TradingView is a leading trading platform known for its comprehensive charting tools, social features, and extensive market data. Effective entry and exit strategies are crucial for successful trading, and TradingView provides powerful tools to develop and implement these strategies. A dedicated website is essential as a hub for accessing TradingView indicators, chart patterns, and trading strategies, enhancing user experience and efficiency.

TradingView supports a wide range of technical indicators, such as Bollinger Bands, which consist of upper and lower bands that signal overbought or oversold conditions and market volatility, the RSI indicator, which is a momentum oscillator that measures the speed and magnitude of price movements to help identify overbought or oversold conditions, and candlestick patterns, which traders use to identify optimal entry and exit points. Certain indicators show entry and exit points visually on the chart, making it easier for traders to act on signals.

- A robust platform for traders of all levels.

- Entry and Exit Strategies: Fundamental for maximizing profits and minimizing losses.

- Tools Provided by TradingView: Enables the creation and backtesting of custom strategies.

- Simple Moving Average: A fundamental tool in technical analysis for identifying trends and generating trading signals.

TradingView is a comprehensive platform designed to empower traders and investors with a robust suite of tools for analyzing financial markets. Whether you’re interested in stocks, forex, futures, or cryptocurrencies, TradingView offers real-time data, interactive charts, and a vast library of technical indicators to support a wide range of trading strategies. The platform’s intuitive interface makes it easy for both beginners and experienced traders to navigate complex markets and execute trades with confidence.

One of TradingView’s standout features is its extensive collection of indicators, which can be customized or combined to suit any trading style. Users can also create and share their own custom indicators and strategies, fostering a vibrant community where traders exchange ideas and insights. This collaborative environment helps traders stay informed about market trends and refine their approaches based on shared experiences. Republishing scripts or using custom indicators is subject to TradingView’s house rules and guidelines.

With support for multiple markets and asset classes, TradingView is a versatile tool that adapts to the needs of traders across the globe. Its powerful charting capabilities, combined with a user-friendly design and active community, make it an essential resource for anyone looking to enhance their trading performance and make more informed decisions.

Entry strategies are predefined rules or conditions that traders use to determine the best time to enter a trade. These strategies can be based on various indicators, patterns, or signals that suggest potential price movements. For example, a trader might decide to enter a long position when a short-term moving average crosses above a long-term moving average. Recommendations for entry and exit points are also available through broker services or analysis tools to assist traders in making informed decisions.

Exit strategies, on the other hand, involve setting criteria for closing a trade. This can include taking profits at a certain price level or cutting losses if the market moves against the position. The goal is to maximize profits while minimizing potential losses. An effective exit strategy ensures that you secure gains and protect your capital from significant drawdowns. Traders often use momentum oscillators, such as the Relative Strength Index (RSI), to identify overbought and oversold conditions, which can signal potential exit points based on market momentum and volatility. The RSI measures the speed and magnitude of price movements, helping traders assess how quickly prices are changing and identify overbought or oversold conditions and potential trend reversals.

The role of these strategies is crucial in trading decisions:

- Maximizing Profits: By entering trades at the right moments and exiting them wisely, traders can enhance their profit margins.

- Minimizing Losses: Proper exit strategies help in mitigating risks by limiting exposure to adverse market movements.

- Impact on Success: Consistently applying well-defined entry and exit strategies contributes to overall trading success and sustainability.

- Monitoring when the RSI enters the overbought zone (above 70) or oversold zone (below 30), or when price reaches key technical levels, helps traders identify potential exit points and make informed decisions.

By understanding and implementing robust entry and exit strategies, you can make informed trading decisions that align with your financial goals. Overbought and oversold conditions, as measured by indicators like RSI, are essential for timing both entries and exits in trading.

Pine Script is a powerful scripting language integrated within TradingView, designed specifically for creating and customizing trading strategies. If you are looking to implement custom strategies or optimize your analysis, consider working with a Pine Script developer. This language allows you to write custom scripts that can automate trading signals, manage orders, and conduct detailed analysis. Pine Script enables the creation of strategies using indicators such as the exponential moving average and can be adapted for contract based trading approaches. When using open-source Pine Script or custom indicators, always credit the author of the script, as proper attribution is important in the trading community.

- Customization: Tailor your strategies to fit your unique trading style.

- Automation: Automate the entry and exit signals to avoid emotional decision-making.

- Flexibility: Create complex strategies with multiple conditions and parameters.

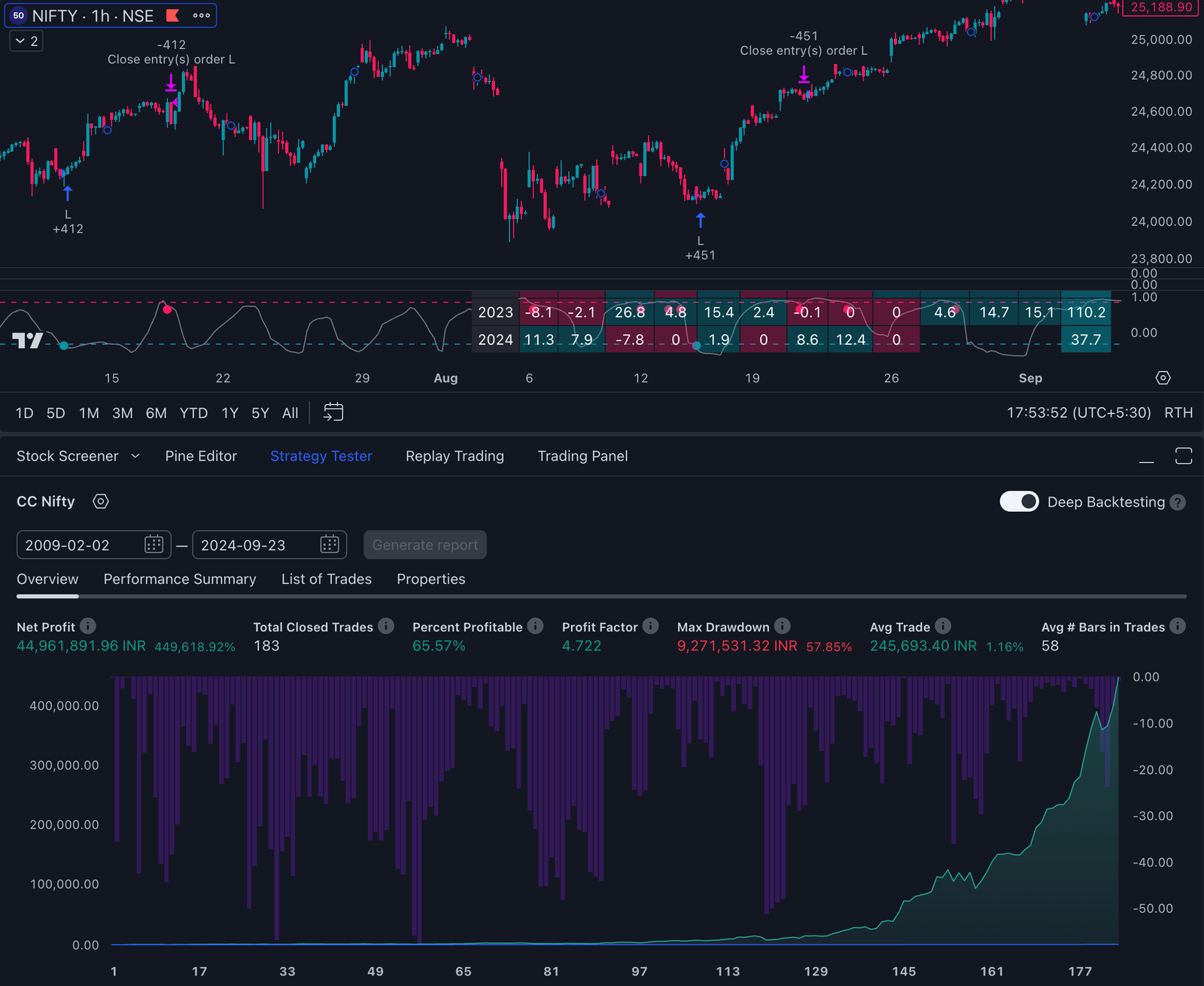

Backtesting is crucial for validating the effectiveness of any trading strategy. Using historical data, you can simulate trades to see how your strategy would have performed in the past. Traders often use horizontal lines to mark key support and resistance levels, and set a desired period for volatility indicators to optimize backtesting results. This helps in identifying strengths and weaknesses before deploying the strategy in a live market.

Key aspects to consider when backtesting:

- Historical Data Analysis: Test your strategy against extensive historical data to ensure its robustness.

- Metrics Evaluation: Focus on performance metrics like profit factor, drawdown, and win rate.

- Strategy Refinement: Use the results from backtesting to refine and optimize your strategy.

Example: You might create a script that enters a trade based on specific indicators and exits based on predefined profit or loss thresholds. By backtesting this script, you can see its potential success rate and make necessary adjustments.

Understanding how to leverage Pine Script and backtesting can significantly enhance your trading performance by allowing you to develop well-tested, robust trading strategies tailored to your needs.

Identifying the prevailing trend is fundamental to successful trading, and moving averages are among the most reliable indicators for this purpose. A moving average smooths out price data, making it easier to spot the underlying direction of the market. By analyzing two moving averages with different timeframes—such as a short-term and a long-term average—traders can develop a crossover strategy to pinpoint optimal entry and exit points.

When the short-term moving average crosses above the long-term moving average, it generates a bullish signal, suggesting a potential entry point for a long position. This crossover indicates that the trend may be shifting upward, providing traders with a clear signal to enter the market. Conversely, when the short-term moving average crosses below the long-term moving average, it signals a bearish entry or a potential exit point, as the trend may be turning downward.

Moving averages also serve as dynamic support and resistance levels. As the price approaches these averages, they can act as barriers, either halting or reversing price movements. This characteristic helps traders identify potential areas where the price might bounce or reverse, further refining their entry and exit strategies. By incorporating moving averages into your trading strategy, you can enhance your ability to identify trends, time your entries and exits, and manage risk more effectively.

The Moving Average Crossover strategy is a classic approach that helps traders pinpoint optimal entry and exit points by analyzing the relationship between two moving averages. Typically, this strategy uses a short-term moving average and a long-term moving average to generate clear trading signals. When the short-term moving average crosses above the long-term moving average, it produces a bullish signal, indicating a potential entry point for a long position. This crossover suggests that momentum is shifting upward, and traders may consider entering the market to capitalize on the emerging trend.

Conversely, when the short-term moving average crosses below the long-term moving average, it generates a bearish signal, signaling a potential exit point for existing long trades or an entry point for short positions. This movement often marks the beginning of a downward trend, prompting traders to adjust their positions accordingly.

The Moving Average Crossover strategy is highly adaptable, working effectively across different markets and timeframes. By focusing on the interaction between two moving averages, traders can identify trend reversals and make more informed decisions about when to enter or exit trades. This straightforward yet powerful strategy remains a cornerstone for traders seeking to enhance their trading outcomes with clear, rule-based signals.

Chart patterns are a powerful tool for traders seeking to identify high-probability entry and exit points. Formed by the price action of an asset over time, these patterns reflect the collective psychology of market participants and often signal upcoming trend reversals or continuations. Recognizing chart patterns such as head and shoulders, triangles, wedges, and flags can provide valuable insights into potential price movements.

For instance, a head and shoulders pattern typically signals a trend reversal, offering traders a potential exit point or an opportunity to enter a trade in the opposite direction. Triangle patterns, on the other hand, often indicate periods of consolidation before a breakout, helping traders anticipate significant price movements and plan their entry and exit points accordingly.

To increase the reliability of chart pattern signals, traders often combine them with technical indicators like moving averages and the relative strength index (RSI). This multi-layered approach helps confirm the validity of the pattern and reduces the likelihood of false signals. By integrating chart patterns with other indicators, traders can develop robust strategies that adapt to changing market conditions and improve their overall trading performance.

Fibonacci retracement is a widely used technical analysis tool that helps traders identify key support and resistance levels, which are essential for determining entry and exit points. Based on the Fibonacci sequence, this tool applies specific ratios—such as 23.6%, 38.2%, 50%, 61.8%, and 76.4%—to a price chart to highlight potential retracement levels during a trend.

When the price of an asset retraces to one of these Fibonacci levels, it often encounters support or resistance, making these points ideal for planning entries and exits. For example, if the price pulls back to the 61.8% retracement level and shows signs of reversing, traders may consider this a strategic entry point for a long position. Conversely, if the price approaches a retracement level from below and struggles to break through, it may serve as a resistance level and a potential exit point.

Fibonacci retracement can be used alongside other technical indicators and chart analysis techniques to strengthen your trading strategy. By identifying these critical levels on your chart, you can make more informed decisions about when to enter or exit trades, manage risk, and capitalize on trend continuations or reversals.

Bollinger Bands are a widely used technical indicator that helps traders navigate market volatility and identify strategic exit points. Comprising a moving average flanked by two standard deviations—one above and one below—the bands expand and contract in response to changes in market volatility. When the bands expand, it signals increased price movements, while contraction indicates a period of lower volatility.

As an exit indicator, Bollinger Bands provide valuable insights into overbought and oversold conditions. When the price touches or breaks through the upper band, it often suggests overbought conditions, signaling a potential exit point for long positions or an entry point for short trades. Conversely, when the price touches the lower band, it may indicate oversold conditions, highlighting a potential exit point for short positions or an entry point for long trades.

Traders can also use Bollinger Bands to set stop-loss levels and take-profit targets, helping to manage risk and lock in gains. By combining Bollinger Bands with other technical indicators, such as the Relative Strength Index or moving averages, traders can develop a comprehensive trading strategy that incorporates dynamic entry and exit points. This approach allows for more precise trade management, especially in contract based trading or when navigating periods of heightened market volatility.

Creating an effective entry and exit strategy in TradingView often begins with defining clear conditions for entering and exiting trades. Below is a step-by-step breakdown of a simple example strategy using Pine Script code.

pinescript //@version=4 strategy(“Simple Entry/Exit Strategy”, overlay=true)

// Define moving averages shortMa = sma(close, 10) longMa = sma(close, 50)

// Condition for buy signal buy_signal = crossover(shortMa, longMa)

In addition to moving average crossovers, traders often use the MACD indicator, which consists of the MACD line, signal line, and histogram. Crossovers between the MACD line and signal line are commonly used to generate buying signals, helping traders identify bullish momentum and optimal entry points.

pinescript if (buy_signal) strategy.entry(“Buy”, strategy.long)

Traders may also look for specific price forms or candlestick patterns to confirm entry points, using these alongside indicators to improve timing and trade success.

pinescript // Define profit target and stop loss levels take_profit = close + 0.21 stop_loss = close – 0.10

// Implement the exit condition strategy.exit(“Take Profit”, from_entry=”Buy”, limit=take_profit, stop=stop_loss)

// Exit indicators, such as a bearish signal from the MACD or other technical tools, can help identify optimal exit points.

- Buy Signal: The buy_signal is triggered when the short-term moving average (shortMa) crosses above the long-term moving average (longMa). This crossover indicates a potential upward trend.

- Entry Condition: When the buy_signal is true, the script executes a long position with strategy.entry(“Buy”, strategy.long).

- Exit Conditions: The strategy.exit() function specifies conditions to exit the trade. It sets:

- A limit price (take_profit) to lock in profits once a certain level is reached.

- A stop price (stop_loss) to minimize losses if the trade goes against you.

- Monitoring prices at key levels is essential for effective trade management, as price movements can signal potential reversal or breakout points for timely exits.

A custom volatility breakout strategy leverages market volatility to identify optimal entry and exit points. By developing a custom volatility breakout indicator, traders can pinpoint periods when the market is likely to experience significant price movements, such as breakouts or trend reversals. This approach is particularly effective in markets where price tends to consolidate before making sharp moves.

The custom volatility breakout indicator measures the degree of market volatility and highlights areas where a breakout is likely to occur. When volatility increases and the indicator signals a potential breakout, traders can use this as an entry point, positioning themselves to capitalize on rapid price movements. Exit points can be determined by monitoring the indicator for signs of diminishing volatility or by using additional technical indicators, such as moving averages or RSI, to confirm the end of the breakout phase.

This strategy can be applied across various markets and asset classes, including stocks, forex, futures, and cryptocurrencies. By combining the custom volatility breakout indicator with other technical tools, traders can enhance their ability to identify high-probability trades, manage risk, and adapt to changing market conditions.

Day traders are market participants who open and close positions within the same trading day, aiming to profit from short-term price fluctuations while avoiding overnight risk. To succeed in this fast-paced environment, day traders rely on a variety of trading strategies and technical indicators to identify high-probability entry and exit points.

A key component of day trading is the ability to quickly interpret market volatility and react to rapid price movements. Indicators such as the Relative Strength Index (RSI) help traders spot overbought and oversold conditions, while tools like the Moving Average Convergence Divergence (MACD) and Bollinger Bands assist in identifying trend reversals and breakout opportunities. The Custom Volatility Breakout indicator is particularly useful for day traders, as it highlights periods of increased volatility that may signal potential exit points or new trading opportunities.

Chart patterns and trend analysis also play a significant role in day trading strategies. By recognizing patterns that precede trend reversals or continuations, day traders can make informed decisions about when to enter or exit trades. Effective risk management is essential, with stop-loss orders and position sizing helping to protect capital in volatile markets.

By combining technical indicators, chart patterns, and a disciplined trading strategy, day traders can navigate the complexities of the market, capitalize on short-term trends, and manage their risk exposure for consistent trading success.

Scalping strategies are designed for traders who seek to capitalize on small price movements within very short time frames. These strategies are particularly popular among day traders who seek to profit from rapid price movements. By executing a high volume of trades, scalpers aim to accumulate small but frequent profits. TradingView provides various tools and indicators that enhance the efficiency of scalping techniques, including the Chandelier ExitUT Bot alerts.

- Rapid Trades: Scalping involves entering and exiting trades swiftly, often within minutes or even seconds.

- High Volume: The strategy relies on executing many trades throughout the trading session.

- Small Profit Margins: Each trade targets a small profit margin, which accumulates over numerous trades.

This indicator helps in determining exit points based on volatility. It places a trailing stop-loss order at a certain multiple of the Average True Range (ATR) from the highest high or lowest low since the trade was entered.

Example:

pinescript length = 22 atrMultiplier = 3.0 atrValue = atr(length) chandelierExitLong = highest(high, length) – atrValue * atrMultiplier chandelierExitShort = lowest(low, length) + atrValue * atrMultiplier

UT Bot alerts provide entry and exit signals based on price action and trend identification.

Example:

pinescript buySignal = close > ta.sma(close, 50) sellSignal = close < ta.sma(close, 50)

if buySignal strategy.entry(“Buy”, strategy.long)

if sellSignal strategy.exit(“Sell”, from_entry=”Buy”)

- Setup: Use indicators like Chandelier Exit or UT Bot to define entry and exit points.

- Backtest: Utilize TradingView’s backtesting feature to simulate the strategy using historical data. This helps in understanding its effectiveness before applying it in live trading.

- Automation: Consider automating the strategy through Pine Script to ensure timely execution of trades.

By leveraging these indicators and the scripting capabilities of TradingView, you can develop robust scalping strategies that take advantage of rapid market movements.

Pyramiding is a powerful technique that traders can use to maximize gains during strong market trends. By utilizing the pyramiding feature in TradingView, you can add additional positions without closing existing ones, allowing you to fully capitalize on upward or downward market trends. Traders often use indicators like Bollinger Bands, entering additional positions as the price approaches the lower band in anticipation of a reversal, or considering exits when the price reaches the upper band, which may signal overbought conditions.

- Initial Entry: Begin with an initial position based on your entry criteria.

- Additional Entries: As the market continues to trend in your favor, add more positions at specified intervals or price levels.

- No Premature Exits: Unlike other strategies where you might close previous positions before opening new ones, pyramiding keeps all positions open to maximize potential gains.

- Increased Profit Potential: By adding multiple positions, you can amplify your returns as the market continues to move in your favor.

- Reduced Risk Per Trade: Instead of committing a large amount of capital at once, you incrementally increase your exposure as the trend confirms itself.

pinescript //@version=4 strategy(“Pyramiding Example”, overlay=true) buy_signal = crossover(sma(close, 10), sma(close, 30)) if (buy_signal) strategy.entry(“Buy”, strategy.long) strategy.exit(“Take Profit”, from_entry=”Buy”, limit=close + 0.21, stop=low)

// Allow up to 3 additional entries strategy.risk.max_position_size(4)

In this example:

- An initial “Buy” signal is generated when a short-term moving average crosses above a long-term moving average.

- Additional positions are added as long as the trend remains favorable.

- A maximum of four positions are maintained simultaneously.

Using techniques like scalping strategies and pyramiding within TradingView can significantly enhance trading performance. Each method provides unique advantages tailored to different market conditions and trading styles.

Optimizing exit points is a vital component of any successful trading strategy, as it directly affects your ability to lock in profits and manage risk. There are several techniques traders can use to refine their exit points and improve overall trading performance.

One popular method is the use of trailing stops, which automatically adjust the stop loss level as the price moves in your favor, allowing you to capture more profit while protecting against sudden reversals. Setting profit targets is another effective technique, where you predetermine a specific price level at which to exit the trade and secure gains. Time-based exits involve closing a trade after a set period, regardless of price movement, which can help avoid overexposure to market volatility.

Technical indicators such as moving averages and the relative strength index (RSI) can also be used to confirm exit signals, ensuring that you exit trades at optimal moments. Additionally, strategies like scaling out—gradually reducing your position size as the trade moves in your favor—and adjusting position size based on market conditions can help manage risk and maximize returns.

By incorporating these exit point optimization techniques into your trading strategy, you can enhance your ability to make timely exits, protect your capital, and achieve more consistent trading results.

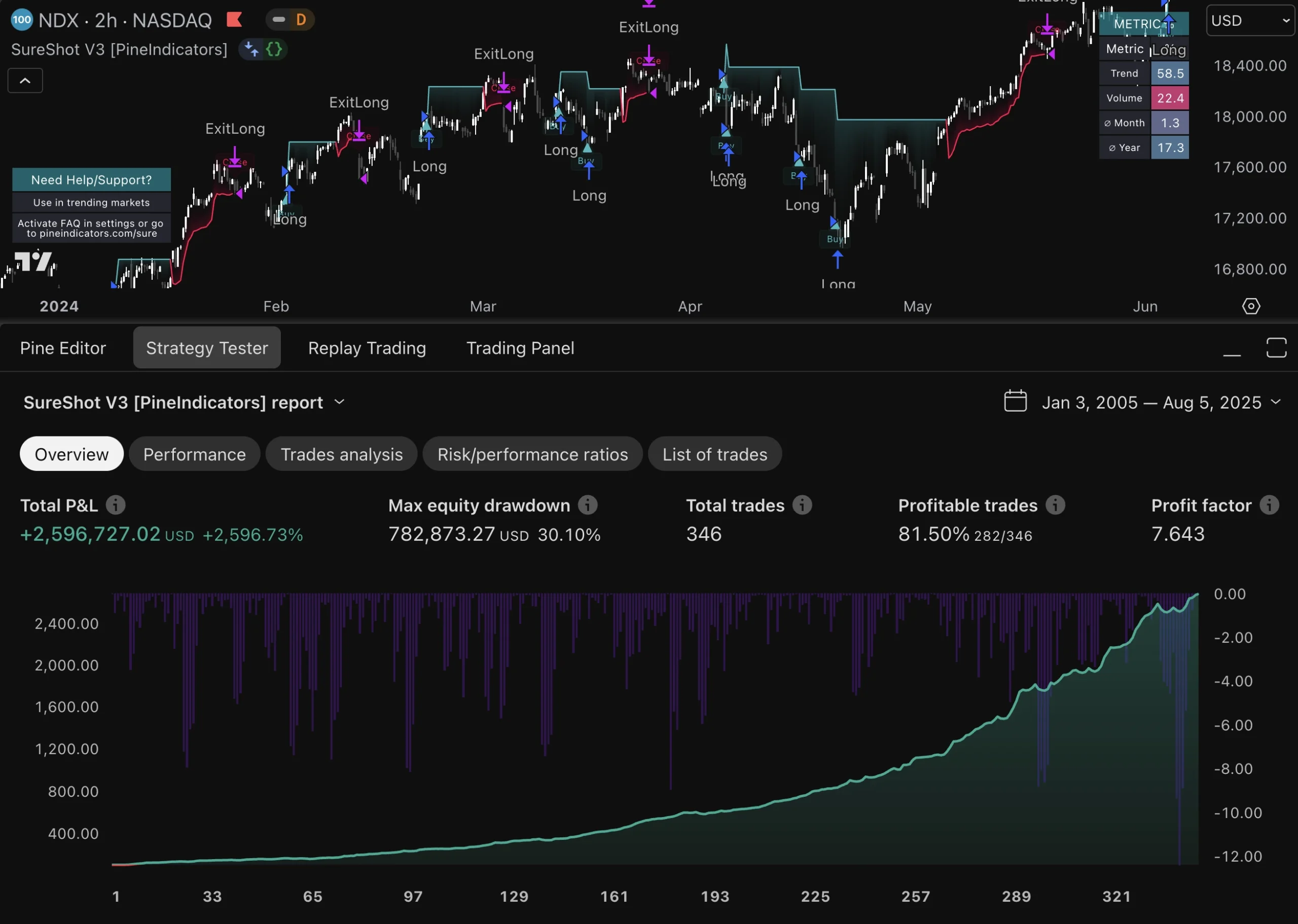

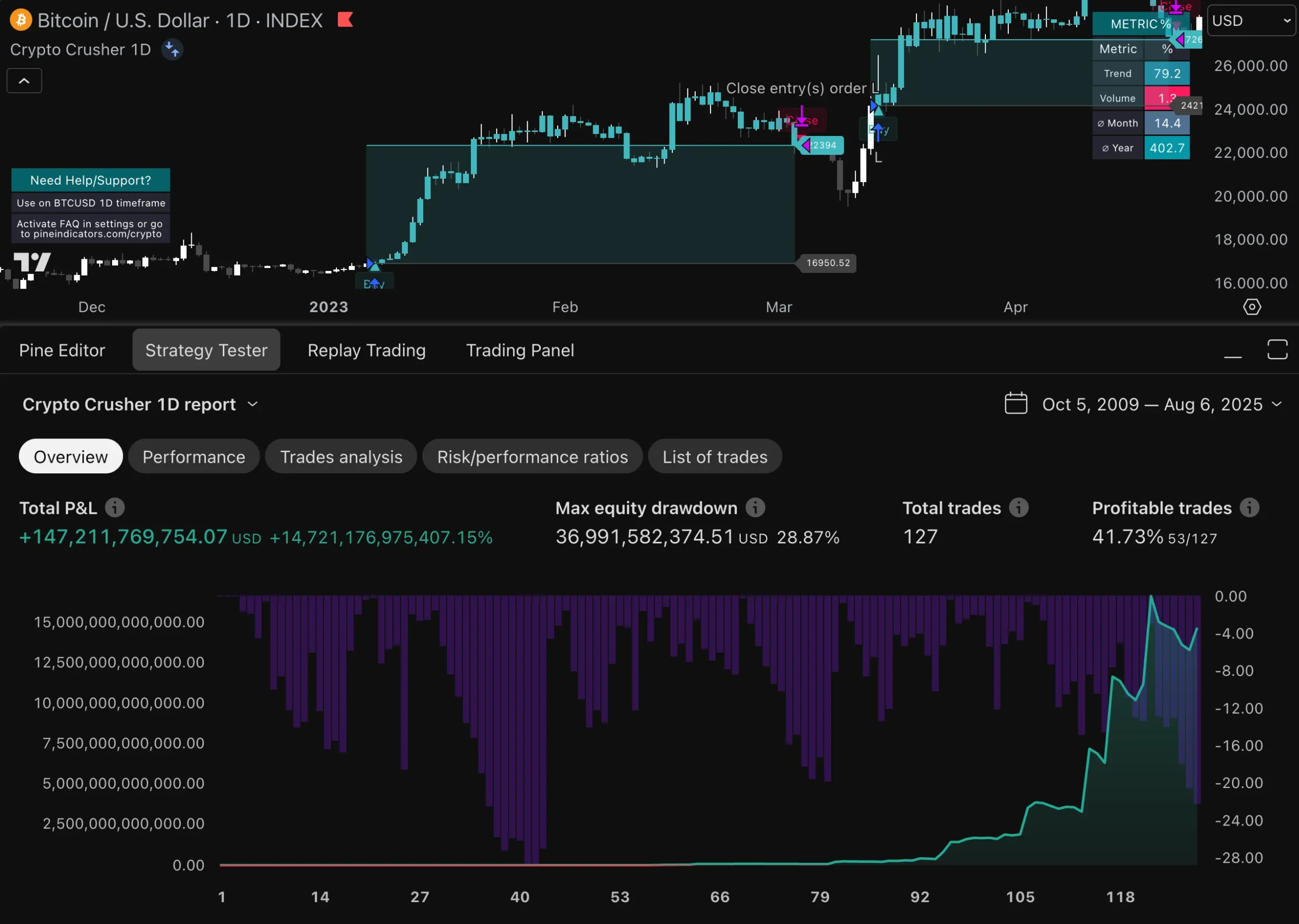

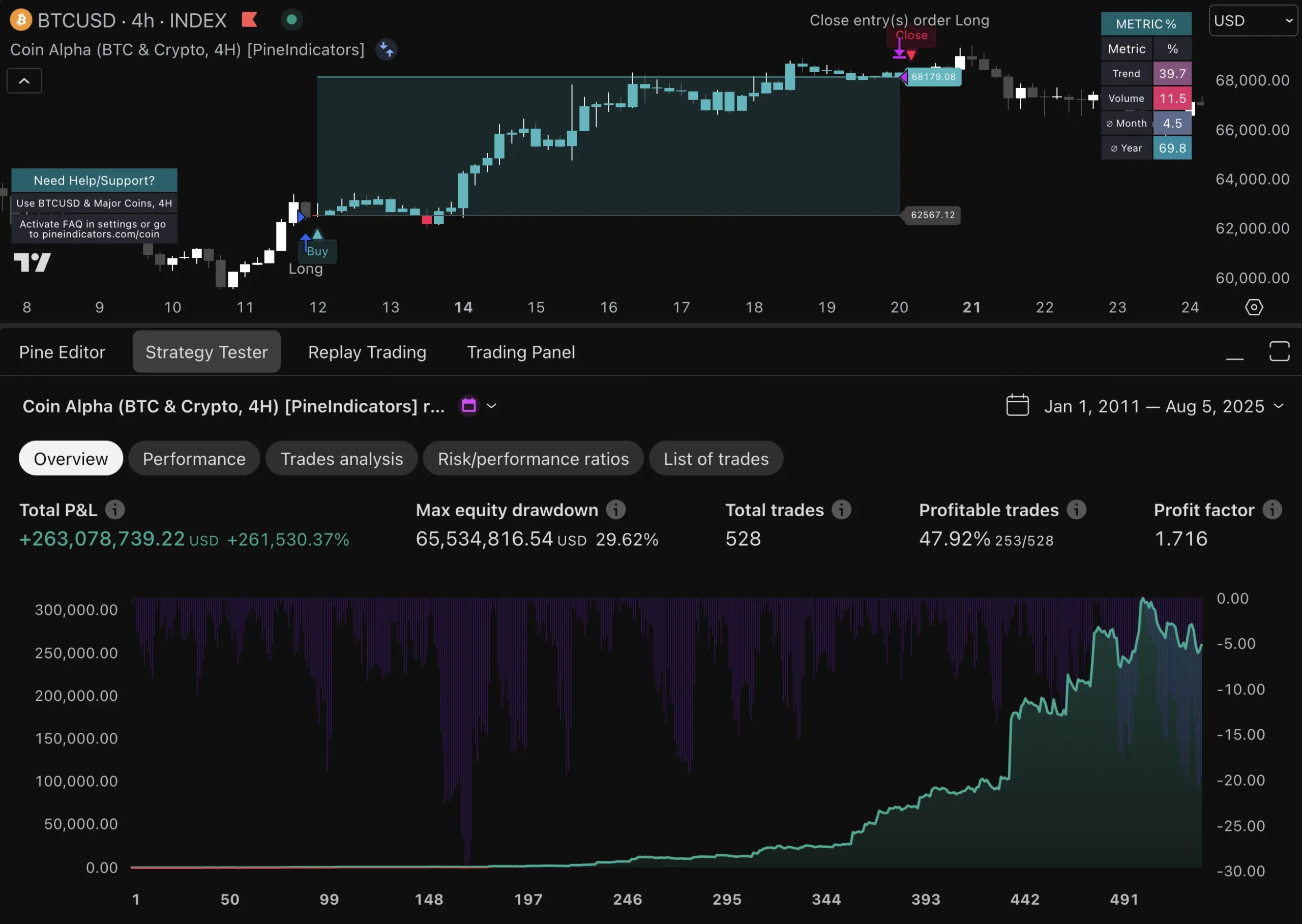

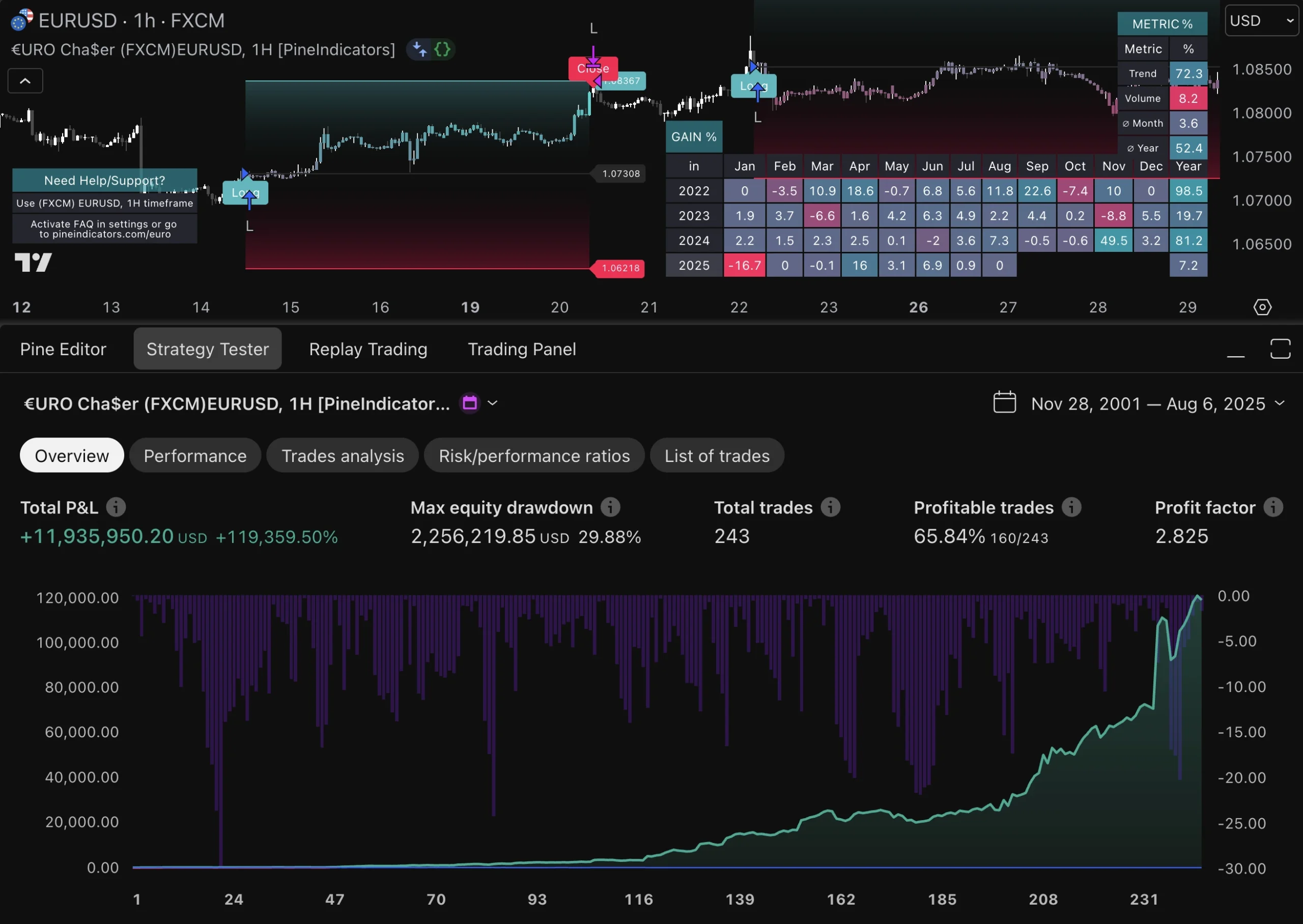

Evaluating the performance of your trading strategies before live trading is essential. The Strategy Tester module in TradingView provides a comprehensive environment to test and analyze hypothetical performance results. By simulating trades on historical data, you can gain insights into how your strategy might perform under various market conditions. Analyzing how your strategy performs around fibonacci retracement levels and during price breaks can provide valuable insights into its robustness, as these moments often signal key support, resistance, and potential trend changes.

Key metrics to consider when evaluating a strategy’s effectiveness include:

- Equity Curves: These curves display the progression of your trading account over time. A steadily rising equity curve indicates consistent profitability, while a fluctuating or declining curve may suggest potential issues with the strategy.

- Drawdown Curves: These curves measure the peak-to-trough decline during a specific period for an investment, highlighting periods of significant loss. Lower drawdowns indicate a more stable strategy that mitigates risk effectively.

Utilizing the Strategy Tester module allows you to:

- Identify strengths and weaknesses in your strategy.

- Optimize entry and exit conditions by adjusting parameters.

- Validate the robustness of your strategy across different market scenarios.

The insights gained from this analysis can guide you in refining your approach, ultimately leading to more informed and confident trading decisions.

Order types available in Pine Script are essential for executing trades effectively based on your strategy. Each order type serves a different purpose and can be chosen depending on your trading needs:

Stop orders are commonly used to enter or exit trades when the price touches a specified level, ensuring precise trade execution.

These orders are executed immediately at the current market price. They are useful when you need to enter or exit a position quickly without waiting for a specific price level.

pinescript strategy.entry(“Market Order”, strategy.long)

Limit orders allow you to specify the price at which you want to buy or sell. The order will only be executed if the market reaches that price. This is beneficial for getting into trades at precise levels.

pinescript strategy.entry(“Limit Order”, strategy.long, limit=priceLevel)

Stop orders become market orders once a specified stop price is reached. They are often used for stop-loss purposes or to enter trades as momentum builds in a particular direction.

pinescript strategy.entry(“Stop Order”, strategy.long, stop=stopPrice)

Understanding these order types allows you to execute your trading strategies more precisely on TradingView using Pine Script. The choice between market, limit, and stop orders depends on your specific trading goals and risk management preferences.

Experimenting with custom scripts and techniques tailored to your individual trading style is key. By leveraging the flexibility of Pine Script and the array of tools available on TradingView, you can create strategies that align with your unique approach to trading, including Pine Script templates.

Key practices to consider:

- Backtesting: Always backtest your strategies using historical data to ensure their effectiveness.

- Risk Management: Maintain sound risk management principles by setting stop-loss levels and profit targets.

- Order Types: Choose the appropriate order types (market, limit, or stop) based on your strategy needs.

- Continuous Learning: Stay updated with new indicators and features in TradingView to continuously refine your strategies.

- Monitor Stock Price: Regularly monitor the stock price in relation to indicator signals to identify optimal entry and exit points.

- Indicator Configuration: When using indicators like Bollinger Bands, configure them to use two standard deviations for more accurate detection of overbought or oversold conditions and potential trade signals.

Adopting these best practices for optimizing trades using entry/exit strategies can significantly enhance your trading performance and outcomes.

TradingView uses cookies and similar technologies to enhance user experience and analyze website traffic. Users can accept or reject cookies to personalize their online experience or protect their privacy according to their preferences.

Entry and exit strategies are predefined rules that traders use to determine when to enter or exit a trade. These strategies play a crucial role in maximizing profits and minimizing losses, significantly impacting overall trading success.

Pine Script is a powerful tool within TradingView that allows users to create and customize their own trading strategies. It enables backtesting of these strategies using historical data, ensuring their effectiveness before applying them in live trading.

A simple entry/exit strategy can be implemented through a sample Pine Script code that includes buy signals and exit conditions. The logic behind these signals is designed to optimize the timing of trades based on market conditions.

Advanced trading techniques on TradingView include scalping strategies, which involve making rapid trades based on specific indicators like the Chandelier Exit or UT Bot alerts, and pyramiding strategies, where traders add positions without closing previous ones to capitalize on strong market trends.

The Strategy Tester module in TradingView allows traders to analyze hypothetical performance results before live trading. Key metrics such as equity curves and drawdown curves help evaluate a strategy’s effectiveness and make informed decisions.

Pine Script offers various order types for execution, including market orders, limit orders, and stop orders. Each type serves different strategic needs, allowing traders to choose the most suitable option based on their specific trading strategy.

All information, data, indicators, and analysis provided in this article are for educational purposes only and do not constitute financial advice or recommendations. The information presented does not constitute official advice or recommendations and should not be relied upon as such. The advice and content here do not replace professional or personalized guidance for financial decisions. Publications on this platform do not serve as official financial advice or endorsements and are subject to the platform’s terms of use. Please read more about our terms and conditions here.

Introduction to TradingView

TradingView is a popular online platform that provides traders with a comprehensive suite of tools for analyzing financial markets. With access to real-time data, interactive charts, and a vast range of indicators, TradingView empowers traders to make informed decisions and refine their trading strategy. The platform is designed to cater to traders of all experience levels, offering everything from basic charting to advanced technical analysis features. One of the standout aspects of TradingView is its active community, where traders can share ideas, discuss strategies, and learn from one another. By leveraging the platform’s robust set of indicators—including those specifically designed to identify exit points—traders can optimize their strategies and improve their overall trading performance. Whether you’re looking to develop a new trading strategy or enhance your existing approach, TradingView provides the data, tools, and community support needed to succeed in today’s fast-moving financial markets.

Understanding Entry and Exit Strategies

Entry and exit strategies form the backbone of any successful trading plan. On TradingView, traders have access to a wide array of indicators and analytical tools that help them pinpoint the best moments to enter and exit trades. An effective entry strategy ensures that traders capitalize on favorable market conditions, while a well-defined exit strategy helps secure profits and limit potential losses. For instance, using indicators like moving averages, RSI, and Bollinger Bands, traders can identify key exit points and entry signals based on market volatility and price action. It’s important to look first at the current market conditions and adjust your trading strategy accordingly, as volatility and other factors can influence the effectiveness of your chosen approach. By combining technical indicators with thorough chart analysis and a keen awareness of market conditions, traders can develop strategies that are both flexible and robust, increasing their chances of long-term success in trading.

Using Indicators for Trading

Indicators are essential tools for traders looking to enhance their trading strategy on TradingView. The platform offers a diverse range of indicators, from simple moving averages to advanced points-based systems, each designed to help traders analyze price movements and identify optimal entry and exit points. By using indicators, traders can detect trends, gauge market momentum, and receive clear signals for when to open or close trades. For example, a points-based indicator can provide straightforward entry or exit signals, making it easier to act decisively in fast-moving markets. TradingView also supports open source scripts, allowing traders to create and share custom indicators tailored to their specific strategies. This flexibility enables traders to experiment with different approaches and refine their methods over time. With the right combination of indicators and a well-structured trading strategy, traders can make more informed decisions, manage risk effectively, and achieve greater consistency in their trading results.

Custom Indicators with Pine Script

Pine Script is TradingView’s proprietary programming language, designed to give traders the power to create custom indicators and strategies that fit their unique trading needs. By using Pine Script, traders can develop scripts that generate specific signals, such as exit points, based on their preferred criteria. This level of customization allows for the creation of indicators that are not only tailored to individual trading styles but can also be made open source, enabling the broader TradingView community to benefit from and contribute to these tools. Whether you want to design an indicator that alerts you to potential exits or automate a complex trading strategy, Pine Script provides the flexibility and functionality required. Scripts can be used to analyze trades, monitor price levels, and provide real-time signals, helping traders make more informed decisions. By leveraging Pine Script, traders can elevate their trading to a new level, ensuring their strategies are both innovative and effective.

Best Entry Strategies on TradingView

Developing a strong entry strategy is essential for successful trading, and TradingView offers a variety of tools and indicators to help traders identify the best opportunities. Some of the most effective entry strategies involve combining multiple indicators—such as moving average crossovers, RSI, and chart patterns—to confirm potential trade setups. For example, a moving average crossover strategy can signal a new trend, while the RSI can help determine if the market is overbought or oversold, providing additional confirmation for entry. Chart patterns like head and shoulders or triangles can also highlight key moments to enter a trade. It’s important to factor in market volatility and use a dynamic approach that adapts to changing conditions. Considering potential exit points from the outset ensures that your strategy remains balanced and risk-aware. Utilizing cookies and data analytics can further enhance your understanding of market behavior, allowing you to make more informed decisions. However, always remember that trading involves risk, and past performance does not guarantee future results. Make sure to review the disclaimer and approach each trade with careful analysis and sound risk management.

Using Open-Source Resources for Indicator Strategies

Open-source resources have revolutionized the way traders develop and implement indicator strategies on TradingView. By leveraging open-source Pine Script code, traders can access a vast library of custom indicators and scripts designed to identify exit points, manage market volatility, and enhance overall trading performance. The collaborative nature of open-source projects allows traders to benefit from the collective expertise of the TradingView community, as scripts are openly shared, reviewed, and improved over time.

Using open-source indicators means you can easily adapt and customize scripts to fit your specific trading needs, whether you’re looking to refine your exit strategy or respond more effectively to changing market conditions. These scripts are designed to allow traders to analyze a wide range of markets and volatility scenarios, providing flexible solutions for both entry and exit signals. The transparency of open-source code also ensures that you can verify how an indicator works before integrating it into your trading strategy, giving you greater confidence in your analysis.

By actively participating in the open-source community on TradingView, traders not only gain access to innovative tools but also contribute to the ongoing development of more effective trading strategies. This open approach fosters continuous learning and improvement, helping traders stay ahead in dynamic markets.

Determining Exit Points for Profitable Trades

Determining the right exit points is essential for maximizing profits and minimizing losses in any trading strategy. Exit points are specific price levels or conditions where a trader decides to close a trade, and they can be identified using a points-based approach that combines multiple technical indicators and market analysis. For example, traders often use moving average crossovers as exit signals—when a short-term average crosses below a long-term average, it may indicate a weakening trend and a potential time to exit.

Other indicators, such as the Relative Strength Index (RSI) and Bollinger Bands, are frequently used to spot overbought or oversold conditions, signaling that a reversal or pullback may be imminent. Fibonacci retracement levels can also highlight key support and resistance areas, providing additional guidance for setting exit points. By integrating these indicators into a comprehensive trading strategy, traders can make more informed decisions about when to exit trades, whether they are holding long or short positions.

A well-defined exit strategy not only helps lock in profits but also protects against unexpected market reversals. By analyzing price action, trend strength, and support levels, traders can develop a systematic approach to exits that adapts to changing market conditions. This disciplined method is crucial for consistent trading success and effective risk management.

Fibonacci Retracement in TradingView Strategies

Fibonacci retracement is a powerful tool in TradingView strategies, widely used by traders to pinpoint potential support and resistance levels that can serve as strategic entry and exit points. Based on the mathematical Fibonacci sequence, this tool helps traders identify where the price of an asset may pause, reverse, or consolidate during a trend.

To use Fibonacci retracement, traders draw a line between a significant high and low on the price chart. The tool then automatically plots key retracement levels—such as 23.6%, 38.2%, 50%, 61.8%, and 76.4%—which are commonly watched by market participants. When the price approaches one of these levels, it may act as a support or resistance zone, signaling a potential exit point for existing trades or an entry point for new positions.

Incorporating Fibonacci retracement into your trading strategy allows you to anticipate where the market may react, helping you make more informed decisions about when to enter or exit trades. By combining Fibonacci levels with other indicators and price analysis, traders can enhance their ability to identify high-probability exit points and manage trades more effectively in both trending and ranging markets.

Leveraging Supertrend and MACD Indicators

Combining the Supertrend and MACD indicators can significantly strengthen your trading strategy by providing clear, actionable signals for both entry and exit points. The Supertrend indicator is designed to follow market trends by factoring in both price and volatility, offering a straightforward visual cue for when the market is bullish or bearish. When the price is above the Supertrend line, it signals an uptrend, while a price below the line indicates a downtrend.

The MACD (Moving Average Convergence Divergence) indicator, on the other hand, is a momentum oscillator that tracks the relationship between two moving averages. It is widely used to identify trend changes, momentum shifts, and potential buy or sell signals. When the MACD line crosses above the signal line, it may indicate a buying opportunity; when it crosses below, it can signal a potential exit point or a sell opportunity.

By using the Supertrend to determine the prevailing trend and the MACD to confirm momentum and signal exits, traders can create a robust trading strategy that adapts to changing market conditions. This combination allows for more precise timing of trades, helping traders capitalize on strong trends while managing risk during periods of increased volatility. Integrating these indicators into your TradingView analysis can lead to more consistent and profitable trading outcomes.

Managing Risk with Exit Points

Effective risk management is at the heart of successful trading, and setting clear exit points is a key component of this process. Exit points help traders limit losses and secure profits by providing predefined levels at which to close trades, especially during periods of heightened market volatility. By using a points-based trading strategy, traders can systematically determine when to exit positions based on a combination of technical indicators and market analysis.

Indicators such as moving averages, RSI, and Bollinger Bands are commonly used to identify potential exit points, as they reflect changes in trend strength, volatility, and support or resistance levels. For example, a sudden spike in volatility or a break below a key support level may signal the need to exit a trade to prevent further loss. Traders can also use stop-loss orders and adjust position sizes to manage their exposure and protect their capital.

It is important for traders to regularly read and review disclaimers, understand the risks involved, and seek advice from financial professionals before making investment decisions. By combining technical analysis with sound risk management practices, traders can navigate market fluctuations more confidently and improve their long-term trading performance. Remember, managing risk is not just about avoiding loss—it’s about making informed decisions that support your overall trading strategy and financial goals.