Optimization

- Include specific trade parameters in alert messages

- Use consistent formatting for bot compatibility

- Add unique identifiers for each trading setup

Performance Monitoring

- Track alert accuracy rates

- Document false signals to refine your strategy

- Maintain a log of alert modifications and their impact

Technical Considerations

- Test alert settings in different market conditions, leveraging best strategies for crypto trading as a reference

- Ensure your webhook connections are stable

- Set up backup notification methods

These practices help create a robust automated trading system that responds to genuine market opportunities while maintaining risk control. Regular review and adjustment of these settings ensure your strategy remains effective as market conditions evolve. For instance, employing the best TradingView strategies for successful trading or utilizing best entry and exit strategies on TradingView can significantly enhance your trading performance.

Conclusion

TradingView alerts are a powerful tool for creating successful automated trading strategies. By using well-configured alerts, you can turn your trading ideas into automated systems and participate in the market consistently without having to constantly monitor your screens.

Setting up these alerts requires careful attention and a systematic approach:

- Define your strategy clearly

- Specify the conditions for your alerts precisely

- Integrate webhooks correctly

- Format your messages in a structured way

- Manage your positions effectively

The success of your automated trading depends on how well you set up your alerts and the reliability of your trading strategy. A strong system combines technical analysis with proper risk management, providing a framework for sustainable trading results.

Take Your Automated Trading to the Next Level

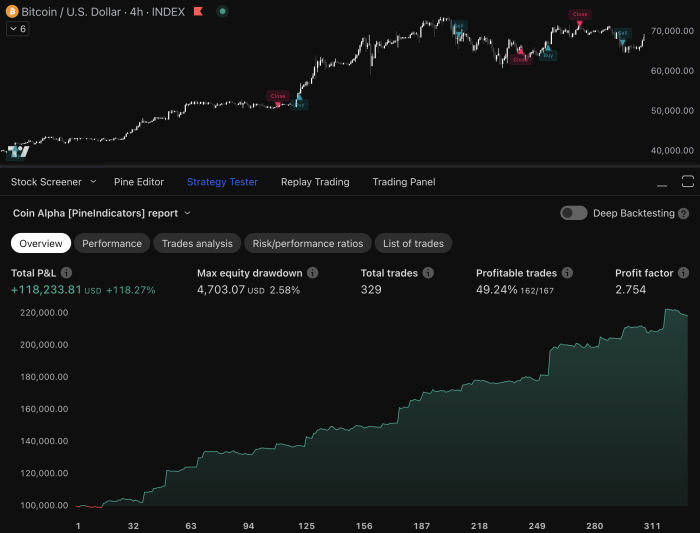

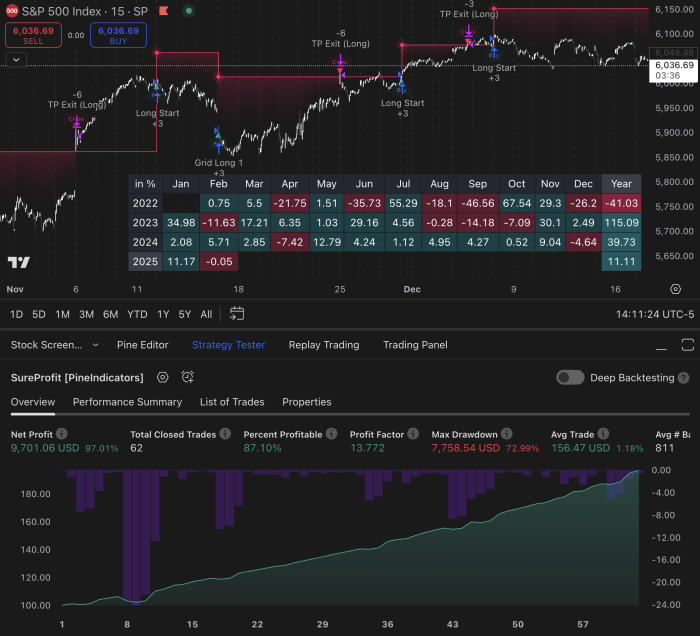

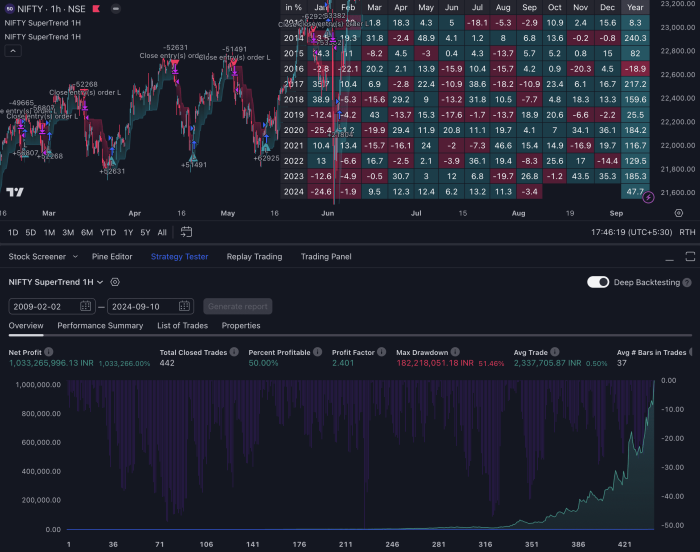

If you’re ready to improve your automated trading, check out PineIndicators.com. We offer a range of high-performing trading strategies specifically designed for TradingView.

These strategies come with pre-configured alert settings and detailed documentation to help you implement them effectively in your automated trading system.

Here are some options you can explore:

- Backtest your Pine Script strategies

- Discover automated Pine Script strategies that can transform your trading experience

- Master trading with custom scripts using our guide on Pine Script

We also have specialized Forex Pine Script strategies and scalping strategies for TradingView in 2024 tailored to meet specific trading needs.

Start your journey toward automated trading success by exploring proven strategies at PineIndicators.com. Upgrade your trading approach with professional-grade indicators and alert configurations designed to seize market opportunities while you focus on other aspects of your trading business.

FAQs (Frequently Asked Questions)

What are TradingView alerts and how do they enhance trading strategies?

TradingView alerts are notifications that inform traders about specific market conditions based on their defined criteria. They enhance trading strategies by allowing traders to automate decision-making processes, enabling them to take advantage of market opportunities without the need for constant monitoring.

How can I set up TradingView alerts for automated trading?

To set up TradingView alerts for automated trading, you first need to define your trading strategy. Then, apply relevant indicators and timeframes to your chart. After that, create alerts based on your strategy conditions. Finally, integrate webhooks if you wish to transmit real-time data to your trading bot or platform.

What role do webhooks play in TradingView alert setup?

Webhooks are essential for enabling automated trading systems to receive real-time signals from TradingView alerts. By obtaining a webhook URL from your preferred trading bot or platform and pasting it into the alert setup in TradingView, you can ensure that your bot receives immediate notifications when an alert condition is met.

How should I configure alert messages for effective risk management?

When configuring alert messages, it’s important to properly format them to ensure seamless execution of automated trades. Define key parameters such as Stop Loss and Take Profit levels within your alert messages to manage risk effectively and protect your capital during trades.

What are the best practices for using TradingView alerts in automated trading?

Best practices include optimizing your alert settings to filter out false signals while maximizing profitable trade opportunities. It’s also advisable to place stop-loss orders at strategic levels based on market structure analysis to mitigate risks and enhance overall trade performance.

How can I monitor executed trades and manage open positions after setting up alerts?

After setting up alerts and executing trades, it’s crucial to actively monitor the trades triggered by those alerts. This ensures proper execution and timely decision-making regarding managing open positions resulting from automated trades, helping you respond effectively to changing market conditions.